SELF EMPLOYED MORTGAGE LENDERS LOANS

BANK STATEMENT ONLY MORTGAGE LENDERS – NO TAX RETURNS NEEDED!

Bank Statement Questions and Answers

Bank Statement Questions and Answers

BANK STATEMENT LOANS TO VERITY INCOME

Designed for California self-employed mortgage applicants who would like to qualify with bank statements and/ or a simple P&L statement. These self-employed mortgage loans DO NOT require tax returns, pay-stubs or W-2s. Up to 90% Loan to Value. No Mortgage Insurance. Interest only available for lowest payments. Loans to $25 million+

STATED INCOME CALIFORNIA MORTGAGE LENDERS

Yes, we offer full stated income loans! These loans are for stated income applicants who prefer NOT to qualify with bank statements or tax returns. These stated income loans have NO income requirements. We offer these for primary residences and investment properties.

- California Self Employed Bank Statement Mortgage Lenders

- 10%down+san Jose California self-employed mortgage lenders

- CA Bank Statement Mortgage For Self-Employed Borrowers

- 10% Down Self Employed Bank Statement Only CA Mortgage Lenders

- 10%down+los Angeles California self-employed mortgage lenders

- CALIFORNIA SELF EMPLOYED-BANK STATEMENT MORTGAGE

- 10% Down Self Employed Bank Statement Only CA Mortgage Lenders

- 10%DOWN+San Francisco CA Self Employed Mortgage Lenders

Many California self-employed business owners agree that their tax returns do not accurately show their ability to make a mortgage payment. The California self-employed borrower tends to write off and or deduct many expenses that a salaried / W2 employee is not able to. Because of the extensive write-offs, the income on their tax returns may not qualify for a traditional bank mortgage to purchase and or get the loan amount they need to purchase the home of their dream. Bank statement mortgage lenders provide an alternative income solution offered by certain bank statement only mortgage lenders to help California self-employed borrowers qualify for a mortgage with NO TAX RETURNS!

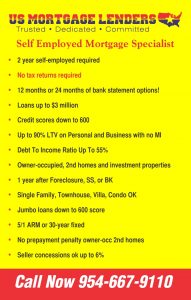

CALIFORNIA BANK STATEMENT ONLY MORTGAGE LENDERS PROGRAM DETAILS INCLUDE:

- 2 Years Self Employed Required!

- Bank statement deposits used to qualify!

- No tax returns required

- 12 months personal bank statements or 24 months Business Statements used for income

- Loans up to $3 million

- Credit scores down to 600

- Rates starting in the 5-6% range.

- Up to 90% LOAN TO VALUE means only 10% Down!

- DTI up to 50% Debt To Income Ratio

- Owner-occupied, 2nd homes, and investment properties

- 2 years seasoning for foreclosure, short sale, BK, DIL

- Non-warrantable condos considered

- Jumbo loans down to 640 score

- 5/1 ARM or 30-year fixed

- No pre-payment penalty for owner-occ and 2nd homes

- SFRs, townhomes, condos, 2-4 units

- Seller concessions to 6% (2% for investment)

Bank Statement Questions and Answers

Bank Statement Questions and Answers

4 Different Options For using Business Bank Statement Only!

- do-i-need-rental-history-to-qualify-for-a-bank-statement-only-mortgage

- Whats the minimum credit score for a bank statement only loan?

- How is income calculated for your bank statement only mortgage loan program?

- How long do I have to prove self-employed to qualify for your bank Statement only loan program?

- Whats your minimum loan amount for a bank statement only mortgage loan?

- how long does it take to get a Pre Approval letter on a Bank Statement only mortgage?

- what-if-im-self-employed-but-cannot-prove-i-have-been-in-business-for-at-least-2-years

- What deposits are NOT used the qualify using bank statements only for income?

- Can i deposit money into more than 1 bank account and still qualify the income?

- how-much-of-a-down-payment-do-i-need-for-a-bank-statement-only-loan

- How long does it take to qualify and close on a bank statement only loan?