Self Employed Mortgage Lenders Income Per Bank Statement Only! Owner occupied and second homes: $100,000 $3,00,000 for condos, duplex, triplex and 4 unit.

Mortgage Lenders for Self-Employed Borrowers

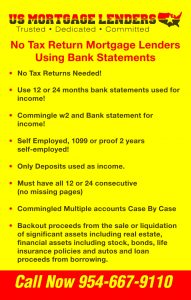

- No tax returns Needed

- 12-month personal bank statements

- 24-month business bank statements

- 2 year self-employed required

- Loans up to $3 million

- Credit scores down to 600

- Rates starting in the 4’s

- Up to 90% LTV on Personal and Business with no MI

- DTI up to 50% considered

- Owner-occupied, 2nd homes and investment properties

- 2 years seasoning for foreclosure, short sale, bankruptcy or deed-in-lieu

- Non-warrantable condos considered

- Jumbo loans down to 600 score

- 5/1 ARM or 30-year fixed

- No pre-payment penalty for owner-occ and 2nd homes

- Seller concessions to 6% (2% for investment)

Here’s what Self employed mortgage lenders want to see from self-employed mortgage applicants:

- Stable or increasing predictable income: You should have the steady income from self-employment. Some fluctuation is acceptable, but it should overall trend upward. “Self-employed Mortgage lenders require submission of tax returns in order to verify the income of self-employed borrowers, “The goal of this review is to evaluate the recurring nature and amount of business income. Self Employed mortgage lenders determine year-to-year trends for gross revenue, expenses and taxable income for the business, which is used to project a trend for the business over time.”

- Consistent Deposit For At Least 2 years: Self-employed mortgage lenders want to see at least two years of self-employment income in the same industry. If you’re newly self-employed, some Self-employed mortgage lenders will make an exception But having a short history of self-employment does not offer Self-employed mortgage lenders the assurance that your income will remain consistent.

- Good credit: Self-employed mortgage lenders want to see that you have a consistent record of repaying your debts. Foreclosures, delinquencies, collections, repossessions, and bankruptcies will increase your risk. They will look at the type, age, limits, use and status of your revolving credit accounts, and at how often you applied for new credit within the past year.

- Cash reserves: Your mortgage payment is due every month, even when you’re short on work. Self-employed mortgage lenders may want to see that you have an emergency fund available to get you through months when you’re not earning as much money.

- Significant down payment: A higher down payment offers more assurance to lenders. Scribner says down payment requirements for self-employed workers with good credit and enough income are usually no different than what other borrowers face with traditional lenders. However, if your financial profile isn’t strong, a larger down payment can be helpful. “A higher down payment from 10-30% can be a mitigating factor if income qualifications are tight.

- Single-family occupancy: According to Self-employed mortgage lenders a mortgage on a single-unit home that will serve as the borrower’s primary residence is a lower risk for Self-employed mortgage lenders. We also offer mortgages on second homes, investment properties, multiunit properties.

Income per Use Bank Statements Only

Self Employed Mortgage Lenders submitting a Loan to Bank Statement Only Mortgage Lenders for purchase under the Income per Use Bank Statements the Only program must document that (i) at least one Self Employed Mortgage Applicant must have been continuously self-employed for two years, and (ii) each Self Employed Mortgage Applicant whose self-employment income is used to qualify for the Loan must have been continuously self-employed for at least two years. In addition, Self Employed Mortgage Lenders must verify the portion of the Self Employed Mortgage Applicants’ business that is owned by the Self Employed Mortgage Applicant. Acceptable documentation may include business licenses, a written statement from a certified public accountant, LLC or partnership agreements, incorporation records, assignment of tax ID notices, and other similar records.

Self Employed Mortgage Lenders submitting loans to Bank Statement Only Mortgage Lenders for purchase under the Income per Bank Statements program must determine and document income from self-employment based on one of the following three methods:

co-mingled accounts If the Bank Statement Only Mortgage Applicants the same bank account for both personal and business banking, Self Employed Mortgage Lenders must determine income from self-employment by obtaining the Self Employed Mortgage Applicant(s)’ 12 most recent Use Bank Statements Only for their bank account. The Lendermust then determine, over the twelve-month period covered by the bank statements, (1) the average monthly business receipts deposited into the bank account, and (2) the average monthly business expenses paid out from the bank account. Self Employed Mortgage Lenders may accept as business receipts, deposits which are typical during the 12-month period, and reasonable for the Self Employed Mortgage Applicants’ type of business. Unusually large deposits must be validated to be ordinary business revenue to be included as business receipts. Deposits not related to ordinary regular business activities, including deposits related to assets sales or borrowings which are not in the ordinary course of business, and deposits related to tax refunds, may not be counted as business receipts. To determine business expenses, Self Employed Mortgage Lenders must classify debits from the Self Employed Mortgage Applicants’ bank account as either business or personal. Debits that are clearly personal in nature, such as loan payments to financial institutions that are aligned with amounts due on non-business mortgages, installment and revolving debts can be classified as personal expenses. Also, classifiable as personal expenses, are payments to doctors, schools, retailers, and other goods and services providers clearly unrelated to the Self Employed Mortgage Applicants’ business, and payments to family members. In addition, withdrawals of limited and reasonable amounts of cash may be classified as personal. Other debits should be classified as business expenses unless documentation is obtained that shows a specific debt is personal. Once a Lender has determined average monthly business receipts and average monthly business expenses (over the past 12 months), the Lender must subtract average business expenses from average business receipts to calculate average monthly income from self-employment. The calculated result should be listed on the Self Employed Mortgage Applicants’ Final Application in the “Other Income Section” as the Self Employed Mortgage Applicants’

“Cash Self-Employment Income Based on Bank Statement Only Mortgage Lenders Analysis.”

Separate Business and Personal Accounts – Personal Bank Statement Analysis

If the Bank Statement Only Mortgage Applicant have both business and personal bank accounts, the Lender may document and determine income from self-employment by averaging the Self Employed Mortgage Applicants’ deposits into their personal bank accounts, over the 12-month periodpreceding the date of the Self Employed Mortgage Applicant’s loan application (the “Analysis Period”),provided such deposits resulted from the Self Employed Mortgage Applicants’ self-employment. For the purposes hereof:

if a deposit is less than the average monthly deposits made into the Self Employed Mortgage Applicants’ personal accounts over the Analysis Period, and provided that the Self Employed Mortgage Applicant’s personal Use Bank Statements Onlydo not explicitly show the deposit results from any of: (a) a transfer from another personal asset account, (b) loan proceeds from a loan to the Bank Statement Only Mortgage Applicant, (c) an asset sale (d) another source of Self Employed Mortgage Applicants’ income (for example deposits due to a spouse’s employment or deposits due to rent receipts), or (e) a tax refund, then Self Employed Mortgage Lenders may presume the deposit is from the Self Employed Mortgage Applicants’ self-employment (for the purposes of clarity: transfers from the Self Employed Mortgage Applicant’s business bank account to their personal bank account(s) may be presumed to result from self-employment).

FOR CREDIT SCORES OF LESS THAN 650, the

minimum loan is $150,000

IF THE CREDIT SCORE IS LESS THAN 650 THEN THE

MINIMUM LOAN AMOUNT IS $150,000.

Minimum Credit Score 620

Maximum Debt to Income Ratio 50% DTI for LTVs to 85%, and

38% DTI for LTVs to 90%

Eligible Properties Types 1-4 Units, warrantable condo and non-warrantable (non-warrantable condo requires rate add-on) Permissible Occupancy Primary residences, second homes and investment

Required Reserves

Loan Amount Reserves

up to $1,000,000 3 months

$1,000,001 to

$2,000,000 6 months

more than

$2,000,000 12 Months

if Bank Statement Only Mortgage Applicant Own investment properties which are not

the Subject Property, then required reserves must be

increased by 1% of the mortgages outstanding on

mortgage debt not secured by the Subject Property.

Reserve requirements may be waived based on mortgage rating, please see Section 10.4 for specific requirements.

For cash-out refinances, loan proceeds disbursed to

Self Employed Mortgage Applicant may be used to meet reserve requirements

Acceptable States All 50 States and DC (territories not permitted)

Gifts Gifts permitted provided gifts must conform to all Fannie

Mae gift requirements (except that Fannie requirements

are modified to permit gifts for investor occupancy); Forgifts of equity, LTV must be reduced by 5%.

Income Documentation

Credit History No Foreclosure, bankruptcy, deed in lieu or short sale

over past 48 months at standard LTVs and reserves

No foreclosure, bankruptcy, deed in lieu or short sale permitted over past 24 months available at a maximum

LTV is 70% and with reserves increased by 6 months

Mortgage and Rental History Maximum permitted delinquency is 1x30x12

Subordinate Financing Subordinate financing permitted provided (1) CLTV does

not exceed the applicable LTV limits, (2) that the debt

service on subordinate financing is included in the DTI

calculation, and (3) that the terms of the subordinate

financing conform to Fannie Mae requirements.

Appraisal Requirements 1 Full Appraisal + CDA or ARR. Loan amounts over

$1,000,000 require 2 appraisals + CDA or ARR

Escrows Required

AUS Not applicable; manual underwrite

Calculator http://Bank Statement Only Mortgage Lendersmortgage.com/calculators/

Pre-Payment Penalty 3 YR prepayment penalty required for investor

occupancy loans where permitted by law (PPP buyouts may be available)

RELATED SELF EMPLOYED ONLY MORTGAGE LENDERS PAGES

Bank Statement Only Florida Mortgage Lenders Min 600+FICO!

Florida and Georgia Stated Income Mortgage Lenders+Same Day Approval!

Florida Bank Statement Only Lenders 12 or 24 Month Bank Statement

Florida Bank Statement Only Solutions 12 or 24 Month Bank Statement Programs For Florida Self-Employed Mortgage Applicants. • Personal Bank Statements …

10% Down_Texas-Bank Statement Only Mortgage Lenders

Texas Stated Income Bank Statement Only Mortgage Lenders has the answer… … https://www.fhamortgageprograms.com/6-texas-stated-income-mortgage- …

10% Down+Georgia Stated Income Bank Statement Only Mortgage …

Georgia Bank Statement Mortgage Lenders offer a 24-Month Bank Statement Loan Program using bank statements ONLY to qualify with Georgia mortgage …

Bank Statement Self Employed Mortgage Lenders-Same Day Approvals!

BANK STATEMENT ONLY SELF EMPLOYED MORTGAGE LENDERS CRITERA …. https://www.fhamortgageprograms.com/georgia-bank–statement–only– …

24 Month Georgia Bank Statement Lenders= min 600 FICO

Self Employed Bank Statement Only Georgia Mortgage Lenders For … www.

TEXAS BANK STATEMENT MORTGAGE LENDERS

Texas-Bank Statement Only Jumbo Mortgage Lenders. 12 or 24 …. https://www.

10%DOWN+GEORGIA BANK STATEMENT FL MORTGAGE LENDERS

www.fhamortgageprograms.com/bank-statment-only-georgia-mortgage-lenders/. Bank Statement OnlyGeoriga Mortgage Lenders- Buy a home using only your …

10%DOWN + SELF EMPLOYED FLORIDA MORTGAGE LENDERS

Self Employed Florida Mortgage Lenders qualifying Florida borrowers with 12 or 24 months Bank statements. NO TAX RETURNS NEEDED! same day approval!

self employed mortgage lenders+no tax returns needed

Jun 1, 2018 – SELF EMPLOYED MORTGAGE LENDERS-NO TAX RETURNS NEEDED TO PURCHASE OR REFINANCE A HOME- Min 580 FICO Loan …

Self Employed Florida Mortgage Lenders-No Tax Returns Needed!

FHAmortgagePrograms.com CURRENTLY SERVING AND LICENSED IN FLORIDA, … Most Florida mortgage lenders that provide self–employed mortgage loans want to see … Self Employed Income Using Tax Returns Make it Hard To Qualify.

10% DOWN SELF EMPLOYED MORTGAGE LENDERS USING BS

10% Down – Texas bank statement only Self Employed Mortgage Lenders- Min … https://www.fhamortgageprograms.com/houston-tx-self–employed-mortgage- …

FLORIDA SELF EMPLOYED MORTGAGE LENDERS USING BS

Sep 18, 2017 – FLORIDA SELF EMPLOYED MORTGAGE LENDERS 12 or 24 … https://www.

SELF EMPLOYED MORTGAGE QUESTIONS AND ANSWERS

10% Down with a 660 & 15% Down with a 600 Score! No tax returns Needed! Proof of 2 years self–employed! Owner-occupied, 2nd homes and investment …

Bank Statement Self Employed Mortgage Lenders-Same Day Approvals!

https://www.fhamortgageprograms.com/texas-bank-statement-mortgage-lenders/. 2 Years Self Employed Texas Bank statement deposits used to qualify! No tax …

SELF EMPLOYED MORTGAGE LENDERS! MIN 600 FICO

Our “Self Employed Mortgage” program can help these individuals get pre-

GEORGIA BANK STATEMENT ONLY+FOR SELF EMPLOYED

Self Employed Bank Statement Only Georgia Bank statement program: Ideal for …www.fhamortgageprograms.com/stated-ga-mortgage-lenders-primary-homes/.

NO TAX RETURNS+GA SELF EMPLOYED MORTGAGE LENDERS

GEORGIA SELF EMPLOYED-BANK STATEMENT MORTGAGE LENDERS-No Tax Returns Needed! Same Day approvals Call now 954-667-9110 – Use 12 …