Self Employed Mortgage Lenders Resources:

- Form 1040-ES, Estimated Tax for Individuals

- Publication 505, Tax Withholding and Estimated Tax

- Publication 535, Business Expenses

- Do I have Income Subject to Self-Employment Tax?

IRS YouTube Videos:

- Estimated Tax Payments – English

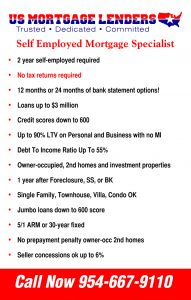

Self Employed Florida Mortgage Lenders qualifying Florida borrowers with 12 or 24 months Bank statements. NO TAX RETURNS NEEDED! same day approval! Call Now Same Day Approvals Issued! 954-667-9110

Greater flexibility for self–employed borrowers-In recent months, some new and flexible programs for self–employed borrowers have come onto the market. These aren’t the “stated-income” loans that arose during the last housing boom.

Self–Employed Mortgage Lenders Approvals – 90% Loans For Self Employed borrowers can qualify for a mortgage using bank statement only mortgage program!

SELF EMPLOYED HOUSTON TEXAS MORTGAGE LENDERS self–employed adjective: self–employed= working for oneself as a freelancer or the owner of a business rather than for an employer.

10% Down+Self Employed Texas Mortgage Lenders- No Tax Returns Needed!• No tax returns • Personal or Business up to 90% LTV• Credit scores starting at 600• Purchase, R&T and Owner-occupied, second homes, and investment properties.

Self Employed Texas Mortgage Lenders qualifying Texas borrowers with Bank statements only. Call 954-667-9110 same day approval! Call 954-667-9110 same day approval! Florida stated income mortgage lenders+same day approval!

Self–Employed Mortgage Lenders Approvals – 90% Loans For Self Employed borrowers can qualify for a mortgage using bank statement only mortgage program!

Self Employed Bank Statement Only Georgia Bank statement program: Ideal for the Georgia self–employed mortgage applicants. … ga self. www.fhamortgageprograms.com …

10% Down Georgia Self Employed Mortgage Lenders! SERVING ALL GEORGIA! Bank Statement Only Georgia mortgage loans down to 600 Fico. Use 12 or 24 months Business bank statement deposits as income!

Greater flexibility for self–employed borrowers-In recent months, some new and flexible programs for self–employed borrowers have come onto the market. These aren’t the “stated-income” loans that arose during the last housing boom.

Self–Employed Mortgage Lenders Approvals – 90% Loans For Self Employed borrowers can qualify for a mortgage using bank statement only mortgage program!

Self Employed Borrowers can use 12 or 24 Month Bank Statements to prove income! No TAX RETURNS NEEDED! SAME DAY APPROVALS CALL NOW 954-667-9110

ALABAMA SELF EMPLOYED MORTGAGE LENDERS 12 or 24 Months Business or personal BS only! When your bank says NO We Say YES! Call Now 954-667-9110

Self Employed ALABAMA Mortgage Lenders qualifying Alabama borrowers with 12 or 24 months Bank statements. NO TAX RETURNS NEEDED! same day approval! Call Now Same Day Approvals Issued! 954-667-9110

Self–Employed Mortgage Lenders Approvals – 90% Loans For Self Employed borrowers can qualify for a mortgage using bank statement only mortgage program!

Many self–employed borrowers do not qualify because they take advantage of the tax codes and write off all their income and therefor do not qualify. No income verification lenders verity income by you most recent 24 months bank statements.

Self-employed taxpayers normally earn income by carrying on a trade or business. Here are six important tips from the IRS for the self-employed:

- Self-Employed Taxpayers. Sole proprietors and independent contractors are two types of self-employment. Taxes can be complex for the self-employed. Check out the IRS Self Employed Individuals Tax Center.

- Estimated Tax. Self-employed taxpayers generally need to make quarterly estimated tax payments. IRS Publication 505, Tax Withholding and Estimated Tax, has details on making those payments.

- Schedule C or C-EZ. Self-employed taxpayers must file a Schedule C, Profit or Loss from Business, or Schedule C-EZ, Net Profit from Business, with their Form 1040. For expenses less than $5,000, use Schedule C-EZ. Each form’s instructions provide the rules for which form to use.

- SE Tax. For those making a profit, self-employment and income tax may need to be paid. Self-employment tax includes Social Security and Medicare taxes. Use Schedule SE, Self-Employment Tax, to figure the tax.

- Allowable Deductions. Taxpayers can deduct expenses paid to run a business that are both ordinary and necessary. An ordinary expense is one that is common and accepted in the industry. A necessary expense is one that is helpful and proper for a trade or business.

- When to Deduct. In most cases, taxpayers can deduct expenses in the year paid or incurred. Some costs must be ‘capitalized,’ however. This means deducting the cost over a number of years.

All taxpayers should keep a copy of their tax return. Beginning in 2017, taxpayers using a software product for the first time may need their Adjusted Gross Income (AGI) amount from their prior-year tax return to verify their identity. Taxpayers can learn more about how to verify their identity and electronically sign tax returns at Validating Your Electronically Filed Tax Return.