- NO INCOME VERIFICATION FLORIDA COMMERCIAL MORTGAGE LENDERS

- NO DOC STATED INCOME FLORIDA MORTGAGE LENDERS

- NO INCOME VERIFICATION FLORIDA COMMERCIAL MORTGAGE LENDERS

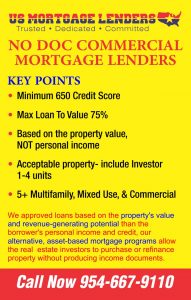

COMMERCIAL NO DOC MORTGAGE LENDERS WITH NO INCOME NEEDED – Apply Now For A Fast Approval!

We never look at tax returns or personal income statements, and there is no Debt to income ratio Analysis. You want to think of us a NO INCOME VERIFICATION MORTGAGE LENDER an asset-based Florida no income documentation mortgage lender whose main concern is the subject property, its value, and its cash flow. Our Florida commercial lenders are asset based, creditdriven, and perfect for investors that have trouble qualifying with traditional institutions but are not interested in hard money options.

Fast Consultation – Apply Now For A Fast Approval!

Flexible Florida No Doc Commercial Mortgage Lenders Provide Solutions for Florida Self Employed no income verification mortgage applicants

NO Doc Florida mortgage lenders are focused exclusively on financing residential 1-4 investment, multi-family, mixed-use, and small balance commercial properties.

By focusing more on the property’s value and revenue-generating potential than the Florida self employed Commercial mortgage applicants personal income and credit, our alternative, asset–based mortgage programs allow Florida real estate investors, including W-2, self–employed, and small business owners, who are often tough to qualify.

Because all Florida commercial mortgage applicant, even the extraordinary ones, deserve an opportunity.

Florida No Doc Commercial Mortgage Lenders programs may be used for purchase, rate/term refinance, and cash-out refinance transactions.Florida No Doc Commercial Mortgage Lenders also allows an IRS 1031 Exchange for any borrower. All Florida No Doc Commercial Mortgage Lenders require impounds of taxes and insurance.

Commercial Florida mortgage lenders never look at tax returns or personal income statements, and there is no DTI Analysis. You want to think of us as an asset-based lender whose main concern is the subject property, its value, and its cash flow. We‘re asset based, credit driven, and perfect for Florida multifamily investors that have trouble qualifying with traditional institutions but are not interested in hard money options.

FLORIDA COMMERCIAL NO INCOME VERIFICATION PROPERTY TYPES INCLUDE

Acceptable property Florida commercial property types include Investor 1–4 units, 5+ Multifamily, Mixed Use, and Florida Commercial. You want to think of our acceptable property types as properties that are generic and conform to Florida zoned use.

Following this logic, VMC will stay away from highly specialized properties like schools, hospitals, hotels, and any single use properties such as reception halls, theaters, or concert venues.

NO INCOME VERIFICATION FLORIDA MORTGAGE PROGRAMS INCLUDE:

- • FlexPerm No Income Verification Commercial Lenders

- • Fast50 Florida No Income Verification Commercial Lenders

- • Quickfix No Income Verification Commercial Lenders

- • ARV Pro Florida No Income Verification Commercial Lenders

FLEX PER NO INCOME FLORIDA MORTGAGE LENDERS SUMMARY

Likely to be your ‘go-to’ No Income verification mortgage loan program, the FlexPerm Florida mortgage Loan boasts a 3 or 8-year fixed ARM, with a 30-year amortization schedule. This program is available for all Florida Commercial property types.

Designed for Florida Commercial investors seeking a simple financing solution for purchase or refinance, with the flexibility to remain in the loan for up to 30 years. It’s an uncomplicated Florida Commercial mortgage option with flexible underwriting and longer terms. You’ll want to think of this Florida Commercial no income verification loan program as a good fit for no income verification mortgage applicants that are looking to buy and hold their investments.

• Great for qualifying W-2 and self-employed Florida real estate investors

• Based on property value,not personal income.

• Best alternative to hard money loans.

• Available as a 3-year-fixed or 8-year-fixed loan, each amortized over 30 years.

• Minimum mid score requirement is 650

• 75% LTV depending on property type

• 7-9% interest rates

• On SFR ‘s – most important rule across any program – borrower must own their primary residence for at least 12 months.

FAST50-NO INCOME FLORIDA MORTGAGE LENDERS SUMMARY

Think of this No income verification Commercial loan program as a credit forgiving extension of the FlexPerm program. Compliance requirements are still in effect even though Underwriting flexibility is at its highest at 50% LTV or less. All Velocity Florida Commercial Property Types are eligible on this program.

Designed for Florida Commercial investors with derogatory credit issues and high equity seeking quick and easy credit qualification. This is a low LTV loan with easy credit requirements. In addition, the pricing is improved by 0.50% when mid FICO is 650+.

FAST50-NO INCOME FLORIDA MORTGAGE LENDERS KEY FEATURES INCLUDE:

• Great for no income verification mortgage applicants with a recent bankruptcy or notice of default.

•No seasoning of ownership required.

• Improved pricing compared to our FlexPerm program.

•Derogatory mortgage history is okay.

• No active FC or NOD inthe past 12 months on

subject property

• Vacant refinance not eligible

•80% CLTV max

QUICKFIX- NO INCOME FLORIDA MORTGAGE LENDERS EXPLAINED

The QuickFix Program is a 12-month interest-only option that balloons at the end of the term. This program is restricted to Investor 1-4 property types and can be used for purchase as well as refinance transactions. This is a purchase or refi program that allows for deferred maintenance, vacancy, and currently listed properties.

Designed for investors with credit issues seeking an interest-only, short-term loan as an alternative to hard money financing. This is a higher LTV alternative to hard money.

This is a great option for no income verification mortgage applicants looking for a short-term capital solution to acquire or leverage an investor 1-4. It is also a great program for investors with legitimate ownership/experience in “Fix & Flip” real estate activities. Rates on this program will be notably higher, but remind your clients this is an alternative to a hard money option.

QUICKFIX- NO INCOME FLORIDA MORTGAGE LENDERS SUMMARY

• A higher LTV than hard money options.

• Great for no income verification mortgage applicants who need a quick close.

• An interest-only 1-year term provides lower monthly payments.

• Perfect for acquiring or leveraging real estate with deferred maintenance.

• No credit minimum.

• 75% LTV for all purchase transactions.

• Only Investor 1-4 property

types.

• We do an as-is valuation and base the LTV off that value.

• Health and Safety issues are not a concern

• We do not do “tear downs”.

• It is a 12-mo. interest-only term with a 2-point cost.

• There is no prepayment penalty, but there is an interest

guarantee of 4 months. If a borrower pays off the loan after making 2 payments, 2 months of interest would be added to the payoff.

• Pricing Tiers are determined by score. A first-time investor is Tier 3.

• The Location Rate Add of 1.5% is for “Long Foreclosure” states.

• Even though Tier 3 does not have a minimum score requirement, all Tiers have minimum tradeline requirements that mirror the FlexPerm

program.

• Mortgage delinquency restrictions are the same as the FlexPerm program.

• This program allows for the refinance of vacant properties and allows for properties that are

currently listed.

Credit Quickfix Enhancement– We are no longer requiring appraisals on the Credit Quick Fix. A BPO will be required instead. Specifics are found in the Quick Fix BPO attachment.

Credit Quick Fix BPO Procedure

We are tweaking the Credit Quick Fix program to make it easier, and more importantly, quicker to get these deals closed. The game changer is moving from requiring an appraisal to only requiring a BPO. The BPOs will be returned to Velocity within 48–72 hours after the order has been placed.

- l. The BPOs will be paid for through the Alpha Realty site. If the Alpha site is showing a commercial appraisal cost, email Joe Clickener who will fix the glitch.

- The BPO cost is $250. $400-$750 LESS than the appraisal cost.

- The BPOs will be ordered by the Appraisal Desk. BE SURE TO COMPLETE THE CONTACT FORM IN PHASE 2 OF THE PORTAL. The BPO includes an internal inspection so we need to know who we are contacting to get the inspection done.

- The openers will be alerted once the order has been placed. It will be on us to get the submission to them AS QUICKLY as possible.

- The BPO review will take less than an hour and will be a priority in the l-4 Real Estate department.

- The stip sheet will not be issued until the BPO has been returned and reviewed. The stip sheet should look like a clear to close if we are on our sales game and send a complete submission to the openers. REMEMBER the only requirements on a Quick Fix are:

- a. Executed CLA

- b. Complete Application Copy of DL & SSC

- Prelim

- Est. HUD

- f. BPO and Review

- Payoff Demand on refi

- Purchase Contract on purchase

ARV PRO- NO INCOME FLORIDA MORTGAGE LENDERS EXPLAINED

A true fix and flip product, the ARV program is great for cosmetic rehab and bringing the subject property up to speed in terms of renovations and maintenance. This is NOT a construction–based rehab loan – no tearing down walls or additions.

Designed for “fix-and-flip” investors who are seeking a short term, interest-only loan to acquire and improve a property based on its “as repaired value” [ARV). The best short-term solution for acquiring and improving property value.

NO INCOME FLORIDA MORTGAGE LENDERS KEY FEATURES

- • Allows no income verification mortgage applicants to finance improvements.

- • Great for no income verification mortgage applicants who need a quick close.

- • An interest-only 1-year term provides lower monthly payments.

- • A higher LTV than hard money lenders.

No Doc Florida investment loans in all Florida cities include: Altamonte Springs, Apopka, Atlantic Beach, Bartow, Boca Raton, Boynton Beach, Bradenton, Callaway, Cape Coral, Clearwater, Cocoa, Cocoa Beach, Coral Gables, Coral Springs, Crestview, Daytona Beach, De Land, DeBary, Delray Beach, Deltona, Destin, Dunedin, Edgewater, Eustis, Fernandina Beach, Fort Lauderdale, Fort Myers, Fort Pierce, Fort Walton Beach, Gainesville, Gulfport, Haines City, Hialeah, Hollywood, Homestead, Jacksonville, Jacksonville Beach, Jupiter, Key West, Kissimmee, Lady Lake, Lake City, Lakeland, Largo, Leesburg, Lynn Haven, Melbourne, Miami, Miami Beach, Middleburg, Miramar, Naples, New Port Richey, New Smyrna Beach, Niceville, North Miami, North Port, Ocala, Oldsmar, Orange Park, Orlando, Ormond Beach, Palatka, Palm Bay, Palm Beach Gardens, Palm Valley, Palmetto, Panama City, Pembroke Pines, Pensacola, Pinellas Park, Plant City, Plantation, Pompano Beach, Port Orange, Port Saint Lucie, Punta Gorda, Rockledge, Saint Augustine, Saint Cloud, Saint Petersburg, Sanford, Sarasota, Satellite Beach, Sebastian, South Daytona, Stuart, Tallahassee, Tamarac, Tampa, Tarpon Springs, Titusville, Venice, Vero Beach, West Palm Beach, Winter Garden, Winter Haven and Winter Springs.

- NO DOC STATED INCOME FLORIDA MORTGAGE LENDERS

- 75% LTV+NO DOC FLORIDA COMMERCIAL MORTGAGE LENDERS

- NO DOC STATED INCOME TAMPA FL COMMERCIAL MORTGAGE

- NO INCOME VERIFICATION COMMERCIAL MORTGAGE LENDERS

- 75% LTV Jacksonville FL No Income Verification Commercial Mortgage Lenders

- 5% NO DOC TEXAS COMMERCIAL MORTGAGE LENDERS

- 75% LTV+Tampa Florida Commercial No Income Verification Mortgage Lenders

- NO INCOME MIAMI FL COMMERCIAL MORTGAGE LENDERS

- Orlando FL NO INCOME Verification Commercial Mortgage Lenders

- No-Doc Orlando FL Mortgage Lenders:No income Doc Lenders No tax returns

- FLORIDA NO-DOC COMMERCIAL MORTGAGE LENDERS

- 75% LTV+NO INCOME VERIFICATION MIAMI FL MORTGAGE LENDERS

- Jacksonville FL No Income Verification Commercial Mortgage Lenders

- Tampa-bay-St Pete-Clear-water FL No DOC Commercial Mortgage Lenders

- Saint Petersburg, FL No Income No Tax Return Commercial Mortgage Lenders

- STATED INCOME MIAMI FL COMMERCIAL MORTGAGE LENDERS

- Jacksonville Fl Stated Income No Doc Commercial Mortgage Lenders

- NO INCOME VERIFICATION TEXAS COMMERCIAL MORTGAGE LENDERS

- No Income Verification Florida Investment Loans