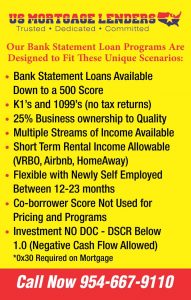

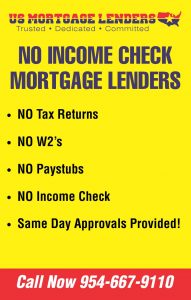

1099 Mortgage Lenders Mortgage Lenders-No Tax Returns

DOCUMENT CHECKLIST FOR 1099 LOAN USING 1099’S FOR INCOME

DOCUMENT CHECKLIST FOR 1099 LOAN USING 1099’S FOR INCOME

- 2 YEARS 1099S

- SELF PREPARED MOST RECENT 24 MONTHS PROFIT AND LOSS STATEMENT.

- NO TAX RETURNS NEEDED

- 1099 MORTGAGE LENDERS NEED NO BANK STATEMENTS FOR INCOME

TEXAS DOCUMENT CHECKLIST FOR 1099 LOAN USING 1099’S

- 2 YEARS 1099 S

- SELF PREPARED MOST RECENT 24 MONTHS PROFIT AND LOSS STATEMENT.

- NO TAX RETURNS NEEDED

- NO BANK STATEMENTS NEEDED FOR INCOME

File Form 1099 Mortgage Lenders-can use 1099 only for each person to whom you have paid during the year. Self-employed Contactors are issued 1099 if they:

- at least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest;

- at least $600 in:

- rents;

- services performed by a 1099 contractor someone who is not your employee;

- Earn 1099 contractor prizes and awards;

- Earn 1099 contractor other income payments;

- Earn 1099 contractor medical and health care payments;

- Earn 1099 contractor crop insurance proceeds;

- Earn 1099 contractor cash payments for fish you purchase from anyone engaged in the trade or business of catching fish;

- Earn 1099 contractor or cash paid from a notional principal contract to an individual, partnership, or estate;

- payments to an attorney; or

- Earn 1099 contractor from any other type of contractor work.

In addition, use tis form to report that you made direct sales of at least $5,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment.

Current 1099 Products

Recent 1099 Only Mortgage Lenders Developments

Filing Forms 1099 Mortgage Lenders-MISC with Nonemployee Compensation (NEC) for Tax Year 2018

Filing Forms 1099 Mortgage Lenders-MISC With NEC in Box 7 with the IRS – Dec-2017

Other 1099 Only Mortgage Lenders Items You May Find Useful

All Form 1099 Mortgage Lenders-MISC Revisions

Online Ordering for Information Returns and Employer Returns

General Instructions for Certain Information Returns

Form 1099 Mortgage Lenders-C, Cancellation of Debt

Form 1099 Mortgage Lenders-K, Payment Card and Third Party Network Transactions

Comment on Form 1099 Mortgage Lenders-MISC

Use the Comment on Tax Forms and Publications web form to provide feedback on the content of this product. Although we cannot respond individually to each comment, we do appreciate your feedback and will consider all comments submitted.

Form 1099-Texas Mortgage lenders

File Form Texas 1099-MISC for each Texas 1099 contracted person to whom you have paid during the year:

- at least $10 in royalties or Texas 1099 contracted broker payments in lieu of dividends or tax-exempt interest;

- at least $600 in:

- rents;

- services performed by Texas 1099 contracted who is not your employee;

- Texas 1099 prizes and awards;

- other Texas 1099 income payments;

- medical and health care payments;

- crop Texas 1099 insurance proceeds;

- Texas 1099 cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or Texas 1099 business of catching fish;

- generally, the cash paid from a Texas 1099 notional principal contract to an individual, partnership, or estate;

- payments to an Texas 1099 attorney; or

- any fishing boat proceeds,

In addition, use this form to report that you made direct Texas 1099 sales of at least $5,000 of consumer products to a Texas 1099 buyer for resale anywhere other than a permanent retail establishment.

Texas 1099 Products

Recent Developments

None at this time.

Other Items You May Find Useful

All Texas 1099 For-MISC Revisions

Online Ordering for Information Returns and Employer Returns

About General Instructions for Certain Information Returns

About Form 1099-C, Cancellation of Debt

About Form 1099-K, Payment Card and Third Party Network Transactions

Comment on Form 1099-MISC

Use the Comment on Tax Forms and Publications web form to provide feedback on the content of this product. Although we cannot respond individually to each comment, we do appreciate your feedback and will consider all comments submitted.

CAUTION: We cannot respond to tax-related questions submitted using this page. Instead, please see our Tax Law Questions page.