One of the best decisions you can make when selecting a FHA mortgage lender in Georgia that specialize in FHA mortgage loans.

Why? Well, for starters, FHA mortgage lenders have access to both conventional and FHA mortgages, so they can present you with a full range of GA mortgage loan options.

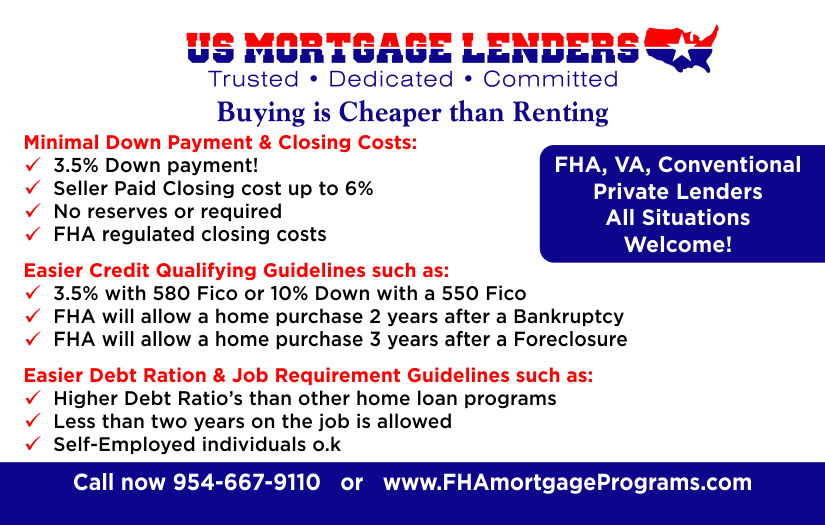

FHA Mortgage Lenders Georgia Advantage Summary

Here’s what you’ll need to qualify for an FHA Mortgage Lenders in GA:

- A minimum credit score of 580 for 3.5% Down\

- No more than two thirty-day late entries on your credit report

- Monthly payments not to exceed 31% of your gross monthly income

- Seller can pay your closing cost up to 6%

- Back-end debt-to-income ratio up to 43%

- Consistent Stable Income And employment over the past two years

Working with an FHA-approved lender in Jacksonville, Florida is always a wise choice. Whether you eventually go conventional or FHA–an FHA-approved lender can give you all the options.

FHA Mortgage Protections for Georgia Home buyers!

Georgia FHA Approved mortgage lenders must meet strict requirements which gives you added protection.

For Example: FHA mortgage lenders must be valid corporations with a minimum net worth—so fly-by-night operations won’t qualify.

There must be a managing officer with at least three years of experience in the mortgage field the company operates in.

No one in the organization may have a loan license suspension or debarment.

There are many other requirements that serve to protect you, the FHA mortgage applicant, as well as the FHA itself.

Georgia FHA Mortgage Lenders Have More Options!

Buying a GA home is the fulfillment of a dream for many people. But some are disappointed to discover they don’t qualify for home loans under conventional lending requirements. They may not have enough cash for a large down payment. Or, they have less-than-perfect credit. For some, the strict debt-to-income ratio requirements put a conventional loan out of reach.

They come away disillusioned and discouraged. But for those people, an FHA loan could be the answer. If they’re working with an FHA-approved lender, a new realm of possibilities can open up.

Here are some advantages an FHA-approved lender in Jacksonville, Florida can show you…

Low Down Payment for Georgia FHA Mortgage Applicants- Not everyone has the piles of cash conventional lenders ask for their down payments. FHA has solved that problem for millions of buyers. With an FHA-insured loan, your down payment can be as low as 3.5 percent.

That difference can be the deciding factor when you’re looking to get into your dream home. For a $500,000 home, even a relatively low down payment of 5 percent comes out to $25,000—way beyond the reach of many buyers. But with an FHA loan your down 3.5 percent down payment would only be $17,500—a difference of $7,500! That’s enough to make or break the deal in many cases.

Lower Closing Costs for Georgia FHA Mortgage Applicants- FHA has very strict guidelines about the closing costs you pay as a buyer. The costs that don’t fall within their guidelines must be paid by someone else! That usually means the seller, the lender or even the real estate agent. That saves you money as a buyer.

Conventional mortgages often cap the amount a seller can contribute to closing costs at $3,000. But an FHA loan allows you to receive $6,000 in closing cost help. Easier Credit Requirements for Georgia FHA Mortgage Applicants- FHA mortgage loans are tailor-made for people who don’t have perfect credit. FHA lenders can be more lenient because the loans are backed by the federal government.

Conventional Georgia mortgage lenders prefer borrowers with credit scores above 700. By contrast, you may qualify for an FHA loan with a score of 550 or even lower in some cases.

Debt-to-Income Ratio for Georgia FHA Mortgage Applicants- A critical part of the loan approval process is calculating your debt-to-income (DTI) ratio. That’s the percentage of your gross monthly income that goes to debt repayment. (Your front-end DTI is calculated using only your FHA mortgage payment; the back-end DTI includes all your monthly debt payments.)

Here too, FHA guidelines can be more forgiving than those for conventional loans. For instance, conventional loan guidelines typically cap the front-end DTI at 28 percent. But under FHA guidelines you may qualify with a DTI of 30 percent.

That means if your monthly gross income is $5,000, you’d be limited to a monthly payment of $1,400 with a conventional loan. But with an FHA loan, your allowed monthly payment could be as high as $1,500. That allows you to buy a bigger, better house.

Likewise, your back-end DTI is typically limited to 36 percent with a conventional loan. With FHA, it can be as high as 41 percent.

Competitive Rates for Georgia FHA Mortgage Applicants- Even though FHA loans have more generous guidelines for eligibility, the interest rates are quite competitive. Find out and compare!

Refinancing for Georgia FHA Mortgage Applicants- FHA offers refinance options for those who already own homes. In fact, if you already have an FHA-backed loan you can take advantage of today’s low interest rates with an FHA Streamline Refinance. This gets you into a new low-interest loan with a minimum of fuss and paperwork. Talk with your FHA-approved lender in Jacksonville, Florida about this attractive program.

GA MORTGAGE LINKS OF INTEREST

- GEORGIA FHA MORTGAGE LENDERS – Florida FHA Mortgage Lenders

- 3.5% Georgia FHA Mortgage Lenders + Min 580 Fico! Same Day …

- 3.5% Georgia FHA Mortgage Lenders Min 580 FICO!! – Florida FHA …

- GEORGIA FHA/VA MORTGAGE LENDERS-Same Day Pre Approvals!

- Georgia FHA Mortgage Lenders Home Loan Options

- GEORGIA Archives – FHA MORTGAGE LENDERS

- TOWN HOME FHA MORTGAGE LENDERS

- Georgia VA Mortgage Lenders Min 580 FICO! – Florida FHA Mortgage …

- 3.5% BAD CREDIT GEORGIA MORTGAGE LENDERS – Florida FHA …