NO DOC STATED INCOME FLORIDA MORTGAGE LENDERS

How Do Florida Self Employed Mortgage Lenders Work?

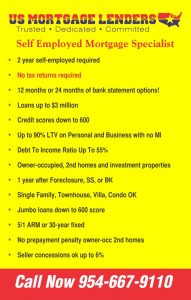

For primary homes, the federal law requires Florida Mortgage Lenders to verify your ability to make the mortgage payments. In lieu of tax returns, k-1’s, or 1099’s the Florida self-employed Mortgage Applicants can qualify with business earnings deposited into a business (24 months) or personal (12 months) bank account. These deposits will become the base qualifying income in lieu of traditional income documentation. Seasonal fluctuations to earnings that are normal to a given business are expected and allowed.

For Lease Option to Purchase Rent To Own Florida transactions executed >12 months ago Florida mortgage lenders can use the CURRENT/TODAYS appraised value. This means any appreciation increase in value between the sales price and the appraised value is passed to the buyer as equity or down payment and thus minimizing out of pockets costs.

Florida Self Employed Jumbo Mortgage Lenders Key Points

- 600 Minimum MID FICO score required

- 10% down payment requires 660 MID-FICO score

- 15% down payment or greater requires 600 MID-FICO scores.

- Bank Statment Only Mortgage Lenders Maximum Loan Amount- $3,000,000

- Purchase or Refinance or Cash Out Refinance with up to $500,000 cash out.

- Self Employed can qualify using 24 Months business or 12 months personal statements.

- We also have a true “Stated Income” available for Investment properties only.

- Must be self-employed for at least 24 months for bank statement qualifier.

- We can combine income from w-2 Self-employed mortgage applicants with a Self-Employed co-Self employed mortgage loan applicants.

- Primary Residence – Investment – 2nd/Vacation Home all O.K.

- No Manufactured or Mobile Homes or Commercial Property

- New Builder Homes OK but NO “construction loans” available.

- Available in 30 Year Fixed Rate and 5/1 ARM products.

- No Pre-Payment Penalties and No PMI for primary and 2nd homes including 90% LTV.

- Special Product options for “lease option to purchase” transactions. See below for more details

| Jumbo Florida Bank Statment Only Mortgage Lenders General Requirements |

|---|

|

- Rate Quoted is for a 5/1 ARM, based on Florida property LTV requested if available – if N/A, the rate is based on Max LTV. Add 0.50% to rate for 30 Year fixed on all programs except Platinum – add .25% on Platinum. 7/1 ARM also available on Platinum with .125% added to rate.

- 24 months Florida Business Bank Statements used for income. Maximum 1 account allowed. Florida jumbo mortgage applicants provided Profit & Loss statement specifying the business expenses as a percent of the gross revenue required. Qualifying income is the total deposits less business expense (minimum expense ratio used is 35%). The Self-employed Florida jumbo mortgage applicants must be 100% owner of the business. The minimum loan amount is $150,000.Platinum Program ONLY: Funds to close: At least 50% of the funds for closing must come from personal accounts OR if using business funds, not more than 50% of ending balance is being used for closing. If either of these is not met loan will not qualify for the Platinum program or rate. Note: Funds must be sourced and seasoned for the minimum of 30 days.

- Note: This self-employed jumbo mortgage information is based on the Florida jumbo mortgage applicants meeting the Standard Tradeline requirements. Need 3 tradelines reporting for a minimum of 12 months -OR- 2 tradelines reporting > 24 months; all with activity in the last 12 months. Canceled checks for 12 or 24 months housing history may also be used as a tradeline. Exceptions allowed on NON PRIME program ONLY – If the Florida Self-employed mortgage applicants do not meet these tradeline requirements, reduce the max LTV by 5% (max LTV not to exceed 75%) and add 50bps to rate. Maximum of 1×30 last 12 months for PortfolioSelect, 0x30 last 12, 1×30 last 24 months for Bank Statement, 0x30 last 24 months for Income Cash Flow & Foreign National loan programs. Additional program restrictions may also apply, contact your Account Executive for details.

- All information is subject to change without notice.

- do-i-need-rental-history-to-qualify-for-a-bank-statement-only-mortgage

- Whats the minimum credit score for a bank statement only loan?

- How is income calculated for your bank statement only mortgage loan program?

- How long do I have to prove self-employed to qualify for your bank Statement only loan program?

- Whats your minimum loan amount for a bank statement only mortgage loan?

- how long does it take to get a Pre Approval letter on a Bank Statement the only mortgage?

- what-if-im-self-employed-but-can not-prove-i-have-been-in-business-for-at-least-2-years

- What deposits have NOT used the qualify using bank statements only for income?

- Can i deposit money into more than 1 bank account and still qualify the income?

- how-much-of-a-down-payment-do-i-need-for-a-bank-statement-only-loan

- How long does it take to qualify and close on a bank statement the only loan?

SELF EMPLOYED MORTGAGE LENDERS PAGES

SELF EMPLOYED FLORIDA MORTGAGE LENDERS

Florida self–employed mortgage lenders want to be sure you can afford your mortgage and for the self–employed that requires some extra paperwork.

10%DOWN + SELF EMPLOYED FLORIDA MORTGAGE LENDERS

Self Employed Florida Mortgage Lenders qualifying Florida borrowers with 12 or 24 months Bank statements. NO TAX RETURNS NEEDED! same day approval!

Self Employed Florida Mortgage Lenders-No Tax Returns Needed!

Self–employed Florida mortgage Lenders are perfect because while most Florida self-employed borrowers earn a solid income, they show a smaller net income …

Florida -Bank Statement Only Mortgage Lenders

10%DOWN+BANK STATEMENT FL MORTGAGE LENDERS

12 or 24 Month Florida Bank Statement Home Loan Program.For Florida Self Employed. Florida Bank Statement Only (Personal or Business). No Tax Returns

Florida -Bank Statement Only Mortgage Lenders

FLORIDA BANK STATEMENT ONLY MORTGAGE LENDERS DETAILS INCLUDE: 2 Years Self EmployedRequired! Bank statement deposits used to qualify! No tax returns required. 24 months personal bank statements (Personal and Business) Loans up to $2 million. Credit scores down to 500. Rates starting in the 5’s. Up to 85% LTV.

Bank Statement Only Florida Mortgage Lenders Min 600+FICO!

US Mortgage Lenders offers a 24-Month Bank Statement Loan Program. Florida and Georgia … Self Employed and 1099 borrowers only 5. Only 6 NSF’s in most …

10%DOWN + SELF EMPLOYED FLORIDA MORTGAGE LENDERS

Self Employed Florida Mortgage Lenders qualifying Florida borrowers with 12 or 24 months Bank statements. … Furthermore, our Florida Bank Statement Loan Program with No Tax Returns can …. EASTNAPLES FL MORTGAGE LENDERS.

10% DOWN+STATED INCOME FLORIDA MORTGAGE LENDERS-

If you are self–employed stated Florida home loan applicant, you already know the benefits that come with making …. EAST NAPLES FL MORTGAGE LENDERS.

Florida No Income Verification Mortgage Lenders

No income or Stated Mortgage loans are approved self–employed borrowers that can verify bank deposits … A No Doc or No income verification Florida loan is not for everyone, if you fit the loan …. EAST NAPLES FL MORTGAGE LENDERS.

Commission Income Only Florida Mortgage Lenders

Florida Self Employed Only 12 Months Florida Mortgage Lenders … If you are self

FLORIDA NO INCOME VERIFICATION MORTGAGE LENDERS

… home financing, being that self–employed Florida mortgage applicants have a complex way of documenting income. … No Reserves; Up To 75% LTV; $2,000,000 loan amounts; Interest Only payment … NAPLES FL MORTGAGE LENDERS.