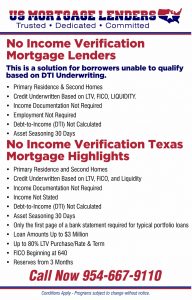

NO INCOME VERIFICATION GEORGIA MORTGAGE LENDERS

For Georgia borrowers unable to qualify based on Debt To Income Ratios!

- Primary Residence & Second Homes

- Credit Underwritten Based on LTV, FICO, and Liquidity

- Income Documentation Not Required

- Employment Not Required

- Debt-to-Income (DTI) Not Calculated

- Asset Seasoning 30 Days

GEORGIA BANK STATEMENT ONLY MORTGAGE LENDERS DETAILS INCLUDE:

- 2 Years Self Employed Required!

- Bank statement deposits used to qualify!

- No tax returns required

- 12 months personal bank statements or 12 months Business Statements used for income

- Loans up to $3 million

- Credit scores down to 600

- Low Rates

- Up to 90% LTV

- DTI up to 55% Debt To Income Ratio

- Owner-occupied, 2nd homes, and investment properties

- 2 years seasoning for foreclosure, short sale, BK, DIL

- Non-warrantable condos considered

- Jumbo loans down to 600 score

- 5/1 ARM or 30-year fixed

- No pre-payment penalty for owner-occ and 2nd homes

- SFRs, town homes, condos, 2-4 units

- Seller concessions to 6% (2% for investment)

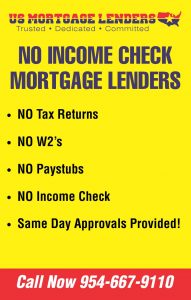

or FAST CONSULTATION – Same Day Approvals

or FAST CONSULTATION – Same Day Approvals

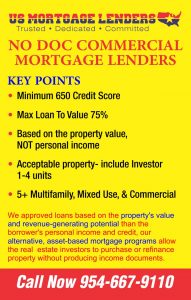

75% GEORGIA NO DOC COMMERCIAL MORTGAGE LENDERS RELATED SELF EMPLOYED GEORGIA MORTGAGE LENDERS PAGES!

RELATED SELF EMPLOYED GEORGIA MORTGAGE LENDERS PAGES!

-

- BANK STATEMENT ONLY-GEORGIA STATED SELF EMPLOYED MORTGAGE LENDERS!

- 12-24 MONTH GEORGIA SELF EMPLOYED MORTGAGE LENDERS

- GEORGIA BANK STATEMENT ONLY SELF EMPLOYED MORTGAGE LENDERS

- GEORGIA SELF EMPLOYED MORTGAGE LENDERS

- 24 Months + GEORGIA BANK STATEMENT ONLY MORTGAGE …

- GEORGIA BANK STATEMENT FL MORTGAGE LENDERS

- Self-Employed Mortgage Approvals Using Bank Statements Only

- Georgia Mortgage Lenders: For Self Employed

Whether buying or refinancing, flipping or renting Georgia property, we’ve designed our no income verification home loans to help you maximize your investment opportunities.

Georgia No Tax Returns

Credit Score

Reserves

600

6 Month

| Max Loan Amount | Min Down | |

| $2,000,000 | 10% |

No income or Stated Mortgage loans are approved self-employed borrowers that can verify bank deposits via bank statements.

| Georgia Bank Statement Only Mortgage Lenders Program Details | |

| Property Type: |

|

| Assets: |

|

| Credit Score: | Minimum 600 |

- Single Family, Townhouses, Condominiums

- 2 Month Bank Statements

- Gift funds allowed

GEORGIA NO INCOME GEORGIA MORTGAGE ADVANTAGES

- No income verification

- No debt-to-income calculations

- No minimum credit score

- Credit score only used to determine tiers

- Close in as little as two weeks

www.Georgia-Mortgage-Lenders.com

Georgia No Income Verifcation Investor Loans 6 month I/O 10 Due-in-3 15 Due-in-3

Purchase Cash-out Refi Purchase Cash-out Refi Purchase Cash-out Refi Georgia Real Estate

Terms include: 6 months 36 months 36 months

Amortization Interest-Only 120 months 180 months

Tier 1 Rate, Points* 13%, 4 points 14%, 4 points 14%, 4 points

Tier 2 Rate, Points 14%, 5 points 15%, 5 points 15%, 5 points

Tier 3 Rate, Points 15%, 6 points 18%, 6 points 18%, 6 points

LTV 65% 50% 65% 50% 65% 50%

Min. Property Value $30K $36K $50K $80K

Property Condition C1-C5 C1-C4 C1-C4

Investment Purpose Flip Flip or rent Rent only

Prepayment Penalty No No Yes

GEORGIA NO INCOME VERIFICATION LOAN CHECKLIST

WHAT WE NEED

- Driver’s License

- Property Address

- Insurance Policy

- Closing Fee

- Credit Score

WHAT WE DON’T NEED

- Pay Stubs

- Tax Returns

- W-2s

- K-1s

- 1099s

- Bank Statements

- Investment History

- Business Plans

- Property Inspection

- Full Credit Report

Flipping a Georgia property? Our short-term interest-only loan lets you keep cash available for improvements and other opportunities. Renting out a Georgia home? Our 10-year and 15-year loans keep your no income verification mortgage payments low. Georgia No income verification lenders providing loans for home investors. As always, we lend our no income verification loans based primarily on the Georgia home value, which means a fast, simple, dependable process:

And with loans up to $300,000 and a wide variety of terms, we can help you reach all of your investment goals.

No Muss, No Fuss Loans. Unlike other Georgia no income verification lenders, we focus on the value of

the Georgia home. Our no income loans provide Georgia homebuyers with a fast and easy approval process. Simply complete an application, provide an appraisal and clear title, and we’re ready to roll. As always, our customers never have to worry about stacks of paperwork and time-consuming personal verifications, which means:

- 1.No income verification

- 2.No debt-to-income calculations

- 3.Close in as little as two

If you have unverifiable income generating from substantial savings the no income verification loan might be best Georgia mortgage you can use to purchase real estate. A No Doc or No income verification Georgia loan is not for everyone, if you fit the loan parameters, it can be a great tool for buying real estate.

What is a no income verification asset based loan? This loan is called an asset-based loan or asset depletion loan. Essentially the no income verification loan takes your assets and spreads them over 360 months (or less in some cases) to create your monthly income.

Who can benefit the most from this type of Georgia no income verification home loan Those who are retired (or close to it) with a liquid high net-worth.

What kinds of assets qualify for a no income verification home loan? No income verification loans largely depend on your goal. If you are purchasing a primary single family home and plan on using assets from your 401k then Freddie Mac or Fannie Mae will suit you well. If, however, your assets are more complicated and you would like to utilize the program to purchase Georgia investment property then a portfolio lender will be a better fit.

NO INCOME GEORGIA MORTGAGE VERIFICATIN GUIDELINES- Whoever is listed on the asset account must be on the mortgage.

The assets you are using must be liquid, available to you with no penalty and a direct result of employment-related savings (i.e., retirement savings):

- Retirement accounts such as 401(k), IRA, SEP, KEOGH account; any account recognized by the IRS.

- Stocks

- Bonds

- Mutual Funds

- Non-self-employed severance package.

- Non-self-employed lump sum retirement.

The Fannie Facts:

- Down Payment Required: 30%

- Minimum Credit Score: 620

- Loan Purpose: Purchase or No Cash-Out Refinance

- Type of Home: Primary Residence or Second Home

- Acceptable Property Type: 1-4 Units

General Freddie Mac Asset Guides

Whomever is listed on the asset account, must be on the mortgage.

The assets you are using must be liquid, available to you with no penalty and a direct result of employment-related savings (i.e., retirement savings):

- Retirement accounts such as 401(k), IRA, SEP, KEOGH account; any account recognized by the IRS.

- Lump-sum monies received (the original source any lump-sum must be employment-related).

- Assets from the sale of a business.

Acceptable Georgia Assets Include:

Cash Equivalents

- Self-Employed Income

- Retirement (must be of retirement age)

- CDs

- Savings

- Money Market Accounts

- Public Stocks

- Bonds

- Mutual Funds

- Trust Funds

- Lotto Winnings

- Lawsuit Settlements

- Other Complex Asset Portfolios

Georgia No Income Verification Mortgage Lenders

NO INCOME VERIFICATION GEORGIA MORTGAGE LENDERS