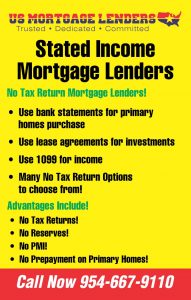

NO TAX RETURN TEXAS MORTGAGE LENDERS

- NO TAX RETURN SELF EMPLOYED MORTGAGE LENDERS

- NO DOC TEXAS COMMERCIAL MORTGAGE LENDERS

Serving All Texas Including And Not Limited to Fort Worth Texas, Austin Texas, Dallas Texas, San Antonio Texas, Houston Texas

- 10% Down with a 660! Fico

- 15% Down with a 600 Foco!

- 90% LTV financing with No PMI

- Loans up to $3 million

- First-time homebuyers are allowed with some restrictions.

- Available after two years after derogatory credit events such as bankruptcy, short sale, deed in lieu, or property foreclosure.

Self Employed Mortgage Using Bank Statements For Income!

Self-employed mortgage applicants have often had a tougher time obtaining mortgage financing under the traditional full documentation bank lenders requirements. Today, for self-employed mortgage applicants that are the sole owners of their business, we have a very flexible bank statement only loan programs to help them obtain a mortgage at competitive terms without the need of your tax returns. Now self-employed can use your bank statements to qualify with relative ease instead of your tax returns. This particular program provides flexibility in qualifying and also flexibility with major credit events with reestablished and/or reaffirmed credit over the past two years.

Self Employed Program Requirements:

- Must proof self-employment for at least 24 months!

- 12 or 24 months personal bank statement or 12 or 24-month business bank statements at your option.

- Self-employed income will be isolated and averaged on the selected statements to determine a qualifying income for the loan.

- An accountant letter will be required to verify ownership of the business.

- There are no tax returns or transcripts required on this program.

The bank statement only loan program is a flexible tool for self-employed business owners when it comes to qualifying for a loan. Please contact us directly for further details and to see if this option is a good fit for your financing needs.