SELF EMPLOYED MORTGAGE LENDERS+NO TAX RETURNS NEEDED…

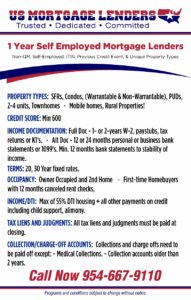

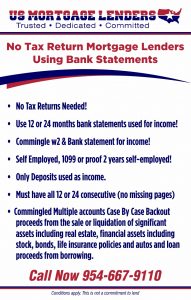

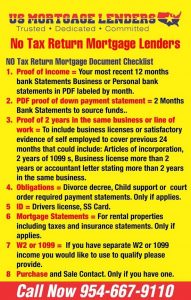

SELF EMPLOYED MORTGAGE LENDERS-NO TAX RETURNS NEEDED TO PURCHASE OR REFINANCE A HOME- Min 600 FICO Loan Amounts From $100,000 to $3,000,000, Use 12 or 24-month bank statements only to qualify. No TAX RETURNS NEEDED!,

Calculate income for self-employed borrowers

with greater efficiency and confidence

Texas Self Employed Lenders can benefit from a new process to calculate income for self-employed borrowers through s FNMA SEI 1084 workbook. The new enhancement allows Texas Self Employed Lenders to experience a consistent and reliable process to calculate self-employment income that is aligned with Fannie Mae’s Selling Guide.

SELF EMPLOYED MORTGAGE LENDERS+NO TAX RETURNS …

SELF EMPLOYED MORTGAGE LENDERS-NO TAX RETURNS NEEDED TO PURCHASE OR REFINANCE A HOME- Min 580 FICO Loan Amounts From $150,000 to $3,000,000, Use 12 or 24-month bank statements only, Loans …

-

1099 Texas Self Employed Mortgage Lenders

texas-mortgage-lenders.com/1099-texas-self-employed-mortgage-lendersTexas 1099 Self Employed 1099 Mortgage Lenders Program Information- Exceptions to published 1099 Self Employed Mortgage Lenders guidelines are considered on a case-by-case basis.1099 Self …

-

DALLAS TX SELF EMPLOYED MORTGAGE LENDERS

https://www.fhamortgageprograms.com/dallas-tx-self…Dallas Texas Self Employed Mortgage Lenders Serving Every Dallas Texas location including and not limited to: Abilene, Alice, Alvin, Amarillo, Andrews, Angleton, Arlington, Athens, Bay City, Beaumont, …

Texas Mortgage Lenders : TEXAS SELF EMPLOYED-BANK …

https://texas-mortgage-lenders.blogspot.com/2018/…Texas Cities with populations over 10,000 include and are not limited to: Abilene, Alice, Alvin, Amarillo, Andrews, Angleton, Arlington, Athens, Bay City, Beaumont, Beeville, Belton, Big Spring Self Employed

COVERAGE AREAS SERVING ALL TEXAS INCLUDING;