FLORIDA JUMBO LENDERS

- Minimum Loan Amount: $150,000-$2M

- Allows **1 DAY** Out of Foreclosure or Short Sale

- Allows Minimum 1 Year out of BK

- BK13 Buyout – OK!

- 5% Minimum Contribution from Mortgage applicants Own Funds Required

- Allows 24M Business or Personal Bank Statements to be Used as Income Verification

- Available in Florida

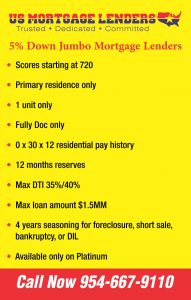

Jumbo Florida Platinum Plus

- Minimum Loan Amount: $150,000

- 95%LTV to $1.5M FULL DOC / 90% to $2.5M ALTDOC (Bank Statements)

- 95%LTV CASHOUT – to $1.5M – 760 FICO/SFR/FULL DOC/OWNER OCC

- NO DOLLAR LIMIT on CASHOUT!

- Up to 80%LTV on IP CASHOUT (Including 2-4 Units!!)

- Will Consider Non Warrantable Condos!

- At 80%LTV, ENTIRE DP can be gift!!

- 30Y / 15Y / 5.1 ARM / 30 or 40Yw10YIO Available!

- 1YR TAX RETURN Feature as well!

Professional Investor Product

- Investment Properties Only

- Loan Amounts $100K – $2M

- Investment Properties Only

- No Income Required on 1003

- No DTI / DSCR Calculations

- No Reserve Requirement

- ‘Funds to Close’ Must Be Seasoned for 60 Days

- Open to Foreign Nationals

- LLCs, Limited/General Partnerships Considered

- No Limit to Number of Financed Properties

- Investment Properties Only

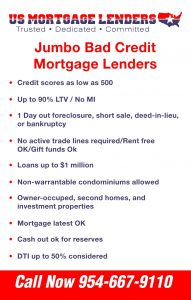

Florida Bad Credit Mortgage Lenders Lending Policy

Loan Manufacturing Philosophy

US Mortgage Lenders Bad Credit underwriters will evaluate many aspects of the loan but primarily relies on evaluation of the mortgage applicant’s ability to repay the loan to predict loan performance. Additional characteristics of the loan are also examined including credit history, asset position, and the property being used for collateral.

US Mortgage Lenders Bad Credit Guidelines establish the criteria under which a loan will be eligible for purchase or funding by Florida Bad Credit Mortgage Lenders. Florida Bad Credit Mortgage Lenders does not require originators or sellers to make any loan simply because it is eligible for funding by Florida Bad Credit Mortgage Lenders, nor does Florida Bad Credit Mortgage Lenders prohibit originators or sellers from originating a loan that is ineligible Florida Bad Credit Mortgage Lenders. Sellers should rely on their own underwriting guidelines to determine whether to extend credit to any applicant.

Bad Credit Mortgage Lender has a no-tolerance policy as it relates to fraud. Sellers should follow their own established fraud and identity procedures on every loan in an effort to prevent and detect fraud (including, but not limited to, Social Security number verification, verbal verifications of employment, processing of 4506-T, etc.) Loans containing fraudulent documentation or information will immediately be declined and forwarded for further review. If there is any determination of seller involvement, the seller will be made inactive and the appropriate agencies notified. Florida Bad Credit Mortgage Lenders will also pursue borrower fraud to the fullest extent of the law.

Bad Credit Mortgage Lenders Fair Lending Statement

Florida Bad Credit Mortgage Lenders operates in accordance with the provisions of the Fair Housing Act and Equal Credit Opportunity Act. The Fair Housing Act makes it unlawful to discriminate in housing-related activities against any person because of race, color, religion, national origin, sex, handicap, or familial status. The Equal Credit Opportunity Act prohibits discrimination with respect to any aspect of a credit transaction on the basis of sex, race, color, religion, national origin, marital status, age (provided the borrower has the capacity to enter into a binding contract), receipt of public assistance, or because the borrower has in good faith exercised any right under the Consumer Credit Protection Act. Florida Bad Credit Mortgage Lenders fully supports the letter and spirit of both of these laws and will not condone discrimination in any mortgage transaction.

Responsible Lending Statement

The primary focus of this lending program is the mortgage applicants ability to repay the mortgage obligation. Loans acquired by Florida Bad Credit Mortgage Lenders should be affordable to the borrower in his or her pursuit of homeownership.

Under the general Ability-to-Repay (ATR) standard, lenders must make a reasonable, good-faith determination that the consumer has a reasonable ability to repay the loan. Lenders must verify information using third-party records that provide reasonably reliable evidence of income or assets.

If a loan is subject to the ATR rules under the Federal Truth in Lending Act (“TILA”), lenders must consider eight underwriting factors to be in compliance:

- 1. Current or reasonably expected income or assets (other than the value of the property that secures the loan)that the consumer will rely on to repay the loan

- 2. Current employment status (if you rely on employment income when assessing the consumer’s ability to repay)

- 3. Monthly mortgage payment for this loan. You calculate this using the introductory or fully-indexed rate, whichever is higher, and monthly, fully-amortizing payments that are substantially equal

- 4. Monthly payment on any simultaneous loans secured by the same property

- 5. Monthly payments for property taxes and insurance that you require the consumer to buy, and certain other costs related to the property such as homeowners association fees or ground rent

- 6. Debts, alimony, and child support obligations

- 7. Monthly debt-to-income ratio or residual income, that you calculated using the total of all of the mortgage and non-mortgage obligations listed above, as a ratio of gross monthly income

- 8. Credit history

Florida Bad Credit Mortgage Lenders will not fund nor purchase a loan subject to the ATR requirement under TILA unless it meets the requirements of the rule. Certain loans may be exempt from TILA or otherwise exempt from the ATR rule. In those cases, though FloridaBad Credit Mortgage Lenders may choose to purchase a loan that does not adhere to the formal requirements of the ATR rule, FloridaBad Credit Mortgage Lenders will only fund or purchase loans that the applicant appears able to afford based on application of prudent underwriting standards.

General Program Information

Programs

Florida Bad Credit Mortgage Lenders offers several Non-Agency loan programs. This Bad Credit Select Guideline focuses specifically on the Bad Credit Select program. See the appropriate Loan Program Matrix for details.

Other Non-Agency Loan Programs offered by Florida Bad Credit Mortgage Lenders Include:

Bad Credit Select Program

The Bad Credit Program allows for multiple 30-day and 60-day mortgage lates in the past 12 months and unlimited consumer lates. This program also includes a Recent Housing Event option that allows for borrowers with a Housing Event in the most recent 24 months from date of closing.

Bad Credit Preferred

The Bad Credit Preferred Program allows expanded Loan – to – Values and increased loan amounts between

$150,000 and up to $2.5M with an adjustable or fixed rate option.

OFC Professional Florida Investor Program

The OFC Professional Investor Program allows for up to 20 financed properties and a foreclosure or short sale in the past 24 months.

OFC ALT-A Florida Loan Program

The ALT-A Program is offered for Prime Borrowers that have a unique situation.

Florida Mortgage Products

See applicable Product Matrix.

Florida Jumbo Mortgage Documentation

Documentation types include Full Documentation and the Bank Statement Income Program.

Maximum LTV/CLTV/HCLTV

See applicable Program Matrix.

Florida Minimum and Maximum Loan Amounts

The minimum loan amount for all Programs is $150,000.

See applicable Product Matrix for maximum loan amounts.

Loan Age

(Correspondent Loans Only) The period between the note date and the purchaser’s funding date cannot exceed

45 days.

Points, Fees and Prepayment Penalties

Total points, fees, and APR may not exceed current state and federal high-cost thresholds.

Prepayment penalties on primary residence and second home transactions are prohibited.

For the OFC Professional Investor Program, a prepayment penalty is required (unless otherwise restricted by state law) with a 2-year duration and a payoff fee equal to six month’s interest on 80% of the unpaid principal balance at the time of payoff

Note: States may impose different definitions of points and fees, rate/APR, or prepayment penalties than apply under HOEPA. States may also use different triggers in each category for determining whether a loan will be a “high-cost mortgage” (or equivalent terms) under state law. As a matter of policy, Florida Bad Credit Mortgage Lenders does not purchase or fund loans defined as high-cost mortgages (or equivalent terms) under Federal or state law, regardless of the basis for the loan’s treatment as such.

Exceptions

Exceptions to published guidelines are considered on a case-by-case basis. Loans with exception requests

should exhibit strong compensating factors. Florida Bad Credit Mortgage Lenders’s decision to allow or deny any exception request relates only to whether Florida Bad Credit Mortgage Lenders will fund or purchase a loan. The decision does not bind a seller with respect to the underlying decision to extend credit.

Alternate Loan Program Analysis

All loan applications are to be reviewed for possible approval under a traditional conventional conforming or

FHA loan program offered by the seller. Originators and Sellers are to complete the Alternate Program

Analysis Form (found online) to ensure borrowers are proceeding under the appropriate loan program.

Platinum Plus Program

Ability to Repay (ATR), Qualified Mortgage, And Net Tangible Benefit Requirements

The Consumer Financial Protection Bureau adopted a rule that implements the Ability to Repay (“ATR”) and Qualified Mortgage (“QM”) provisions of the Dodd-Frank Act. Florida Bad Credit Mortgage Lenders will only purchase or fund loans in which the Mortgage applicants ability to repay has been established as laid out in the Truth In Lending Act. Investment properties used for business purposes (Borrower does not intend to occupy property more than 14 days per year), are exempt from ATR, but must still meet applicable points and fees threshold.

Clients are responsible for providing evidence of compliance with ATR/QM rules.

The Originator must verify the income and assets used to determine the Mortgage applicants ability to repay the loan. Refer to the Income and Assets sections of this Guide for additional information.

Benefit to the Florida Jumbo Mortgage Applicants

In keeping with the Commitment to responsible lending, all Loans must have a measurable benefit to the Borrower. When determining the benefit on a transaction, one of the following items must exist to support the benefit to the Borrower:

- 1. Purchasing a home

- 2. Lower principal and interest housing payment

- 3. Lower total monthly payments

- 4. Lower interest rate

- 5. Conversion from an adjustable rate to a fixed rate

- 6. Pay-off of a balloon payment

- 7. Conversion from negative amortization to fullyamortization

- 8. Reduction of loan term

- 9 Reduction of total interest payments

- 10. Consolidation of debt

- 11. Resolution of loss mitigation actions

- 12. Pay-off of a tax lien

- 13. Proceeds (cash-out) to Borrower in excess of the costs and fees For Refinance

- 14. Pay-off of a Construction Loan

- 15. Pay-off of property taxes

- 16. Title transfer/Court order

- 17. Eliminating mortgage insurance

- 18. Cash-out for medical needs

- 19. Cash-out for education needs

- 20. Pay-off of a privately held mortgage

- 21. Other as defined by the Borrower

On a Loan where the only benefit is monthly savings, closing costs and fees must be taken into account and recouped within state-specified timeframes as applicable. Originators must adhere to any state-specific or federal benefit to Borrower compliance requirements. Benefit to Borrower must be calculated based on the qualifying housing payment.

Borrower Eligibility

The guidelines below describe a person’s eligibility to be a Borrower on US Mortgage LendersPlatinum Plus Loan Program. We will purchase or fund loans made to individual, natural persons only. Loan applications from corporations, general partnerships, limited partnerships, and “Doing Business As” (DBAs) or religious/non-profit organizations are ineligible on this program.

Immigration And Naturalization Service (Ins) Classifications

The U.S. Department of Immigration and Naturalization Service (INS) has defined specific residency classifications. Platinum Plus is limited to individual persons who are citizens and/or legal permanent residents of the United States. For eligibility and restriction details, refer to the Platinum Plus Loan Program Matrices.

The following are some of the classifications defined by the

INS:

Program Guideline

United States citizens are eligible Borrowers for all of

US Mortgage LendersLoan Programs.

A permanent resident alien may be an eligible Borrower, if the Borrower is a holder of an alien registration card (green card). The Client is responsible to verify that the Borrower has a

valid registration card.

A non-permanent resident alien may be eligible if they maintain a current G-1 to G-5, H-1, L-1, or E-1 Visa and they can provide a copy of the

Visa with underwriting documentation. Not eligible

|

United States.

Persons with Diplomatic Immunity

A person with diplomatic immunity is allowed to live in the United States to carry out their official diplomatic duties. They are not U.S citizens, and are exempt from lawsuit or prosecution under the

h ’ l

Not eligible

Evidence of Residency

Acceptable evidence of permanent residency for Borrowers who are not U.S. citizens must be provided. The Borrower must provide the INS evidence as follows:

- Alien Registration Receipt Card I-151 (referred to as a green card).

- Alien Registration Receipt Card I-551 (Resident Alien Card) that does not have an expiration date on the back (also known as a green card).

- Alien Registration Receipt Card I-551 (Conditional Resident Alien Card) that has an expiration date on the back, and is accompanied by a copy of the filed INS Form I-751 (petition to remove conditions).

- Non-expired foreign passport that contains a non-expired stamp (valid for a minimum of three years) reading “Processed for I-551 Temporary Evidence of Lawful Admission for Permanent Residence. Valid until [mm-dd-yy]. EmploymentAuthorized.”

- The U.S. Citizenship and Immigration Services Web site is:

https://egov.immigration.gov/cris/caseStatusSearchDisplay.do

Other forms of evidence of residency that are not listed may be acceptable, and will be reviewed on a case-by- case basis.

Borrower Types

The following are the types of Borrowers allowed on the Platinum Plus loan programs. FloridaBad Credit Mortgage Lenderslimits the number of Borrowers per Loan to four. For eligibility and restriction details, refer to the Platinum Plus Loan Program Matrices.

Primary Borrower

The Primary Borrower is the individual who earns the most income. Non-Occupant Co-Borrowers cannot be the Primary Borrower on the Mortgaged Property.

Co–Borrower

A Co-Borrower is an individual other than the Primary Borrower whose credit history, income, or assets are used for qualifying the loan. The Co-Borrower is the Mortgage applicants spouse, domestic partner, or any individual jointly responsible for repayment of the loan with the Borrower. All Co-Borrowers must be on title.

First-Time Homebuyers (FTHB)

Borrowers are considered First-Time Homebuyers (FTHB) when there is no evidence of owning residential property in the previous three years. First-Time Homebuyers generally must fulfill specific requirements in addition to the conditions stipulated for experienced homebuyers. A Borrower(s) who has experience owning a home, but has not owned one in the past three years, will be considered a FTHB.

In the instance where one Borrower is a FTHB and the other Borrower(s) is not, we will treat the transaction as a non-FTHB transaction for grading and program eligibility.

For LTV/CLTV restrictions, reserve requirements and other guidelines specific to FTHBs, refer to the Platinum Plus Loan

Program Matrices.

Non-Borrowing Occupant

A Non-Borrowing Occupant is the Mortgage applicants legal spouse, domestic partner, or any person residing in the Mortgaged Property whose credit, income, and/or assets are not considered in the loan qualifying process. Non- Borrowing Occupants that appear on title will have to execute the documents required by law to create a valid lien on the property.

When a married Borrower purchases a property without involving a spouse, we requires the spouse to sign the security instrument, and any other applicable documentation under governing state law to confirm relinquishment of their rights to the property.

Non-Occupant Co–Borrower

A Non-Occupant Co-Borrower (co-signer) is an individual who will not be living in the Mortgaged Property, but whose income and/or assets have been used to qualify for the loan. The co-signer must sign the Note. Although the Non- Occupant Co-Borrower does not reside in the Mortgaged Property, he or she is jointly responsible

(with the Primary Borrower) for repaying the loan. If the Loan Program allows for a Non-Occupant Co- Borrower, the loan is subject to the following conditions:

- Mortgage Loan:

– Owner occupied or second vacation home

– Full Documentation only

– The Primary (occupant) Mortgage applicants credit profile will be used for grade determination, and the Primary

Borrower must have a DTI of no more than 60%

– A minimum of 5% of the down payment must come from the Primary (occupant) Mortgage applicants own funds. A down payment of 100% gift funds is allowed at LTVs less than 80% or the program maximum, whichever requires the greater down payment. Secondary financing is not allowed on Non-Occupant Co-Borrower or Non-Owner Occupied transactions. Closing costs may also be in the form of a gift.

- Non-Occupant Co-Borrower:

– Individual cannot be the Primary Borrower, and must be a close family member such as a parent, child, grandparent, or sibling. Credit must meet the minimum credit standards for the grade assigned to the loan

– Must provide income and asset documentation to be used for loanqualification

– Must be vested on the Mortgaged Property for a minimum of six months for a Rate/Term Refinance and twelve months for a Cash-Out Refinance transaction

− Up to two Non-Occupant Co-Borrowers allowed

Title Held in a Trust or LLC on Behalf of the Borrower

The Borrower must be an individual with the exception of inter-vivos revocable trusts and limited-liability companies (LLCs) under certain circumstances. Inter vivos revocable trusts are created by individuals, while they are still living, as an estate planning tool.

Title must generally be in the Mortgage applicants name as an individual, trust, or LLC at time of application for refinance transactions and at the time of closing for all transactions.

Title in the name of an LLC at time of application is acceptable provided the Borrower is a member of the LLC

and the Loan will be in the Mortgage applicants name as an individual or acceptable trust at closing.

Non-individual legal entities such as corporations, general partnerships, limited partnerships, real estate syndications or investment trust are not eligible.

The inter vivos revocable trust, also called a family trust, living trust, or revocable living trust, can be used as an alternative form of property ownership. An inter vivos revocable trust (“living trust”) is a trust defined

as follows:

Eligibility Requirements

- Created by an individual during his/her lifetime

- Becomes effective during its creator’s lifetime

- Can be changed or canceled by its creator at any time, for any reason, during his or her lifetime

- At least one individual establishing the trust must be on theLoan.

Trust Agreement Requirements

The Client must obtain copies of the entire trust document and include them in the loan file submitted for review. The copies must be certified by an attorney or the grantor/trustor/settlor. The title company must also be supplied with copies of the trust.

A review of the trust agreement is required to ensure the agreements meets all of the following requirements:

- The trust is established by one or more natural persons, solely or jointly. The person establishing the trust is known as the “Settlor”, “Trustor”, or “Grantor”, referred to below as “Settlor”.

- The trust is effective during the Settlor’s lifetime

- The Settlor is the primary beneficiary of the Trust. If there is more than one Settlor there can be more than one primary beneficiary.

- The Settlor is the trustee or one of the co-trustees

- The trustee has the power to mortgage the Subject Property for the purpose of securing a loan to the party (or parties) who are the borrowers on the Note.

- The trustee is not required to obtain written consent from the beneficiaries to mortgage the subject property if written consent has been provided.

- There is no unusual risk or impairment of lender’s rights, such as distributions required to be made in specified amounts other than net income

- The trust is valid under federal, state, and local law

- If the trust agreement requires more than one trustee to borrow money or purchase, construct, or encumber realty, the Client must confirm that the requisite number of trustees have signed the loan documents.

Certification of Trust

A certification of trust or a summary of trust is acceptable if required by state law. In states that require a Client to rely on an abstract, summary or certification of the trust agreement instead of the trust agreement, a copy of the

abstract, summary or certification is acceptable.

California (CA) Only Exception

California (CA) law provides for the use of a Certification of Trust that states the various facts about the trust in lieu of obtaining copies of the trust. Clients can rely upon this certification so long as it is signed by all of the trustees (Powers of Attorney are not allowed). Clients must review the certification to verify the above requirements are met.

Title

The title insurance policy must ensure full title protection, and must indicate that title to the subject property is vested in the name of the trustees. The policy may not list any exceptions with regard to the trust or the trustees.

Additional documentation:

- Inter Vivos Revocable Trust Rider to the Deed ofTrust/Mortgage

- Inter Vivos Trust as Borrower Acknowledgment

- Verbiage on this Acknowledgement may be incorporated into the Inter Vivos Revocable Trust Rider to the

Deed of Trust/Mortgage. If the verbiage is included in the Rider, then the Acknowledgement is not required

Maximum Loans to One Borrower

In order to reduce the level of risk and ensure lien security, FloridaBad Credit Mortgage Lenderslimits the potential Mortgage applicants open loans, total number of properties owned, and number of mortgaged properties owned in one area.

The occupancy of the property being financed will determine the limitations on how many other financed 1-4 family properties the Borrower may own and/or be obligated on. These limitations apply to each Borrower, individually and all Borrowers collectively that own and/or are obligated on a note secured by a mortgage. The Borrower(s) obligation on a mortgage is important when evaluating capacity. Therefore, even if the Borrower is not an owner of record, but is obligated on a note of a financed property, it must be included in the maximum number of financed properties.

The following are excluded from these limitations:

- Properties owned free and clear

- Joint or total ownership in property this is held in the name of a corporation, even if the Borrower is the owner of the corporation. However, if the Borrower is individually obligated on the note, it must be included

- Ownership in a multi-family property (5+ units)

- Ownership in commercial property

- Ownership in timeshares

- Ownership in unimproved land

For all loans, the Mortgage applicants primary residence, the subject property and any properties owned separately by a

Co- Borrower must be included in the total number of properties owned.

Maximum Dollar Amount Sold under Platinum Plus

The aggregate dollar amount of all loans made to one Borrower sold or funded under the Platinum Plus Program may not exceed $4M.

Maximum Loans to One Borrower Sold under Platinum Plus

There is no limit to the number of loans that can be submitted for the same Borrower to be sold or funded under the Platinum Plus program. Rather, the maximum number of loans to one Borrower is limited by the aggregate dollar amount of the total loans sold or funded under the Platinum Plus program. The aggregate dollar amount of all loans sold or funded under the Platinum Plus program may not exceed $4M.

Maximum Properties One Borrower May Own

A Borrower may finance or own multiple properties. Platinum Plus offers two options for Borrowers that own multiple properties. They include:

1) If the Loan being sold or funded under Platinum Plus is secured by the Mortgage applicants principal residence, there are no limitations to the number of properties that the Borrower can own or are currently financing.

2) If the Loan being sold or funded under Platinum Plus is secured by the Mortgage applicants second home or an investment property:

- a. The Borrower may have up to ten financed properties (including their principal residence) OR

- b. The Borrower may own or have financed an unlimited number of properties if the Loan being sold or funded

under Platinum Plus has a maximum LTV/CLTV that does not exceed the lesser of the program maximum or 70%.

More stringent lending practices should be implemented in cases where the Mortgage applicants loan documents exhibit escalation of late payments and multiple refinances. New investors that have made multiple real estate acquisitions (more than 50% of the properties purchased) in the past 12 months may require additional review, documentation, or be ineligible.

In all cases the Borrower must have sufficient assets to close and meet reserve requirements. For more information, refer to the Platinum

Plus Loan Program Matrices.

Maximum Loans in One Market Area Sold to Under Platinum Plus

The number of loans to one Borrower in any single market area is limited to two. The term “single market area” refers to the physical location of the property—meaning two or more homes owned by the same Borrower within a several block radius, defined neighborhood, or lending area.

Loan Application Analysis

The Loan File assists in determining the Mortgage applicants eligibility for the loan. During the completion and review of the application, the Client should analyze the application in the following manner:

- Verify and substantiate the quantity, quality, and durability of the Mortgage applicants income.

- Verify and analyze the Mortgage applicants assets to determine if adequate funds are available to meet the equity and reserve requirements of the transaction.

- Verify and substantiate the Mortgage applicants liabilities and credit history in relation to the Mortgage applicants assets and income.

- Evaluate the Mortgage applicants net worth in relation to his or her ability to manage financial affairs and accumulate assets/wealth.

- Verify that the declarations are consistent with programeligibility.

The Loan File must contain a complete, fully executed Loan application (1003). Both the initial and final 1003’s must be provided. The following applies:

- Must be signed and dated by the Borrower

- All HMDA data must be completed.

- Client is determined by auditing the interviewers section

- Client Contact information is included

Potential “Buy and Bail” Loan Scenarios

Loans that exhibit the following characteristics, sometimes referred to “Buy and Bail Characteristics”, may be deemed ineligible for sale or funded under Platinum Plus:

- The borrower defaults on the original mortgage shortly after purchasing a second property

- The borrower will be a first time landlord (renting out the originalproperty)

- The borrower has minimal or no equity in the originalproperty

- Inability to validate lease terms with the purported tenant

- Purported tenant has a pre-existing relationship with thehomeowner

Credit

Credit is defined as the Mortgage applicants history of credit payments and financial obligations. An assessment of the Mortgage applicants capacity and willingness to pay financial obligations is a major factor used in determining a Mortgage applicants creditworthiness. A Borrower(s) who has consistently met financial obligations in the past may indicate reasonable justification that he or she is likely to continue to do so in the future. A Mortgage applicants credit history provides a strong measure of their intent to repay.

Credit history is measured on credit depth, number of obligations, delinquency patterns, and demonstrated intent to repay. In a subjective evaluation of credit, many factors are considered when evaluating a Mortgage applicants credit history. The factors include:

- Credit repayment history

- Line utilization

- Proportion of balances versus limits on revolvingaccounts

- Patterns of debt pyramiding

- Recent inquiries and newly opened accounts

- Recent changes in the number of open accounts or overall amount of creditoutstanding

- The number of open accounts and length of credit history

- Public record information

For more information, refer to the Platinum Plus Loan Program Matrices.

Equal Credit Opportunity Act

The Federal Equal Credit Opportunity Act prohibits lenders from discriminating against credit Borrowers on the basis of race, color, religion, national or ethnic origin, sex, marital or familial status, age (provided the Borrower has the capacity to enter into a binding contract), disability, because all or part of the Mortgage applicants income is derived from a public assistance program or because the Borrower has, in good faith, exercised any rights under the Consumer Credit Protection Act. State laws may also prohibit discrimination on certain additional basis such as sexual orientation.

Number of Open Accounts

It is generally not one credit usage factor, but the combination of factors that establish whether or not the overall pattern of credit use is acceptable.

In general, the greater the number of credit accounts, the higher the credit risks. However, it is important to analyze the number of accounts within specific types of credit (i.e., retail, installment, revolving and mortgage). The higher risk group includes Borrowers with a large number of bank revolving accounts, and/or accounts with outstanding balances. On the other hand, if there is no bank revolving accounts, this could indicate an inability of the Borrower to obtain credit.

The lack of acceptable credit cannot be compensated for by either capacity or collateral strengths. When determining investment quality, the likelihood of timely repayment, as demonstrated by responsible credit, must always be

present. Once credit is established, however, collateral and capacity can be used to strengthen the loan’s overall investment quality.

Recent Inquiry Risk Factors and Undisclosed Liabilities

Recent inquiries indicate that the consumer has actively been seeking credit. A Borrower with minimal credit experience and a number of recent inquiries should be more closely scrutinized than a Borrower with the same number of inquiries and a very long and stable credit history.

Multiple inquiries within the most recent 12 months generally increase risk and, when combined with high balances- to-limits on revolving accounts may indicate that the Borrower is in danger of becoming overextended. In addition, several recent inquiries combined with a credit history of short duration may make even mild derogatory credit information significant.

The following factors should be considered:

- Mortgage applicants payment experience

- Type of credit being sought

- Total amount of credit outstanding

- Credit utilization reflected on the report

If the credit report indicated that a creditor has made multiple inquiries within the previous 90-day period, the underwriter must determine whether additional credit was granted as a result of the Mortgage applicants request. A review and evaluation of the inquiries section of the Mortgage applicants credit report is required to determine if the Borrower

has received additional credit that is not reflected in the credit report or disclosed in the Loan File. A detailed explanation letter that specifically addresses both the purpose and outcome of each inquiry is required from the Borrower(s). An overall generic credit explanation letter is not acceptable.

As a result of the credit inquiries, the loan may be subject to additional requirements. If additional credit was obtained, a verification of that debt must be provided and the Borrower must be qualified with the monthly payment. The verification can be achieved through a direct verification with the creditor or use of a credit supplement.

Clients are expected to proactively identify any and all undisclosed liabilities that may affect the loan approval in relation to underwriting guidelines, eligibility parameters, or pricing. It is the Client’s responsibility to develop and implement its own business processes to support compliance with Fannie Mae’s requirements for undisclosed liabilities. Although Clients may already have such processes in place, some best practices that may be incorporated include:

- Refreshing a credit report prior to closing to uncover additional debt or credit inquiries

- Adopting new services from credit vendors that provide Borrower credit report monitoring services between the time of loan application and closing

- Investigating credit inquiries listed on the credit report to determine whether the Borrower did in fact, open additional debt resulting in repayment obligations. In some cases, it is possible to obtain a direct verification with the creditor associated with theinquiry

It is also highly recommended that a Mortgage Electronic Registration System (MERS) report be run, prior to closing, to determine if the Borrower has undisclosed liens and/or if another mortgage is being originated. If new debt has been obtained, the Loan File must be re-evaluated to ensure compliance with debt-to-income and Borrower eligibility requirements.

Recently Opened Accounts

Like inquiries, several recently opened accounts may be a warning that the Borrower(s) may be getting overextended. In addition, a credit history with all accounts recently opened may signal that the Borrower(s) do not have sufficient experience managing financial obligations. The following factors should be considered:

- Mortgage applicants payment experience

- Utilization of revolving credit lines

- Total amount of credit outstanding

- Recent inquiries

- Whether the Borrower has sufficient experience in managing investmentproperty

Outstanding Debt/Line Utilization

Two very important indicators of repayment ability are the number of accounts with sizable outstanding balances and high credit line utilization. The number of trade lines with balances reported in the last three years should be considered and reviewed in relationship to the number and activity in the last 12 months.

Analyze the current balance for each open account to the high credit limit to determine whether there is a pattern of accounts with balances at or near their limits. Generally, if a Borrower has credit balances that represent at or near 70% of their open and active credit limit, this may require additional review and/or compensating factors. The more accounts with high balances-to-limits and the higher the percentage used, the higher the risk.

High balances-to-limits may also indicate the Borrower is making minimum payments on revolving accounts

rather than reducing the debt and may be at or near payment capacity. Any derogatory information in a credit history within the most recent two years combined with several revolving accounts at or near their limits should be considered derogatory information when evaluating the credit profile of the Borrower. Generally, the higher the Mortgage applicants overall utilization of revolving credit, the higher the amount of risk. Compensating factors or additional documentation may be required to offset this risk.

Reason/Score Codes

Along with the credit scores, credit repositories return up to four reason codes with each credit score provided. These codes are sometimes referred to as score factor codes. These reason codes provide an explanation as to why the Borrower(s) did not receive a higher score. This is taken into consideration when evaluating mortgage applicants

credit.

HAWK Alerts

All three national credit repositories have developed automated messages to help messages to help identify possible fraudulent activity on a credit report. These alerts are commonly known as HAWK Alerts. All HAWK Alert messages shown on a credit report, especially those in the Fraud Verification Information section must be addressed and resolved.

Military Active Duty Alert

Military personnel are particularly susceptible to identity theft because many of their records, orders, and identification documents display their social security number. An active duty alert is a type of fraud alert established under the Fair and Accurate Credit Transactions Act (FACTA) that provides credit identity theft protection for U.S. military service personnel.

The Mortgagee must contact the Borrower directly to verify identity whenever an active duty alert appears on the Mortgage applicants credit report.

Customer Identification and OFAC Alert Screening

The mortgagee must comply with Section 326 of the USA Patriot Act and OFAC, including:

- Provide each Borrower with a customer identification notice

- Obtain at least four items verifying the Mortgage applicants identity through documentary or non- documentary methods

- OFAC alert screening

- Determine if the Borrower is questionable orsuspicious

- Monitor questionable instance which may require internal and external reporting of suspected individuals

- Ensure Client’s employees are trained and informed of suspicious activities related to anti- money laundering or terrorist activities

Weighing Risk Factors

When evaluating Borrower(s) with adverse credit information, more weight should be given to derogatory credit information or late payments occurring within the past two years. The following factors should still be considered:

- The number, timing and extent of the delinquency

- Eventual repayment of delinquent obligations

- Any previous bankruptcy, mortgage foreclosures, or deed-in-lieu of foreclosure within the past seven years

- Whether other characteristics of the Mortgage applicants credit profile, such as age of credit, use of outstanding credit, and inquiries, make any significant difference in the derogatory credit

Delinquency and Derogatory Credit

There are a number of factors to consider in the analysis of delinquency or derogatory credit:

- The type of accounts on which the delinquency occurred

- The reason for delinquency

- The severity of the delinquency

- The frequency of delinquent accounts, AND

- How recently the delinquency occurred

More weight is placed on installment loan delinquency than on revolving debt delinquency. The most weight is placed on mortgage payment history. The most serious types of delinquency include foreclosures, bankruptcy, judgments, collection accounts and tax liens. Explanations and supporting documentation should be in the file to show these events were an isolated occurrence and are unlikely to happen again.

Accounts which are currently delinquent are closely scrutinized. All accounts past due must be brought current or otherwise resolved prior to closing according to the Platinum Plus program guidelines. Please refer to the Platinum Plus Matrix for details.

Credit Report Requirements

For each Borrower whose income or assets are required to qualify for the loan, the Loan File must contain one of the following:

- A full Residential Mortgage Credit Report(RMCR)

- An in-file merged credit report that accesses the three national credit repositories

- Joint merged credit reports are allowed without regard to marital status

General Requirements

The following outlines the general requirements for credit reports. The credit report must contain merged credit information provided by all three national repositories.

Residential Mortgage Credit Reports:

- Credit Report must not be dated more than 90 days from the Note Date. In the event that the Disbursement Date causes the Mortgage applicants credit report and/or credit file to be greater than 90 days old, we reserve the right to request updated credit, asset, and/or income documentation. Disbursement Date is the day on which the loan closes.

- Must contain all discovered credit and legal information that is not considered obsolete under the Fair Credit

Reporting Act

- Be issued by an independent consumer reporting agency that obtains or verifies all information from sources other than the Borrower.

- Identify the full name, address, and phone number of the consumer reporting agency

- Identify the names of the national credit repositories from which the information was obtained. The consumer reporting agency must contact at least two national credit repositories for each area in which the Borrower has resided during the most recent two-yearperiod.

- Indicate the dates the accounts were last updated with creditors. Each account should have been updated within 90 days of the credit report.

- Include a certification stating that it meets the standards that Fannie Mae, Freddie Mac, the FHA, and VA prescribe for an RMCR. Separate credit repository inquiries are necessary when Co- Borrowers have maintained creditindividually.

- List all credit inquiries received within the previous 90days.

- Evidence the consumer reporting agency verified the Mortgage applicants current employment and, if obtainable, income.

The report must show the date of verification. Verification may be made by telephone. If there has been a change in employment in the past two years, the report must also describe the Mortgage applicants previous employment and income. In cases in which employment was not verified, the report must indicate why it was not.

- Show responsive statements concerning items on the report. For example, the consumer reporting agency must report unable to verify or employer refused to verify. The same responsive reporting applies to trade and credit history.

- Must contain specific information regarding legal items found in public records, including judgments, foreclosures, tax liens, bankruptcies,etc.

Tri-Merged Credit Reports:

- Must contain all the information from the three in-file creditreports.

- If the information is not exactly the same on each report, then the merged report must repeat the information as stated on each report or include the most derogatory of the duplicate information that pertains to the payment history and/or current paymentstatus.

- Identify the repositories that were used for the in-file creditreports.

- Must provide a credit bureau score, accompanied by reason codes, for each Borrower.

- The report must include all of the information verified by the threerepositories.

- Any social security number discrepancy must be disclosed by therepositories.

- Each individual trade line must identify the primary repository that provided the account information.

No Borrower in a transaction may have frozen credit. Frozen credit is where the Mortgage applicants credit has been involuntarily frozen by a court order, government entity or similar mandate. If a Borrower has frozen credit and unfreezes their credit after the original credit report was ordered, a new credit report must be obtained to reflect current updated information for evaluation.

Each credit report must contain a Fair Isaac credit score (“Empirica” on TransUnion, “Beacon” on Equifax, and “FICO” on Experian) for all Borrowers whose income and/or assets are used to qualify for the loan. The Client must provide at least two qualifying credit scores for each Borrower. These credit scores will be used as a component in determining the credit grade of the loan. A Co-Borrower with no valid credit score will be allowed in cases where income and/or assets are not required for qualification purposes. For grade determination, refer to the Platinum Plus Loan Program Matrices.

Selecting The Credit Score

FloridaBad Credit Mortgage Lenderswill select the Mortgage applicants credit score using one of the following methods:

- If all three scores are available, the middle score will beused.

- If only two scores are available, the lower score will be used. Once the score is selected for each Borrower, it is used for loan qualification as follows:

- For Full/Alternative Documentation Loans, the Primary Mortgage applicants selected score is used.

- For Reduced Documentation Loans, the lowest selected score among all Borrowers is used.

- If in the case where both Borrowers earn equal income, the Borrower with the lower score will be used for grade determination.

To ensure credit score validity, the Originator should review the scores, the score codes and the Mortgage applicants credit history, Score codes must be consistent with trade line information and use. Scores that do not appear to

represent an accurate assessment of the Mortgage applicants credit risk will not be considered usable and valid.

Limited, No Credit History Or Alternative Credit History

Borrowers with limited, no credit history, or that do not meet Platinum Plus program’s minimum credit requirements are not eligible. Each Borrower must have at least two valid and usable credit scores as defined by the guidelines. A Borrower not using income to qualify and showing $0 earned or is not employed does not need to meet the minimum trade line requirements.

Minimum Credit Requirements / Trade Lines

- A Borrower(s) without an established credit history is ineligible. A valid and usable score is one that is generated based upon credit history and credit patterns that accurately reflect the Mortgage applicants history. It should contain at least:

– Three established open and active trade lines that reported for a minimum of 24months

– At least one of the three established trade lines must have a minimum $2,500 high credit limit

– At least one open mortgage trade line in the last 36months

- If the Borrower is a First-Time Homebuyer, the Mortgage applicants rental housing payment history for the previous 12 months is required. Payments must be documented via an institutional VOR or cancelled checks/bank statements.

- For Borrowers that currently own or have owned a property free and clear, a copy of the title or credit report must document the free and clear status.

- If the Borrower is in college, is a recent college graduate or living with family members and is not paying rent, he or she must meet the minimum creditrequirements.

Mortgage applicants failing to meet the 3 trade lines criteria but have a minimum of 1 open trade line with 12 months or more reporting history can be considered without exception if the following requirements are met:

- 8 or more trade lines reported with at least one being a mortgage tradeline

- Minimum 7 years of established credit history

- If the mortgage history is not reported on the credit report, it may be verified through cancelled checks, or verification of mortgage (VOM).

OR

- 6 months additional reserves and meets one of the following requirements: DTI < 35%, LTV < 70, or the program maximum, whichever is less.

Unacceptable Tradelines

The following cannot be used to meet the minimum trade line requirement:

- Collections

- Charge-offs

- Public records and derogatory credit, included in or prior to abankruptcy

- Accounts currently over 90 days delinquent

- Student loans not currently in repayment

- “Authorized User” accounts

Adverse Credit

Collection accounts, charge-off accounts, judgments, liens, delinquent property taxes, repossessions, and garnishments are considered to be adverse credit. Adverse credit does not impact the grade determination, since these elements have already been included in the credit score; however, the allowance of adverse credit is restricted by grade and program.

All delinquent credit that will impact title must be paid off prior to or at closing. Title must insure FloridaBad Credit Mortgage Lenders

Funding’s lien position without exception.

However, Charge-Offs or collection accounts that do not impact title are not required to be paid off. For eligibility and restriction details, refer to the Platinum Plus Loan Program Matrices.

Derogatory Credit

Any derogatory information requires a full investigation including:

- A written explanation from the Borrower that outlines the cause of the major derogatory credit event and the likelihood of re-occurrence.

- Explanations must make sense and cannot conflict with other verified information or documentation in the Loan File. When a Borrower indicates unusual circumstances have contributed to serious delinquencies or derogatory credit, documentation to support those circumstances should be obtained to justify a decision to approve a loan with recent credit problems.

- Proper consideration must be given in evaluating the Mortgage applicantscreditworthiness

- Proof that the incident has been resolved and documentation supporting the resolution and conclusion of the matter. If a derogatory item is being paid through this transaction, the file should note it in the closing statement.

- A Borrower may provide medical information to explain a pattern of late payments. Medical information must never be specifically requested. However, explanation for a pattern of late payments or derogatory information on the credit report should be requested. The underwriting decision to grant credit should not be based on a Mortgage applicants physical, mental or behavioral health condition.

Divorce Debt

Delinquent credit which belongs to an ex-spouse may be excluded from the credit evaluation when all of the following apply:

- Loan File contains a copy of the filed/recorded divorce decree or recorded separation agreement which shows the derogatory accounts belong solely to theex-spouse;

- Late payments that have occurred after the date of the divorce or separation;and

- If debt in question is a mortgage, evidence of title transfer prior to any delinquent debt must be provided and evidence of “buyout” as part of courtproceedings.

Co-Signed Debt

Delinquent credit that belongs to a co-signer must be considered in determining the Mortgage applicants credit acceptance.

Bankruptcy

Bankruptcy is defined as court proceedings to relieve the debts of an individual or business unable to pay creditors. Bankruptcy may be declared under one of the Chapters of the Federal Bankruptcy Code.

- Chapter 7. Covers liquidation of individual or businessassets.

- Chapter 11. Covers reorganization of bankruptbusinesses.

- Chapter 13. Covers contractual repayment byindividuals.

Requirements and Guidelines

The following requirements and guidelines apply to bankruptcies:

- Loans to Borrowers with multiple bankruptcies are ineligible for purchase or funded under Platinum Plus. For example, a Borrower who filed for bankruptcy in 2009 and later in 2012 is ineligible under these guidelines regardless of whether the bankruptcy was discharged or dismissed. We do not consider the following

scenarios as multiple bankruptcies:

– When a Chapter 13 rolls into a Chapter 7 bankruptcy

– When individual Borrowers each have filed separate bankruptcies.

- Bankruptcy dismissal dates are treated the same as discharge dates.

- If a discharge/dismissal date cannot be established, documentation validating the dates must be provided.

If a Foreclosure is included in the Bankruptcy, each event is treated separately for grade determination. The Client must determine the seasoning for each event and grade the Loan accordingly.

Please refer to the Platinum Plus Loan Program Matrices for bankruptcy seasoning information, and Loan Program restrictions. Credit depth requirements must be met post-bankruptcy. Credit prior to bankruptcy will not be considered for meeting the trade line requirements.

Chapter 7 Bankruptcy

Chapter 7, also called liquidation, is the most common type of bankruptcy. It provides for the absolute and complete elimination of most types of debt, thereby giving the debtor a fresh start. The goal of a Chapter 7

bankruptcy is to obtain a court order discharging one’s debts.

For all credit grades, the aging of the Chapter 7 bankruptcy is measured from the discharge date. For further details, refer to the Platinum

Plus Loan Program Matrices.

Chapter 11 Bankruptcy

Chapter 11 bankruptcies allow businesses the opportunity to reorganize business debt without having to liquidate all assets. The debtor presents a plan to creditors that allows the debtor to reorganize financial obligations in order to improve the financial stability of the business.

For all credit grades, the aging of the Chapter 11 bankruptcy is measured from the discharge date. For further details, refer to the Platinum

Plus Loan Program Matrices.

Chapter 13 Bankruptcy

Chapter 13 bankruptcies provide individuals who have a regular income, but are overcome with debt, the opportunity to repay within a reasonable period of time. Chapter 13 bankruptcies permit the debtor to file a plan to pay a certain percentage of future income to the bankruptcy court for payment to creditors. If the court approves the plan, the debtor will be under the court’s protection while repaying stated debts.

Depending on the Loan Program, the aging of a Chapter 13 bankruptcy is measured from the discharge date. For further details, refer to the Platinum Plus Loan Program Matrices. If Borrower enters into Bankruptcy and cancels, the seasoning is measured from the Cancellation Date

Consumer Credit Counseling Services (Cccs)

Consumer Credit Counseling Services (CCCS) assist Borrowers with financial management of debts in an attempt to avoid further delinquencies or possible bankruptcy. Generally, creditors agree to a reduced repayment under a consumer credit counseling plan. In all cases, the CCCS plan must have been paid in full. A payment history is required in this situation and if delinquent in the most recent 12 months, the CCCS will be treated as an open Chapter 13 and is ineligible. The date the CCCS was paid off will be considered the discharge date. If Borrower enters into CCCS and subsequently cancels, the seasoning is measured from the cancellation date.

Foreclosures

A foreclosure is a proceeding that enables the creditor, in accordance with the terms of the security instrument, to take legal action that could ultimately result in the forced sale of the collateral property for full or partial satisfaction of the debt. Such action typically extinguishes the property owner’s rights, title, and interest. In the instance where a Borrower has been or is currently delinquent 120 days or longer and the lender has not initiated formal actions, the

120 day plus delinquency will be treated as a foreclosure for grading purposes. Documentation should be provided to show the individual Mortgage applicants circumstance.

Foreclosure is substantiated by real estate loans that are delinquent 120 days or longer, as mentioned above or the existence of any of the following:

- Breach

- Lis Pendens

- Notice of Sale

Requirements and Guidelines

- Service

- Sheriff’s Sale

- Short Payoff

- Bankruptcy Notice

The following requirements and guidelines apply to foreclosures:

- The length of time elapsed since the occurrence or completion of the foreclosure is considered in the grade determination.

- Applicants who have undergone foreclosure procedures must provide a mortgage/housing history in accordance with specific Program Guidelines.

- A Borrower with a history of more than one foreclosure is ineligible. For example, a Borrower who had a foreclosure in 2009 and then loses a home through bankruptcy in 2012 is ineligible.

- Any repossession or 120-day delinquency on a mobile home, manufactured home or timeshare, even if shown as an installment debt, will be considered aforeclosure.

If a Foreclosure is included in the Bankruptcy, each event is treated separately for grade determination. The Client must determine the seasoning for each event and grade the Loan accordingly.

Please refer to the Platinum Plus Loan Program Matrices for foreclosure seasoning information, and Loan Program restrictions.

Loss Mitigation History – Modifications, Forbearances, Rearrangements, Extensions, Or Workouts

Loss mitigation history includes the following:

- Deed-in-Lieu

- Short Sale

- NOD

- Short Refinance

- Pre-Foreclosure Sale

- Loan Extensions

- Loan Modification

For further details, refer to the Platinum Plus Loan Program Matrices.

An agreement to forbear, workout, extend, or rearrange the terms of the original loan does not change the fact that the loan was not paid in accordance with its original terms. This applies even if the extension or modification was initiated by the Borrower, and the debt was subsequently paid in accordance with the rearranged terms. Any forbearance on a mortgage including deed-in-lieu, NOD, pre-foreclosure sale, short sale, short refinance, modification or non-foreclosure action will be considered a loss mitigation action for grading purposes.

Please refer to the Platinum Plus Loan Program Matrices for loss mitigation action seasoning information, and Loan Program restrictions.

Lawsuits and Pending Litigation

If the application, title, or credit documents indicate that the Borrower is involved in a lawsuit or litigation additional documentation, such as an attorney’s explanation, copy of the complaint and answer, etc. is required. The title company closing the loan must provide a letter stating affirmative coverage of subject lien position.

Generally, lawsuit and pending litigation is not eligible under the Platinum Plus program. Situations in which the lawsuit or pending litigation does not have a meaningful impact on the mortgage applicants ability to repay the mortgage may be permitted.

Mortgage/Housing History

Each loan must include a mortgage/housing history for the Mortgage applicants primary residence and any other properties the Borrower owns. On non-owner occupied transactions, a mortgage/housing history is required on the Mortgaged Property as well as the primary residence. For specific program requirements refer to the Platinum

Plus Loan Program Matrices.

Requirements and Guidelines

The requirements and guidelines for mortgage/housing payments are:

- Mortgage/housing payment history on any property, regardless of the occupancy or lien status, is considered mortgage/housing history for grading purposes.

- If the Borrower does not own a property, a housing/rental payment history must be provided

- Any payments on a manufactured home or timeshare are considered to be mortgage debt, even if reported as an installment loan. They will be treated as installment debt rather than real estate owned.

- The existing mortgage on the Mortgaged Property can be no greater than the max delinquency contractually allowed by the program.

- Each contractual delinquency must be considered separately. (i.e. a first and second lien)

- Any delinquency must be explained and documented in a letter of explanation.

Mortgage / Housing History Requirements

- If the Borrower is a First-Time Homebuyer, the Mortgage applicants rental housing payment history is required.

Payments must be documented via an institutional VOR or cancelled checks/bank statements.

- If the Borrower is in college, is a recent college graduate, living with family members, is not paying rent, or is otherwise unable to verify housing history, he or she must meet the minimum credit requirements

- For Borrowers that currently own or have owned a property free and clear, this requirement will be waived for any period where there was free and clear ownership. A copy of the title or credit report must document the free and clear status.

Verification of Mortgage (VOM)

The following are acceptable for verifying mortgage payments:

- An institutional verification of mortgage (VOM)

- Copies of canceled checks (front and back)

- Bank statements

- A current credit bureau report

Third-party verification or copies of canceled checks (front and back) are always required for non-arm’s length verifications of mortgage (private mortgage, Land Contract/Contract-for-Deed, or Lease Option to purchase).

Verification of Rent (VOR)

Any of the following documents are acceptable for verifying rent payments:

- An institutional Verification of Rent form

- A letter and rating from a property management company

- Copies of canceled checks (front and back)

- A credit supplement for a rental rating

Third-party verification or copies of canceled checks (front and back) are always required for non-arm’s length or private party verifications of rent (related landlords, client landlords, employers or any interested party to the transaction).

To use rental history as a tradeline, the Borrower must verify rent using copies of canceled checks (front and back).

If the Borrower does not have a checking account, money orders may be accepted if they are valid and legible, are purchased from a legitimate vendor, and can be validated by conducting a telephone audit with the vendor.

Analyzing Delinquent Mortgage/Housing Payments

Mortgage/housing payment history is determined as follows:

- Rolling Lates. Consecutive, identical delinquencies. There is no limit to the number of rolling delinquencies that can occur to be counted as one event.

- Intermittent Lates A pattern of late payments that is not consecutive, but is broken into intervals.

- Progressive Lates Delinquencies that increase in severity. The most severe delinquency reached is considered one event.

When evaluating the mortgage/housing history, all delinquencies must be added. For example, if the Borrower has a First and Second Mortgage on his or her property and each one had one late payment (1×30) in the last 12 months, the Mortgage applicants mortgage/housing history is equal to two late payments (2×30).

Mortgage/housing delinquencies must be calculated as follows (with the mortgage history beginning in January and read from right to left):

Example 1:

|

Jan

2

60

This account would be counted as 1×60 rolling and 2×30 rolling for determining the mortgage/housing component of the grade determination. The eight 30-day and the three 60-day delinquent payments are

counted as two 30-day rolling delinquencies and one 60-day rolling delinquency because there is no limit to the

number of rolling lates that are considered one event.

Example 2:

|

Jan

2

60

This account would be counted as 1×90 non-rolling and 1×30 rolling for determining the mortgage/housing component of grade determination. The two 60-day and the one 90-day delinquency are considered a progressive delinquency and one event. The five 30-day delinquencies are rolling and considered one event because there is

no limit to the number of rolling lates that are considered one event.

Grade Determination

The Mortgage applicants grade is based on the following factors:

- Housing (mortgage/rental) payment history

- Credit score

- Bankruptcy history

- Foreclosure history

- Loss mitigation history, including non-foreclosure actions such as deed-in-lieu, NOD, pre- foreclosure sale, short sale, short refinance andmodification

- Required Program Reserves

The Mortgage applicants least favorable factor will determine the credit grade. For example, a negative rating on a mortgage will determine the credit grade if it is worse than the aging of the bankruptcy.

The debt-to-income (DTI) ratio, adverse credit, residual income, and reserve requirements must also be met. For details on determining grade, refer to the Platinum Plus Loan Program Matrices.

Qualifying Ratios

Qualifying ratios are ratios used to calculate the Mortgage applicants debt versus collateral and debt versus income in order to qualify the Borrower for a Loan Program. Note that all Loan Programs limit the ratios allowed when underwriting the loan. For specific details, refer to the Platinum Plus Loan Program Matrices.

Loan-To-Value (Ltv) And Combined Loan-To-Value (Cltv) Ratios

Calculating LTV Ratio

The loan-to-value (LTV) ratio is the loan amount divided by the value of the Mortgaged Property. The combined loan- to-value (CLTV) ratio is the sum of all liens on the Mortgaged Property divided by the value of the

property. Note that all Loan Programs offered limit the maximum LTV ratio allowed and may have seasoning

requirements when underwriting the loan. Value is determined as follows:

Determining the Value for LTV/CLTV

Purchase Transactions:

- Purchase Transactions. Loans must use the lesser of the purchase price or the Appraised Value as the value amount for calculating the LTV/CLTV ratios. The purchase price can be documented using the original, fully executed purchase agreement or the closing statement (HUD-1).

Refinance Transactions:

- Cash-Out Refinance. Loans on properties owned less than 12 months must use the lesser of the purchase price plus the added value of any documented improvements or the Appraised Value as the value amount for calculating the LTV/CLTV ratios. Cash-Out Refinance Loans on properties owned more than 12 months may use the Appraised Value as the value amount for calculating the LTV/CLTV ratios. The purchase price can be documented using the closing statement (HUD-1) from the original financing. The value of the improvements must be documented for each improvement.

- Rate/Term Refinance. The Appraised Value can be used as the value amount for calculating the LTV/CLTV ratios.

Lease Option to Purchase:

Lease Options must be treated as purchases for disclosure/documentation purposes. A rescission notice is not required.

- Less Than 12 Months’ Seasoning. A documented lease with a lease option-to-purchase will be treated as a purchase

transaction when there is less than 12 months of seasoning. The lesser of the Lease Option price or the Appraised

Value will be used to determine the LTV/CLTV.

- At Least 12 Months’ Seasoning. The Lease Option will be treated as a refinance transaction if there is at least 12 months of seasoning. The Appraised Value will be used to determine the LTV/CLTV.

Construction-to-Permanent Refinances:

A Construction-to-Permanent transaction may be closed as a purchase, limited Cash-Out Refinance or a Cash-Out Refinance. When a refinance is used, the Borrower must have held legal title to the lot before he applied for the construction financing and must be named as the Borrower for the Construction Loan.

- Cash Recapture. When the Borrower wishes to recapture monies paid out-of-pocket and to pay off an existing Construction Loan, the loan will be considered a purchase transaction. Evidence of the acquisition cost of the property will be required. The lower of the total acquisition cost (lot plus improvements) or the Appraised Value will be used to determine the LTV/CLTVratios:

− Owned Less Than 12 Months. If the lot was purchased less than 12 months prior to the date of application, the value of the lot will be based on the lower of the purchase price or land value as indicated on the appraisal.

− Owned at Least 12 Months. If the lot has been owned for more than 12 months, the value will be determined by the appraisal.

- Construction Loan Payoff. When the Borrower does not require cash recapture and the proceeds from the loan are being used to pay off the construction financing and closing costs, the loan will be considered a Rate/Term Refinance transaction. The Appraised Value will be used to determine the LTV/CLTV ratios.

- Equity Withdrawal. When the Borrower wishes to withdraw equity, the loan will be considered a Cash-Out Refinance transaction. Program guidelines for allowable cash-out limits must be met. The LTV/CLTV is determined by one of the following:

− Owned Less Than 12 Months. If the lot was purchased less than 12 months prior to the date of application, the lesser of the Appraised Value or acquisition cost of the lot plus the documented cost of property improvements will be used.

− Owned at Least 12 Months. If the lot has been owned for more than 12 months, the LTV/CLTV will be determined by the current AppraisedValue.

- Borrower/Builder Transactions are considered non-arm’s length transactions and are ineligible.

Land Contracts, Installment Land Contract, Contract for Deed Refinance (applies to both recorded and unrecorded transactions):

Land Contracts must be treated as refinances for documentation purposes. The Borrower must be given the right to rescind the transaction.

- Executed Less Than 12 Months. If the Land Contract/Contract for Deed has been executed for less than 12 months, then the LTV will be based on the current Appraised Value or the purchase/contract price, whichever is less.

- Executed at Least 12 Months. If the Land Contract/Contract for Deed has been executed for at least 12 months, the LTV will be based on the current AppraisedValue.

Inherited Property:

If the subject property was inherited less than 12 months prior to application, the transaction is deemed a Special Purpose Cash-Out Refinance and is subject to the following:

- Proceeds are used to buy-out the documented equity interest of others. Equity owners must be paid through settlement

- The Mortgaged Property has cleared probate and property is vested in the Mortgage applicants name, AND

- Current Appraised Value is used for LTV/CLTVdetermination

Housing And Debt-To-Income Ratios

The debt-to-income (DTI) ratio is the sum of all the Mortgage applicants applicable monthly debt obligations divided by the Mortgage applicants gross monthly income. The Client must verify all of the Mortgage applicants outstanding liabilities. Note that all Loan Programs offered limit the maximum DTI ratio allowed when underwriting the loan – refer to the Platinum Plus Loan Program Matrices for details. The following debts must be included in the Mortgage applicants DTI ratio:

- Qualifying rate for monthly housing expensecalculation:

– Fixed Rate Loans qualified using the fully amortized payment calculated at the note rate

– Adjustable Rate (ARM) Loans qualified using the higher of the fully indexed rate or the initial note rate plus the periodic adjustment (2%)

– Interest Only Loans qualified at the note rate based on the fully amortizing Principal & Interest payment during the principal repayment period. Borrowers will not be qualified on the interest only payment amount.

- Monthly housing expense includes the following charges divided by the Mortgage applicants stable monthly income:

– Monthly principal and interest payment (as per the qualifyingrate)

– 1/12th of the annual hazard insurance premium

– 1/12th of the annual real estate taxes and assessments

– 1/12th of the annual flood insurance premium, whenapplicable

– 1/12th of the annual private mortgage insurance premium (whenapplicable)

– Monthly leasehold payments (when applicable)

– Monthly HOA dues, condominium maintenance fees, monthly assessments (when applicable)

– Monthly payment for other secured financing (whenapplicable).

- For equity lines of credit (as applicable), the monthly payment used for qualification should be based on the greater of:

– The payment noted on the credit, OR

– 1% of the maximum current available draw

- The DTI ratio includes the monthly housing expenses plus the followingcharges:

– Revolving charges (if no payment is showing on the credit report, use 5% of the outstanding balance)

– Installment debt with 10 or more remaining payments if the inclusion of this installment debt would cause the Mortgage applicants DTI to be > 5% over the program allowance, up to a max DTI of 60%, additional compensating factors and/or documentation would be required to offset the risk

– Real estate loans

– Real estate net rental losses from all investment propertiesowned

– Automobile loans

– Automobile leases (must be included in the DTI even if fewer than 10 payments remain)

– Net rental losses from real estate owned

– Alimony, child support, or maintenance payments with 10 or more remainingpayments

– Joint obligations, if applicable, for divorced or separated Borrowers

– Student loans, whether deferred, in forbearance, or in repayment (notdeferred)

– Monthly paid charge accounts, such as an Amex account, payment will not be included but outstanding balance amount will be netted out of availableassets

For maximum DTI ratio allowed when underwriting the loan, refer to the Platinum Plus Loan Program Matrices for details.

Payment Shock

Payment shock is the percentage that a Mortgage applicants mortgage/housing payment increases with the new loan. One of the strongest indicators of a Mortgage applicants ability to repay is his/her past record of handling housing payments. The percentage of payment shock, even when not limited expressly by the Loan Program will be analyzed to determine the likelihood of the Borrower to pay promptly. Generally, payment shock >150%, may require

further review and additional compensating factors and/or documentation may be required.

Second Trust Deeds, Junior Liens, And Secondary Financing

Second trust deeds, junior liens, and secondary financing (subordinate liens) are defined as mortgages having rights that are secondary to a First Mortgage. These are encumbrances on real estate (for example, a Second Mortgage, a tax lien or a mechanic’s lien), where the priority of the secondary financing is subordinate to that of another recorded interest in the same property.

This section outlines the requirements for junior liens or secondary financing that is not the subject Loan being sold or funded under the Platinum Plus Program.

Requirements and Guidelines

Client must investigate whether the Borrower has applied for any simultaneous loan or subordinate financing, including one that will occur after consummation of the FloridaBad Credit Mortgage LendersFirst Mortgage if the simultaneous loan will cover the closing costs of the First Mortgage. The following rights and restrictions apply to second trust deeds, junior liens, and secondary financing when the Platinum Plus program is being used to fund or purchase a First Mortgage with non-FloridaBad Credit Mortgage Lenderssecondary financing:

- The CLTV ratio of the first and secondary lien must not exceed the limit outlined in the applicable Platinum Plus Loan Program Matrices. Refer to the Platinum Plus Loan Program Matrices for details. The CLTV is calculated by adding the principal balance of the First Mortgage with the current principal balance of the subordinated closed-end second lien or the maximum available credit line of a subordinated open-end second lien and then dividing the sum by the Appraised Value of the property.

- A copy of the executed second lien note, recorded trust deed, and signed subordination agreement must be provided to confirm the loan amount, terms, andlien status.

- Terms of the subordinate lien must be less than or equal to the term of the First Mortgage.

- The subordinate lien must have a minimum remaining term of no less than five years, unless the financing

fully amortizes prior to that time.

- The financing must not permit the note holder to “call” the financing within the first five years following the loan closing.

- The note rate must be at market rates.

- The secondary financing must not have a negative amortizationfeature.

- The terms of the note must provide for regular monthly payments of at least the interest due with no provisions for future advances or wrap-around terms.

- Monthly payments on the secondary financing must be included in the Mortgage applicants debt-to- income ratio.

- Payments may be graduated or variable, as long as the annual payment adjustment of the secondary financing does not exceed a 2% interest rateincrease.

- The subordinate lien must be from an institutional lender.