Bad Credit Florida Cash-Out Mortgage Refinance

- Florida Mortgage Approvals with Poor or Bad Credit

- Bad Credit Florida Mortgage Lenders

- Cashout Florida Bad Credit Mortgage Lenders

- Cash-Out Florida Refinance – NO SEASONING REQUIRED!!!

If you 50k-250k GEORGIA BAD CREDIT HOME EQUITY LINE OF CREDIT Florida Bad Credit Home Equity Line Of Credit +Cashout+No Monthly Payments

If you 50k-250k GEORGIA BAD CREDIT HOME EQUITY LINE OF CREDIT Florida Bad Credit Home Equity Line Of Credit +Cashout+No Monthly Payments

POPULAR PAGES INCLUDE

-

FLORIDA BAD CREDIT CASH-OUT MORTGAGE LENDERS

https://www.florida-mortgage-lenders.com/portfolio/…Florida Bad Credit Home Equity Loans-A bad credit equity loan is an excellent source of funds, it can free up your equity in your Florida home, and you can get cash for any purpose.This bad credit Florida home loan can be a revolving line of credit, or a fully amortized 15 year loan. We provide competitive home equity loans rates and home equity loans.

-

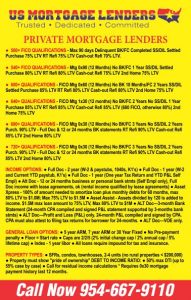

500+FICO BAD CREDIT FLORIDA CASH-OUT MORTGAGE …

https://www.florida-mortgage-lenders.com/bad…BAD CREDIT MORTGAGE LENDERS PROGRAMS INCLUDE: Bank Statement Only Bad Credit Florida Mortgage Lenders FHA Bad Credit Mortgage Lenders VA Bad Credit Florida Mortgage Lenders USDA Bad Credit Florida Mortgage Lenders Jumbo Bad Credit Florida Mortgage Lenders Hard Money Bad Credit Hard Money Lenders …

-

3.5% DOWN BAD CREDIT FLORIDA MORTGAGE LENDERS

https://www.florida-mortgage-lenders.com/bad-credit.htmlFLORIDA BAD CREDIT MORTGAGE LENDERS PROGRAMS INCLUDE: FHA Bad Credit Mortgage Lenders VA Bad Credit Florida Mortgage Lenders USDA Bad Credit Florida Mortgage Lenders Jumbo Bad Credit Florida Mortgage Lenders Condominium Florida Bad Credit Mortgage Lenders Town House Florida Bad Credit Mortgage …

-

500+Bad Credit Florida Cash-out Refinance Mortgage Lenders

https://www.fhamortgageprograms.com/min-500-bad…Many bad credit Florida cash out mortgage seekers struggle with how to tap into the equity in their Florida home. Bad credit Florida mortgage lenders are governed by regulations and restrictions placed on \ Florida cash-out refinancing. The good news is you are not alone if you do not understand the process. The bottom line is bad credit Florida mortgage lenders help you get cash out of your Florida …

As a result of the mortgage cash, Florida mortgage lenders have strict requirements for homeowners with bad credit. Millions of American are property rich and cash challenged.

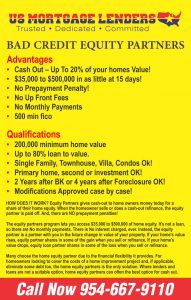

Our Equity Partners alternative program releases equity homeowners have in their house now and gives them time to either buy the home back or sell the house.

NO Minimum Credit Score

Liquidate or sell your home for about 70% of fair market value today and get up to 5 years to either buy your home back or sell the home and capture the rest of your equity.

Why Bad Credit Cash Out Refinance Homeowner Love Equity Partners

FAST & FLEXIBLE- Cashout NOW within 21 days or less. Repurchase your home or move at any point.

FEWER QUALIFICATIONS – We don’t have a minimum credit score or income requirement.

TRANSPARENCY- We’re upfront about fees. You receive a contract tailored just for you.

Introducing: Equity Partners

If you cannot we created a new way for your to access your money saved in your house, not borrowed money. It’s simple, we buy your home, you get your equity. You can put that money towards your business, paying off debts, your kid’s college tuition, or that unexpected life event.

Equity Partners Gives you Options — You Can Repurchase or Move At Any Time

We want to help people by providing a new and flexible way for them to release

their equity. Life doesn’t always go as planned, and when the financial hits begin

to add up, getting out of the hole can be tough. The current equity release options

out there aren’t set up to help the people who really need it. We want to help

homeowners get a fresh start so they can live life on their terms while keeping

their options open.

Millions of Americans are property rich and cash poor. As a result of the credit

crisis, lenders have strict requirements that disqualify many of the homeowners

applying for re-financing. Without viable alternative options, they are forced to

sell their homes and move. You shouldn’t have to sell your house in a panic. You

deserve the chance to get your life in order and establish some financial stability.

We created Equity Partners to provide homeowners with a new way to release their

equity, without having to move, or who aren’t ready to move.

Equity Partners, the first commercialized residential sale leaseback program in the USA,

allows homeowners to sell their home, then lease it back. Unique to Equity Partners,

homeowners have the ability and flexibility to buy back their home or move at any

time, releasing the full equity of their home. On top of that, our program doesn’t

have many of the barriers that are associated with other equity extraction options

like HELOC loans or reverse mortgages.

1. Get qualified: Once you complete our qualification form, you will be notified if

your home qualifies. A team member will reach out within 2 days to discuss the

next steps.

2. We create a custom contract: We agree on a funding amount, rental price,

buyback price, and initial lease term.

3. We buy your home, and you get your equity: We execute the sale and lease

agreements. Closing takes 30 days, but can expedite if necessary.

4. You can carry on living at home: You continue to live in your home, paying a

monthly rent. You can buy back your home, or move, at any time.

5. You buy back your home: Buy back your home for the buyback price.

You decide to move: We put your house on the market, once sold, you move

and receive the sellout value.

Once our proposal is accepted, Equity Partners will send you the purchase and

sale agreement and the lease agreement. We always advise our customers

to consult an attorney. We will send an inspector to the property to check for

any maintenance issues. Equity Partners will also run a title report and address any

concerns. Upon closing you’ll receive your cash.

You can access the remainder of your equity if and when you decide to move.

Once a buyer is found and the home is sold, you’ll receive the remainder of your

equity, minus any accrued rent and fees.

Scenario: The Smiths own a house worth $240,000 and they have a mortgage

with a current balance of $80,000. They want to invest money into starting a

new business, but they are behind on their mortgage and have a below average

credit score.

Solution: Equity Partners will buy the Smith’s home for $150,000, paying off the

mortgage, allowing the Smiths to walk away from the closing with $70,000 in

cash. The Smiths then become tenants for two years. At any time during the

lease term, they can buy the house back for $160,000 OR request the house be

listed with a local realtor and sold at fair market value.

Once sold, the Smiths would then receive the net sale proceeds over $160,000

(e.x $240,000 – $160,000 = proceeds of $80,000 – transaction costs).cash. The

Smiths then become tenants for two years. At any time during the lease term,

they can buy the house back for $160,000 OR request the house be listed with

a local realtor and sold at fair market value. Once sold, the Smiths would then

receive the net sale proceeds over $160,000 (i.e $240,000 -$160,000 = proceeds

of $80,000 – transaction costs).

or liens.

Equity Release: Providing a homeowner or other property owner with funds

derived from the value of their property, while offering the right to use the

property.

Funding Amount: Equity Partners ’s total initial payment (including paying off mortgage

balances).

Annual Inflation Premium: A 2.5% increase that may be applied to yearly rent or

buyback price to account for inflation.

Lease Termination Option: A clause in the Equity Partners lease contract allowing the

homeowner to sell, buyback, or continue to rent their home.

Buyback Price: Your price to buy back your home at any time, calculated by adding

the funding amount and the greater of the CPI or annual inflation premium.

Sellout Value: The amount of money you receive after your house sells, calculated

by subtracting the buyback price and closing costs from the estimated sale price.

The sellout value is an estimate, as we do not know what price the home will sell

for.

Closing Costs: The cost of transferring your property either to Equity Partners , or to the

next buyer May include but not limited to: attorney fees, origination fees (the cost

of opening a bank account), title transfer fees (state fee for transferring ownership),

title insurance, real estate broker commission, filing fees.

Glossary

Page 7

Who is Equity Partners for?

Equity Partners is for single family homeowners who need to access their home equity,

but do not want to, or are not ready to move. We can currently help homeowners

with homes valued at at least $150,000 with at least 50% equity in their homes,

regardless of credit score.

How much rent will I pay?

We aim to have you pay “market rent.” Market rent is based on the rent being paid

for similar homes in your area.

What is the lease term length?

A year is the standard minimum lease length. You can renew your year lease with

three months’ notice.

How long does it take to close?

Typically, it will take 30 days to close. However, we can expedite if necessary.

What documents are used in a Sell and Stay transaction?

The “Sell” is governed by a purchase and sale agreement, and the “Stay” is

governed by a residential lease.

During the Sell and Stay process, who handles the paperwork?

We use lawyers to draft our agreements, which are then sent to you. You or your

lawyer will be responsible for reviewing the documents. We highly recommend

you use a lawyer too!

How do I buy back my home?

The lease includes an “Option Agreement” allowing you to buy back your home at

Our Lease has an Option Agreement has language allowing you to authorize the

sale of your house at any time. You will have the ability to control the timing,

asking price, and real estate agent, if you’d like. If a sale is finalized prior to your

lease end date, you are able to terminate the lease early. The price that your home

sells for, less the buyback price and closing fees, will be entitled to you.

If I decide to buy back the property, who handles inspections, appraisals and

financing options?

We are happy to refer you to our partners. Your lawyer is also able to assist with

this.

What if I default on my lease?

You will be given written notice of the default and the opportunity to fix the

problem (aka cure the default). If you do not cooperate and cure the default (fix

the problem), we may be forced to evict. Even if your lease ends with an eviction,

we will still give you the net sale proceeds after deducting the back rent, legal

expenses and selling costs. Please note, we will sell the property using an auctionsale process, to prevent conflicts of interest and ensure transparency around

this sale.

Who gets the value if my home appreciates during the lease term?

You any appreciation above our annual premium; as the buyback price is fixed,

you receive the net sale proceeds minus fees.

Who handles the home maintenance?

The tenant is responsible for maintenance including cutting the grass, snow

removal and appliance repairs.

Equity Partners will pay the property taxes.

Is there a property manager?

You will not have a local property manager.

Do I need to hire an attorney?

A lawyer is not needed, but recommended.

Do I need insurance?

We recommend all tenants consider renters insurance.

www.Florida-Mortgage-Lenders.com

If you

If you