- NO TAX RETURN TEXAS MORTGAGE LENDERS

- Texas Self Employed Questions And Answers

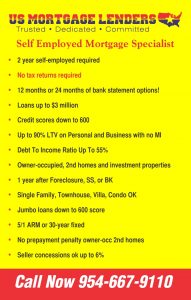

- Texas Self Employed Get Mortgage Approval with NO Tax Returns!

- Texas No Tax Return Mortgage Lenders- Using Texas Bank Statements

Self Employed Texas Mortgage Lenders Serving All Texas Including And Not Limited To: Fort Worth Texas, Austin Texas, Dallas Texas, San Antonio Texas, Houston Texas

Texas No Tax Return Mortgage Lenders- Using Texas Bank Statements For Income

Texas No Tax Return Mortgage Lenders- Using Texas Bank Statements For Income

- No Tax Returns Needed!

- Use 12 or 24 months Texas Bank Statements used for income!

- Commingle w2 and Texas Bank Statement for income!

- Self Employed, 1099 or proof 2 years self-employed!

- Only Deposits used as income.

- Must have all 12 or 24 consecutive (no missing pages)

- Commingled Multiple accounts Case By Case

- Backout Texas Bank Statement proceeds from the sale or liquidation of significant assets including real estate, financial assets including stock, bonds, life insurance policies and autos and loan proceeds from borrowing.

- Business licenses or satisfactory evidence of self employed to cover previous 24 months and percentage of ownership (LLP)

- Self-Employment Business Questionnaire and Certification to be completed by borrower when business Texas Bank Statements are used to document income

- Provide last 2 months of Personal Texas Bank Statements for all closing assets including $Earnest Money Deposit check, clearance and escrow deposit receipt

- If using business funds to qualify, provide a signed Letter of Explanation as to how the use of the assets will affect the company

- Explain the source of income for the deposits on Texas Bank Statements for the following: Stripe, Venmo, Paypal and disbursements for Elite Marketing

BUSINESS Texas Bank Statement QUESTIONNAIRE

Questions to for self-employed person about his/her business. Which are necessary to analyzing Texas Bank Statements to determine income.

- Describe the business you are in?

- How many office or plant do you have? How much rent do you pay for the location you operate your business from? Do you pay monthly?

- How many people do you have working for you? How much do you pay them monthly?

- Do you manufacture a product such that you have a cost of goods for the product that you ultimately sell? How much do you spend on it monthly or every few months or every half a year (estimate a $).

- Do you buy and then resell a product?

- If your business address is different than your home address explain how you use that address.

- What percentage of the business do you own?

- Which bank account do you deposit the gross rents of the properties you owned? If applies.

Texas Bank Statement MORTGAGE LENDERS INCOME ANALYSIS

- Borrower Name:

- Loan Number:

- Person Completing Analysis:

- Product Submitted:

- A1 12 Month A1 24 Month A4 24 Month

- A5 Business A5 Personal

- Purchase Rate/Term Cash Out

- How Many Years Self Employed:

- 2YR 3YR 3YR+

- Statements used to qualify

- Business

- Business and Personal

- Commingled

- Account Number Used

- Personal: provide last three months of personal stmts to UW

- Business: 6429

- Profession of Self-Employed Borrower:

- Business(s) Used to Qualify: J&F INTERIOR INC

- Calculator Notes:

- Large Deposits Used: Yes No

- If Yes, explain: $

- Retained Earnings: Yes No

- If yes, explain

- Other: Additional income conditions, analysis, and sourcing may be assessed after submission to underwriting. Provide 3 months personal Texas Bank Statements.

Texas Bank Statement MORTGAGE QUESTIONS AND ANSWERS

- do-i-need-rental-history-to-qualify-for-a-bank-statement-only-mortgage

- Whats the minimum credit score for a Texas Bank Statement only loan?

- How is income calculated for your Texas Bank Statement only mortgage loan program?

- How long do I have to prove self-employed to qualify for your Texas Bank Statement only loan program?

- Whats your minimum loan amount for a Texas Bank Statement only mortgage loan?

- how long does it take to get a Pre Approval letter on a Texas Bank Statement only mortgage?

- what-if-im-self-employed-but-cannot-prove-i-have-been-in-business-for-at-least-2-years

- What deposits are NOT used the qualify using Texas Bank Statements only for income?

- Can i deposit money into more than 1 bank account and still qualify the income?

- how-much-of-a-down-payment-do-i-need-for-a-bank-statement-only-loan

- How long does it take to qualify and close on a Texas Bank Statement only loan?

Serving All Texas Including And Not Limited To: Fort Worth Texas, Austin Texas, Dallas Texas, San Antonio Texas, Houston Texas