- 3.5% DOWN TEXAS BAD CREDIT MORTGAGE Lenders

- Bad Credit Texas Land Lenders – Bad Credit Texas Land Loans

- Texas Mortgage 1 Day After Foreclosure – Short Sale – Bankruptcy!

- TEXAS MORTGAGE AFTER BANKRUPTCY OR FORECLOSURE =OK

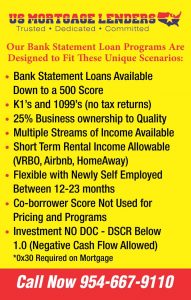

TEXAS BAD CREDIT NO TAX RETURN MORTGAGE LENDERS

TEXAS BAD CREDIT NO TAX RETURN MORTGAGE LENDERS

- Same Day Texas Bad Credit Loan Approvals!

- Texas Mortgage 1 Day After Foreclosure – Short Sale – Bankruptcy!

- Texas Mortgage Approvals With Collection Accounts!

- Texas Mortgage Approvals with repossession!

- 100% Texas FHA Mortgage Lenders Min 620 fico!

- Texas Bad Credit Cash OUT Refinance UP To $500K In Hand!

Refinance or Purchase Texas No Tax Return Bad Credit bad credit land acreage Lenders!

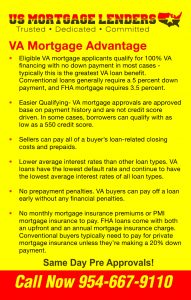

Refinance or Purchase Texas No Tax Return Bad Credit bad credit land acreage Lenders! TEXAS VA BAD CREDIT MORTGAGE LENDERS

TEXAS VA BAD CREDIT MORTGAGE LENDERS -

POPULAR BAD CREDIT MORTGAGE QUESTIONS INCLUDE

POPULAR BAD CREDIT MORTGAGE QUESTIONS INCLUDE

- Do Mortgage Lenders require repossessions to be paid off Mortgage Qualifying?

- What debts are not considered when qualifying for a mortgage?

- Are Bad Credit mortgage loan amounts restricted when the purchase involves a Family member?

- Get Approved For A Mortgage With Collection Accounts!

- How To Qualify For Bad Credit /VA Mortgage After 12 months After Bankruptcy!

- We specialize in the following Bad Credit Texas Mortgage Loans:

- Texas Mortgage Lenders that allow past collections- Texas Lenders that approve you with collections!

- Texas Bad Credit Bad Credit / VA Mortgage Lenders – Bad credit Lenders exclude disputed, collection chargeoffs

- Bad Credit Texas Mortgage Lender Programs– Case By Case situational approvals!

- Bad Credit Bad Credit Texas Mortgage Lenders – Min 580 middle 3.5% Down min 550 With 10% Down.

- VA Bad Credit Texas Mortgage Lenders – Min 550 middle credit score with 100% financing.

- Texas Mortgage After Foreclosure – Short Sale – Bankruptcy- Foreclosure– Private Portfolio GA Bad Credit Lenders .

- Bad Credit Teas Portfolio Lenders – Private Texas mortgage Lenders that do not sell the loans.

- Hard Money Texas mortgage Lenders – Hard money for case by case bad credit Texas mortgage applications.

- No Credit Score Texas Mortgage– No Credit score Texas with a bad credit past!

- Modular Home Bad Credit Texas Mortgage Lenders – Factory built bad credit modular home loans.

- Texas Bad Credit Jumbo Mortgage Lenders – Bad Credit GA jumbo mortgage Lenders down to a 500 fico!

- Debt Consolidation Bad Refinance in Texas – Refinance to lower your total monthly obligations to provide financial relief.. JUMBO TEXAS BAD CREDIT MORTGAGE Lenders – Bad Credit …

- Texas Bad Credit Mortgage Lenders After A Repossessions! We have the right bad credit mortgage Lenders that allow repossessions!

-

3.5%Texas Bad Credit Mortgage Lenders Min 580 FICO!, TEXAS BAD CREDIT JUMBO MORTGAGE Lenders ,JUMBO TEXAS BAD CREDIT MORTGAGE Lenders – Bad Credit …

-

Texas Bad Credit Mortgage Lenders After A Repossessions! We have the right bad credit mortgage Lenders that allow repossessions! 3.5%Texas Bad Credit Mortgage Lenders Min 580 FICO!

-

Texas Mortgage 1 day after Bankruptcy or Foreclosure Approvals!

https://www.Bad Credit mortgageprograms.com/texas-bankruptcy-foreclosure-short-sale-ok

PORTFOLIO- PRIVATE TEXAS MORTGAGE LENDER APPROVALS! Purchase 1 day after bankruptcy, foreclosure, short sale and deed in lieu of Texas foreclosure up to 2.5 million. These are not subprime loans, but they do often have higher interest rates, and higher closing costs.

TEXAS Mortgage Approvals After Foreclosure, Bankruptcy=YES!!

https://www.Bad Credit mortgageprograms.com/texas-mortgage-Lenders -bankruptcy-ok

Jan 25, 2018 – TEXAS Bad Credit -VA-Private Mortgage Lenders After Bankruptcy TEXAS Chapter 7, 11 or 13 bankruptcies and want to know if you can still get a TEXAS mortgage the answer is YES!!! Call Now 954-667-9110.

You visited this page on 2/7/18.Texas Mortgage 1 Day After Bankruptcy Or Foreclosure

https://www.Bad Credit mortgageprograms.com/texas-mortgage-1-day-after-bankruptcy-or-fo..

Texas Mortgage Lenders After Bankruptcy – Foreclosure – Short Sale. Purchase 1 day after bankruptcy, foreclosure, short sale and deed in lieu of Texas foreclosure up to 2.5 million. These are not subprime loans, but they do often have higher interest rates, and higher closing costs.

- Same Day Texas Bad Credit Loan Approvals!

- Many Bad Credit Texas mortgage applicants don’t realize these Government guaranteed low-interest rate Bad Credit , VA mortgage loans can help Texas home buyers with bad credit. Even If you have a bad credit past and you’re looking for a low Texas mortgage interest rateTexas mortgage a government or private lender may be a better option then renting.

- BAD CREDIT Texas Bad Credit MORTGAGE Lenders :

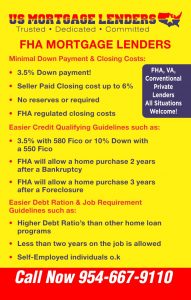

- Down payment only 3.5% of the purchase price.

- Gifts from family or Bad Credit Grants for down payment assistance and closing costs OK!

- Sellers can credit the buyer’s up to 6% of sales price towards buyers costs and pre-paid.

- No reserves or future payments in account required.

- Bad Credit regulated closing costs.

- Read more about buying a home with an Bad Credit mortgage Bad Credit –No Credit – Investment –Second Home –Multi Family –

- BAD CREDIT Texas Lenders MAKE QUALIFYING EASIER BECAUSE YOU CAN PURCHASE:

- 12 months after a chapter 13 Bankruptcy Bad Credit mortgage Lender approvals!

- 24 months after a chapter 7 Bankruptcy Bad Credit mortgage Lender approvals!

- 3 years after a Foreclosure Bad Credit mortgage Lender approvals!

- No Credit Score Bad Credit mortgage Lender approvals!

- 580 required for 96.5% financing or 3.5% down payment Bad Credit mortgage Lender approvals.

- 500 required for 90% financing or 10% down payment Bad Credit mortgage Lender approvals.

- BAD CREDIT TEXAS with minimum 500 FICO credit score with 10% Down Payment Bad Credit . For Bad Credit mortgage applicants with credit scores between 500 and 579 must make down payments of at least 10% down!

- Read more about Bad Credit Qualifying Qualification Summary – Manual Underwrite – Collections-Judgement’s – Bankruptcy or Foreclosure – Compensating Factors –

- BAD CREDIT Bad Credit TEXAS Lenders ALLOW HIGHER DEBT TO INCOME & EASIER JOB QUALIFYING

- Bad Credit allows higher debt ratio’s than any conventional mortgage loan programs.

- Less than two years on the same job is OK!

- Self-employed buyers can also qualify with Bad Credit Mortgage Lenders .

- Read More about Gifts For Down Payment – Documents Checklist – Debt To Income – Student Loans –

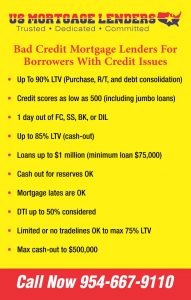

- Texas Bad Credit Mortgage Solutions!

- 1 day out of foreclosure, short sale, BK, DIL

- Rates starting in the low 5’s

- Bad Credit Texas Home Loans up to $1 million

- Credit scores down to 500

- Up to 85% LTV

- Combo loans up to 85% CLTV (min 680 score)

- DTI up to 50% considered

- Owner-occupied, 2nd homes, and investment properties

- Non-warrantable condos considered

- Jumbo loans down to 500 score

- 5/1 ARM or 30-year fixed

- No pre-payment penalty for owner-occ and 2nd homes

- No active tradelines OK with housing hisstory

- SFRs, townhomes, condos, 2-4 units

- Seller concessions to 6% (2% for investment)

- ALL TEXAS SITUATIONS ARE WELCOME!!!

- The Bad Credit mortgage can help you purchase a new Texas home with 3.5% down payment even if you have bad credit. Even If you’ve had accounts forwarded to collections, past bankruptcies or Foreclosures, high debt to income ratio, then you still may qualify for our bad credit or no credit Texas mortgage. These government-backed bad credit Texas mortgage loans can work for Texas mortgage applicants that don’t have cash for a down payment or closing costs. And they are a much better choice than a Texas hard money loan.

- We work with all types of bad credit Texas mortgage applicants with all types of credit situations who described themselves as having “bad credit” – that are now Texas homeowners! The truth is, there are many more Bad credit mortgage applicants that will qualify for an Bad Credit mortgage over the conventional mortgage.

- TEXAS BAD CREDIT REPAIR CHECKLIST

- Credit scores indicate to Texas mortgage Lenders how well you manage money. You can improve bad credit mortgage application by demonstrating that you can now handle monthly obligations more responsibly. Furthermore, since bad credit scores could translate into high interest rates on your next bad credit Texas mortgage, your improved credit score will help you get lower interest rates when you are ready to qualify.

- HOW DO I IMPROVE BAD CREDIT TO QUALIFY FOR A TEXAS MORTGAGE?

- Here are a few ways bad credit Texas mortgage applicants can raise their chances of qualifying for a Texas mortgage:

- Prove 12 months’ timely rental history either provide canceled checks or verification of rent from a management company. In the hierarchy of credit if you can prove to the Texas bad credit mortgage lender timely rent then you have proven the ability to pay the mortgage.

- Show the Teas mortgage lender last 12 months’ timely payment history with 0 x 30 days late in the last 12 months on any credit reported obligations.

- Keep all revolving charge card balances as low as possible less than 10% of the limit is best.

- Negotiate all past collections on your credit report other than medical bills to show a zero balance.

- BAD CREDIT TEXAS MORTGAGE Lenders PROGRAMS INCLUDE:

- Texas Bad Credit Bank Statement Only

- FL Mortgage After Foreclosure – Short Sale – Bankruptcy- Foreclosure

- Bad Credit Texas mortgage

- Bad Credit Texas Mortgage Refinance

- Bad Credit Texas Portfolio Lenders

- Buy a Texas home 1 day after a Foreclosure or Bankruptcy

- Bad Credit Texas Bad Credit Mortgage Lenders

- No Credit score Texas mortgage

- Bad Credit Texas Bad Credit mortgage

- Hard Money Texas mortgage

- Bad Credit Texas Modular Home Loans

- Texas Chapter 13 Bankruptcy Mortgage Lenders

- Bad Credit 2nd Second Texas Mortgage

- Texas Stop Foreclosure Loans

- Bad Credit Texas VA mortgage

- Bad Credit Texas Cash for Deed

- Bad Credit Texas Mortgage Rates Sheet

- Bad Credit Texas Mortgage with Judgements

- Bad Credit Texas Mortgage with Evictions

- Bad Credit Texas Mortgage with Tax Liens

- Bad Credit Investor Loans Buyer Or Refi With Texas LLC!

- ALL TEXAS SITUATIONS ARE WELCOME- SERVING EVERY CITY LOCATION IN TEXAS INCLUDING:

- Cities with populations over 10,000 include: Abilene, Alice, Alvin, Amarillo, Andrews, Angleton, Arlington, Athens, Bay City, Beaumont, Beeville, Belton, Big Spring, Borger, Brenham, Brownsville, Brownwood, Bryan, Burkburnett, Canyon, Carrollton, Cedar Park, Cleburne, College Station, Conroe, Converse, Copperas Cove, Corpus Christi, Corsicana, Dallas, Del Rio, Denison, Denton, Dumas, Eagle Pass, Edinburg, El Campo, El Paso, Ennis, Fort Worth, Freeport, Gainesville, Galveston, Gatesville, Georgetown, Greenville, Groves, Harlingen, Henderson, Hereford, Hewitt, Houston, Humble, Huntsville, Ingleside, Irving, Jacksonville, Kerrville, Kilgore, Killeen, Kingsville, La Marque, Lake Jackson, Lamesa, Laredo, Levelland, Lewisville, Live Oak, Lockhart, Longview, Lubbock, Lufkin, Mansfield, Marshall, McAllen, McKinney, Midland, Missouri City, Mount Pleasant, Nacogdoches, New Braunfels, Palestine, Pampa, Paris, Pasadena, Pecos, Plainview, Plano, Port Arthur, Port Lavaca, Portland, Richmond, Rio Grande City, Rockwall, Roma, Round Rock, San Angelo, San Antonio, San Benito, San Marcos, Seguin, Sherman, Snyder, Socorro, Stephenville, Sugar Land, Sulphur Springs, Sweetwater, Taylor, Texas City, Tyler, Uvalde, Vernon, Victoria, Vidor, Waco, Waxahachie and Wichita Falls.

- TEXAS Bad Credit MORTGAGE Lenders

- Pharr Texas Bad Credit Mortgage Lenders Galveston Texas Bad Credit Mortgage Lenders Grapevine Texas Bad Credit Mortgage Lenders DeSoto Texas Bad Credit Mortgage Lenders Euless Texas Bad Credit Mortgage Lenders Spring Texas Bad Credit Mortgage Lenders Port Arthur Texas Bad Credit Mortgage Lenders Pflugerville Texas Bad Credit Mortgage Lenders Rowlett Texas Bad Credit Mortgage Lenders San Marcos Texas Bad Credit Mortgage Lenders Georgetown Texas Bad Credit Mortgage Lenders Mansfield Texas Bad Credit Mortgage Lenders Atascocita Texas Bad Credit Mortgage Lenders Harlingen Texas Bad Credit Mortgage Lenders Sugar Land Texas Bad Credit Mortgage Lenders Cedar Park Texas Bad Credit Mortgage Lenders Victoria Texas Bad Credit Mortgage Lenders Conroe Texas Bad Credit Mortgage Lenders North Richland Hills Bad Credit Mortgage Lenders New Braunfels Texas Bad Credit Mortgage Lenders Flower Mound Texas Bad Credit Mortgage Lenders Temple Texas Bad Credit Mortgage Lenders Missouri City Texas Bad Credit Mortgage Lenders Baytown Texas Bad Credit Mortgage Lenders Bryan Texas Bad Credit Mortgage Lenders Longview Texas Bad Credit Mortgage Lenders Mission Texas Bad Credit Mortgage Lenders Edinburg Texas Bad Credit Mortgage Lenders Allen Texas Bad Credit Mortgage Lenders League City Texas Bad Credit Mortgage Lenders San Angelo Texas Bad Credit Mortgage Lenders Tyler Texas Bad Credit Mortgage Lenders Lewisville Texas Bad Credit Mortgage Lenders Wichita Falls TEXAS Bad Credit MORTGAGE Lenders College Station TEXAS Bad Credit MORTGAGE Lenders Pearland Texas Bad Credit Mortgage Lenders Richardson TEXAS Bad Credit MORTGAGE Lenders The Woodlands TEXAS Bad Credit MORTGAGE Lenders Laredo Texas Bad Credit Mortgage Lenders Plano Texas Bad Credit Mortgage Lenders Corpus Christi Texas Bad Credit Mortgage Lenders Arlington Texas Bad Credit Mortgage Lenders El Paso Texas Bad Credit Mortgage Lenders Fort Worth Texas Bad Credit Mortgage Lenders Round Rock Texas Bad Credit Mortgage Lenders Beaumont Texas Bad Credit Mortgage Lenders Odessa Texas Bad Credit Mortgage Lenders Abilene Texas Bad Credit Mortgage Lenders Denton Texas Bad Credit Mortgage Lenders Waco Texas Bad Credit Mortgage Lenders Midland Texas Bad Credit Mortgage Lenders Carrollton Texas Bad Credit Mortgage Lenders McAllen Texas Bad Credit Mortgage Lenders Killeen Texas Bad Credit Mortgage Lenders Mesquite Texas Bad Credit Mortgage Lenders Pasadena Texas Bad Credit Mortgage Lenders Frisco Texas Bad Credit Mortgage Lenders McKinney Texas Bad Credit Mortgage Lenders Brownsville Texas Bad Credit Mortgage Lenders Grand Prairie Texas Bad Credit Mortgage Lenders Amarillo Texas Bad Credit Mortgage Lenders Irving Texas Bad Credit Mortgage Lenders Garland Texas Bad Credit Mortgage Lenders Lubbock Texas Bad Credit Mortgage Lenders San Antonio Texas Bad Credit Mortgage Lenders Houston Texas Bad Credit Mortgage Lenders Austin Texas Bad Credit Mortgage Lenders Dallas Texas Bad Credit Mortgage Lenders

POPULAR BAD CREDIT MORTGAGE QUESTIONS INCLUDE

POPULAR BAD CREDIT MORTGAGE QUESTIONS INCLUDE