- TEXAS CO-OP-CONDOTEL-NON WARRANTABLE CONDO REFINANCE

- TEXAS PURCHASE OR REFINANCE NON-WARRANTABLE CONDO LENDERS

- TEXAS-PURCHASE OR REFINANCE-CONDOTEL- CO OP MORTGAGE LENDERS

- TEXAS PURCHASE OR REFINANCE CO-OP- MORTGAGE LENDERS

TEXAS CO-OP, CONDOTEL, NON-WARRANTABLE CONDO LENDERS OPTIONS INCLUDE:

TEXAS CO-OP, CONDOTEL, NON-WARRANTABLE CONDO LENDERS OPTIONS INCLUDE: - Primary TEXAS Co-op, Condotel, Non-Warrantable Condo Mortgage Lenders

- Second TEXAS Co-op, Condotel, Non-WarrantableMortgage Lenders

- Investments TEXAS Co-op, Condotel, Non-Warrantable Mortgage Lenders

- Cash Out TEXAS Co-op, Condotel, Non-Warrantable Refinancing

- Second TEXAS TEXAS Co-op, Condotel, Non-Warrantable Mortgage Lenders

- Jumbo TEXAS Co-op, Condotel, Non-Warrantable Mortgage Lenders

- Low TEXAS Co-op Closing Costs

- Up to 80 Percent TEXAS Co-op Mortgage Loans

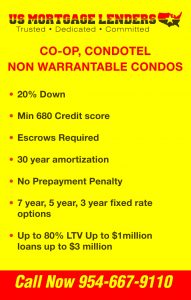

TEXAS CO-OP, CONDOTEL, NON-WARRANTABLE, MORTGAGE LENDERS FEATURES

• Max DTI 43%

• 80% LTV up to $1 million loan amount with reduced LTVs up to $3 million

• 30-year amortization

• No prepayment penalty

• 2/2/6 caps, 1-year CMT Index, 3.0% Margin, Floor = Note Rate

• Escrows required

- TEXAS PURCHASE OR REFINANCE NON-WARRANTABLE CONDO LENDERS

- TEXAS-PURCHASE OR REFINANCE-CONDOTEL MORTGAGE LENDERS

- TEXAS PURCHASE OR REFINANCE CO-OP- MORTGAGE LENDERS

TEXAS Condo Hotel (Condotel) Mortgage Lenders. Buyer often ask,” What is a condotel?”

A condotel is a condominium project that is operated as a hotel with a registration desk, cleaning service and more. The units are individually owned. Unit owners also have the option to place their unit in the hotel’s rental program where it is rented out like any other hotel room. Condotel properties are often treated like second homes and are quickly growing in popularity among TEXAS vacationers looking for TEXAS timeshare type of real estate.

CONDOTEL- CO-OP- NON-WARRANTABLE CONDO LENDERS SUMMARY

– We can lend on co-ops, non-warrantable condos and condotels in all TEXAS

• Loan sizes from $100,000 – $3,000,000 allowed

• Up to 80% Loan to Value for TEXAS owner-occupied and TEXAS 2nd homes

• 80% LTV cash out for TEXAS owner-occupied and 2nd homes with up to $1.5mm cash in hand

• Investment TEXAS Co-op Condotels and Non-Warrantable Homes allowed up to 60% LTV

• TEXAS Mortgage Lenders allows up to 10 financed units and 15 total REO including cash out loans

• Limited review of the TEXAS co-op and/or TEXAS condos

• Review of TEXAS Mortgage Lenders Co-op/Condo Certificate and the HOA master insurance policy required.

FL CONDOTEL, FL CO-OP, FL NON-WARRANTABLE CONDO LENDERS INFO

- Same building comps preferred

- Only one appraisal required regardless of loan amount

- Only one stock certificate, one lease and one security instrument typically needed for Co-ops

- All specialty programs can be used in conjunction with Co-ops, Non-warrantable Condos and Condotels:

- Asset Depletion

- Depletion Work Visa/Expat

No Credit / Limited Credit - Foreign National

- NOO cash out condotel – non-warrantable condos and TEXAS co-ops

- Up to 6% seller’s concessions allowed for closing costs including upfront/advance HOA dues

- •Fast rush closings available – think of us if a loan has fallen out through a conventional source

RESTRICTIONS FOR CONDOTEL- CO-OP- NON-WARRANTABLE CONDO

- Minimum unit size: 500 sq. ft.

- Must have a full kitchen and a separate bedroom

- No studios allowed

- Large flip tax allowed case by case

- Deed restrictions allowed case by case on the subject property

- Blackout dates are not allowed

- No pending litigation involving structural or construction items allowed

- Litigation for other reasons can be reviewed case by case, typically at a reduced LTV

- Low HOA reserves allowed case by case – call your AE for details

- Must have 100% replacement coverage or agreed amount endorsement if coinsurance is present

TEXAS MORTGAGE LENDERS FOR YOUR CO-OP TEXAS MORTGAGE

A traditional TEXAS house (or a condo unit) has a deed, which is signed to a lender when a home buyer secures a TEXAS mortgage for a property. Co-ops are a little different. In the case of a co-op, each individual unit does not have a deed; there is only one deed for the entire building. A TEXAS co-op mortgage is actually a “share loan,” that is, a loan that enables the buyer to purchase their share in the co-op. This difference makes securing a loan for a co-op a little more difficult than a getting a traditional TEXAS mortgage because they are offered by fewer TEXAS mortgage lenders.

WHAT IS A CO-OP?

TEXAS coops are housing within a corporation, which owns a piece of real estate (generally an apartment building). Someone who wishes to live in the TEXAS Coop building would purchase a share of the corporation, which grants the cooperative buyer a proprietary lease on a specific unit in the building. Shareholders or the unit owners within a cooperative building are responsible for maintenance fees that go toward the upkeep of the building, property taxes, etc. The common areas such as hallways, recreation and parking areas are owned jointly by the co-op’s shareholders.

TEXAS coop homebuyers that which to buy into a co-op must be approved by the board or shareholders. The approval process can be extensive and may require interviews, character references, and employment and financial verification, and credit history. Co-op boards may refuse a prospective buyers application to purchase within the building for any lawful reason.

HOW TEXAS CO-OP MORTGAGE LENDERS DIFFER FROM TEXAS CONDO LOANS

In a TEXAS condominium complex, the condo owners own specific units, they own the surface of the interior walls of the unit contained within. Someone who owns a TEXAS condo owns a piece of real estate. In contrast to a TEXAS co-op, residents within a coop own a share of the co-op corporation which entitles the owner to a proprietary lease for a specific coop unit. This share is considered personal property rather than real estate.

Another big difference is that co-op shareholders do not have the right of alienation, which means they cannot sell their share/unit without the permission of the co-op board. Some condo associations may have the right of first refusal, which means they can stop the sale of a unit so long as they match the prospective buyer’s price. Co-op boards can simply deny a coop sale without matching the sale price.

Finally, there could be additional restrictions on unit renovation/alteration in a co-op as compared to a TEXAS condo. This varies depending upon a given TEXAS co-op’s by-laws