BANK STATEMENT – NO TAX RETURN TEXAS MORTGAGE LENDERS

Serving NO Tax Return Mortgage Loans In All Texas Including And Not Limited To: Fort Worth Texas, Austin Texas, Dallas Texas, San Antonio Texas, Houston Texas

Texas No Tax Return Mortgage Refinancing is the process of replacing an existing Texas mortgage with a new mortgage loan. Typically, Texas self employed borrowers can refinance their current Texas mortgage without their tax returns in order to reduce their monthly payments, lower their interest rate, or change their loan program from an adjustable rate mortgage to a fixed-rate mortgage or Cash out in order to payoff debt or spend the funds how needed. US Mortgage Lenders uses bank statements to refinance you Texas home. No tax returns are needed with our Texas Cash out bank statment mortgage program

Texas Self Employed Texas Cash-Out Refinance Up To 500K!

Texas Texas Self Employed-bank statement mortgage lenders

Texas bank statement only Texas Self Employed mortgage lenders

Texas Texas Self Employed Get Mortgage Approval with NO Tax Returns!

12-24 month texas bank statement mortgage lenders program

ARE YOU A TEXAS BUSINESS OWNER AND CANNOT QUALIFY FOR A MORTGAGE?

Texas Self Employed mortgage lenders allows self-employed Mortgage Applicants qualify based on a 12 or 24 month average of deposits using their personal or Texas Self Employed business bank account. NO TAX RETURNS NEEDED!

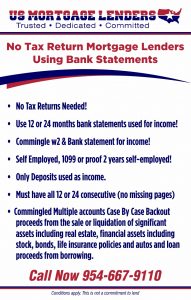

BANK STATMENT ONLY MORTGAGE LENDERS KEYPONTS INCLUDE:

- No Tax Returns Required

- Up to 90% LTV (No MI) allowed on Personal and Texas Self Employed Business

- Personal Bank Statement qualified based on 12 month average monthly deposits

- Business Bank Statement qualified based on 24 month average monthly deposits

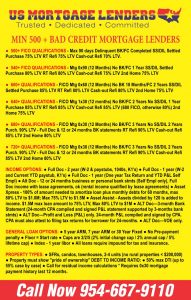

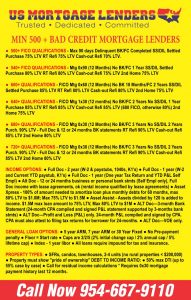

- 600 Minimum Credit Score- Determined by the middle number.

- Loans to $3 Million (Minimum $150,000)

- 5/1 year ARM or 30-year fixed

- 1 Years Seasoning for foreclosure, short sale, bankruptcy, deed In lieu

- Owner-Occupied, 2nd homes, investment properties allowed

- Non-warrantable condos considered

- Gift funds allowed

- No prepay penalty for owner-occupied and/or 2nd homes

- SFRs, town homes, condos, 2-4 units

- DTI above 40/45% with no additional reserve requirement

- Bankruptcy after 12 months OK – Multiple BK filings are not permitted.

- ELIGIBLE BANK STATMENT ONLY PROPERTY TYPES INCLUDE:

Eligible: Single Family Residences, PUDs, Townhouses, Condominiums (Warrantable Only), 2-4 Units (Owner Occupied Only) - Ineligible: Acreage greater than 10 acres (appraisal must include total acreage) • Agricultural zoned property • Condo hotel • Co-ops • Hobby Farms • Income producing properties with acreage • Leaseholds • Log Homes • Manufactured housing • Mixed use properties • Modular homes • Properties subject to oil and/or gas leases •Unique properties • Working farms, ranches or orchards

TEXAS SELF EMPLOYED APPLICANTS MUST BE SELF-EMPLOYED 2 YEARS TO QUALIFY

- Using Personal Bank Statements to Qualify

- Business license (if available – depending on nature of the Texas Self Employed business)

- Letter from a Licensed Tax Professional certifying profession & self-employment in same line of Texas Self Employed business for a min of 2 years & ownership

- percentage

- Most recent 12 months personal bank statements – Utilize 12 months average deposits to qualify (minus disqualified/unrelated deposits)

- Most recent 3 months Texas Self Employed business bank statements – Demonstrate transfers from business to personal bank account statements provided

- Texas Self Employed Mortgage Applicants must own a minimum of 25% of Texas Self Employed business to be considered Self-Employed, for use of personal of personal bank statements.

- Qualifying income may not exceed the income indicated on the initial 1003.

CO BORROWERS WITH W2 INCOME OK! Joint borrowers with one wage earner and one self-employed business owner can verify income separately, with the self-employed borrower utilizing above (Income Calculation Documentation) and the wage earner providing paystubs/W-2s.

BUSINESS BANK STATEMENTS TEXAS SELF EMPLOYED MORTGAGE LENDERS

- Business license (if available – depending on nature of Texas Self Employed business) Or/and

- Letter from a licensed tax professional certifying profession & self-employment in same line of Texas Self Employed business for a min of 2 years and that the borrower is

- 100% owner of the Texas Self Employed business – For use of Texas Self Employed Business Bank Statements/P&L for Texas Self Employed Mortgage Applicants who own less than 100% but more than or equal to 80%, a

- letter is required from each other owner of the Texas Self Employed business stating the borrower has full access to the Texas Self Employed business funds. Less than 80% ownership will

- require exception approval for use of Business Bank Statements/P&L

- Most recent 12 months Texas Self Employed business bank statements.

- 12 month Profit and Loss Statement (P&L) prepared by a Licensed Tax Professional – Net Income on P&L will be used for qualifying (Net Income/12)

- o Gross Income must be supported by the total deposits of bank statements provided (variance of 5% allowed for deposits compared to Gross

- Revenue)

- o Borrower to provide Texas Self Employed business expenses for Licensed Tax Professional – must be reasonable for the nature of the Texas Self Employed business

- o P&L is not Audited by Licensed Tax Professional

- Profit and loss must be signed and dated by the preparer and borrower.

- Qualifying income may not exceed income on loan application.

TEXAS SELF EMPLOYED WITH COMMINGLED BUSINESS AND PERSONAL ACCOUNTS

- Business license (if available – depending on nature of Texas business)

- Letter from a licensed Texas tax professional certifying profession & Texas self-employment in same line of Texas business for a min of 2 years and that the borrower is 100% owner of the Texas Self Employed business – For use of Business Bank Statements/P&L for Texas Self Employed Mortgage Applicants who own less than 100% but more than or equal to 80%, a letter is required from each other owner of the Texas Self Employed business stating the borrower has full access to the Texas Self Employed business funds. Less than 80% ownership willrequire exception approval for use of Business Bank Statements/P&L

- Most recent 12 months personal bank statements.

- 12 month Profit and Loss Statement (P&L) prepared by a Licensed Tax Professional – Net Income on P&L will be used for qualifying (Net Income/12)

- o Gross Income must be supported by the total deposits of bank statements provided (variance of 5% allowed for deposits compared to Gross Revenue)

- o Borrower to provide Texas Self Employed business expenses for Licensed Tax Professional – must be reasonable for the nature of the Texas Self Employed business

- o P&L is not Audited by Licensed Tax ProfessionalTEXAS SELF EMPLOYED MORTGAGE LENDERS TERMS INCLUDE: 5 years fixed 30 years fixed

CASHOUT SELF EMPLOYED TEXAS MORTGAGE LENDERS

- Cash Out – Refinance Using Bank Statements Only- No Tax Returns Needed!

- For all cash-out refinance transactions, a minimum of 6 months must have elapsed since the most recent mortgage transaction on the subject

- property (either the original purchase transaction or subsequent refinance). Note date to note date is used to calculate the 6 months.

- If the property was acquired < 12 months from application date, the lesser of the current appraisal value or previous purchase price plus

- documented improvements (if any) must be used. The purchase settlement statement and any invoices for materials/labor will be required.

- Cash Out cannot be used for reserve requirements

ASSETS- TEXAS SELF EMPLOYED BANK STATEMENT MORTGAGE LENDERS - Assets – Documentation Assets sourced and seasoned for 60 days. Gift funds allowed (see Gift Funds)

- Texas Self Employed Mortgage Applicants- QUALIFIED FOR BANK STATEMENT ONLY MORTGAGE LENDERS

Eligible Texas Self Employed: U.S. Citizens • Permanent Resident Aliens (A permanent resident alien is a non-U.S. citizen authorized to live and work in the U.S. on a

permanent basis. Permanent resident aliens are eligible for financing. Acceptable evidence of lawful permanent residency must be documented

and meet one of the following criteria: I-151 – Permanent Resident Card (Green Card) that does not have an expiration date; I-551 – Permanent Resident Card (Green Card) issued for 10 years that has not expired; I-551 – Conditional Permanent Resident Card (Green Card) issued for 2

years that has an expiration date, as long as it is accompanied by a copy of USCIS form I-751 requesting removal of the conditions; Un-expired

Foreign Passport with an un-expired stamp reading as follows: “Processed for I-551 Temporary Evidence of Lawful Admission for Permanent

Residence. Valid until mm-dd-yy. Employment Authorized.”)

Ineligible Texas Self Employed: Co-signer(s) • Non-occupant co-Texas Self Employed Mortgage Applicants • Texas Self Employed Mortgage Applicants not on title • Foreign Nationals • Corporations • partnerships • LLCs •

Irrevocable and Inter-Vivos trusts • Non-Permanent Resident Aliens • First Time Home Buyers

TEXAS SELF EMPLOYED MORTGAGE LENDERS INCOME QUALIFICATIONS & DOCUMENT REQUIREMENTS

- (1) 12 or 24 months Personal or 24 months Texas Self Employed Business Bank statements

- Texas Self Employed Mortgage Applicants who own more than 3 Texas Self Employed businesses must use personal bank statements option

- Bank statements must be most recent available at time of application and must be consecutive

- (2) Profit & Loss Statement

- If submitting personal bank statements, a P&L prepared by the borrower covering no less than 12 or 24 months is required.

- Texas Self Employed profit and loss up to 95% must be signed by mortgage applicants.

- If submitting Texas Self Employed business bank statements, a P&L prepared by the borrower covering no less than 24 months is required

- Borrower is required to provide separate P&Ls for each Texas Self Employed business being used in qualifying.

- Texas Self Employed profit and loss must match bank statements corresponding 24 months and match bank statements in submission.

PROFIT & LOSS ANALYSIS REQUIRED ON TEXAS BUSINESS BANK STATEMENTS

- Adjusted Net Income from the P&L will be used as Qualifying Income for both personal and business bank statement.

- Profit and loss used to qualify Texas Self Employed must be signed by business owner.

- Declining income on Texas Self Employed profit and loss requires letter of explanation.

- Any amounts on the P&L representing salary/wages paid to the borrower/business owner can be added back and considered in the net income analysis.

- Expense line items that can be added back to the Texas Self Employed business net income include depreciation, depletion, amortization, casualty losses, and other losses or

- expenses that are not consistent and recurring.

- Texas Self Employed Mortgage Applicants utilizing Texas Self Employed business bank statements that own > 50% but < 100% of a business will be qualified at the P&L/AES net income multiplied by their ownership

- percentage.

- The P&L expense ratio, Gross Income minus Net Income, divided by Gross Income, should be reasonable for the profession.

- Example: A home-based sole practitioner therapist/consultant can be expected to have a low expense ratio, while a retail business that has a full staff of

- employees and relies heavily on inventory to generate income will have a high expense ratio.

- If the file does not contain a CPA prepared P&L, steps must be taken by the underwriter to evaluate the reasonableness of the expenses listed by the borrower.

- This requires the borrower to provide a Texas Self Employed business narrative which includes detail related to the size/scope and operating profile of the business, including the following: o Description of Business/Business Profile o Location & Associated Rent o Number of Employees / Contractors o Estimated Cost of Goods Sold (Does Texas Self Employed business involve sale of goods or just services?) o Materials/Trucks/Equipment o Commercial or Retail client base? o Texas Self Employed Business Analysis

- Business Expenses listed on a borrower prepared P&L should generally relate to the information provided below. Joint Accounts – A joint personal account with a non-borrowing spouse or domestic partner can be used for qualifying as follows: o If not contributing income/deposits, it must be validated by a borrower affidavit o If contributing income/deposits, source must be clearly identified (direct deposit, SSI, trust

- income) and amounts must be subtracted from the analysis o Relationship letter must be present in file Retirement, Government Annuity, and Pension Income – GB may recognize an ancillary income stream from employment-related assets as eligible for

- income qualification. Borrower must evidence a 12 month history of documented draws or interest/dividend income. If, based on that history, the income will continue for at least three years, the income may be used for loan qualification. One of the following types of income documentation is required: o Copy of award letter or letters from the organizations providing the income o Most recent personal income tax return with all schedules o Most recent W2 or 1099 o

- Most recent 2 months bank statements showing deposit of funds If the income being used for qualifying represents at least 50% of the borrower’s total income, a five year continuance is required. The borrower must have unrestricted access, and available to the borrower without penalty. Documentation of asset ownership must be in compliance with the allowable age of credit documents.

- Restricted Stock Income – GB will only consider restricted stock that was awarded in prior 2 years and became unrestricted (vested) in the current year. The

- Vesting Schedule must indicate the income will continue for a minimum of 3 years at a similar level to the prior 2 years. Continuance is based on the vesting

- schedule using a stock price based on the 52 week low for the most recent 12 months reporting at the time of closing. A 2 year average of prior income

- received from RSU’s or stock option will be used. The following documentation is required: o Copy of the vesting schedule o Most recent W2 and pay stub o

- Private Stock not eligible.

- Component Sources of Income – A borrower who has a self-employed business and also receives income from other sources is eligible for the bank

- statement program. Income sources include but are not limited to rental properties, trust & investment, alimony, etc. These income sources should be

- separately documented on the 1003 and should be separately supported by bank statement deposits.

- o Rental Income –

- months via cancelled checks, deposits clips, or bank records ed by a vacancy/expense factor of

- 25%

- o Trust Income – idenced by

- unt, distribution frequency, and duration of payments

- o Alimony Income –

- deposit slips, or bank records

- o Note Receivable Income opy of the note confirming amount and length of payment

- checks, deposit slips, or bank records

NON PERMANENT TEXAS BANK STATEMENT ONLY MORTGAGE LENDERS

- Non-Permanent Resident Aliens must meet the following requirements:

- Must have an unexpired passport from their country of citizenship containing INS form I-94 (or equivalent) which must be stamped Employment Authorized.

- An Employment Authorization Card along with a copy of the Petition for Non-Immigrant Worker form I-140 (or equivalent) in file

- The borrower(s) must have a minimum of 2 years residency, with the likelihood of employment continuance.

- Primary Residence only, No Cash Out

- Valid visas are required

- Visa must have a minimum remaining duration of 1 year

- Texas Self Employed Mortgage Applicants with diplomatic immunity are ineligible (cont. next page)

- 70% LTV/CLTV Maximum

- Single unit only

- Maximum 43% DTI

- An additional 6 months reserves is required

- No Credit Event only

MAX PAYMENT INCREASE (SHOCK) TEXAS SELF EMPLOYED MORTGAGE LENDERS

- Payment shock is limited to 300% on primary residence transactions.

- Payment Shock Calculation –

- (Proposed PITI – Current PITI) / Current PITI X 100

- For Texas Self Employed Mortgage Applicants who do not have a current housing payment, or own a home free and clear, payment is shock is not considered.

OCCUPANCY FOR TEXAS BANK STATEMENT ONLY MORTGAGE LENDERS

- A primary Texas residence is a property that the borrower(s) intend to occupy (within 60 days) as his or her principal residence.

- Characteristics that may indicate that a property is used as a borrower’s primary residence include:

- It is occupied by the borrower for the major portion of the year.

- It is in a location relatively convenient to the borrower’s principal place of employment.

- It is the address of record for such activities as federal income tax reporting, voter registration, occupational licensing, and similar functions.

- Texas Self Employed mortgage applicants may not own an additional single family residence of equal or greater value than subject property

SECOND HOME TEXAS SELF EMPLOYED OCCUPANCY REQUIRMENTS

- A property is considered a second home when it meets all of the following requirements:

- Must be located a reasonable distance away from the borrower(s) principal residence.

- Must be occupied by the borrower(s) for some portion of the year.

- Is restricted to a one-unit dwelling.

- Must be suitable for year-round occupancy.

- Cash-Out transactions are not permitted

- The borrower(s) must have exclusive control over the property.

- Gifts not permitted

PROPERTY TYPES TEXAS SELF EMPLOYED MORTGAGE APPROVALS

- Property Types Eligible: Single Family Residences 1-4 Units (3-4 Units NOO Only), PUDs*, Townhouses, Condominiums (Warrantable Only)

- PUDs- New PUDs/Subdivisions must be at least 60% sold or under bonafide contract. The PUD questionnaire must be included with submission. • Maximum

- LTV of 80% for new PUDs Ineligible Property Types Include: • Acreage greater than 10 acres (appraisal must include total acreage) • Agricultural/Rural zoned property • Condo hotel • Co-ops • Hobby Farms •Income producing properties with acreage • Leaseholds • Log Homes • Manufactured housing • Mixed use properties • Modular homes • Non-Warrantable Condos • Properties subject to oil and/or gas leases • Unique properties • Working farms, ranches or orchards.CONDO- Texas Self Employed MORTGAGE LENDERS

- Fannie Mae eligible projects: project exposure maximum shall be $3,000,000 or 15% of the project whichever is lower • Borrower project/Unit concentration limit: two (2) units • Project meets all FNMA Insurance requirements for property, liability and fidelity coverage • Borrower must carry H06 coverage for replacement of such items as flooring, wall covering, cabinets, fixtures, built-ins and any improvements made to the unit • The Condo Project Questionnaire must be completed, including all the required documentation from the questionnaire including: CCR, Articles of Incorporation, By-Laws, MasterInsurance Policy, Budget / Balance Sheet & HOA questionnaire .• All projects are subject to full review and approval.

REFINANCE INTEREST RATE BANK STATEMENT ONLY MORTGAGE LENDERS

- A Rate/Term Refinance transaction is when the new loan amount is limited to the payoff of the present first lien mortgage, any seasoned non-first lien mortgages, closing costs and prepays, or a court ordered buyout settlement.

- A seasoned non-first lien mortgage is a purchase money mortgage or a closed end or HELOC mortgage that has been in place for more than 12 months(and/or not having any draws greater than $2,000 in the past 12 months for HELOC’s. Withdrawal activity must be documented with a transaction history fromthe HELOC).

- Limited cash to the borrower must not be greater than 1% of the principal amount of the new mortgage to be considered a Rate/Term refinance.

- If the property is owned less than 6 months at the time of application, the LTV/CLTV will be based on the lesser of the original purchase price plusimprovements or current appraised value. The prior HUD-1 will be required for proof of purchase price. Proof of improvements is required.

- There is no waiting period if the lender documents that the borrower acquired the property through an inheritance or was legally awarded the property(divorce, separation, or dissolution of a domestic partnership). If the borrower acquired the property at any time as a gift, award, inheritance or othernon-purchase transaction, the LTV will be based on the current appraised value. The lender must obtain appropriate documentation to verify theacquisition and transfer of ownership.

- Follow FNMA for Delayed Financing guidelines.

- Properties that have been listed for sale within the past 6 months from the loan application date are not eligible for a rate/term refinance transaction.

- The rate/term refinance of a construction loan is eligible with the following conditions:

- If the lot was acquired 12 or more months before applying for the subject loan, the LTV/CLTV/HCLTV is based on the current appraised value of the property.

- If the lot was acquired less than 12 months before applying for the construction financing, the LTV/CLTV/HCLTV is based on the lesser of i) the current appraised value of the property and ii) the total acquisition costs.

CASH OUT TEXAS BANK STATEMENT ONLY MORTGAGE LENDERS

- A Cash-Out Refinance transaction allows the borrower to pay off the existing mortgage by obtaining new financing secured by the same property or allows the

- property owner obtain a mortgage on a property that is currently owned free and clear. The borrower can receive funds at closing as long as they do not exceed

- the program requirements.

- To be eligible for a Cash-Out Refinance the borrower must have owned the property for a minimum of six months prior to the application date. Properties listed

- for sale within the last 12 months are ineligible for cash out.

- If the property is owned less than 12 months but greater than 6 months at the time of application, the LTV/CLTV will be based on the lesser of the originalpurchase price plus documented improvements, or current appraised value. The prior HUD-1 will be required for proof of purchase price.

REFINANCE DEBT CONSOLIDATION TEXAS MORTGAGE LENDERS

- A debt consolidation refinance transaction involves the repayment of an existing lien and other borrower debt from the proceeds of a new mortgage. A debtconsolidation refinance may include the payoff of:

- o First mortgage secured by the subject property.

- o Junior liens secured by the subject property.

- o Credit cards, installment loans, past due taxes, etc.

- Direct evidence of debt payment at closing is required.

- Borrower must own property for a minimum of 12 months

- Loan must produce a net tangible benefit to the borrower resulting in an increase in residual income and a reduction of borrower’s total debt obligationpayments.

- Existing subordination not permitted.Cash to borrower at closing must not exceed 2% of the loan amount.

- Non-Occupant Co-Borrower: An additional 6 months reserves is required

- First Time Home Buyers: Minimum of 6 months PITI reserves required

- Interest Only loans require a minimum of 12 months reserves

- Texas Self Employed Mortgage Applicants with greater than 2 financed properties require 9 months or otherwise stated higher reserve amount above and an additional 3 months of reservesfor each additional financed property. The 3 months additional reserves are based on the PITI plus HOA fees of the other financed properties. For primaryresidence transactions, this requirement can be waived for Texas Self Employed Mortgage Applicants who have a minimum 18 months reserves on the primary residence.

- Texas Self Employed Mortgage Applicants with greater than 2 financed properties require an additional 3 months of reserves for each additional financed property. The 3 months additionalreserves are based on the PITI plus HOA fees of the other financed properties.

- Texas Self Employed Mortgage Applicants with greater than 2 financed properties require an additional 3 months of reserves for each additional financed property. The 3 months additionalreserves are based on the PITI plus HOA fees of the other financed propertiesCash-out permitted to meet reserve requirements if loan-to-value is 5% below the matrix maximum LTV/CLTV and a minimum 680 representative FICO score

RESIDUAL INCOME USE FORTEXAS SELF MORTGAGE APPLICANTS

- Texas Self Employed Mortgage Applicants must have a minimum monthly residual income that is 2X the requirement of the VA.

- For bank statement loans, the underwriter should apply an estimated income tax payment of 28% of net income.

- Not required for non-owner occupied properties

DOCUMENT AGE FOR TEXAS SELF EMPLOYED MORTGAGE LENDERS

- Credit Report/Credit Documentation: 90 days old at the time of closing

- Income and Asset Documentation: Dated within 90 days of closing

- Title Report/Title Commitment: Dated no later than 60 days prior to closing

APPRAISAL TEXAS SELF EMPLOYED MORTGAGE LENDERS

- Full Interior / Exterior appraisal required. Fannie Mae/Freddie Mac Forms 1004/70, 1025/72, 1073/465 or 2090 must be used. All Texas Self Employed Fannie Guidelines apply to appraisal process and value determination, in addition an Appraisal Management Company must be utilized for appraiser selection.The Appraisal should be dated no more than 120 days prior to the Note Date. After a 120 day period, a new appraisal is required. Re-certification of value is not acceptable. Minimum Square Footage 800 Sq. Feet Not eligible: Properties for which the appraisal indicates condition ratings of C5 or C6 or a quality rating of Q6, each as determined under the Uniform Appraisal Dataset (UAD) guidelines. Texas Self Employed Mortgage Lenders will consider if issue has been corrected prior to loan funding with proper documentation.

CREDIT SCORES FOR TEXAS SELF EMPLOYED MORTGAGE LENDERS

- TradeLines: 3 tradelines reporting for 12+ months with activity in last 12 months; Limited Tradelines N/A Credit Revised 2.26.2018

- Consumer Lates Maximum: Most Recent 12 Months – May not exceed 2×30 and 0x60; Most Recent 13-24 Months – May not exceed 1×60 Credit Scores

- The applicable credit score is the middle of three scores provided for any borrower. If only two credit score are obtained, the lesser of two will be used.

- When there are multiple Texas Self Employed Mortgage Applicants/guarantors, the lowest applicable score from the group of Texas Self Employed Mortgage Applicants/guarantors is the representative credit score fo qualifying.

GIFT FUND REQUIREMENTS FOR TEXAS SELF EMPLOYED MORTGAGE LENDERS

- Gift funds are allowed after the borrower has made the minimum required contribution (see Minimum Borrower Contribution) towards the down

- payment. Gift funds can be used for down payment and closing cost but are not allowed to meet the reserve requirement. When the funds are

- not transferred prior to closing, the originator must document that the donor gave the closing agent the gift funds in the form of a certified check,

- a cashier’s check, money order, or wire transfer