GEORGIA FHA MORTGAGE LENDERS / FHA MORTGAGE REQUIREMENTS/ GEORGIA FHA LOAN LIMITS

Our goal as Georgia FHA mortgage lenders to provide you with all of the information and tools you need in order to determine if a FHA mortgage will work for your situation. On this page, you can view the 2017 Georgia FHA mortgage loan limits and FHA mortgage guidelines, view Georgia loan limits by county, and calculate your Georgia FHA mortgage monthly payments. These Georgia FHA mortgage requirements related to credit history, income, employment, and the type of Georgia home you want to purchase. After reviewing the Georgia FHA mortgage requirements and loan limits, you can use our FHA mortgage calculator, which will allow you to determine what your monthly payment, will cost.

One of the most common questions people ask is regarding where in Georgia FHA loans are available. They are available throughout every county of the state, and you can view the max Georgia FHA mortgage loan limits for your county below.

FHA mortgages are especially popular in cities and larger towns, such as: Atlanta, Albany, Alpharetta, Athens, Augusta, Columbus, Dunwoody, East Point, Johns Creek, Macon, Marietta, Peachtree, Rome, Roswell, Sandy Springs, Savannah, Smyrna and Warner Robins city, Valdosta. You can finance a home purchase with a FHA loan in a rural area as well though.

GEORGIA FHA MORTGAGE LENDERS

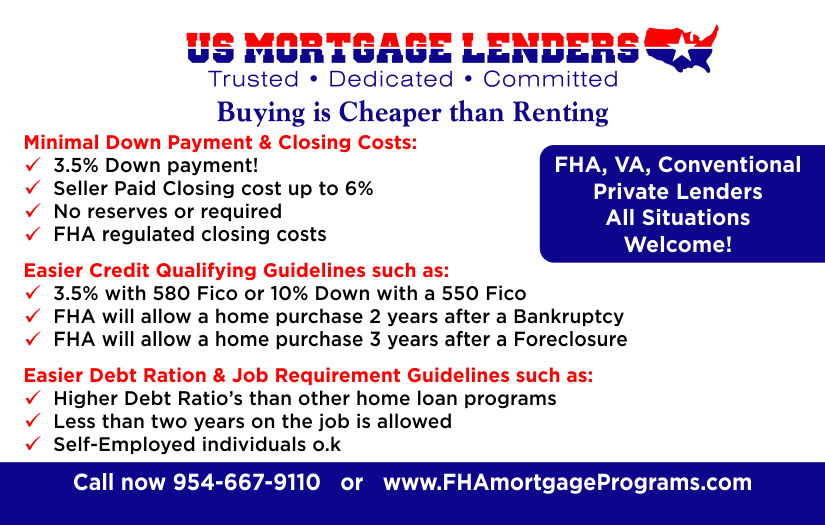

FHA MINIMAL DOWN PAYMENT AND FEES:

- Down payment only 3.5% of the purchase price, down payment assistance and closing costs OK!

- Sellers can credit the buyer’s up to 6% of sales price towards buyers costs and pre-paid.

- No reserves or future payments in account required.

- FHA regulated closing costs.

- Read more about buying a home with an FHA mortgage Bad Credit –No Credit –FHA Guidelines –Debt To Income Limits –

FHA IS EASIER TO QUALIFY:

- 12 months after a chapter 13 Bankruptcy FHA mortgage Lender approvals!

- 24 months after a chapter 7 Bankruptcy FHA mortgage Lender approvals!

- 3 years after a Foreclosure FHA mortgage Lender approvals!

- No Credit Score FHA mortgage Lender approvals!

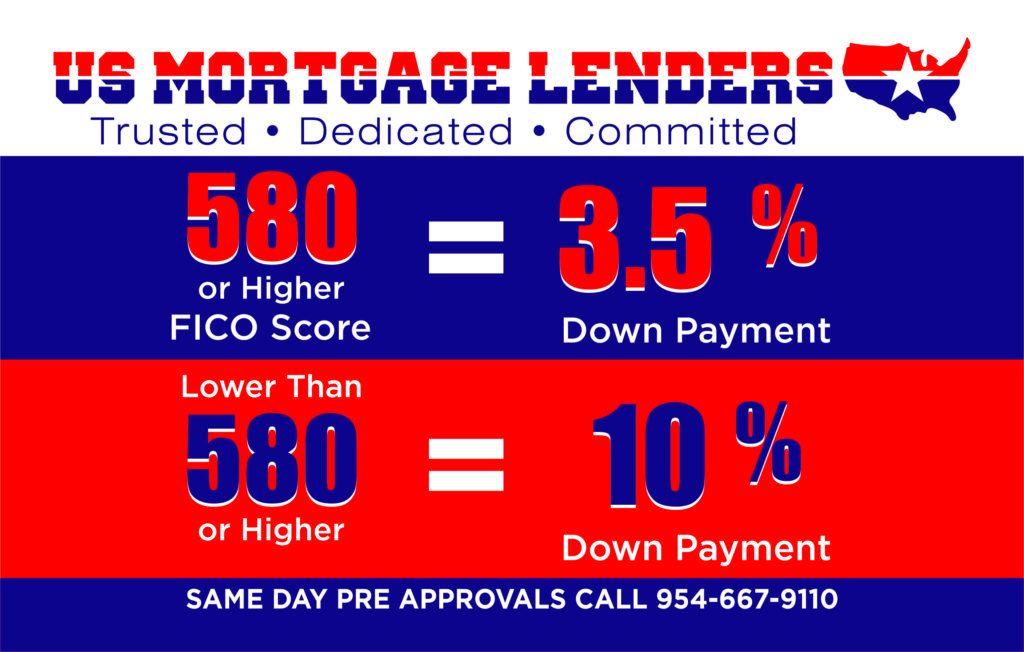

- 580 required for 96.5% financing or 3.5% down payment FHA mortgage Lender approvals.

- 500 required for 90% financing or 10% down payment FHA mortgage Lender approvals.

- Bad Credit with minimum 500 FICO credit score with 10% Down Payment FHA.

FHA OK WITH HIGHER DEBT EASIER QUALIFYING:

- FHA allows higher debt ratio’s than any conventional mortgage loan programs.

- Less than (2) two years on the same job is OK!

- Self-employed buyers can also qualify with FHA Mortgage Lenders.

- Read More about Gifts For Down Payment – Documents Checklist – Debt To Income – Student Loans.

Georgia FHA Lenders Loan Requirements

Keep in mind that each application is looked at individually, and Georgia FHA mortgage lenders have a considerable amount of leniency in what is required for an approval. There are some solid FHA loan requirements set out by the FHA mortgage lenders, which dictates what Georgia FHA mortgage lenders will insure. The following information is written in the context of buying a Georgia home with a FHA mortgage loan.

The Georgia FHA Mortgage Lenders requirements for a home purchase are as follows:

- Min Credit Score– A credit score of 580 or higher is needed for FHA loans for the 3.5% down payment requirement. Select bad credit FHA mortgage lenders will go down to a 550 fico with a clean and solid payment history. This includes first time Georgia first time home buyer mortgages, repeat buyer loans, and any FHA mortgage refinance program.

- Primary Home– You must occupy the Georgia home that you intend to purchase and have it be your primary residence. The FHA does not insure investment properties. Multifamily Georgia homes are allowed, which can have up to 4 units, but you must occupy at least one of them for it to be eligible for a Georgia FHA home loan.

- Job History – Proof of employment for 2 years is required. It is ok if you have changed jobs, but you need to show stable predicable income.

- Income Documentation – Paystubs and tax returns are required to show employment income, as well as bank statements, including your checking or savings accounts.

- DTI Ratio– Your monthly debts, including your new mortgage payment, must not exceed 43% of your bring home income. What you want to do is calculate all of your current monthly debts (do not include anything that does not show on your credit report – only those that appear on a credit report are counted). Then, take the total of your current debts, plus what your expected new mortgage payment, and get a total. Let’s say your current monthly debts are $750 and your new mortgage payment will be $1,000/month. Your total monthly debts would be $1,750. Compare this amount to your monthly income to calculate your DTI ratio. Your monthly debts compared to your monthly income shall not exceed 43% for you to qualify for a FHA loan.

Georgia FHA Mortgage Lenders Loan Limits

Use this Georgia FHA mortgage lenders table to determine the max lending limits for your county. The four columns and amounts for each represent the highest Georgia FHA mortgage loan amount the FHA mortgage lenders will insure based on the number of units. Keep in mind, these maximum Georgia FHA mortgage loan limits are the ceiling amount that can be financed with a FHA mortgage loan. The Georgia FHA mortgage loan limit to how much you can personally borrow will be based on your credit, income, and how much debt you currently have.

| County | Single Family | 2 Family | 3 Family | 4 Family |

| APPLING COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| ATKINSON COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| BACON COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| BAKER COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| BALDWIN COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| BANKS COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| BARROW COUNTY | $358,800 | $459,300 | $555,200 | $690,000 |

| BARTOW COUNTY | $358,800 | $459,300 | $555,200 | $690,000 |

| BEN HILL COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| BERRIEN COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| BIBB COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| BLECKLEY COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| BRANTLEY COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| BROOKS COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| BRYAN COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| BULLOCH COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| BURKE COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| BUTTS COUNTY | $342,700 | $438,700 | $530,300 | $659,050 |

| CALHOUN COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| CAMDEN COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| CANDLER COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| CARROLL COUNTY | $358,800 | $459,300 | $555,200 | $690,000 |

| CATOOSA COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| CHARLTON COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| CHATHAM COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| CHATTAHOOCHEE COUNTY | $289,800 | $371,000 | $448,450 | $557,300 |

| CHATTOOGA COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| CHEROKEE COUNTY | $342,700 | $438,700 | $530,300 | $659,050 |

| CLARKE COUNTY | $320,850 | $410,750 | $496,500 | $617,000 |

| CLAY COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| CLAYTON COUNTY | $342,700 | $438,700 | $530,300 | $659,050 |

| CLINCH COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| COBB COUNTY | $342,700 | $438,700 | $530,300 | $659,050 |

| COFFEE COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| COLQUITT COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| COLUMBIA COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| COOK COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| COWETA COUNTY | $342,700 | $438,700 | $530,300 | $659,050 |

| CRAWFORD COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| CRISP COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| DADE COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| DAWSON COUNTY | $342,700 | $438,700 | $530,300 | $659,050 |

| DECATUR COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| DEKALB COUNTY | $342,700 | $438,700 | $530,300 | $659,050 |

| DODGE COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| DOOLY COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| DOUGHERTY COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| DOUGLAS COUNTY | $342,700 | $438,700 | $530,300 | $659,050 |

| EARLY COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| ECHOLS COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| EFFINGHAM COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| ELBERT COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| EMANUEL COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| EVANS COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| FINNIN COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| FAYETTE COUNTY | $342,700 | $438,700 | $530,300 | $530,150 |

| FLOYD COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| FORSYTH COUNTY | $342,700 | $438,700 | $530,300 | $659,050 |

| FRANKLIN COUNTY | $275,665 | $352,950 | $426,625 | $659,050 |

| FULTON COUNTY | $342,700 | $438,700 | $530,300 | $530,150 |

| GILMER COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| GLASCOCK COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| GLYNN COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| GORDON COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| GRADY COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| GREENE COUNTY | $515,200 | $659,550 | $797,250 | $990,800 |

| GWINNETT COUNTY | $342,700 | $438,700 | $530,300 | $659,050 |

| HABERSHAM COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| HALL COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| HANCOCK COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| HARALSON COUNTY | $342,700 | $438,700 | $530,300 | $659,050 |

| HARRIS COUNTY | $289,800 | $371,000 | $448,450 | $557,300 |

| HART COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| HEARD COUNTY | $342,700 | $438,700 | $530,300 | $659,050 |

| HENRY COUNTY | $342,700 | $438,700 | $530,300 | $659,050 |

| HOUSTON COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| IRWIN COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| JACKSON COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| JASPER COUNTY | $342,700 | $438,700 | $530,300 | $659,050 |

| JEFF DAVIS COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| JEFFERSON COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| JENKINS COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| JOHNSON COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| JONES COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| LAMAR COUNTY | $342,700 | $438,700 | $530,300 | $659,050 |

| LANIER COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| LAURENS COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| LEE COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| LIBERTY COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| LINCOLN COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| LONG COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| LOWNDES COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| LUMPKIN COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| MACON COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| MADISON COUNTY | $320,850 | $410,750 | $496,500 | $617,000 |

| MARION COUNTY | $289,800 | $371,000 | $448,450 | $557,300 |

| MCDUFFIE COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| MCINTOSH COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| MERIWETHER COUNTY | $342,700 | $438,700 | $530,300 | $659,050 |

| MILLER COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| MITCHELL COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| MONROE COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| MONTGOMERY COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| MORGAN COUNTY | $342,700 | $438,700 | $530,300 | $659,050 |

| MURRAY COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| MUSCOGEE COUNTY | $289,800 | $371,000 | $448,450 | $557,300 |

| NEWTON COUNTY | $342,700 | $438,700 | $530,300 | $659,050 |

| OCONEE COUNTHY | $320,850 | $410,750 | $496,500 | $617,000 |

| OGLETHORPE COUNTY | $320,850 | $410,750 | $496,500 | $617,000 |

| PAULDING COUNTY | $342,700 | $438,700 | $530,300 | $659,050 |

| PEACH COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| PICKENS COUNTY | $342,700 | $438,700 | $530,300 | $659,050 |

| PIERCE COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| PIKE COUNTY | $342,700 | $438,700 | $530,300 | $659,050 |

| POLK COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| PULASKI COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| PUTNAM COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| QUITNAM COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| RABUN COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| RANDOLPH COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| RICHMAN COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| ROCKDALE COUNTY | $342,700 | $438,700 | $530,300 | $659,050 |

| SCHLEY COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| SCREVEN COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| SEMINOLE COUNTY | $275,665 | $438,700 | $530,300 | $659,050 |

| SPALDING COUNTY | $342,700 | $352,950 | $426,625 | $530,150 |

| STEPHENS COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| STEWART COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| SUMTER COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| TALBOT COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| TALIAFERRO COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| TATTNALL COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| TAYLOR COUNTY | $275,665 | $352,950 | $419,425 | $530,150 |

| TELFAIR COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| TERRELL COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| THOMAS COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| TIFT COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| TOOMBS COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| TOWNS COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| TREUTLEN COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| TROUP COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| TURNER COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| TWIGGS COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| UNION COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| UPSON COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| WALKER COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| WALTON COUNTY | $342,700 | $438,700 | $530,300 | $659,050 |

| WARE COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| WARREN COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| WASHINGTON COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| WAYNE COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| WEBSTER COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| WHEELER COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| WHITE COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| WHITFIELD COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| WILCOX COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| WILKES COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| WILKINSON COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |

| WORTH COUNTY | $275,665 | $352,950 | $426,625 | $530,150 |