TEXAS TIN MORTGAGE LENDERS-NO SOCIAL SECURITY NUMBER –

Non-Permanent Resident Texas Mortgage Lenders TEXAS ITIN MORTGAGE LENDERS PROGRAMS

TEXAS ITIN MORTGAGE LENDERS PROGRAMS

Non-Permanent Resident Texas Mortgage Lenders

Non-Permanent Resident Texas Mortgage Lenders

Down to a 600 FICO up to 75% LTV

FNMA loan limits

OO Primary Only

43DTI

No Visa or EAD Required

Must have a valid ITIN # and ID

Full Doc only

Sellers assist allowed

SFR, 2-4 Units, Townhomes, Warrantable Condos

ITIN# & SSN on W2 does not have to match – MAX 85%LTV

Texas Visa Mortgage Lenders Acceptable Visa Classifications

The following visa classifications are allowed as NPRA:

• E-1, E-2, E-3

• G-1 through G-5

• H-1

• L-1

• NATO

• O-1

• R-1

• TN (NAFTA)

Texas Visa Mortgage Lenders Documentation Requirements

Copies of the borrower’s passport and unexpired visa must be obtained.

Acceptable alternative documentation to verify visa classification is an I-797

form (Notice of Action) with valid extension dates and an I-94 form

(Arrival/Departure Record). Borrowers unable to provide evidence of lawful

residency status in the U.S. are not eligible for financing under the NPRA

program.

A valid employment authorization document (EAD) must be obtained if the

visa is not sponsored by the borrower’s current employer. If the visa will

expire within 12 months of loan application, it is acceptable to obtain a letter

from the employer documenting the borrower’s continued employment and

continued visa renewal sponsorship (employer on the loan application must

be the same as on the unexpired visa). If a NPRA is borrowing with a U.S.

citizen, it does not eliminate visa or other residency requirements.

Individuals in possession of spouse or family member visas are to qualify as

co-borrowers only. A valid EAD must be provided to use their income for

qualification.

Borrowers who are residents of countries which participate in the State

Department’s Visa Waiver Program (VWP) will not be required to provide a

valid visa. Participating countries can be verified through the U.S.

Department of State website at http://travel.state.gov/content/visas/english/visit

Texas Visa Mortgage Lenders Qualifying Foreign Credit

The Qualifying Foreign Credit designation refers to NPRA borrowers who do not meet the Standard Tradeline requirements in Tradeline Requirements guidelines. A Qualifying Foreign Credit borrower may or may not have a U.S. credit report with no credit score, a single score, or a score with insufficient tradelines. If no credit score is available,

the NPRA borrower will be graded based on the A- credit grade.

Qualifying Foreign Credit borrowers must establish an acceptable credit history subject to the following requirements:

• Three open accounts with a 2-year history must be documented for each borrower reflecting no late

payments.

• A 2-year housing history can be used as a tradeline.

• U.S. credit accounts can be combined with letters of

reference from verifiable financial institutions in a foreign country to establish the 3 open accounts and an acceptable

credit reputation. If letters of reference are obtained, they

must:

o State the type and length of the relationship, how the accounts are held, and status of the account;

o Provide contact information for person signing the letter; and

o Translations must be signed and dated by a certified translator

ITIN Texas Mortgage Lender?

An ITIN Texas Mortgage lender is a lender that uses Individual Taxpayer Identification Number ( ITIN Texas) is a tax processing number issued by the Internal Revenue Service. It is a nine-digit number that always begins with the number 9 and has a range of 70-88 in the fourth and fifth digit. Effective ITIN Texass are issued regardless of immigration status because both resident and nonresident aliens may have a U.S. filing or reporting requirement under the Internal Revenue Code. ITIN Texas Mortgage lender use this number to verify and confirm borrowers stable predictable income for mortgage loan qualification. Individuals must have a filing requirement and file a valid federal income tax return to receive an ITIN Texas unless they meet the ITIN Texas exception. Application for Texas IRS Individual Taxpayer Identification Number to apply

Individual Taxpayer Identification Number (ITIN) Program

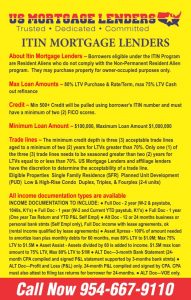

Borrower/Product Eligibility- Borrowers eligible under the ITIN Program are Resident Aliens who do not comply with the Non-Permanent Resident Alien program. They may purchase property for owner-occupied purposes only.

Credit- Credit will be pulled using borrower’s ITIN number and must have a minimum of two (2) FICO scores.

Tradelines-The minimum credit depth is three (3) acceptable trade lines aged to a minimum of two (2) years for LTVs

greater than 70%. Only one (1) of the three (3) trade lines needs to be seasoned greater than two (2) years

for LTVs equal to or less than 70%. INTIN Mortgage Lenders have. the discretion to determine the

acceptability of a trade line.

OFACA check will be run on all borrowers and any positive returns must be satisfactorily cleared.

Eligible Properties- The following property types are acceptable for financing provided they meet general property guidelines:

• Single Family Residence (SFR)

• Planned Unit Development (PUD)

• Low & High-Rise Condo

• Duplex, Triplex, & Fourplex (2-4 units)

Maximum LTV

The maximum LTV for the transactions are shown below:

• Purchase – 80%

• Rate/Term Refinance – 80%

• Cash Out Refinance – 75%

Minimum Loan Amount: $100,000- Maximum Loan Amount: $1,000,000

Texas ITIN Texas Mortgage Lenders – Loan Amounts & Downpayment!

- 10% Down up to 300k Texas ITIN Texas Mortgage Lenders.

- 20% down up to 400k Texas ITIN Texas Mortgage Lenders.

- 30% Down up to 500k Texas ITIN Texas Mortgage Lenders.

- 40% down up to 600k Texas ITIN Texas Mortgage Lenders.

Texas ITIN Texas Mortgage Lenders – Purchase or Refinance

In order to qualify for an ITIN Texas loan in Texas, you will need to satisfy the ITIN Texas mortgage lenders requirements. Most ITIN Texas mortgage lenders offering these programs will require proof the following:

- ITIN Texas card, state ID, drivers license, or passport.

- The most recent 2 years W2 or 1099 proof of stable predictable income.

- A down payment of at least 20-25% depending on the ITIN Texas Mortgage lender.

- A credit report or Proof of payment history.

- Your most recent 2 months bank statements

Texas ITIN Texas Mortgage Lenders Refinance

• If the property was purchased within 12 months of the application date, Property Value is equal to the lower of the sales price or appraised value. If the property was purchased more than 12 months prior to the application date, the property value is equal to the appraised value.

• For Texas homes where capital improvements have been made to the property after purchase, LTV/CLTV/HCLTV can be based on the lesser of the current

appraised value or original purchase price plus the documented improvements. Receipts are required to document cost of improvements.

Texas ITIN Texas Mortgage Lenders Property Types

Eligible: Single Family Residences, PUDs, Townhouses, Condominiums (warrantable only)Property Types – All Condos FNMA Warrantable Only; Warrantable Types S, T or U • New condominium projects (Type R) with Condo Project Manager (“CPM”) or PERS approval • Site (detached) Condos • Limited Review is not eligible

Ineligible: 2-4 Units • Texas Non-Warrantable condos • Acreage greater than 10 acres (appraisal must include total acreage) • Agricultural zoned property • Condo

hotel • Co-ops • Hobby Farms • Income producing properties with acreage • Leaseholds • Log Texas homes • Manufactured housing • Mixed-use Texas properties • Modular

Texas homes • Properties subject to oil and/or gas leases •Unique properties • Working farms, ranches or orchards.

Texas ITIN Texas Mortgage Lenders Income Documentation

A minimum of two (2) years employment and income history

• Gaps in employment in excess of 30 days during the past two (2) years require a satisfactory letter of explanation and the Texas ITIN Texas mortgage applicants must be

employed with their current employer for a minimum of six (6) months to qualify.

• For a Texas ITIN Texas mortgage applicants who has less than a two-year employment and income history, the Texas ITIN Texas mortgage applicants’s income may be qualifying income if the Mortgage file

contains documentation to support that the Texas ITIN Texas mortgage applicants was either attending school or in a training program immediately prior to their current

employment history. School transcripts must be provided to document.

IRS Form 4506‐T / Tax Transcripts

• A completed, signed, and dated IRS form 4506-T must be completed for all Texas ITIN Texas mortgage applicantss at closing whose income is used to qualify for the mortgage.

• The 4506-T must be processed and tax transcripts obtained (for each year requested) to validate against all tax returns used for qualifying and/or W-

2 forms. For self-employed Texas ITIN Texas mortgage applicantss, this applies to both personal and business returns (for businesses where Texas ITIN Texas mortgage applicants(s) has 25% or more

ownership) regardless of whether or not income is used to qualify, a separate form must be filled out for each business entity.

Texas ITIN Texas Mortgage Lenders Documentation requirements:

• Pay Stub – 1 full month with YTD earnings

• W-2’s and/or 1099’s – prior two (2) years for all Texas ITIN Texas mortgage applicants

• 1040’s – prior two years, including all pages, schedules, statements

• Year to date Profit and Loss Statements and Balance Sheets are required for all self-employed Texas ITIN Texas mortgage applicants (in addition to two years of tax returns)

• K-1’s on all corporations and Schedule E business entities prior two years

• Texas Business returns on all Corporations and Schedule E business entities prior two years if ownership is > 25%, including all pages, schedules,

statements

• 1120S, 1120 and 1065’s – prior two (2) years if General Partner and/or percentage of ownership is > 25%, including all pages, schedules,

statements

Texas ITIN Texas Mortgage Lenders Max Payment Shock

Payment shock is 150%

Payment Shock Calculation: Payment shock is a function of the percentage of the pay increase of a new payment when compared to a prior rental or housing monthly payment.

Texas ITIN Texas Mortgage Lenders After Bankruptcy

Chapter 7 and 11:

Texas Chapter 7 and Chapter 11 bankruptcies must be discharged for a minimum of 36 months from closing date. Seasoning is measured from the month and year of discharge.

Chapter 13:

Texas Chapter 13 bankruptcies must be discharged for a minimum of 36 months from closing date. Seasoning is measured from the month and year of discharge. If

the Chapter 13 bankruptcy was dismissed, 36 months’ seasoning is required from the date of the dismissal.

Texas ITIN Texas Mortgage Lenders Checking and Savings Accounts

• The two (2) most recent, consecutive months’ statements for each account are required.

• Large deposits inconsistent with monthly income or other deposits must be verified.

Marketable Securities

• Two (2) most recent, consecutive months stock/securities account statements are required.

• 70% of stock accounts can be considered in the calculation of assets for closing and reserves.

• Non-vested or restricted stock accounts are not eligible for use as down payment or reserves.

Earnest Money Deposit (EMD)

Earnest money deposit (EMD) must be sourced and verified on all loans

Retirement Accounts

• Most recent Texas retirement account statement covering a minimum of two (2) month period.

• Evidence of liquidation is required when funds are used for down payment or closing cost

• 60% of the vested value of retirement accounts, after reduction of any outstanding loans, may be considered toward the required reserves.

• Excluding 401k’s & IRA’s, verification of the terms of liquidation if funds are used for reserves

• Retirement accounts that do not allow any type of withdrawal are ineligible for use as reserves.

Business Funds

• The Texas mortgage applicant withdrawal of cash from a business may not have a severe negative impact on the business’ ability to continue operating. If a Texas ITIN Texas mortgage applicants

is trying to use business funds for closing/down payment or reserves, an analysis must be completed by the underwriter to ensure the cash

withdraw will not impact the business.

Texas ITIN Texas mortgage applicants(s) must be 100% owner and the following is required:

• Cash flow analysis required using 3 months business bank statements to determine no negative impact to business based on withdrawal of funds

• A letter from the Texas ITIN Texas mortgage applicants(s) accountant must include the following statements or comments:

• The Texas ITIN Texas mortgage applicants has access to the funds.

• The funds are not a loan.

• The accountant may not be related to the Texas ITIN Texas mortgage applicants or be an interested party to the transaction.

Ineligible Assets:

• Gift of Equity • Grant Funds • Pooled Funds • Builder Profits • Cash on Hand • Unsecured loans • No Employer Assistance Assets • Sale of an asset

other than real property or publicly traded securities Age of Documents

Credit Report/Credit Documentation: 90 days old at the time of closing

Income and Asset Documentation: Dated within 90 days of closing

Title Report/Title Commitment: Dated no later than 60 days prior to closing Texas

Texas ITIN Texas Mortgage Lenders Appraisals

Full Interior / Exterior appraisal required. Fannie Mae/Freddie Mac Forms 1004/70, 1025/72, 1073/465 or 2090 must be used. All Fannie Guidelines apply to

appraisal process and value determination, in addition, an Appraisal Management Company must be utilized for appraiser selection.

The Appraisal should be dated no more than 120 days prior to the Note Date. After a 120 day period, a new appraisal is required. Re-certification of value is

not acceptable. Minimum Square Footage 800 Sq. Feet

Not eligible: Properties for which the appraisal indicates condition ratings of C5 or C6 or a quality rating of Q6, each as determined under the Uniform Appraisal

Dataset (UAD) guidelines. GreenBox will consider if issue has been corrected prior to loan funding with proper documentation.

TEXAS APPRAISAL REVIEW : An Appraisal Desktop Review (ARA) from Computer Share is required on all transactions.

Texas ITIN Texas Mortgage Lenders Seller Concessions

All seller concessions must be addressed in the sales contract, appraisal and Closing Disclosure, as applicable, and be compliant with applicable federal and local state law. A seller concession is defined as any interested party contribution beyond the stated limits, or any amounts not being used for closing costs or prepaid expenses (i.e. funds for repairs not completed prior to closing is a seller concession). If a seller concession is present, both the appraised value and sales price must be reduced by the concession amount for purposes of calculating the LTV/CLTV/HCLTV.

Interested party contributions include funds contributed by the property seller, builder, real estate agent/broker, mortgage lender, or their affiliates, or any other party with an interest in the real estate transaction. Interested party contributions may only be used for closing costs and prepaid expenses, and may never be applied to any portion of the down payment or contributed to the Texas ITIN Texas mortgage applicants’ financial reserve requirements.

When and Why should I apply for an ITIN Texas?

You should complete Form W-7 as soon as you are ready to file your federal income tax return, since you need to attach the return to your application.

If you meet one of the exceptions to the tax filing requirement, submit Form W-7, along with the documents that prove your identity and foreign status. You are also required to include supplemental documents to substantiate your qualification for the exception, as soon as possible after you determine that you are covered by that exception.

You can apply for an ITIN Texas any time during the year. However, if the tax return you attach to Form W-7 is filed after the return’s due date, you may owe interest and/or penalties. You should file your current year return by the prescribed due date to avoid this situation.

Texas ITIN Texas Mortgage Lenders Serving Every City In Texas

TEXAS

Texas Taxpayer Identification Numbers (TIN)

A Taxpayer Identification Number (TIN) is an identification number used by the Internal Revenue Service (IRS) in the administration of tax laws. It is issued either by the Social Security Administration (SSA) or by the IRS. A Social Security number (SSN) is issued by the SSA whereas all other TINs are issued by the IRS.

Texas Taxpayer Identification Numbers

- Social Security Number “SSN“

- Employer Identification Number “EIN“

- Individual Taxpayer Identification Number “ITIN“

- Taxpayer Identification Number for Pending U.S. Adoptions “ATIN“

- Preparer Taxpayer Identification Number “PTIN“

Do I Need One?

A TIN must be furnished on returns, statements, and other tax related documents. For example a number must be furnished:

- When filing your tax returns.

- When claiming treaty benefits.

A TIN must be on a withholding certificate if the beneficial owner is claiming any of the following:

- Tax treaty benefits (other than for income from marketable securities)

- Exemption for effectively connected income

- Exemption for certain annuities

When Claiming Texas Exemptions for Dependent or Spouse

You generally must list on your individual income tax return the social security number (SSN) of any person for whom you claim an exemption. If your dependent or spouse does not have and is not eligible to get an SSN, you must list the ITIN instead of an SSN. You do not need an SSN or ITIN for a child who was born and died in the same tax year. Instead of an SSN or ITIN, attach a copy of the child’s birth certificate and write Died on the appropriate exemption line of your tax return.

How Do I Get A Texas TIN?

Texas SSN

You will need to complete Form SS-5, Application for a Social Security Card (PDF). You also must submit evidence of your identity, age, and U.S. citizenship or lawful alien status. For more information please see the Social Security Administration web site.

Form SS-5 is also available by calling 1-800-772-1213 or visiting your local Social Security office. These services are free.

Texas EIN

An Employer Identification Number (EIN) is also known as a federal tax identification number, and is used to identify a business entity. It is also used by estates and trusts which have income which is required to be reported on Form 1041, U.S. Income Tax Return for Estates and Trusts. Refer to Employer ID Numbers for more information.

The following form is available only to employers located in Puerto Rico, Solicitud de Número de Identificación Patronal (EIN) SS-4PR (PDF).

Texas ITIN

An ITIN, or Individual Taxpayer Identification Number, is a tax processing number only available for certain nonresident and resident aliens, their spouses, and dependents who cannot get a Social Security Number (SSN). It is a 9-digit number, beginning with the number “9”, formatted like an SSN (NNN-NN-NNNN).

You can use the IRS’s Interactive Tax Assistant tool to help determine if you should file an application to receive an Individual Taxpayer Identification Number (ITIN).

To obtain an Texas ITIN, you must complete IRS Form W-7, IRS Application for Individual Taxpayer Identification Number. The Form W-7 requires documentation substantiating foreign/alien status and true identity for each individual. You may either mail the documentation, along with the Form W-7, to the address shown in the Form W-7 Instructions, present it at IRS walk-in offices, or process your application through an Acceptance Agent authorized by the IRS. Form W-7(SP), Solicitud de Número de Identificación Personal del Contribuyente del Servicio de Impuestos Internos is available for use by Spanish speakers.

Acceptance Agents are entities (colleges, financial institutions, accounting firms, etc.) who are authorized by the IRS to assist applicants in obtaining ITINs. They review the applicant’s documentation and forward the completed Form W-7 to IRS for processing.

NOTE: You cannot claim the earned income credit using an ITIN.

Foreign persons who are individuals should apply for a social security number (SSN, if permitted) on Form SS-5 with the Social Security Administration, or should apply for an Individual Taxpayer Identification Number (ITIN) on Form W-7. Effective immediately, each ITIN applicant must now:

-

Apply using the revised Form W-7, Application for IRS Individual Taxpayer Identification Number; and

-

Attach a federal income tax return to the Form W-7.

Applicants who meet one of the exceptions to the requirement to file a tax return (see the Instructions for Form W-7) must provide documentation to support the exception.

New W-7/ITIN rules were issued on December 17, 2003. For a summary of those rules, please see the new Form W-7 and its instructions.

For more detailed information on Texas ITINs, refer to:

Texas ATIN

An Adoption Taxpayer Identification Number (ATIN) is a temporary nine-digit number issued by the IRS to individuals who are in the process of legally adopting a U.S. citizen or resident child but who cannot get an SSN for that child in time to file their tax return.

Form W-7A, Application for Taxpayer Identification Number for Pending U.S. Adoptions is used to apply for an ATIN. (NOTE: Do not use Form W-7A if the child is not a U.S. citizen or resident.)

Texas PTIN

Beginning January 1, 2011, if you are a paid tax preparer you must use a valid Preparer Tax Identification Number (PTIN) on returns you prepare. Use of the PTIN no longer is optional. If you do not have a PTIN, you must get one by using the new IRS sign-up system. Even if you have a PTIN but you received it prior to September 28, 2010, you must apply for a new or renewed PTIN by using the new system. If all your authentication information matches, you may be issued the same number. You must have a PTIN if you, for compensation, prepare all or substantially all of any federal tax return or claim for refund.

If you do not want to apply for a PTIN online, use Form W-12, IRS Paid Preparer Tax Identification Number Application. The paper application will take 4-6 weeks to process.

If you are a foreign preparer who is unable to get a U.S. Social Security Number, please see the instructions on New Requirements for Tax Return Preparers: Frequently Asked Questions.

Texas Foreign Persons and IRS Employer Identification Numbers

Texas Foreign entities that are not individuals (i.e., foreign corporations, etc.) and that are required to have a Texas federal Employer Identification Number (EIN) in order to claim an exemption from withholding because of a Texas tax treaty (claimed on Form W-8BEN), need to submit Form SS-4 Application for Employer Identification Number to the Internal Revenue Service in order to apply for such an EIN. Those foreign entities filing Form SS-4 for the purpose of obtaining an Texas EIN in order to claim a tax treaty exemption and which otherwise have no requirements to file a U.S. income Texas tax return, employment tax return, or excise tax return, should comply with the following special instructions when filling out Form SS-4. When completing line 7b of Form SS-4, the applicant should write “N/A” in the block asking for an SSN or ITIN, unless the applicant already has an SSN or ITIN. When answering question 10 on Form SS-4, the applicant should check the “other” block and write or type in immediately after it one of the following phrases as most appropriate:

“For W-8BEN Purposes Only”

“For Tax Treaty Purposes Only”

“Required under Reg. 1.1441-1(e)(4)(viii)”

“897(i) Election”

If questions 11 through 17 on Form SS-4 do not apply to the applicant because he has no U.S. tax return filing requirement, such questions should be annotated “N/A”. A foreign entity that completes Form SS-4 in the manner described above should be entered into IRS records as not having a filing requirement for any U.S. tax returns. However, if the foreign entity receives a letter from the IRS soliciting the filing of a U.S. tax return, the foreign entity should respond to the letter immediately by stating that it has no requirement to file any U.S. tax returns. Failure to respond to the IRS letter may result in a procedural assessment of tax by the IRS against the foreign entity. If the foreign entity later becomes liable to file a U.S. tax return, the foreign entity should not apply for a new EIN, but should instead use the EIN it was first issued on all U.S. tax returns filed thereafter.

To expedite the issuance of an EIN for a foreign entity, please call (267) 941-1099. This is not a toll-free call.