1099 GEORGIA Mortgage Lenders – No Tax Returns – No Bank Statements

- BANK STATEMENT ONLY-GEORGIA STATED MORTGAGE LENDERS!

- Georgia Bank Statement Only Mortgage Lenders

- 10%DOWN+Georgia Self Employed Mortgage Lenders – WE SAY YES!

- NO TAX RETURNS+GA SELF EMPLOYED MORTGAGE LENDERS

GEORGIA BANK STATEMENT ONLY MORTGAGE LENDERS THAT ONLY NEED 1099’S:

GEORGIA BANK STATEMENT ONLY MORTGAGE LENDERS THAT ONLY NEED 1099’S:

- 1099 Only GEORGIA Mortgage Lenders – 2 Years Self Employed Required!

- 1099 Only GEORGIA Mortgage Lenders – Last 2 years 1099a used to qualify!

- 1099 Only GEORGIA Mortgage Lenders – No tax returns required

- 1099 Only GEORGIA Mortgage Lenders – NO Business Or Personal Tax Returns Needed!(Personal and Business)

- 1099 Only GEORGIA Mortgage Lenders – Loans up to $3 million

- 1099 Only GEORGIA Mortgage Lenders – Credit scores down to 600

- 1099 Only GEORGIA Mortgage Lenders – Credit scores down to 500 if mortgage payments timely

- 1099 Only GEORGIA Mortgage Lenders – Up to 85% LTV

- 1099 Only GEORGIA Mortgage Lenders – DTI up to 55% considered

- 1099 Only GEORGIA Mortgage Lenders – Owner-occupied, 2nd homes, and investment properties

- 1099 Only GEORGIA Mortgage Lenders – 1 day seasoning for foreclosure, short sale, BK, DIL

- 1099 Only GEORGIA Mortgage Lenders – Non-warrantable condos considered

- 1099 Only GEORGIA Mortgage Lenders – Jumbo loans down to 660 score

- 1099 Only GEORGIA Mortgage Lenders – 5/1 ARM or 30-year fixed

- 1099 Only GEORGIA Mortgage Lenders – No pre-payment penalty for owner-occ and 2nd homes

- 1099 Only GEORGIA Mortgage Lenders – SFRs, townhomes, condos, 2-4 units

- 1099 Only GEORGIA Mortgage Lenders – Seller concessions to 6% (2% for investment)

What is a 1099 GEORGIA Mortgage Lender?

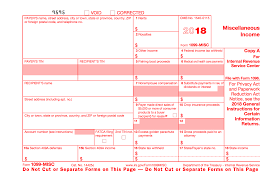

The 1099 form is a series of GEORGIA independent contractor documents the IRS Internal Revenue Service refers to as “information returns.” There are a number of different GEORGIA 1099 forms that report the various types of income you may receive throughout the year other than the salary your GEORGIA employer pays you. A GEORGIA independent contractor or or a GEORGIA entity that pays you is responsible for filling out the appropriate GEORGIA 1099 tax form and sending it to you by regular mail.

GEORGIA Independent Contractor or Freelancer Income

If you are a GEORGIA worker earning a salary or wage, your GEORGIA employer reports your annual earnings at year-end on IRS Form W-2. However, if you are an independent contractor, freelancer or GEORGIA self-employed you probably receive a Form 1099. from each business client that pays you at least $600 per year during the tax year.

For example, if you are a freelance writer, consultant or artist, you hire yourself out to individuals or GEORGIA companies on a contract basis. The income you receive from each contract or job and or service you take part in should be reported to you on by the GEORGIA business on Form 1099. When you prepare your tax return, the IRS requires you to report all of this income and pay income tax on it. Your are still required to report all of your income even if you do not receive a form 1099.

1099 from interest and dividend income

When you own a portfolio of stock investments or mutual funds, you may receive a Form 1099-DIV to report the dividends and other distributions you receive during the year. These payments are different than the income you earn from selling stocks. Rather, it is a payment of the corporation’s earnings directly to shareholders.

Other types of investments you have may pay periodic interest payments rather than dividends. These interest payments are also taxable and are usually reported to you on Form 1099-INT. Commonly, taxpayers receive this form from banks where they have interest bearing accounts.

1099-C income from debt cancellation

Sometimes, transactions can increase your taxable income even when you don’t receive a payment. This commonly occurs when a creditor cancels a portion of your outstanding debt. When this happens, the IRS treats the debt cancellation as income which may be taxable to you. For example, if your credit card company no longer requires you to pay your outstanding balance, it may send you Form 1099-C to report the amount of debt it cancels and you may need to report this amount on your tax return.

1099 income from Government payment Income

The federal and state governments are equally responsible for reporting income that it pays to taxpayers. Government agencies commonly use Form 1099-G to report the state income tax refunds and unemployment compensation you receive during the year. If you receive unemployment income, you must include the entire amount your state reports on the 1099-G form in your taxable income. However, you only include your state refund in income if you claimed a deduction state income taxes in a prior tax year.

Income Withdrawals from a retirement account

When you withdraw money from your traditional IRA, in most cases it is taxable. You will receive a Form 1099-R that reports your total withdrawals for the year. The form also covers other types of distributions you receive from pension plans, annuities and profit-sharing plans. Usually the 1099-R will show the taxable amount of the distribution on the form itself and will report the amount of federal tax that was withheld.

- NO TAX RETURN 1099 SELF EMPLOYED ONLY MORTGAGE LENDERS

- GEORGIA SELF EMPLOYED MORTGAGE LENDERS USING BS

- SELF EMPLOYED MORTGAGE LENDERS+NO TAX RETURNS ..

- GEORGIA SELF EMPLOYED MORTGAGE LENDERS USING BS

- 10%DOWN+SELF EMPLOYED GEORGIA MORTGAGE LENDERS

1099 SELF EMPLOYED MORTGAGE LENDERS QUESTIONS AND ANSWERS

- do-i-need-rental-history-to-qualify-for-a-bank-statement-only-mortgage

- Whats the minimum credit score for a bank statement only loan?

- How is income calculated for your bank statement only mortgage loan program?

- How long do I have to prove self-employed to qualify for your bank Statement only loan program?

- Whats your minimum loan amount for a bank statement only mortgage loan?

- how long does it take to get a Pre Approval letter on a Bank Statement the only mortgage?

- what-if-im-self-employed-but-can not-prove-i-have-been-in-business-for-at-least-2-years

- What deposits have NOT used the qualify using bank statements only for income?

- Can i deposit money into more than 1 bank account and still qualify the income?

- how-much-of-a-down-payment-do-i-need-for-a-bank-statement-only-loan

- How long does it take to qualify and close on a bank statement the only loan?

GEORGIA BANK STATEMENT ONLY MORTGAGE LENDERS THAT ONLY NEED 1099’S

GEORGIA BANK STATEMENT ONLY MORTGAGE LENDERS THAT ONLY NEED 1099’S