TEXAS BAD CREDIT JUMBO MORTGAGE LENDERS

TEXAS BAD CREDIT 15-30 YEAR FIXED JUMBO FIXED LOAN PROGRAMS

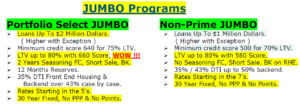

For your traditionally qualified borrower, we offer dynamo FIXED rates on loans $424,100 – $3mil.

- Primary and 2nd homes

- SFR, Warrantable Condo, 2-unit

- DTI to 45

- First time home buyer to $1.2m

- Cash Out OK!

TEXASBad Credit Jumbo PORTFOLIO ARMS

For your not so traditional borrower… we have an “exceptional” PORTFOLIO capabilities!

- Portfolio Lender: Manual Underwrites & Make-Sense Exceptions

- Loan Amounts $300,000 to $5,000,000

- Texas Bad Credit Jumbo ARMs – 5yr, 7yr, and 10yr ARMS

- Interest only – 5/1 and 5/6 ARM

PORTFOLIO Bad Credit Jumbo TEXAS MORTGAGE LENDERS ALLOWABLE INCOME

- Unique Income Scenarios considered

- Asset Depletion Loan Program: substantial liquid assets may qualify as income

- Listed Properties: Properties listed for sale may be eliminated from DTI calc if certain criteria are met

- Complex Tax Returns

- Self Employed borrowers

- Recent job/income change can be considered

PORTFOLIO TEXAS JUMBO LOAN PROPERTY APPROVAL TYPES

- Primary, 2nd, Investment properties: No Limits on Acreage

- Condos and Condo-hotels (with full kitchen) (FL/AZ/NV = exceptions)

- High land to home value

- Hobby Farms

- Other unique properties owned by sophisticated borrowers considered

TEXAS Bad Credit Jumbo PORTFOLIO FEATURES- Vesting Title in Entities Program – LLC’s, Trusts, Partnerships & Sub S Corporations can hold title

- Pledged Asset Loan Program – allowing 90% financing for sophisticated borrowers (flyer attached)

- Listed properties may not be included in DTI, if file meets additional reserve requirement

- Asset Depletion – helps borrowers qualify based on substantial liquid assets (flyer attached)

- Foreign National loans – up to 50LTV. (flyer attached)

- Call or email me with your Texas Bad Credit Jumbo scenarios today!

90% Texas Bad Credit Jumbo Bad Credit Texas Mortgage Lenders

Texas Mortgage Lenders.com offers several Texas Bad Credit Jumbo home mortgage solutions for home purchase or refinancing first and second Texas Bad Credit Jumbo Texas mortgages for loans up to (2) two million dollars. Our TexasBad Credit Jumbo home mortgage solution allows you to and refinance your Texas home and roll your high interest first and second mortgage loans into a new low rate Texas Bad Credit Jumbo Texas mortgage. Finding a -Texas Bad Credit Jumbo mortgage lender that offers bad credit Texas Bad Credit Jumbo programs is nearly impossible in today’s challenging secondary market. Texas Mortgage Lenders has one of the last Texas Bad Credit Jumbo lenders offering bad credit Texas Bad Credit Jumbo home loans in today’s challenging market-place.

Up To 90% Texas Bad Credit Jumbo Bad Credit Mortgage Lenders

- Loans to $2+ million (Ask for higher loan amount exceptions)

- No mortgage insurance

- Interest Only available

- Up to 90% LTV/CLTV

- Credit scores down to 500

- No seasoning for foreclosure, short sale, BK

- 24-month personal bank statement program for self-employed borrowers

- Owner-occ, 2nd homes and investment properties

- 24-48 hours in Underwriting

| Portfolio Select Combo | 90% | 75/15 | 5.875%/10.99% (6.728% blended) |

$3,000 | 24 months, 60 months if multiple filings | 24 months from foreclosure deed date | 6 months |

| Prequalification Request | |||||||

| Portfolio Select Single Loan | 90% | 90% | 7.25% | $3,000 | 24 months, 60 months if multiple filings | 24 months from foreclosure deed date | 6 months |

| Prequalification Request | |||||||

| Non Prime Combo | 90% | 75/10 | 7.24%/10.99% (7.681% blended) |

$1,500 | 12 months | 24 months | 3 months minimum, 6-12 months required for certain programs |

| Prequalification Request | |||||||

| Non Prime Single Loan | 90% | 75% | 6.74% | $1,500 | 12 months | 24 months | 3 months minimum, 6-12 months required for certain programs |

* General Requirements

- Rate Quoted is for a 7/1 ARM, based on LTV requested if available – if N/A, rate is based on Max LTV. Add 0.25% to rate for 30 Year fixed.

- Note: This quote is based on the borrower meeting the Standard Tradeline requirements. Need 3 tradelines reporting for a minimum of 12 months -OR- 2 tradelines reporting > 24 months; all with activity in the last 12 months. Cancelled checks for 12 or 24 months housing history may also be used as a tradeline. If the borrower does not meet these tradeline requirements the max LTV is 75% and add 50bps to rate. Additional program restrictions may also apply, contact your Account Executive for details.

- Bank statements are personal and for S/E borrowers. Minimum loan amount for Bank Statement program is $150,000.

- Gift funds not allowed for Portfolio Select Combo and Bank Statement programs.

All rates/programs are subject to review and approval by your AE.

Texas Bad Credit Jumbo Mortgage Rates Starting at 2.75% on 7/1 ARM

- 70- 100% – Texas Bad Credit Jumbo Home Mortgage Refinance

- HARP Refinancing on High Balance Mortgage Loans

- Get Approved for a Texas Bad Credit Jumbo Mortgage with Bad Credit

- Pay-Off ARM or Bad Credit Texas Bad Credit Jumbo Home Loans with Low Fixed Interest

Tips for Million Dollar Texas Jubmo Mortgages with Bad Credit

Freddie Mac and Fannie Mae set guidelines for mortgage lenders and the borrowing limits for traditional mortgage loans. For single-family homes the loan limit in 2006 is $417,000. Anything above that loan limit is considered a non-conforming mortgage loan, or TexasTexasBad Credit Jumbo mortgage loan. Any mortgage loan outside of the Freddie Mac and Fannie Mae underwriting guidelines is considered unconventional, including those for people with bad credit.

With Texas housing prices continuing to rise, particularly in areas like Florida, about the only way you can get a mortgage is to get a non-conforming TexasBad Credit Jumbo mortgage. However, as a result of the sub-prime market, there are many programs available today that help Texas homebuyers with recent bankruptcies, collections, and even Texas foreclosures obtain bad credit Texas mortgage financing, including bad credit Texas Bad Credit Jumbo home loans for home purchases and for refinancing Texas Bad Credit Jumbo loans.

Before shopping for a Texas Bad Credit Jumbo Texas mortgage loan, get your credit report from each of the three credit bureaus: Experian, Equifax and TransUnion. Check the reports for errors. You’d be surprised at how much your FICO credit scores can raise by doing nothing more than correcting errors on your reports. Raising your scores as little as five points can make a big difference in the interest you pay on your sub-prime Texas Bad Credit Jumbo loan. Visit myFICO.com for current mortgage rates. Select your location, enter the loan amount and click the “Recalculate” button to compare the rates for different FICO scores. You’ll see how much a difference as little as one point can make.

Ordering your own FICO scores won’t generate any inquiries, either. Then, you can fax your scores and codes from myFICO to lenders you are considering. With that information, they should be able to tell you if you stand a chance of being approved for the bad credit TTexasBad Credit Jumbomortgage loan or at least refer you to someone else who may be able to work with you. This will save you from having numerous inquiries, which could lower your credit scores even more. Don’t let ANYONE run your credit reports until you’ve narrowed your choices down to 2 – 3 lenders.

Shop for your TexasBad Credit Jumbo mortgage loan online. Online brokers and mortgage sites can either work with you directly or refer you to hundreds of lenders that specialize in bad credit mortgages, Texas Bad Credit Jumbo mortgage loans, sub-prime Texas Bad Credit Jumbo loans and other unconventional loans. Through online lenders, you could get up to four quotes on your Texas Bad Credit Jumbo loan, refinance, cash-out Texas Bad Credit Jumbo or 2nd mortgage (home equity loan).

We specialize in the following Bad Credit Texas Mortgage Loans:

- Texas Mortgage Lenders that allow past collections- Texas lenders that approve you with collections!

- Texas Bad Credit FHA / VA Mortgage Lenders- Bad credit lenders exclude disputed, collection chargeoffs

- Bad Credit Texas Mortgage Lender Programs– Case By Case situational approvals!

- FHA Bad Credit Texas Mortgage Lenders– Min 580 middle 3.5% Down min 550 With 10% Down.

- VA Bad Credit Texas Mortgage Lenders – Min 550 middle credit score with 100% financing.

- Texas Mortgage After Foreclosure – Short Sale – Bankruptcy- Foreclosure– Private Portfolio GA Bad Credit lenders.

- Bad Credit Teas Portfolio Lenders- Private Texas mortgage lenders that do not sell the loans.

- Hard Money Texas mortgage lenders- Hard money for case by case bad credit Texas mortgage applications.

- No Credit Score Texas Mortgage– No Credit score Texas with a bad credit past!

- Modular Home Bad Credit Texas Mortgage Lenders– Factory built bad credit modular home loans.

- Texas Bad Credit Jumbo Mortgage lenders– Bad Credit GA jumbo mortgage lenders down to a 500 fico!

- Debt Consolidation Bad Refinance in Texas – Refinance to lower your total monthly obligations to provide financial relief..

- Texas Bad Credit Mortgage Lenders After A Repossessions! We have the right bad credit mortgage lenders that allow repossessions!

-

3.5%Texas FHA Mortgage Lenders Min 580 FICO!

3.5% DOWN BAD CREDIT TEXAS MORTGAGE LENDERS

https://www.fhamortgageprograms.com/3-5-down-bad-credit-texas-mortgage-lenders/

TEXAS MORTGAGE AFTER BANKRUPTCY, FORECLOSURE OR SHORT SALE. Bad Credit Texas Mortgage Lenders After A Bad Credit Event! Have you heard the term “boomerang buyer” is a Texas mortgage applicant who’s been kept out of the housing market due to a prior Texas foreclosure, short sale or bankruptcy …

Bad Credit Florida Mortgage Lenders- Min 500 FICO

https://www.fhamortgageprograms.com/mortgage/bad-credit/

Getting a Florida Mortgage with bad credit isn’t as easy as it was a year or two ago. However, it isn’t as impossible as some news reports make it seem. Even Floridians with bad credit reports which reveal past financial sins still sometimes get to the promised land of mortgage approval. Most Home Buyers and Refinance …

bad credit texas fha mortgage guidelines – fha mortgage lenders

https://www.fhamortgageprograms.com/bad-credit-texas-fha-mortgage-guidelines/

Bad Credit Texas Mortgage Lenders general credit policy requirements for underwriting a mortgage involve • considering the type of income the borrower needs in order to qualify to analyze the Texasmortgage applicants liabilities to determine creditworthiness and • reviewing ratios, including debt-to-income, and Texas …

100% TEXAS VA Bad Credit Mortgage Lenders Min 580 FICO!

https://www.fhamortgageprograms.com/texas-va-mortgage-lenders/

US Mortgage specializes in good and bad credit VA mortgage loans even no credit score Texas VA loans in every city and county in Texas VA Mortgage Lenders VA mortgages are guaranteed by the Department of Veterans Affairs (VA

TEXAS SELF EMPLOYED-BANK STATEMENT MORTGAGE LENDERS

https://www.fhamortgageprograms.com/texas-self-employed-bank-statement-mortgag…

Jan 8, 2018 – Bus or personal bank statements Credit start 600’s. Same Day Pre Approvals! Call Now 954-667-9110. 3.5% DOWN BAD CREDIT TEXAS MORTGAGE LENDERS. https://www.fhamortgageprograms.com/3-5-down-bad–credit–texas–

https://www.fhamortgageprograms.com/500-fico-florida-bad-credit-Texas Bad Credit Jumbo-mortgage-…

Florida Bad Credit Texas Bad Credit Jumbo Mortgage Lenders exceed conforming loan limits. A Florida Bad CreditTexas Bad Credit Jumbo Mortgage Lenders provide financing for high-priced or Florida luxury home. If you have a lower debt-to-income ratio, a higher credit score, and a larger down payment, a Florida Bad Credit Texas Bad Credit Jumbo Mortgage Lenders loan …

Bad Credit Home Loans – FHA MORTGAGE LENDERS

https://www.fhamortgageprograms.com/bad-credit-home-loans/

Bad credit home loans are available for residents in Florida. At FHA mortgage programs.com we go the extra mile to help find secure a bad credit mortgage for our bad credit home loan applicants, regardless of their credit status. If your credit has been ruined as a result of Foreclosure or Bankruptcy, don’t give up on …

https://www.fhamortgageprograms.com/texas-mortgage-1-day-after-bankruptcy-or-fo…

Examples include: 12 months timely rental history, high credit scores, lower loan to value (larger down payments), and reserves (future Texas mortgage payments in the account at closing). A minimum 500 credit score For Texas Portfolio Mortgage Lenders Programs!! BAD CREDIT FHA MORTGAGE LENDERS …

https://www.florida-mortgage-lenders.com/…/texas-bank-statement-mortgage-lenders….

Established Florida Mortgage Lenders providing FHA, VA, CONVENTIONAL, Texas Bad Credit Jumbo, BAD CREDITMortgage loans. … https://www.fhamortgageprograms.com