Texas Bad Credit Mortgage Lenders Cash OUT Refinance UP To $500K In Hand!

- WHATS THE MINIMUM DOWN FOR TEXAS BAD CREDIT TEXAS MORTGAGE LENDER

- YES! TEXAS MORTGAGE WITH COLLECTION ACCOUNTS!

- TEXAS MORTGAGE WITH COLLECTIONS!! + WE SAY YES!!

- YES! TEXAS MORTGAGE WITH COLLECTION ACCOUNT

- 3.5% Down Texas Bad Credit Mortgage Lenders

FAST CONSULTATION

- San Antonio Texas Mortgage Lenders Loan Programs Include:

- Bad Credit Texas Mortgage Lenders

- FHA Texas Mortgage Lenders

- Self Employed Mortgage Lenders

- Stated Income Texas Mortgage Lenders

- VA Texas Mortgage Lenders

- Texas FHA Mortgage Lenders

- Texas Bad Credit Debt Consolidation Mortgage Lenders

- APPLY NOW

-

NO CREDIT TEXAS MORTGAGE LENDERS = YES

https://www.fhamortgageprograms.com/no-credit-texas-mortgage-lenders-yes/

There are however maximum income limits for the USDA FHA mortgage and special terms available for low-income FHA mortgage applicants. VA Texas No Credit SCORE Texas Mortgage LendersS- VA loansare only for veterans and their eligible spouses, as well as those who have served within civil organizations.

3.5% DOWN BAD CREDIT TEXAS MORTGAGE LENDERS

https://www.fhamortgageprograms.com/3-5-down-bad-credit-texas-mortgage-lenders/

3 years after a Foreclosure FHA mortgage Lender approvals! No Credit Score FHA mortgage Lenderapprovals! 580 required for 96.5% financing or 3.5% down payment FHA mortgage Lender approvals. 500 required for 90% financing or 10

% down payment FHA mortgage Lender approvals. BAD CREDITTEXAS with … You’ve visited this page many times. Last visit: 2/15/183.5% BAD CREDIT TEXAS MORTGAGE LENDERS

https://www.fhamortgageprograms.com/3-5-down-texas-bad-credit-mortgage-lenders/

Texas Mortgage Lenders After Bankruptcy – Foreclosure – Short Sale. Purchase 1 day after bankruptcy, foreclosure, short sale and deed in lieu of Texas foreclosure up to 2.5 million. These are not subprimeloans, but they do often have higher interest rates, and higher closing costs.

You’ve visited this page many times. Last visit: 2/14/18Texas FHA Mortgage Lenders – Bad Credit – No Credit OK!

https://www.fhamortgageprograms.com/texas-fha-mortgage-lenders-bad-credit-no-cre…

Texas FHA-Mortgage–Lenders.com is dedicated to providing current Texas Home Owners and TexasFirst Time Home Buyers so they can Buy A Home with less than 3.5% down and/or FHA MortgageRefinance up to 96.5% of the home’s value. Explore FHA Loan Programs including Bad Credit Mortgage Lenders or No …

TEXAS MORTGAGE AFTER BANKRUPTCY OR FORECLOSURE =OK

https://www.fhamortgageprograms.com/texas-mortgage-bankruptcy-foreclosure-ok/

TEXAS MORTGAGE AFTER BANKRUPTCY, FORECLOSURE OR SHORT SALE. Bad Credit Texas Mortgage Lenders After A Bad Credit Event! Have you heard the term “boomerang buyer” is a Texas mortgage applicant who’s been kept out of the housing market due to a prior Texas foreclosure, short sale or bankruptcy …

You visited this page on 1/25/18. -

Texas Mortgage 1 Day After Bankruptcy Or Foreclosure

https://www.fhamortgageprograms.com/texas-mortgage-1-day-after-bankruptcy-or-fo…

Purchase 1 day after bankruptcy, foreclosure, short sale and deed in lieu of Texas foreclosure up to 2.5 million. Same Day Approvals Call Now 954-667-

9110. You’ve visited this page 3 times. Last visit: 1/25/18 Same Day Texas Bad Credit Loan Approvals! - Many Bad Credit Texas mortgage applicants don’t realize these Government guaranteed low interest rate FHA, VA mortgage loans can help Texas home buyers with bad credit. Even If you have a bad credit past and you’re looking for a low Texas mortgage interest rate GA mortgage a government or private lender may be a better option then renting.

- BAD CREDIT TEXAS FHA MORTGAGE LENDERS:

- Down payment only 3.5% of the purchase price.

- Gifts from family or FHA Grants for down payment assistance and closing costs OK!

- Sellers can credit the buyer’s up to 6% of sales price towards buyers costs and pre-paid.

- No reserves or future payments in account required.

- FHA regulated closing costs.

- Read more about buying a home with an FHA mortgage Bad Credit –No Credit – Investment –Second Home –Multi Family –

- BAD CREDIT TEXAS LENDERS MAKE QUALIFYING EASIER BECAUSE YOU CAN PURCHASE:

- 12 months after a chapter 13 Bankruptcy FHA mortgage Lender approvals!

- 24 months after a chapter 7 Bankruptcy FHA mortgage Lender approvals!

- 3 years after a Foreclosure FHA mortgage Lender approvals!

- No Credit Score FHA mortgage Lender approvals!

- 580 required for 96.5% financing or 3.5% down payment FHA mortgage Lender approvals.

- 500 required for 90% financing or 10% down payment FHA mortgage Lender approvals.

- BAD CREDIT TEXAS with minimum 500 FICO credit score with 10% Down Payment FHA. For FHA mortgage applicants with credit scores between 500 and 579 must make down payments of at least 10% down!

- Read more about FHA Qualifying Qualification Summary – Manual Underwrite – Collections-Judgement’s – Bankruptcy or Foreclosure – Compensating Factors –

- BAD CREDIT FHA TEXAS LENDERS ALLOW HIGHER DEBT TO INCOME & EASIER JOB QUALIFYING

- FHA allows higher debt ratio’s than any conventional mortgage loan programs.

- Less than two years on the same job is OK!

- Self-employed buyers can also qualify with FHA Mortgage Lenders.

- Read More about Gifts For Down Payment – Documents Checklist – Debt To Income – Student Loans –

- We specialize in the following Bad Credit Texas Mortgage Loans:

- Bad Credit GA Mortgage Lender Programs– Case By Case situational approvals!

- FHA Bad Credit Texas Mortgage Lenders– Min 580 middle 3.5% Down min 550 With 10% Down.

- VA Bad Credit Texas Mortgage Lenders – Min 550 middle credit score with 100% financing.

- Texas Mortgage After Foreclosure – Short Sale – Bankruptcy- Foreclosure– Private Portfolio GA Bad Credit lenders.

- Bad Credit Texas Portfolio Lenders- Private GA mortgage lenders that do not sell the loans.

- Hard Money GA mortgage lenders- Hard money for case by case bad credit Texas mortgage applications.

- No Credit Score Texas Mortgage– No Credit score Texas with a bad credit past!

- Modular Home Bad Credit Texas Mortgage Lenders– Factory built bad credit modular home loans.

- Texas Bad Credit Jumbo Mortgage lenders– Bad Credit GA jumbo mortgage lenders down to a 500 fico!

- Debt Consolidation Bad Refinance in Texas – Refinance to lower your total monthly obligations to provide financial relief..

- 3.5% Texas FHA Mortgage Lenders Min 580 FICO!!

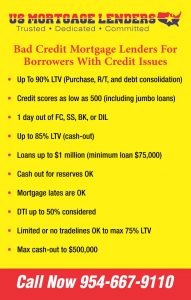

- Texas Bad Credit Mortgage Solutions!

- 1 day out of foreclosure, short sale, BK, DIL

- Rates starting in the low 5’s

- Bad Credit Texas Home Loans up to $1 million

- Credit scores down to 500

- Up to 85% LTV

- Combo loans up to 85% CLTV (min 680 score)

- DTI up to 50% considered

- Owner-occupied, 2nd homes, and investment properties

- Non-warrantable condos considered

- Jumbo loans down to 500 score

- 5/1 ARM or 30-year fixed

- No pre-payment penalty for owner-occ and 2nd homes

- No active tradelines OK with housing hisstory

- SFRs, townhomes, condos, 2-4 units

- Seller concessions to 6% (2% for investment)

- Contact your non-agency specialist today!

- ALL TEXAS SITUATIONS ARE WELCOME!!!

- The FHA mortgage can help you purchase a new Texas home with 3.5% down payment even if you have bad credit. Even If you’ve had accounts forwarded to collections, past bankruptcies or Foreclosures, high debt to income ratio, then you still may qualify for our bad credit or no credit Texas mortgage. These government backed bad credit Texas mortgage loans can work for Texas mortgage applicants that don’t have cash for a down payment or closing costs. And they are a much better choice than a Texas hard money loan.

- We work with all types of bad credit Texas mortgage applicants with all types of credit situations who described themselves as having “bad credit” – that are now Texas homeowners! The truth is, there are many more Bad credit mortgage applicants that will qualify for an FHA mortgage over conventional mortgage.

- TEXAS BAD CREDIT REPAIR CHECKLIST

- Credit scores indicate to Texas mortgage lenders how well you manage money. You can improve bad credit mortgage application by demonstrating that you can now handle monthly obligations more responsibly. Furthermore, since bad credit scores could translate into high interest rates on your next bad credit Texas mortgage, your improved credit score will help you get lower interest rates when you are ready to qualify.

- HOW DO I IMPROVE BAD CREDIT TO QUALIFY FOR A TEXAS MORTGAGE?

- Here are a few ways bad credit Texas mortgage applicants can raise their chances of qualifying for a Texas mortgage:

- Prove 12 months’ timely rental history either provide cancelled checks or verification of rent from a management company. In the hierarchy of credit if you can prove to the Texas bad credit mortgage lender timely rent then you have proven the ability to pay the mortgage.

- Show the lender last 12 months’ timely payment history with 0 x 30 days late in the last 12 months on any credit reported obligations.

- Keep all revolving charge card balances as low as possible less than 10% of the limit is best.

- Negotiate all past collections on your credit report other than medical bills to show a zero balance.

- Related TEXAS Mortgage Information

- Texas FHA Mortgage

- Texas Bad Credit

- Texas VA Mortgage

- BAD CREDIT TEXAS MORTGAGE LENDERS PROGRAMS INCLUDE:

- Texas Bad Credit Bank Statement Only

- FL Mortgage After Foreclosure – Short Sale – Bankruptcy- Foreclosure

- Bad Credit Texas mortgage

- Bad Credit Texas Mortgage Refinance

- Bad Credit Texas Portfolio Lenders

- Buy a Texas home 1 day after a Foreclosure or Bankruptcy

- Bad Credit Texas FHA Mortgage Lenders

- No Credit score Texas mortgage

- Bad Credit Texas FHA mortgage

- Hard Money Texas mortgage

- Bad Credit Texas Modular Home Loans

- Texas Chapter 13 Bankruptcy Mortgage Lenders

- Bad Credit 2nd Second Texas Mortgage

- Texas Stop Foreclosure Loans

- Bad Credit Texas VA mortgage

- Bad Credit Texas Cash for Deed

- Bad Credit Texas Mortgage Rates Sheet

- Bad Credit Texas Mortgage with Judgements

- Bad Credit Texas Mortgage with Evictions

- Bad Credit Texas Mortgage with Tax Liens

- Bad Credit Investor Loans Buyer Or Refi With Texas LLC!

- ALL SITUATIONS ARE WELCOME!!!

-

Texas Bad Credit Information

The presence of significant derogatory bad credit events dramatically increases the likelihood of a future default and represents a significantly higher level of default risk. Examples of significant bad credit events include bankruptcies, foreclosures, deeds-in-lieu of foreclosure, preforeclosure sales, short sales, and charge-offs of mortgage accounts.

Note: The terms “preforeclosure sale” and “short sale” are used interchangeably in this Guide and have the same meaning (see Deed-in-Lieu of Foreclosure, Preforeclosure Sale, and Charge-Off of a Mortgage Account below).

The Texas mortgage lender must determine the cause and significance of the derogatory information, verify that sufficient time has elapsed since the date of the last derogatory information, and confirm that the borrower has re-established an acceptable bad credit history. The lender must make the final decision about the acceptability of a borrower’s bad credit history when significant derogatory bad credit information exists.

This topic describes the amount of time that must elapse (the “waiting period”) after a significant derogatory bad credit event before the borrower is eligible for a new loan salable to Fannie Mae. The waiting period commences on the completion, discharge, or dismissal date (as applicable) of the derogatory credit event and ends on the disbursement date of the new loan for manually underwritten loans. See B3-5.3-09, DU Credit Report Analysis, for additional information pertaining to DU loan casefiles, including how the waiting period is determined. Also see B3-5.3-08, Extenuating Circumstances for Derogatory Credit, for additional information.

Identification of Significant BAD Credit Events in the Credit Report

Lenders must review the credit report and Section VIII, Declarations, of the loan application to identify instances of significant derogatory credit events. Lenders must review the public records section of the credit report and all tradelines, including mortgage accounts (first liens, second liens, home improvement loans, HELOCs, and manufactured home loans), to identify previous foreclosures, deeds-in-lieu, preforeclosure sales, charge-offs of mortgage accounts, and bankruptcies. Lenders must carefully review the current status of each tradeline, manner of payment codes, and remarks to identify these types of significant derogatory credit events. Remarks Codes are descriptive text or codes that appear on a tradeline, such as “Foreclosure,” “Forfeit deed-in-lieu of foreclosure,” and “Settled for less than full balance.”

Significant derogatory credit events may not be accurately reported or consistently reported in the same manner by all creditors or credit reporting agencies. If not clearly identified in the credit report, the lender must obtain copies of appropriate documentation. The documentation must establish the completion date of a previous foreclosure, deed-in-lieu or preforeclosure sale, or date of the charge-off of a mortgage account; confirm the bankruptcy discharge or dismissal date; and identify debts that were not satisfied by the bankruptcy. Debts that were not satisfied by a bankruptcy must be paid off or have an acceptable, established repayment schedule.

Note: Timeshare accounts are considered installment loans and are not subject to the waiting periods described below.

Texas Bankruptcy (Chapter 7 or Chapter 11)

A four-year waiting period is required, measured from the discharge or dismissal date of the bankruptcy action.

Exceptions for Extenuating Circumstances

A two-year waiting period is permitted if extenuating circumstances can be documented, and is measured from the discharge or dismissal date of the bankruptcy action.

Texas Bankruptcy (Chapter 13)

A distinction is made between Chapter 13 bankruptcies that were discharged and those that were dismissed. The waiting period required for Chapter 13 bankruptcy actions is measured as follows:

- two years from the discharge date, or

- four years from the dismissal date.

The shorter waiting period based on the discharge date recognizes that borrowers have already met a portion of the waiting period within the time needed for the successful completion of a Chapter 13 plan and subsequent discharge. A borrower who was unable to complete the Chapter 13 plan and received a dismissal will be held to a four-year waiting period.

Exceptions for Extenuating Circumstances

A two-year waiting period is permitted after a Chapter 13 dismissal, if extenuating circumstances can be documented. There are no exceptions permitted to the two-year waiting period after a Chapter 13 discharge.

Texas Multiple Bankruptcy Filings

For a borrower with more than one bankruptcy filing within the past seven years, a five-year waiting period is required, measured from the most recent dismissal or discharge date.

Note: The presence of multiple bankruptcies in the borrower’s credit history is evidence of significant derogatory credit and increases the likelihood of future default. Two or more borrowers with individual bankruptcies are not cumulative, and do not constitute multiple bankruptcies. For example, if the borrower has one bankruptcy and the co-borrower has one bankruptcy this is not considered a multiple bankruptcy.

Exceptions for Extenuating Circumstances

A three-year waiting period is permitted if extenuating circumstances can be documented, and is measured from the most recent bankruptcy discharge or dismissal date. The most recent bankruptcy filing must have been the result of extenuating circumstances.

Texas Foreclosure

A seven-year waiting period is required and is measured from the completion date of the foreclosure action as reported on the credit report or other foreclosure documents provided by the borrower.

Exceptions for Extenuating Circumstances

A three-year waiting period is permitted if extenuating circumstances can be documented, and is measured from the completion date of the foreclosure action. Additional requirements apply between three and seven years, which include:

- Maximum LTV, CLTV, or HCLTV ratios of the lesser of 90% or the maximum LTV, CLTV, or HCLTV ratios for the transaction per the Eligibility Matrix.

- The purchase of a principal residence is permitted.

- Limited cash-out refinances are permitted for all occupancy types pursuant to the eligibility requirements in effect at that time.

Note: The purchase of second homes or investment properties and cash-out refinances (any occupancy type) are not permitted until a seven-year waiting period has elapsed.

Texas Foreclosure and Bankruptcy on the Same Mortgage

If a mortgage debt was discharged through a bankruptcy, the bankruptcy waiting periods may be applied if the lender obtains the appropriate documentation to verify that the mortgage obligation was discharged in the bankruptcy. Otherwise, the greater of the applicable bankruptcy or foreclosure waiting periods must be applied.

Texas Deed-in-Lieu of Texas Foreclosure, Texas Preforeclosure Sale, and Charge-Off of a Mortgage Account

These transaction types are completed as alternatives to foreclosure.

- A deed-in-lieu of foreclosure is a transaction in which the deed to the real property is transferred back to the servicer. These are typically identified on the credit report through Remarks Codes such as “Forfeit deed-in-lieu of foreclosure.”

- A pre-foreclosure sale or short sale is the sale of a property in lieu of a foreclosure resulting in a payoff of less than the total amount owed, which was pre-approved by the servicer. These are typically identified on the credit report through Remarks Codes such as “Settled for less than full balance.”

- A charge-off of a mortgage account occurs when a creditor has determined that there is little (or no) likelihood that the mortgage debt will be collected. A charge-off is typically reported after an account reaches a certain delinquency status, and is identified on the credit report with a manner of payment (MOP) code of “9.”

A four-year waiting period is required from the completion date of the deed-in-lieu of foreclosure, preforeclosure sale, or charge-off as reported on the credit report or other documents provided by the borrower.

Exceptions for Extenuating Circumstances

A two-year waiting period is permitted if extenuating circumstances can be documented.

Note: Deeds-in-lieu and preforeclosure sales may not be accurately or consistently reported in the same manner by all creditors or credit reporting agencies. See Identification of Significant Derogatory Credit Events in the Credit Report above for additional information.

Summary — All BAD CREDIT Waiting Period Requirements

The following table summarizes the waiting period requirements for all significant derogatory credit events.

Derogatory Event Waiting Period Requirements Waiting Period with Extenuating Circumstances Texas Bankruptcy — Chapter 7 or 11 4 years 2 years Texas Bankruptcy — Chapter 13 - 2 years from discharge date

- 4 years from dismissal date

- 2 years from discharge date

- 2 years from dismissal date

Texas Multiple Bankruptcy Filings 5 years if more than one filing within the past 7 years 3 years from the most recent discharge or dismissal date Texas Foreclosure1 7 years 3 years additional requirements after 3 years up to 7 years: - 90% maximum LTV ratios2

- Purchase, principal residence

- Limited cash-out refinance, all occupancy types

Texas Deed-in-Lieu of Foreclosure, Preforeclosure Sale, or Charge-Off of Mortgage Account 4 years 2 years Derogatory EventTexas Bankruptcy — Chapter 7 or 11Waiting Period Requirements4 yearsWaiting Period with Extenuating Circumstances2 yearsDerogatory EventTexas Bankruptcy — Chapter 13Waiting Period Requirements- 2 years from discharge date

- 4 years from dismissal date

Waiting Period with Extenuating Circumstances- 2 years from discharge date

- 2 years from dismissal date

Derogatory EventTexas Multiple Bankruptcy FilingsWaiting Period Requirements5 years if more than one filing within the past 7 yearsWaiting Period with Extenuating Circumstances3 years from the most recent discharge or dismissal dateDerogatory EventTexas Foreclosure1Waiting Period Requirements7 yearsWaiting Period with Extenuating Circumstances3 years additional requirements after 3 years up to 7 years:- 90% maximum LTV ratios2

- Purchase, principal residence

- Limited cash-out refinance, all occupancy types

Derogatory EventTexas Deed-in-Lieu of Foreclosure, Preforeclosure Sale, or Charge-Off of Mortgage AccountWaiting Period Requirements4 yearsWaiting Period with Extenuating Circumstances2 yearsRequirements for Re-establishing BAD Credit after bankruptcy

After a bankruptcy, foreclosure, deed-in-lieu of foreclosure, preforeclosure sale, or charge-off of a mortgage account, the borrower’s credit will be considered re-established if all of the following are met:

- The waiting period and the related additional requirements are met.

- The loan receives a recommendation from DU that is acceptable for delivery to Fannie Mae or, if manually underwritten, meets the minimum credit score requirements based on the parameters of the loan and the established eligibility requirements.

- The borrower has traditional bad credit as outlined in Section B3–5.3, Traditional Credit History. Nontraditional credit or “thin files” are not acceptable.

- BAD CREDIT TEXAS MORTGAGE ADVANTAGES INCLUDE:

- BAD CREDIT MORTGAGE LENDERS IN EVERY CITY AND COUNTY IN TEXAS INCLUDING:

| Texas Population – FHA Mortgage Lenders | 25,145,561 |

| Houston city | 2,099,451 |

| San Antonio city | 1,327,407 |

| Dallas city | 1,197,816 |

| Austin city | 790,390 |

| Fort Worth city | 741,206 |

| El Paso city | 649,121 |

| Arlington city | 365,438 |

| Corpus Christi city | 305,215 |

| Plano city | 259,841 |

| Laredo city | 236,091 |

| Lubbock city | 229,573 |

| Garland city | 226,876 |

| Irving city | 216,290 |

| Amarillo city | 190,695 |

| Grand Prairie city | 175,396 |

| Brownsville city | 175,023 |

| Pasadena city | 149,043 |

| Mesquite city | 139,824 |

| McKinney city | 131,117 |

| McAllen city | 129,877 |

| Killeen city | 127,921 |

| Waco city | 124,805 |

| Carrollton city | 119,097 |

| Beaumont city | 118,296 |

| Abilene city | 117,063 |

| Frisco city | 116,989 |

| Denton city | 113,383 |

| Midland city | 111,147 |

| Wichita Falls city | 104,553 |

| Odessa city | 99,940 |

| Round Rock city | 99,887 |

| Richardson city | 99,223 |

| Tyler city | 96,900 |

| Lewisville city | 95,290 |

| College Station city | 93,857 |

| San Angelo city | 93,200 |

| Pearland city | 91,252 |

| Allen city | 84,246 |

| League City city | 83,560 |

| Longview city | 80,455 |

| Sugar Land city | 78,817 |

| Edinburg city | 77,100 |

| Mission city | 77,058 |

| Bryan city | 76,201 |

| Baytown city | 71,802 |

| Pharr city | 70,400 |

| Missouri City city | 67,358 |

| Temple city | 66,102 |

| Harlingen city | 64,849 |

| Flower Mound town | 64,669 |

| North Richland Hills city | 63,343 |

| Victoria city | 62,592 |

| New Braunfels city | 57,740 |

| Mansfield city | 56,368 |

| Conroe city | 56,207 |

| Rowlett city | 56,199 |

| Port Arthur city | 53,818 |

| Euless city | 51,277 |

| DeSoto city | 49,047 |

| Cedar Park city | 48,937 |

| Galveston city | 47,743 |

| Georgetown city | 47,400 |

| Bedford city | 46,979 |

| Pflugerville city | 46,936 |

| Grapevine city | 46,334 |

| Texas City city | 45,099 |

| Cedar Hill city | 45,028 |

| San Marcos city | 44,894 |

| Haltom City city | 42,409 |

| Wylie city | 41,427 |

| Keller city | 39,627 |

| Coppell city | 38,659 |

| Huntsville city | 38,548 |

| Duncanville city | 38,524 |

| Sherman city | 38,521 |

| Rockwall city | 37,490 |

| Hurst city | 37,337 |

| Burleson city | 36,690 |

| Texarkana city | 36,411 |

| Lancaster city | 36,361 |

| The Colony city | 36,328 |

| Friendswood city | 35,805 |

| Weslaco city | 35,670 |

| Del Rio city | 35,591 |

| Lufkin city | 35,067 |

| San Juan city | 33,856 |

| La Porte city | 33,800 |

| Nacogdoches city | 32,996 |

| Copperas Cove city | 32,032 |

| Socorro city | 32,013 |

| Deer Park city | 32,010 |

| Schertz city | 31,465 |

| Rosenberg city | 30,618 |

| Waxahachie city | 29,621 |

| Cleburne city | 29,337 |

| Farmers Branch city | 28,616 |

| Kyle city | 28,016 |

| Big Spring city | 27,282 |

| Lake Jackson city | 26,849 |

| Harker Heights city | 26,700 |

| Southlake city | 26,575 |

| Leander city | 26,521 |

| Eagle Pass city | 26,248 |

| Kingsville city | 26,213 |

| Little Elm city | 25,898 |

| Greenville city | 25,557 |

| Weatherford city | 25,250 |

| Seguin city | 25,175 |

| Paris city | 25,171 |

| San Benito city | 24,250 |

| Alvin city | 24,236 |

| Corsicana city | 23,770 |

| Balch Springs city | 23,728 |

| Marshall city | 23,523 |

| Watauga city | 23,497 |

| University Park city | 23,068 |

| Colleyville city | 22,807 |

| Denison city | 22,682 |

| Kerrville city | 22,347 |

| Plainview city | 22,194 |

| Benbrook city | 21,234 |

| Sachse city | 20,329 |

-

Texas – FHA MORTGAGE LENDERS

https://www.fhamortgageprograms.com/texas/

Texas Cities with populations over 10,000 include: Abilene, Alice, Alvin, Amarillo, Andrews, Angleton, Arlington, Athens, Bay City, Beaumont, Beeville, Belton, Big Spring, Borger, Brenham, Brownsville, Brownwood, Bryan, Burkburnett, Canyon, Carrollton, Cedar Park, Cleburne, College Station, Conroe, Converse, Copperas

… You’ve visited this page 2 times. Last visit: 12/5/17 -

Texas Bank Statement Only Mortgage Lenders

https://www.fhamortgageprograms.com/texas-bank-statement-only-mortgage-lenders-…

Texas Bank Statement Only Mortgage Lenders approve borrower based on a 24 month deposit history. Same Day Approvals! Call Now 954-667-9110.

-

100% TEXAS VA Mortgage Lenders Min 580 FICO!

https://www.fhamortgageprograms.com/texas-va-mortgage-lenders/

US Mortgage specializes in good and bad credit VA mortgage loans even no credit score Texas VA loans in every city and county in Texas VA Mortgage Lenders VA mortgages are guaranteed by the Department of Veterans Affairs (VA

). These Texas VA mortgage loans were established to provide transition assistance and … -

TEXAS FHA/VA MORTGAGE LENDERS-Same Day Pre Approvals!

https://www.fhamortgageprograms.com/texas-mortgage-lenders/

Our Texas loan officers will work with you one-on-one to tailor a financial solution that is specifically suited to meet your financing needs. Whether you are purchasing a Texas dream home, refinancing an outstanding loan, or consolidating debt, our highly experienced Texas mortgage originator can help you find the right …

-

Texas FHA/VA Mortgage Lenders+Min 580 Fico

https://www.fhamortgageprograms.com/texas-fha-va-mortgage-lenders/

Every City In Texas FHA/VA Mortgage Lenders+Min 580 Fico Same Day Pre Approvals Call Now 954-667-9110 or Apply Online! Click Here to Apply!

-

3.5% Florida FHA Mortgage Lenders Min 580 FICO!!

https://www.fhamortgageprograms.com/

FHA Mortgage Lenders Florida-CALLNOW! 954-667-9110 +Same DAY PRE APPROVALS min 580 FICO+3.5% down!+ALL CREDIT WELCOME!++ NO LENDER FEES!! 5 STAR REVEIWS!!

You’ve visited this page 4 times. Last visit: 12/6/17 -

TEXAS STATED INCOME MORTGAGE LENDERS PROGRAMS

https://www.fhamortgageprograms.com/6-texas-stated-income-mortgage-lenders-prog…

6 TEXAS STATED INCOME MORTGAGE LENDERS PROGRAMS – Stated income Texas mortgage lenders Bank Statements For Income. Same Day Approvals Call Now 954-667-9110.

-

15 DOWN+SELF EMPLOYED TEXAS MORTGAGE LENDERS

https://www.fhamortgageprograms.com/self-employed-texas-mortgage-lenders/

Self Employed Texas Mortgage Lenders qualifying Texas borrowers with Bank statements only. Call 954-667-9110 same day approval!

-

3.5% Texas FHA Mortgage Lenders Min 580 FICO!!

https://www.fhamortgageprograms.com/texas-fha-mortgage-lenders/

3.5% Texas FHA Mortgage Lenders Min 580 FICO!! Same Day FHA, VA, Bad Credit Texas Mortgage Loans Pre Approvals Call Now 954-667-9110.

-

Bad Credit Home Loans – FHA MORTGAGE LENDERS

https://www.fhamortgageprograms.com/bad-credit-home-loans/

Bad credit home loans are available for residents in Florida. At FHA mortgage programs.com we go the extra mile to help find secure a bad credit mortgage for our bad credit home loan applicants, regardless of their credit status. If your credit has been ruined as a result of Foreclosure or Bankruptcy, don’t give up on …