50K-250K FLORIDA BAD CREDIT HOME EQUITY LINE OF CREDIT HOME EQUITY PARTNERS- UNLOCK YOUR WEALTH

HOME EQUITY PARTNERS- UNLOCK YOUR WEALTH

- 400+FICO BAD CREDIT FLORIDA CASH-OUT MORTGAGE REFINANCE

- 50k-250k GEORGIA BAD CREDIT HOME EQUITY LINE OF CREDIT

- Florida Bad Credit Home Equity Line Of Credit +Cashout+No Monthly Payments

This is Not A Loan. Get 35,000 to 250,000 with no monthly payments!

Until Now, your home equity has been locked up unless you took on more debt. This program is different. You get cash today for a piece of your Florida home equity, without adding any more monthly payment obligations. As your partner investing in your home right alongside you, we do well when you do well!

Have debt that needs paying off? A kitchen that is overdue for some upgrades? Need assistance with unexpected medical bills? Point gets it. Whatever you need, we can help you achieve your financial goals and get back to enjoying life.

This is Not A Loan. The investor is a partner in your property. That means there’s no interest rate and no monthly payments. If your cash flow has been burdened by crippling debt payments each month, Point is your ticket to freedom.

HOW DOES A HOME EQUITY PARTNER WORK?

YOUR FLORIDA HOME EQUITY PARTNER

FACE LIFES CHALLENGES WITH A PARTNER ON YOUR SIDE!

Do you have a debt to pay off? A kitchen that is overdue for some upgrades? Need assistance with unexpected medical pills? We can help! Whatever you need, we can help you achieve your financial goals and help you tap into your home equity.

FLORIDA HOME EQUITY LINE OF CREDIT WITH NO PAYMENTS

The prorgram does not lend money. The lender invest in your property as a partner. That means there’s no monthly payments. If your debt to income ratio is currently out of control by debt paymetn each month our program might be your ticket to freedom.

FLORIDA HOME EQUITY LINE OF CREDIT PROCESS

The program takes a holistic approach to underwriting and uses technology to make the process efficient for homeowners, processing your client’s application is fast, easy, and completely done online. Homeowners will upload all their supporting documents using our online underwriting tool and will interact directly with us through email.

- FLORIDA HOME EQUITY ALTERNATIVE FEATURES

Funding Amount $35,000 – $250,000 (to 15%-25% of Appraisal Value) for up to Term 10 years

● HOME EQUITY ALTERNATIVE FOR FLORIDA HOMEOWNERS

This equity option was created for homeowners who need access to their home equity wealth but do not meet conventional HELOC and home equity loan underwriting guidelines. For homeowners, is a tax-deferred

lump sum with NO monthly payments.

● HOW THE FLORIDA HOME EQUITY OPTION WORKS

The investor buys a fraction of the homeowner’s property for up $250,000 or 15%-25% of its current value. We process applications quickly, so funds can be in the homeowner’s

bank account in 3-5 weeks.

● NO MONTHLY PAYMENT FLORIDA HOME EQUITY OPTION

is not a loan so there are no monthly payments. There’s

no interest rate either. We’re invested in the property with

the homeowner, we share in the gain or loss in value as a

partner.

● BUY BACK ANYTIME OR REPAYMENT ON SALE

is automatically paid its share of the property’s value

when the property is sold. Homeowners can buy out at

any time during the 10-year term. In either case, the

effective interest rate is capped for the homeowner!

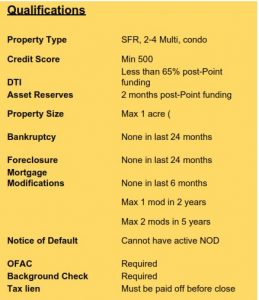

● HOME EQUITY ALTERNATIVE QUALIFICATIONS

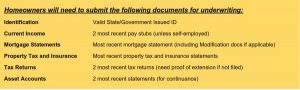

- Homeowners will need to submit the following documents for underwriting:

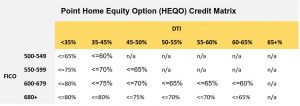

● FLORIDA HOME EQUITY MATRIX

How is the line of credit recorded on the property?

records a Deed of Trust with an Option Memorandum. The Deed of trust is recorded at the investment amount and Option Memorandum explains Point’s interest in the subject property.

How is the value of the home determined?

A third-party appraisal company to conduct the appraisals for homeowners. The company works directly with

the homeowner to schedule and complete the appraisal on the property, using independent licensed appraisers in the

homeowner’s local market.

Are all properties subject to Risk Adjustment and what are the usual discount percentages to the value.

Yes, all properties are subject to the risk-adjustment. The range is 15-20% and is considered risk-based pricing.

How much appreciation does share in the future home value?

The appreciation share amount is generally between 20%-40% and is considered part of the risk-based pricing,

impacted mostly by the amount of the investment (higher check size usually results in larger share of appreciation). Will you accept partial payments on existing loans to minimize balance?

No. Because the repayment is tied to the value of the property at the moment of repayment, partial payments are not

allowed. Asking for a payoff at any given time would require full payment to be made.

What types of properties will be invested in?

Owner Occupied and Non-Owner Occupied properties, as long as they meet the property requirements

(SFR/Condo/Multi-family 2-4, less than 1 acre, less than $3.5 in value, and in market area). Non-Owner Occupied

are subject to a Florida loan to value Penalty (max Florida loan to value of 70% including investment) and must be in 2nd lien position.

Can you close concurrently with a new First Mortgage?

No. We need to have the most current Florida loan to value on the property, as well as updated title info so that we can secure our Deed of Trust without errors. The homeowner should close on the 1st mortgage and take on after.

Will subordinate to a new first mortgage or second Florida mortgage?

Yes. will subordinate to a first and a second, but will not subordinate lower than a 3rd lien position. Any new liens

added to the property after the investment should be discussed with prior to completion.

What types of loans will subordinate its lien position to?

will take a lien position behind most types of mortgages, with a few exceptions. Reverse mortgages and other Equity

Sharing products (or any other negatively amortizing loan) are loans that will not go behind. PACE/HERO loans

remaining in place after funding must be no larger than 50% of the investment.

What vesting types will accept?

The partnerships accept most forms of fee simple ownership. Vesting the property in a trust is allowed, but trust docs will need to be provided for underwriters to review. The only form of vesting that is not currently allowed is Tenancy-In-Common.

HOW QUICKLY DOES FLORIDA BAD CREDIT EQUITY LOAN PAY?

We usually send the money within 4 business days of closing.

WHO IS A FLORIDA BAD CREDIT EQUITY LOAN FOR?

Florida BAD CREDIT EQUITY LOAN is ideal for Florida homeowners who want to access the equity they have accumulated in their Florida homes and are interested in the flexibility of having no monthly repayments.

WHAT HAPPENS IF I DON’T SELL MY FLORIDA HOME?

If a Florida homeowner does not sell her Florida home within the term, she has the option to buy out the investors during the term or at the end of the term at the then-current property value.

HOW DO FLORIDA HOMEOWNERS US FLORIDA BAD CREDIT EQUITY LOAN?

For diversifying some of your wealth, paying off and reducing your monthly debt payments, financing one-time major expenses or acting as a bridge ahead of your next Florida home purchase or real estate investment.