No Income Verification Florida Mortgage Lenders

No Income Florida Mortgage Lenders Requirements Of Florida No Income Mortgage Lenders Primary Residence & Second Homes Credit Underwritten Based on LTV, FICO, and Liquidity Read More »

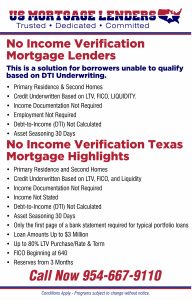

Requirements Of Florida No Income Mortgage Lenders

- Primary Residence & Second Homes

- Credit Underwritten Based on LTV, FICO, and Liquidity

- Income Documentation Not Required

- Employment Not Required

- Debt-to-Income (DTI) Not Calculated

- Asset Seasoning 30 Days

Florida No Income Mortgage Credit

- No Mortgage or Rental Late payments in the last 12 months.

- Foreclosure, and Short Sale, Require 12 months of seasoning

- Bankruptcy must be discharged or settled.

- Assets must be sourced or seasoned for 30+ Days.

- Texas Cashout A6 Not permitted.

- US Citizen Permanent Resident Alien, Non-Permanent Resident Alien with US Credit Report

- Maximum 20 properties including subject property.

- Primary and Second Homes Only

- No PRepayment penalty

- SFR, PUD, Townhome, Condo, Non-Warrantable COndo max 65% 2-4 unite Modular, Rural, Log homes.

- Manufactured homes Not Eligible

- Seller-paid closing cost up to 6%

Typically Florida No Income Applicants Include:

Self-Employed/Small Business Owner, Independent contractors, Bakeries, Bars, Convenience Stores, Transportation services, Dry cleaners, Dancers, Laundromats, Security services, Retirees, Day Traders, YouTubers, Social Media Influencers, Content Creators, Internet Marketers, Day Traders, YouTubers, Social Media Influencers, Content Creators, Internet Marketers, Realtors, Gig economy workers, Commission earners, Freelancers, Entrepreneurs, Consultants, Retirees, Day Traders, YouTubers, Social Media Influencers, Content Creators, Internet Marketers, And many more!

Close Faster – Confirm LTV – Confirm Fico – Confirm Reserves

- Elimination of “feel good” conditions

- Only the first page of a bank statement is required for typical portfolio loans

- No overlays on agency and government loans

- White-Glove Concierge Desk services

- Leading-edge technology

- Florida no doc loans for self-employed

- mortgage for self-employed

- home loans for self-employed

- self-employed mortgage network

- 100% stated income Florida mortgage lenders

- mortgage broker for self-employed

- Florida self-employed home loan

- no doc mortgage loans

- no income verification mortgage

- self-employed mortgage lenders

- stated income loans

- stated income mortgage lenders

- stated income mortgages

- Florida self-employed loan

- stated income loan mortgage

- stated income loans

- Florida stated income loans

- stated income lender info

- stated income mortgage

- self employed mortgage

- stated income loans for self employed

- mortgage loans for self employed

- stated income loan programs

- Florida stated income mortgage lenders

- no doc mortgages still available

- self employed mortgage loans

- self employed mortgages

- best mortgage for self employed

- loans for self employed

- buying home self employed

- fha self employment income guidelines

- loans for self employed with bad credit

- stated income mortgage loans

- stated income mortgage lenders

- mortgage for self employed individual

- self employed home loan options

- self employed home loan programs

- stated income jumbo mortgage loans

- what is stated income

- no doc mortgage lender 2015

- Florida stated income loans lender

- who does stated income loans

- self-employed

- online loans for self-employed

- loans for self employed without a credit check

- stated income mortgage rates

- self-employed mortgage

- mortgage rates for self-employed

- guaranteed self-employed loan