bad credit Texas mortgage lenders

Texas Bad Credit Cash OUT Refinance UP To $500K In Hand!

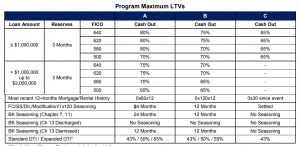

- Min Fico 500+ (including jumbo)

- Up to 85% LTV (purchase & R/T) w/ no MI

- 1 day out of Foreclosure, Short Sale, Bankruptcy, SS, BK, or Deed in Lue

- Up to 80% of your home value (cash-out)

- Maximum cash-out to $500,000

- Loans up to $1 million (minimum loan $100,000)

- Cash out for reserves OK

- Mortgage Late Payments OK

- DTI up to 55% considered

- Limited or no tradelines OK to max 75% LTV

Texas Bad Credit Cash-out Refinance Fico And Loan To Value

- 500+ Fico Rate and term Bad Credit Cashout down to 65% of Appraisal

- 540+ Fico Rate and term Bad Credit Cashout down to 70% of Appraisal

- 600+ Fico Rate and term Bad Credit Cashout down to 75% of Appraisal

- 640+ Fico Rate and term Bad Credit Cashout down to 80% of Appraisal

- 680+ Fico Rate and term Bad Credit Cashout down to 80% of Appraisal

- $1,500,000 = Bad Credit Cashout = Max Loan Amount

Texas Bad Credit Cash-out Refinance General Information

Loan Terms: ● 5 year ARM, 7 year ARM or 30 Year Fixed Options

● No Prepayment penalty ● Floor = Start rate

● Caps are 2/2/5 (2% initial change cap/ 2% annual cap/ 5% lifetime cap)

● All bad credit loans require to impound for tax and insurance Texas home Types:

● SFRs, condos, townhouses, 2-4 units (no rural Texas bad credit mortgage loans < $200,000)

● The Texas home must be clean and in better than average cond

● The Texas home must show “pride of ownership” Debt to Income Ratio:

● 55% Max back end ratio

Texas Bad Credit Cash-out Refinance Income Documentation

● Alt Doc Options- 24 months business bank statements or 24 or 12 months personal bank statements(self-employed only), rental income qualified by lease agreements.

● Full Doc – W-2 & paystubs, 1040s ● Full Doc – 1 year (W-2 and Current YTD Paystub)

● Full Doc – 1 year (One-year Tax Return, Self Employed)

● Alt Doc – 24 months business bank statements or 24 or 12 months personal bank statements(self-employed only), rental income qualified by lease agreements.

● Asset Only Options- 100% of amount needed to amortize loan plus monthly debts for 60 months, max 80% LTV to 1.0M; Max 75% LTV to $1.5M

● Asset Assist- Assets divided by 120 is added to income. $1.5M max loan amount to 75% LTV, Max 80% LTV to $1M. Down Payments:

● All down payment funds must be verified prior to drawing loan documents

● Secondary Financing 80% Max LTV/90% Max CLTV Tax Liens, Judgments:

● All tax liens and judgments must be paid at closing. Collection Accounts:

● Collections and charge off the need to be paid off except – Medical Collections – Collection accounts older then 2 years First time home buyer:

Texas Cash-Out Requirements

One Texas cash out mortgage applicants must have held title to the subject property for at least 6 months (measured from previous note date to subject note date). Loan is considered a cash-out

refinance if:

Paying off a first and/or second Texas mortgage that is not Texas 50(a)(6) and is getting cash-out.

Paying off a first mortgage that is a Texas 50(a)(6) loan, is not getting any cash out and is paying off a second lien that is not a Texas 50(a)(6) loan, which was

not used in whole to acquire the subject property.

Paying off a first mortgage that is not a Texas 50(a)(6) loan and is paying off a second lien that is a Texas 50(a)(6) loan, and

o The Texas cash out mortgage applicants is getting cash back from the refinance, or

o The Texas cash out mortgage applicants is not getting cash out but is paying a second mortgage that was not used in whole to acquire the subject property.

Cash-out Refinance For all cash-out refinance transactions: a signed letter from the Texas cash out mortgage applicants disclosing the purpose of the cash-out must be obtained. At least one Texas cash out mortgage applicants must have been

on title a minimum of six (6) months prior to the new note date and a minimum of 6 months must have elapsed since the most recent mortgage transaction on the subject

property (either the original purchase transaction or subsequent refinance). Note date to note date is used to calculate the 6 months.

There is no waiting period if the Texas cash out mortgage applicants acquired the property through an inheritance or was legally awarded the property through divorce, separation, or dissolution of

a domestic partnership.

Texas Bad Credit Cash Out Texas Mortgage Refinance Programs

- Texas Bad Credit Cash Out Refinance Bank Statement Only

- Texas Bad Mortgage Refinance To Pay off Tax Liens And Mechanics Liens

- Bad Credit Cash Out Refinance Texas Business Loans!

- FL Mortgage After Foreclosure – Short Sale – Bankruptcy- Foreclosure

- Bad Credit Cash Out Refinance Texas mortgage

- Bad Credit Cash Out Refinance Texas Mortgage Refinance

- Bad Credit Cash Out Refinance Texas Portfolio Lenders

- Buy a Texas home 1 day after a Foreclosure or Bankruptcy

- Bad Credit Cash Out Refinance Texas FHA Mortgage Lenders

- No Credit score Texas mortgage

- Bad Credit Cash Out Refinance Texas FHA mortgage

- Hard Money Texas mortgage

- Bad Credit Cash Out Refinance Texas Modular Home Loans

- Texas Chapter 13 Bankruptcy Mortgage Lenders

- Bad Credit Cash Out Refinance 2nd Second Texas Mortgage

- Texas Stop Foreclosure Loans

- Bad Credit Cash Out Refinance Texas VA mortgage

- Bad Credit Cash Out Refinance Texas Cash for Deed

- Bad Credit Cash Out Refinance Texas Mortgage Rates Sheet

- Bad Credit Cash Out Refinance Texas Mortgage with Judgements

- Bad Credit Cash Out Refinance Texas Mortgage with Evictions

- Bad Credit Cash Out Refinance Texas Mortgage with Tax Liens

- Bad Credit Cash Out Refinance Investor Loans Buyer Or Refi With Texas LLC!

bad credit Texas property types

All Texas bad credit mortgage loans must be residential in nature. Tax certification and exemptions for the property are to be reviewed and must meet the following requirements:

Property must be a principal residence constituting the bad credit Texas cash out mortgage applicants’s homestead in state of Texas.

The homestead property may not exceed the applicable acreage limit as determined by Texas law.

All separate structures must be included in the homestead exemption.

The homestead parcel, as identified on the county appraisal district records, must include ingress/egress to a properly identified public road.

The new lien may only be secured by the homestead parcel and the market value for LTV calculation can only be assessed on that parcel.

Texas CASh-OUT MORTGAGE loan PARAMETERS

The following are considered Texas Section 50(a)(6) loans:

Loans using Texas cash out refinance mortgage proceeds to pay off an existing 50(a)(6) loan (as identified in title work)

Loans using Texas cash out refinance mortgage proceeds to pay off federal tax debt liens

Loans using Texas cash out refinance mortgage proceeds to pay property tax liens on the property securing the new loan

Loans using Texas cash out refinance mortgage proceeds to pay off or pay down debts that are not secured by the homestead property

Loans with any cash back to the bad credit Texas cash out mortgage applicants

The following are NOT considered Texas Section 50(a)(6) loans:

Loans using Texas cash out refinance mortgage proceeds to pay current taxes due on the property securing the loan

Loans using Texas cash out refinance mortgage proceeds to buy out equity pursuant to a court order or agreement of the parties (usually applies to a divorce settlement) require that an acceptable

Owelty lien of partition is established. The Owelty lien documents should be reviewed and approved by the company’s Texas counsel before the loan can

proceed to closing.

Note: Owelty liens are a type of lien that allows the owner of a home to use the existing equity in their home to assist in dividing property in the case of a divorce

or inheritance. The Texas Constitution specifically designates an Owelty of partition as one of the permitted encumbrances on a Texas homestead.

Loan Texas cash out refinance mortgage proceeds used to pay a prepayment penalty assessed on an existing non-50(a)(6) loan, and the prepayment is included in the payoff amount (new loan

must have a new title policy issued without exception to the financing of the prepayment fee)

Loans that include the payment of HOA dues, if title company requires them to be paid

Rate/Term refinance loans that include the payment by the lender of reasonable closing costs in the loan amount are acceptable.

Texas CASh-OUT MORTGAGE REQUIREMENTS

The bad credit Texas cash out mortgage applicants(s) must be provided a complete and accurate copy of the Final 1003, no later than one (1) business day prior to loan closing.

The bad credit Texas cash out mortgage applicants(s) must be provided a complete and accurate copy of the Final Closing Disclosure no later than one (1) business day prior to loan closing.

The following Subsections of the Closing Disclosure: A. (Origination Charges), B. (Services bad credit Texas cash out mortgage applicants Did Not Shop For), C. (Services bad credit Texas cash out mortgage applicants Did Shop For), E. (Taxes

and Other Government Fees), or H. (Other) cannot change, either up or down, from the Closing Disclosure the bad credit Texas cash out mortgage applicants(s) acknowledged at least one (1) business day

prior to the closing. If a change occurs, a new Closing Disclosure must be provided and acknowledged by the bad credit Texas cash out mortgage applicants(s) at least one (1) business day prior to the

closing.

The bad credit Texas cash out mortgage applicants(s) must sign “bad credit Texas cash out mortgage applicants’s Certification of Receipt of Settlement Statement and Accuracy Thereof”” (also called Acknowledgement of Itemization of

Fees, Points, Interest, Costs and Charges for Texas Home Equity Loan or Line of Credit at closing.

Both spouses must execute the mortgage; however, both spouses are not required to be parties to the promissory note. All individuals on title and their spouses

(including non-titled spouses) must sign the Security Instrument, TIL, Right of Rescission, if applicable and the Texas Notice Concerning Extensions of Credit.

bad credit Texas cash out mortgage applicants(s) must be provided a copy of all documents at closing and sign the Acknowledgement of Receipt of Copies. The documents may not contain any blank

spaces.

All loans must contain a Texas Attorney Representation letter

All bad credit Texas cash out mortgage applicantss must attend the closing and execute the documentation in person at the closing.

Texas Notice Concerning Extensions of Credit – 50(a)(6) 12 Day Notice

Texas Acknowledgement Regarding the Fair Market Value of Homestead Property – LO/Broker and bad credit Texas cash out mortgage applicants must sign form

Texas Home Equity Affidavit Agreement – bad credit Texas cash out mortgage applicants acknowledgement that copies of all documentation was provided

Discount Point Disclosure – bad credit Texas cash out mortgage applicants signs if discount points were paid by the bad credit Texas cash out mortgage applicants

Texas CASh-OUT MORTGAGE REFINANCE OCCUPANCY

Homesteaded Properties Only: All bad credit Texas cash out mortgage applicantss on the loan (other than a spouse) must be on title and occupy the subject property as their primary residence.

Texas Home Equity loans are only allowed on the bad credit Texas cash out mortgage applicants’s homestead. There is also a requirement that the bad credit Texas cash out mortgage applicants have a present intention to reside in the

property as the bad credit Texas cash out mortgage applicants’s principal residence for a period of at least one year after closing.

bad credit Texas cashout mortgage lenders

Credit Score Use middle FICO score of the primary wage earner

Housing History 30’s and 1 x 60 in the past 12 months allowed (No add‐on to rate) 1 or more 90 day late in the past 12 months allowed

Min Credit Score Owner Occupied: 500 Non‐Owner Occupied: 580 Non‐Perm Resident Aliens: 580 Second Home: 580 First Time Homebuyer: 540

Bad Credit Mortgage Lenders Trade line Requirements Standard: 3 trade lines reporting for ≥ 12 month; or 2 trade lines reporting for ≥ 24 months with activity in the past 12 months 12 to 24 months canceled rent checks can be used as a trade line Limited Trade lines Max LTV 75% No minimum trade line requirements Not allowed on Investment Texas bad credit mortgage loans

DTI Requirements Max 40/50% Investment Texas bad credit mortgage loans max 50%

Seasoning Requirements Foreclosure, Deed‐In‐Lieu & Short Sale – None

Bankruptcy 7 ‐ 12 months

from discharge date Bankruptcy 7: None when property excluded from

BK and a 0 x 30 x 12 residential pay history Bankruptcy 13: None if filed >24

months ago and paid as agreed All BK’s must be discharged (case by case exceptions) Reserves 3 months minimum Investment Texas bad credit mortgage loans – 6 months

Loan amounts ≥ $453,100 ‐ 6 months Loans ≥ $750,000 ‐ 9 months

Second Home – 6 months First Time Homebuyer – 6 months

Limited trade lines – 6 months Non‐Perm Resident Aliens – 6 months

Non‐Perm Resident Alien with non‐US credit – 12 months Residual Income Primary Residence $1,500

First‐Time Homebuyer Residential pay history 0x30

Texas bad Texas bad credit Cashout Refinance – • For Texas homes owned 12-months or longer, the LTV/CLV is based upon the appraised value. • If Cash-Out Seasoning is 7-11 months, the transaction property value is limited to the lower of the current appraised value or the property’s purchase price + documented improvements• If Cash-Out Seasoning is 6 months or less, the transaction property value is limited to delayed financing or inherited Texas homes.

Texas Home and Property Types -Eligible: Single Family Residences1-4 Units, PUDs, Townhouses, Condominiums (Warrantable & Non-Warrantable condos approved case by case:

Ineligible Texas Texas homes include: • Acreage greater than 10 acres (appraisal must include total acreage) • Agricultural zoned property • Condo hotel • Co-ops • Hobby Farms •Income producing Texas homes with acreage • Leaseholds • Log Homes • Manufactured housing • Mixed-use Texas homes • Modular homes • Texas homes subject to oil and/or gas leases •Unique Texas homes • Working farms, ranches or orchards.

Texas Approved Condos Property Types –Fannie Mae eligible projects and Non-Warrantable projects allowed • GreenBox Loans, Inc. project exposure maximum shall be $3,000,000 or 15% of the project whichever is lower • bad credit Texas cash out mortgage applicants project/Unit concentration limit: two (2) units • Project meets all FNMA Insurance requirements for property, liability and fidelity coverage • bad credit Texas cash out mortgage applicants must carry H06 coverage for replacement of such items as flooring, wall covering, cabinets, fixtures, built-ins and any improvements made to the unit • The Condo Project Questionnaire must be completed, including all the required documentation from the questionnaire including: CCR, Articles of Incorporation, By-Laws, Master Insurance Policy, Budget / Balance Sheet & HOA questionnaire .• All projects are subject to full review and approval.

Texas Tax Liens – All Texas income tax liens (federal, state, local) must be paid off prior to or at loan closing. Tax liens that do not impact title may remain open provided the

following are meet;

• The file must contain a copy of the repayment agreement

• A minimum of 6-payments has been made under the plan with all payments made on time

• The balance of the lien must be included when determining the maximum CLTV for the program

• Refinance transactions require a subordination agreement from the taxing authority

bad Texas bad credit bad Texas bad credit Downpayment requirements- Down payment funds should be documented for 60 days per the Fannie Mae Verification of Deposits and Assets guidelines with the documentation

included in the loan file.In addition to documenting the down payment, closing costs, and minimum PITIA reserve requirements, all bad credit Texas cash out mortgage applicantss must disclose and verify all other

liquid assets.• Business funds may be used for down payment, closing costs and for the purposes of calculating reserves. GreenBox will perform a business cash flow analysis to confirm that the withdrawal of funds for this transaction will not have a negative impact on the business. GreenBox will utilize FNMA Form

1084 or a similar cash flow analysis form to show the business can support the withdrawal of the funds.

• Account Statements should cover most recent 60-day period

• Stocks/Bond/Mutual Funds -100% of stock accounts can be considered in the calculation of assets for closing and reserves;

• Vested Retirement Account funds –60% may be considered for closing and/or reserves;

• Non-vested or restricted stock accounts are not eligible for use as down payment or reserves.

• Any assets which produce income or are used as income already included in the income calculation are not eligible for use as down payment or reserves.

Texas Mortgage After Texas mortgage after bankruptcy / bad Texas bad credit Housing Event- Chapter 7 and Chapter 11 bankruptcies must be discharged for a minimum of 12 months from closing date. Seasoning is measured from the month and

year of discharge. There is no seasoning requirement for Chapter 13 bankruptcies when the Texas mortgage after bankruptcy is discharged prior to closing. If the Chapter 13 Texas mortgage after bankruptcy was dismissed

, 12-months’ seasoning is required from the date of the dismissal.

A Chapter 13 Texas mortgage after bankruptcy may remain open after loan closing when all of the following requirements are met:

• A minimum 12-month repayment period in the Texas mortgage after bankruptcy has elapsed.

• All required Texas mortgage after bankruptcy plan payments have been made on time.

• The bad credit Texas cash out mortgage applicants has received written permission from the Texas mortgage after bankruptcy court to enter into the mortgage transaction.

• Full Texas mortgage after bankruptcy papers may be required. For a 120-day mortgage late, seasoning is from the date the mortgage was brought current. Seasoning for a modification is from the date the modification

was executed. A cash-out refinance to pay off the remaining balance of a Chapter 13 Texas mortgage after bankruptcy is allowed. In addition to meeting the requirements listed above, the

transaction must provide an overall reduction in monthly obligations for the bad credit Texas cash out mortgage applicants.

Texas Mortgage with Texas collections And Charge-Offs Individual collection and non-mortgage charge-off accounts equal to or greater than $250 and accounts that total more than $2,000 must be paid in

full prior to or at closing.

Medical Texas collections may remain open with a max cumulative balance of $10,000

Texas collections and charge-offs that have expired under the state statute of limitations on debts may be excluded. Evidence of expiration must be documented

.

All open Texas judgments, garnishments, and all outstanding liens must be paid off prior to or at loan closing. Charge-offs and Texas collections not excluded by the above bullet points must be paid or may stay open if using one or a combination of both of the following:

o Payments for open charge-offs or Texas collections are included in the DTI (Subject to program DTI restrictions)

o Reserves are sufficient to cover the balance of the charge-offs or Texas collections and meet reserve requirements.

Texas bad Texas bad credit Mortgage bad Texas bad credit Standards

Clean housing history since housing event • Any non-mortgage account can be no more than 30-days delinquent at time of application. Any delinquent

account must either be brought current or paid off at closing.

Standard: 3 tradelines reporting for 12+ mo’s or 2 tradelines reporting for 24+ mo’s with activity in the last 12 mo’s Limited: No minimum tradeline

requirements.

Only the primary bad credit Texas wage-earner must meet the minimum tradeline requirements listed above. To qualify as an acceptable tradeline, the bad Texas bad credit line must be reflected on the bad credit Texas cash out mortgage applicants’s bad Texas bad credit report. The bad credit Texas account must have activity in the past 12 months and may be open or closed. bad credit Texas Accounts with delinquencies are allowed when the account is no more than 30-days past due at time of application. An acceptable 12- or 24-month housing history not reporting on bad Texas bad credit may also be used as a tradeline. bad Texas bad credit lines on which the bad credit Texas mortgage applicants are not obligated to make payments are not acceptable for establishing a minimum history. Examples of unacceptable tradelines include loans in a deferment period, collection or charged-off accounts accounts discharged through bankruptcy, and authorized user accounts. Student loans can be counted as tradelines as long as they are in repayment and are not deferred. Standard Tradelines: Texas mortgage applicants qualifying with Standard Tradelines are eligible for all occupancy types and programs. Limited Tradelines: The following requirements apply when qualifying with Limited Tradelines: 10% minimum Texas mortgage applicants contribution • Minimum 6 months reserves after closing • Full documentation of income. When qualifying with Limited Tradelines, the lower of either the Representative Loan Score or a 580 score is used to qualify the bad credit Texas cash out mortgage applicants on the Non-Prime Matrix and Recent Housing Event Matrix. The loan may be priced, however, using the actual Representative Loan Score • Primary residence only

Texas mortgage applicants Housing late payments exceeding 1x60x24 require a letter of explanation from the Texas mortgage applicants. The situation causing the delinquency must be adequately

documented as resolved. The new housing payment must be considered when determining if the situation is adequately resolved.

Texas bad Texas bad credit Mortgage Lenders Requirments

| Texas bad Texas bad credit Mortgage | Texas bad Texas bad credit Mortgage Min Fico |

| Min Fico | 500 |

| Housing | 1 x 120 0 x 30 since housing event |

| Chapter 13 or Chapter 7 bankruptcy | 12 months payment or settled |

| Foreclosure | Settled |

| short sale | settled |

| BAD CREDIT CASH OUT MORTGAGE LENDERS IN EVERY CITY IN TEXAS | |

| Houston Texas BAD CREDIT CASH OUT Mortgage Refinance | 2,099,451 |

| San Antonio Texas BAD CREDIT CASH OUT Mortgage Refinance | 1,327,407 |

| Dallas Texas BAD CREDIT CASH OUT Mortgage Refinance Texas | 1,197,816 |

| Austin Texas BAD CREDIT CASH OUT Mortgage Refinance Texas | 790,390 |

| Fort Worth Texas BAD CREDIT CASH OUT Mortgage Refinance | 741,206 |

| El Paso Texas BAD CREDIT CASH OUT Mortgage Refinance | 649,121 |

| Arlington Texas BAD CREDIT CASH OUT Mortgage Refinance | 365,438 |

| Corpus Christi Texas BAD CREDIT CASH OUT Mortgage Refinance | 305,215 |

| Plano Texas BAD CREDIT CASH OUT Mortgage Refinance | 259,841 |

| Laredo Texas BAD CREDIT CASH OUT Mortgage Refinance | 236,091 |

| Lubbock Texas BAD CREDIT CASH OUT Mortgage Refinance | 229,573 |

| Garland Texas BAD CREDIT CASH OUT Mortgage Refinance | 226,876 |

| Irving Texas BAD CREDIT CASH OUT Mortgage Refinance | 216,290 |

| Amarillo Texas BAD CREDIT CASH OUT Mortgage Refinance | 190,695 |

| Grand Prairie Texas BAD CREDIT CASH OUT Mortgage Refinance | 175,396 |

| Brownsville Texas BAD CREDIT CASH OUT Mortgage Refinance | 175,023 |

| Pasadena Texas BAD CREDIT CASH OUT Mortgage Refinance | 149,043 |

| Mesquite Texas BAD CREDIT CASH OUT Mortgage Refinance | 139,824 |

| McKinney Texas BAD CREDIT CASH OUT Mortgage Refinance | 131,117 |

| McAllen Texas BAD CREDIT CASH OUT Mortgage Refinance | 129,877 |

| Killeen Texas BAD CREDIT CASH OUT Mortgage Refinance | 127,921 |

| Waco Texas BAD CREDIT CASH OUT Mortgage Refinance | 124,805 |

| Carrollton Texas BAD CREDIT CASH OUT Mortgage Refinance | 119,097 |

| Beaumont Texas BAD CREDIT CASH OUT Mortgage Refinance | 118,296 |

| Abilene Texas BAD CREDIT CASH OUT Mortgage Refinance | 117,063 |

| Frisco Texas BAD CREDIT CASH OUT Mortgage Refinance | 116,989 |

| Denton Texas BAD CREDIT CASH OUT Mortgage Refinance | 113,383 |

| Midland Texas BAD CREDIT CASH OUT Mortgage Refinance | 111,147 |

| Wichita Falls Texas BAD CREDIT CASH OUT Mortgage Refinance | 104,553 |

| Odessa Texas BAD CREDIT CASH OUT Mortgage Refinance | 99,940 |

| Round Rock Texas BAD CREDIT CASH OUT Mortgage Refinance | 99,887 |

| Richardson Texas BAD CREDIT CASH OUT Mortgage Refinance | 99,223 |

| Tyler Texas BAD CREDIT CASH OUT Mortgage Refinance | 96,900 |

| Lewisville Texas BAD CREDIT CASH OUT Mortgage Refinance | 95,290 |

| College Station Texas BAD CREDIT CASH OUT Mortgage Refinance | 93,857 |

| San Angelo Texas BAD CREDIT CASH OUT Mortgage Refinance | 93,200 |

| Pearland Texas BAD CREDIT CASH OUT Mortgage Refinance | 91,252 |

| Allen Texas BAD CREDIT CASH OUT Mortgage Refinance | 84,246 |

| League Texas BAD CREDIT CASH OUT Mortgage Refinance Texas BAD CREDIT CASH OUT Mortgage Refinance | 83,560 |

| Longview Texas BAD CREDIT CASH OUT Mortgage Refinance | 80,455 |

| Sugar Land Texas BAD CREDIT CASH OUT Mortgage Refinance | 78,817 |

| Edinburg Texas BAD CREDIT CASH OUT Mortgage Refinance | 77,100 |

| Mission Texas BAD CREDIT CASH OUT Mortgage Refinance | 77,058 |

| Bryan Texas BAD CREDIT CASH OUT Mortgage Refinance | 76,201 |

| Baytown Texas BAD CREDIT CASH OUT Mortgage Refinance | 71,802 |

| Pharr Texas BAD CREDIT CASH OUT Mortgage Refinance | 70,400 |

| Missouri Texas BAD CREDIT CASH OUT Mortgage Refinance Texas BAD CREDIT CASH OUT Mortgage Refinance | 67,358 |

| Temple Texas BAD CREDIT CASH OUT Mortgage Refinance | 66,102 |

| Harlingen Texas BAD CREDIT CASH OUT Mortgage Refinance | 64,849 |

| Flower Mound town | 64,669 |

| North Richland Hills Texas BAD CREDIT CASH OUT Mortgage Refinance | 63,343 |

| Victoria Texas BAD CREDIT CASH OUT Mortgage Refinance | 62,592 |

| New Braunfels Texas BAD CREDIT CASH OUT Mortgage Refinance | 57,740 |

| Mansfield Texas BAD CREDIT CASH OUT Mortgage Refinance | 56,368 |

| Conroe Texas BAD CREDIT CASH OUT Mortgage Refinance | 56,207 |

| Rowlett Texas BAD CREDIT CASH OUT Mortgage Refinance | 56,199 |

| Port Arthur Texas BAD CREDIT CASH OUT Mortgage Refinance | 53,818 |

| Euless Texas BAD CREDIT CASH OUT Mortgage Refinance | 51,277 |

| DeSoto Texas BAD CREDIT CASH OUT Mortgage Refinance | 49,047 |

| Cedar Park Texas BAD CREDIT CASH OUT Mortgage Refinance | 48,937 |

| Galveston Texas BAD CREDIT CASH OUT Mortgage Refinance | 47,743 |

| Georgetown Texas BAD CREDIT CASH OUT Mortgage Refinance | 47,400 |

| Bedford Texas BAD CREDIT CASH OUT Mortgage Refinance | 46,979 |

| Pflugerville Texas BAD CREDIT CASH OUT Mortgage Refinance | 46,936 |

| Grapevine Texas BAD CREDIT CASH OUT Mortgage Refinance | 46,334 |

| Texas Texas BAD CREDIT CASH OUT Mortgage Refinance Texas BAD CREDIT CASH OUT Mortgage Refinance | 45,099 |

| Cedar Hill Texas BAD CREDIT CASH OUT Mortgage Refinance | 45,028 |

| San Marcos Texas BAD CREDIT CASH OUT Mortgage Refinance | 44,894 |

| Haltom Texas BAD CREDIT CASH OUT Mortgage Refinance Texas BAD CREDIT CASH OUT Mortgage Refinance | 42,409 |

| Wylie Texas BAD CREDIT CASH OUT Mortgage Refinance | 41,427 |

| Keller Texas BAD CREDIT CASH OUT Mortgage Refinance | 39,627 |

| Coppell Texas BAD CREDIT CASH OUT Mortgage Refinance | 38,659 |

| Huntsville Texas BAD CREDIT CASH OUT Mortgage Refinance | 38,548 |

| Duncanville Texas BAD CREDIT CASH OUT Mortgage Refinance | 38,524 |

| Sherman Texas BAD CREDIT CASH OUT Mortgage Refinance | 38,521 |

| Rockwall Texas BAD CREDIT CASH OUT Mortgage Refinance | 37,490 |

| Hurst Texas BAD CREDIT CASH OUT Mortgage Refinance | 37,337 |

| Burleson Texas BAD CREDIT CASH OUT Mortgage Refinance | 36,690 |

| Texarkana Texas BAD CREDIT CASH OUT Mortgage Refinance | 36,411 |

| Lancaster Texas BAD CREDIT CASH OUT Mortgage Refinance | 36,361 |

| The Colony Texas BAD CREDIT CASH OUT Mortgage Refinance | 36,328 |

| Friendswood Texas BAD CREDIT CASH OUT Mortgage Refinance | 35,805 |

| Weslaco Texas BAD CREDIT CASH OUT Mortgage Refinance | 35,670 |

| Del Rio Texas BAD CREDIT CASH OUT Mortgage Refinance | 35,591 |

| Lufkin Texas BAD CREDIT CASH OUT Mortgage Refinance | 35,067 |

| San Juan Texas BAD CREDIT CASH OUT Mortgage Refinance | 33,856 |

| La Porte Texas BAD CREDIT CASH OUT Mortgage Refinance | 33,800 |

| Nacogdoches Texas BAD CREDIT CASH OUT Mortgage Refinance | 32,996 |

| Copperas Cove Texas BAD CREDIT CASH OUT Mortgage Refinance | 32,032 |

| Socorro Texas BAD CREDIT CASH OUT Mortgage Refinance | 32,013 |

| Deer Park Texas BAD CREDIT CASH OUT Mortgage Refinance | 32,010 |

| Schertz Texas BAD CREDIT CASH OUT Mortgage Refinance | 31,465 |

| Rosenberg Texas BAD CREDIT CASH OUT Mortgage Refinance | 30,618 |

| Waxahachie Texas BAD CREDIT CASH OUT Mortgage Refinance | 29,621 |

| Cleburne Texas BAD CREDIT CASH OUT Mortgage Refinance | 29,337 |

| Farmers Branch Texas BAD CREDIT CASH OUT Mortgage Refinance | 28,616 |

| Kyle Texas BAD CREDIT CASH OUT Mortgage Refinance | 28,016 |

| Big Spring Texas BAD CREDIT CASH OUT Mortgage Refinance | 27,282 |

| Lake Jackson Texas BAD CREDIT CASH OUT Mortgage Refinance | 26,849 |

| Harker Heights Texas BAD CREDIT CASH OUT Mortgage Refinance | 26,700 |

| Southlake Texas BAD CREDIT CASH OUT Mortgage Refinance | 26,575 |

| Leander Texas BAD CREDIT CASH OUT Mortgage Refinance | 26,521 |

| Eagle Pass Texas BAD CREDIT CASH OUT Mortgage Refinance | 26,248 |

| Kingsville Texas BAD CREDIT CASH OUT Mortgage Refinance | 26,213 |

| Little Elm Texas BAD CREDIT CASH OUT Mortgage Refinance | 25,898 |

| Greenville Texas BAD CREDIT CASH OUT Mortgage Refinance | 25,557 |

| Weatherford Texas BAD CREDIT CASH OUT Mortgage Refinance | 25,250 |

| Seguin Texas BAD CREDIT CASH OUT Mortgage Refinance | 25,175 |

| Paris Texas BAD CREDIT CASH OUT Mortgage Refinance | 25,171 |

| San Benito Texas BAD CREDIT CASH OUT Mortgage Refinance | 24,250 |

| Alvin Texas BAD CREDIT CASH OUT Mortgage Refinance | 24,236 |

| Corsicana Texas BAD CREDIT CASH OUT Mortgage Refinance | 23,770 |

| Balch Springs Texas BAD CREDIT CASH OUT Mortgage Refinance | 23,728 |

| Marshall Texas BAD CREDIT CASH OUT Mortgage Refinance | 23,523 |

| Watauga Texas BAD CREDIT CASH OUT Mortgage Refinance | 23,497 |

| University Park Texas BAD CREDIT CASH OUT Mortgage Refinance | 23,068 |

| Colleyville Texas BAD CREDIT CASH OUT Mortgage Refinance | 22,807 |

| Denison Texas BAD CREDIT CASH OUT Mortgage Refinance | 22,682 |

| Kerrville Texas BAD CREDIT CASH OUT Mortgage Refinance | 22,347 |

| Plainview Texas BAD CREDIT CASH OUT Mortgage Refinance | 22,194 |

| Benbrook Texas BAD CREDIT CASH OUT Mortgage Refinance | 21,234 |

| Sachse Texas BAD CREDIT CASH OUT Cash Out Mortgage Refinance | 20,329 |

Dealing with Texas Debt Consolidation- USA.gov

Texas Debt Consolidation Refinance . Consolidation means that your various debts, such as credit card bills or loan payments, are rolled into one monthly payment. If you have multiple credit card accounts or loans, Texas debt consolidation Refinance through a mortgage refinance can help simplify or lower your payments.

Credit and Debt

- Credit Cards

- Credit Issues

- Credit Reports and Scores

- Dealing with Debt