PALM BEACH FLORIDA CONDO MORTGAGE LENDERS

- PALM BEACH FLORIDA CONDO + CONDOTELS + NON-WARRANTABLE CONDO LENDERS

- NON-WARRANTABLE CONDO LENDERS PALM BEACH FLORIDA

- Miami Beach — Panama City Beach FL –Fort Lauderdale FL – Palm Beach FL–

PALM BEACH FLORIDA CONDO + CONDO-TEL MORTGAGE LENDERS OPTIONS

- PALM BEACH FLORIDA Condo Lenders Minimum Credit Score = Minimum Credit Score 500

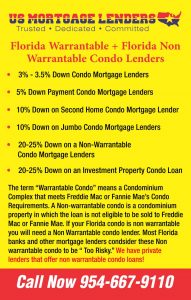

- 3.5% FHA mortgage down payment for FHA Approved PALM BEACH FLORIDA Condo Mortgage Loans.

- 100% financing for VA Approved PALM BEACH FLORIDA Condo Mortgage Loans.

- 3% down payment for Fannie Mae Approved PALM BEACH FLORIDA Condo Loans.

- 5% down payment PALM BEACH FLORIDA Condo Mortgage For Owner Occupied.

- 10% down payment for Second PALM BEACH FLORIDA Condo Mortgage.

- 20% down payment for Investment PALM BEACH FLORIDA Condo Mortgage Loans.

- 20% down for Jumbo PALM BEACH FLORIDA Condo Mortgage Loans.

- 20% down Non or Un Warrant-able Condo Lenders

- 20% Down PALM BEACH FLORIDA CondoTel Mortgage Lenders

PALM BEACH FLORIDA CONDO MORTGAGE LENDERS PROVIDE:

- Loan Closings in as little as 21 to 30 days.

- We offer same day free same day pre approvals!

- 48 hour underwriting.

- We follow Fannie Mae underwriting guidelines and don’t add additional loan requirements like many PALM BEACH FLORIDA banks do!

- We see oout necessary information to determine if the PALM BEACH FLORIDA condo mortgage will qualify for financing up front within 1 to 5 days so you don’t waste money on a PALM BEACH FLORIDA condo inspection and appraisal if it doesn’t qualify.

- Many years combined experience working with national PALM BEACH FLORIDA condo mortgage lenders.

- We work for you and only get paid when we’re successful condo mortgage closes! In most cases, our fees are paid by the PALM BEACH FLORIDA condo mortgage lender so clients have no out of pocket expenses for loan origination costs.

- We don’t just offer the normal PALM BEACH FLORIDA condo mortgage loan programs like most banks do, We offer ALL PALM BEACH FLORIDA condo mortgage loan programs available and we offer them without the additional underwriting requirements and loan limitations that other PALM BEACH FLORIDA mortgage lenders may have.

- We’re your direct access to many nationwide wholesale PALM BEACH FLORIDA condo mortgage Lenders.

PALM BEACH FLORIDA CONDOS GET MORTGAGE LENDERS TURNED DOWN BECAUSE:

- Won’t accept the master condo Insurance policy.

- Require 20% down payment.

- Require at least 51% be owner occupied & second homes.

- Is listed on their not lend list.

- It’s a Non Warrantable condo or a Condotel.

- If you have the PALM BEACH FLORIDA condo association budget and the condo questionnaire already completed please email it to us for approval.

PALM BEACH FLORIDA CONDO MORTGAGE LENDERS DOWN PAYMENT REQUIREMENTS

PALM BEACH FLORIDA condo mortgage applicants will find that a mortgage loan approvals on a PALM BEACH FLORIDA Condo is more complex than purchasing a single family house, townhouse or villa. With PALM BEACH FLORIDA condos there are additional requirements for these PALM BEACH FLORIDA mortgage transactions. The PALM BEACH FLORIDA Condo association must be approved via condo association questionnaire before you can secure PALM BEACH FLORIDA condo mortgage approval.

If the condo is on the FHA Approved List you can purchase the condominium as a primary residence with a 3.5% down-payment.

| FANNIE MAE CONDO MORTGAGE LENDERS DOWN PAYMENT | |

|---|---|

| Primary Condo Residences Down payment: | 5% |

| Second Condo Homes Down payment: | 10% |

| Investment Condo Property Down payment: | 10% |

For Fannie Mae not Approved PALM BEACH FLORIDA Condos purchases, typically the minimum down payment is 25%.

We encourage that you put more money down so that we can waive the project approval requirements.

| LIMITED REVIEW PALM BEACH FLORIDA CONDO MORTGAGE LENDERS CONDO DOWN PAYMENT | |

|---|---|

| Primary Condo Residences Down payment: | 25% |

| Second Condo Homes Down payment: | 30% |

| Condo Questionnaire: | Not Required |

| Budget Review: | Not Required |

PALM BEACH FLORIDA CONDO MORTGAGE LENDERS CONDO REVIEW PROCESS

A PALM BEACH FLORIDA Condo Limited Review Lender process used by PALM BEACH FLORIDA Condo mortgage lenders on properties for PALM BEACH FLORIDA condo approvals. A full review can take time and can be costly and if the PALM BEACH FLORIDA condo mortgage underwriter finds any flaws in the condo association’s financials and or if there are litigation issues, the PALM BEACH FLORIDA condo mortgage loan applicant may get their condo mortgage loan application denied. Getting a PALM BEACH FLORIDA Condo mortgage on a PALM BEACH FLORIDA condo with limited review is the way to go for projects not approved by Fannie Mae.