STATED FLORIDA INVESTOR MORTGAGE LENDERS

- 2 to 4 Unit properties & Condos MAX 75% LTV / SFR max LTV 80%

- RATES starting in the mid 5’s on NO-income doc investment properties!

- DSCR Down to 80%- Projected rent must cover up to 80% of the mortgage PITI.

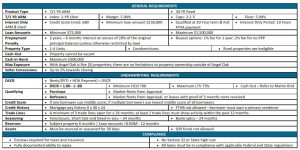

STATED INVESTOR MORTGAGE LENDERS GENERAL REQUIRMENTS

Florida Stated Income Investor Product Types

• 7/1 YR ARM • 30 YR Fixed

7/1 YR ARM • Index: 1‐YR Libor • Margin: 5.00% • Caps: 2‐2‐5 • Floor: 5.00%

Interest Only

ARM & Fixed

• Credit Score (min): 680 • Minimum loan amount $150,000 • Qualified at 20 Year term & Full PITIA payment

Loan Amounts • Minimum $75,000 • Maximum $1,500,000

Prepayment

Penalty

• 2 years – 6 months interest on excess of 20% of the original

principal balance (unless otherwise restricted by law)

• Interest‐Only Period: 10 Years

• Buyout options: 1% fee for 1 year; 2% fee for no PPP

Property Type • 1‐4 Units • Condominiums • Rural properties are ineligible

Cash-Out • Property cannot be vacant

Cash in Hand • Maximum $300,000

Max Exposure • With Florida Stated Income Mortgage is five (5) properties; there are no limitations to property owners outside of Florida Stated Income Mortgage

Seller Concessions • Up to 2% towards closing

STATED FLORIDA INVESTOR LOAN UNDERWRITING REQUIREMENTS

DSCR • Rents/(PITI + HOA Payment) = DSCR

• DSCR < 1.00 – ≥ .80 • Minimum FICO 700 • Maximum LTV 75% • Cash Out – Refer to Matrix Grid

Qualifying • Purchase • Market Rents from Appraisal

• Refinance • Market Rents from Appraisal, or leases with proof of 3 months rents received

Credit Score • If one borrower use middle score; if multiple borrowers use lowest middle score of all borrowers

Credit History • Mortgage pay history 0 x 30 x 24 • FTHB not allowed – borrower must own a primary residence

Trade Lines • A minimum of 3 trade lines open for ≥ 24 months; at least 2 trade lines must show activity within the past 12 months.

Seasoning • Foreclosure, Short Sale and Deed‐in‐Lieu – 24 months • Bankruptcy – 24 months

Reserves • Subject property 6 months | Loan amounts >$1MM ‐ 12 months

Assets • Must be sourced or seasoned for 30 days • Gift funds not allowed

STATED INCOME MORTGAGE LENDERS COMPLIANCE

• Escrows required for taxes and insurance • No Section 32 or State high cost

• Fully documented ability to repay • All loans must be in compliance with applicable Federal and State regulations

STATED INCOME FLORIDA MORTGAGE LENDERS RELATED PAGES

10% DOWN+STATED INCOME FLORIDA MORTGAGE LENDERS-

Stated Income Florida Mortgage Lenders For Primary Homes! Same Day Approvals Call Now954-667-9110 Providing Stated Florida home loans in every city …

Florida stated income mortgage lenders+same day approval

Dec 23, 2016 – FLORIDA STATED INCOME MORTGAGE LENDERS. STATED INCOME MORTGAGE LENDERS FOR PRIMARY HOMES = CLICK HERE. Details of Florida Bank Statement Only LendersProgram: Florida Stated Lenders Loan Approval Property Types: Florida Stated Loan Investor Amounts:Stated Florida Lenders Maximum (LTV) Loan To Value. Florida Stated …

STATED INCOME FL MORTGAGE LENDERS PRIMARY HOMES!

stated income florida investment lenders – fha mortgage lenders. Stated Income (No IncomeVerification). Loan Amounts: $100,000 – $7,000,000. Rates from 8.50% Interest Only.

10% DOWN+STATED INCOME FLORIDA MORTGAGE LENDERS-

Stated Income Florida Mortgage Lenders For Primary Homes! Same Day Approvals Call Now954-667-9110 Providing Stated Florida home loans in every city …

Stated Income Florida Mortgage Program Details

As with many traditional loans, stated income Florida mortgage loans may be a 30-year fixed interest or variable interest loans. Stated borrowers do not have to …

NO DOC STATED INCOME FLORIDA MORTGAGE LENDERS

Stated income Florida mortgage lenders provided loans to anyone that met the minimum credit score without verification of income. These stated income …

Florida stated income mortgage lenders+same day approval

Dec 23, 2016 – FLORIDA STATED INCOME PRIMARY HOMES AND INVESTOR LOANS Call NOW954-667-9110 Same Day Florida stated income loan Pre …

Thomas Wesley Martin – www.FLORIDA-MORTGAGE-LENDERS.COM …

Visit Thomas Wesley Martin’s profile on Zillow to read customer ratings and reviews. Find great Hollywood, FL mortgage lending professionals on Zillow like