3.5 CLEARWATER FLORIDA FHA MORTGAGE LENDERS – CLEARWATER FL FHA MORTGAGE LENDERS Serving all Florida including Clearwater Florida zip codes: 33755, 33756, 33759, 33761, 33763, 33764, 33765, 33767.

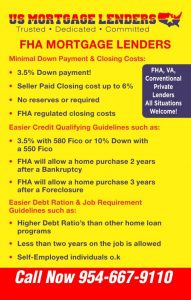

CLEARWATER FLORIDA FHA MORTGAGE LOANS HAVE MINIMAL DOWNPAYMENT AND CLOSING FEES:

- The down payment only 3.5% of the purchase price.

- Gifts from family or Grants for down payment assistance and closing costs OK!

- The seller can credit buyers up to 6%of sales price towards buyers costs.

- No reserves or future payments in the account are required.

- FHA regulated closing costs.

CLEARWATER FLORIDA FHA MORTGAGE LOANS ARE EASY TO QUALIFY FOR BECAUSE YOU CAN:

- Purchase a Florida home 12 months after a chapter 13 Bankruptcy

- Purchase a Florida 24 months after a chapter 7 Bankruptcy.

- FHA will allow a FHA mortgage 3 years after a Foreclosure.

- Minimum FICO credit score of 580required for96.5%financing.

- Bad credit Florida FHA mortgage approvals minimum FICO credit score of 550 required for 90 FHA financing.

- No Credit Score Florida mortgage loans & No Trade Line Florida FHA home loans.

CLEARWATER FLORIDA FHA MORTGAGE LOANS ALLOW HIGHER DEBT TO INCOME & EASIER JOB QUALIFYING

- FHA allows higher debt ratios than any other Florida home loan programs.

- Less than two years on the same job is OK!

- Self-employed buyers can also qualify for FHA.

- Check Florida FHA Mortgage Articles for more information.

CLEARWATER FLORIDA FHA MORTGAGE BULLETS:

- CLEARWATER FHA MORTGAGE LOANS ARE EASY TO QUALIFY & EASY TO AFFORD- The Federal Housing Administration (FHA) insures FHA mortgage loans against default as a way to help first-time home buyers, as well as lower and middle-income citizens. Unlike traditional mortgages, FHA loans require lower down payments and easier credit requirements to secure a loan. In fact, FHA mortgages now make up nearly a third of all new purchase mortgages in America. Get Started Now!

- CLEARWATER FLORIDA BAD CREDIT FHA MORTGAGE LENDERS? -That is Not a Problem- Florida Mortgage Lenders.com is ready to help all Florida residents in all saturation with their next Florida home purchase! Whether you’re looking for a turn-key property, hoping to refinance your current Florida home, or purchase a fixer-upper, Florida Mortgage Lenders.com can help you secure an FHA mortgage loan in the in every city and county in Florida. With an FHA mortgage loan, you can buy a property with little money down, or cash out using equity in your current home. Don’t hesitate – give us a call today to find the right FHA mortgage programs for your situation. Ready to apply now? Click the button at the bottom of the page. Our Florida specialists look forward to helping you secure your new home!

- CLEARWATER FLORIDA FIRST TIME HOME BUYERS- For the last 10 years, Florida Mortgage Lenders.com has served Florida as one of the top Florida FHA Mortgage Lenders. We’ve helped residents secure Florida FHA loans in every city and county in Florida. Buying or refinancing a home can be tricky, but we are here to help. Imagine a streamlined, stress-free Florida mortgage approval process: that’s what you get when you apply for a mortgage with us! We take pride in taking care of our clients for life.

- CLEARWATER FLORIDA FHA MORTGAGE REQUIRMENTS AND BENEFITS- Florida FHA Mortgages are only available for a borrower’s Primary Residence. You cannot

- CLEARWATER FHA MORTGAGE FOR HOME BUYERS The fact is, there are a wide range of FHA home loans available to qualified Florida mortgage applicants. And the real truth is, these programs are based on a common sense approach to lending and approval is not heavily based on your credit score. Many people find this very difficult to believe, but it is in fact dictated by HUD guidelines that credit scores cannot be considered during underwriting, only credit quality instead. This gives consumers who might not otherwise have the ability to secure a low fixed interest rate mortgage ample opportunity to qualify. It is one of the biggest benefits that many FHA mortgage loans offer to people just like you.

- CLEARWATER FLORIDA FHA STEAMLINE REFINACE– With the FHA streamline mortgage program, so long as your mortgage payments have been on time for the prior 12 months, you can inexpensively take advantage of any improvements in market Interest Rates. Even if you had a “payment” bump in the road, you can still possibly qualify for a FHA streamline mortgage refinance with the right circumstances!

- ABOUT FLORIDA-MORTGAGE-LENDERS.COM has no affiliation with the government, including HUD or the FHA. In addition, our program is not pre-approved by the government or your lender. Your lender may not necessarily change your loan based on your acceptance of our offers.

- CLEARWATER FLORIDA HOMEBUYERS APPLY FOR A FLORIDA FHA MORTGAGE NOW!! Florida Mortgage requirements are always changing, and Florida homebuyers can count on Florida Mortgage Lenders.com to provide up-to-date information support. In addition, we are one of Florida most active and experienced Florida mortgage lenders. With so many options out there, our job is to help you make the best decision for you. We make the FHA application process easy to understand and are always here to answer questions. Our website is also packed with information for you to browse. Our secure mortgage application is available online when you’re ready to apply for a mortgage and we will even call you to start the process.

NO INCOME VERIFICATION FLORIDA MORTGAGE LENDERS

NO TAX RETURNS FLORIDA MORTGAGE LENDERS

NO INCOME VERIFICATION COMMERCIAL FLORIDA MORTGAGE LENDERS

BAD CREDIT NO TAX RETURN FLORIDA MORTGAGE LENDER

Clearwater FL Self Employed Mortgage Lenders Florida Zip codes: 33755, 33759, 33761, 33763, 33764, 33765, 33767, 34695.

CLEARWATER FL Self Employed Mortgage Lenders DATA

- Clearwater, FL Self Employed Mortgage Lendersorida

Clearwater: Dolfin in Gulf of Mexico, off shore of Clearwater FL Self Employed Mortgage LendersoridaClearwater: Dolphin in Gulf of Mexico, off shore of Clearwater FL Self Employed Mortgage Lendersorida - Clearwater: Pelicans on the pier Clearwater: Pelicans on the pier

- Clearwater: Sunset at Clearwater Beach Clearwater: Sunset at Clearwater Beach

- Clearwater: BridgeClearwater: Bridge

- Clearwater: Clearwater BeachClearwater: Clearwater Beach

- Clearwater: Beautiful sunset at Clearwater BeachClearwater: Beautiful sunset at Clearwater Beach

- Clearwater: Dock at the end of Turner StreetClearwater: Dock at the end of Turner Street

- ClearwaterClearwater

- Clearwater: Island Estate, at Clearwater Beach zip code 33767Clearwater: Island Estate, at Clearwater Beach zip code 33767

- Clearwater: Clearwater BeachClearwater: Clearwater Beach

- Clearwater: Clearwater Beach Clearwater: Clearwater Beach

Current weather forecast for Clearwater, FL Self Employed Mortgage Lenders

Population in 2014: 110,703 (100% urban, 0% rural). Population change since 2000: +1.8%

Males: 52,742 (47.6%)

Females: 57,961 (52.4%)

Median resident age: 43.0 years

FL Self Employed Mortgage Lendersorida median age: 41.5 years

Clearwater Zip Code Map

Estimated median household income in 2013: $44,768 (it was $36,494 in 2000)

Clearwater: $44,768

FL Self Employed Mortgage Lenders: $46,036

Estimated per capita income in 2013: $28,684 (it was $22,786 in 2000)

Clearwater city income, earnings, and wages data

Estimated median house or condo value in 2013: $152,800 (it was $91,100 in 2000)

Clearwater: $152,800

FL Self Employed Mortgage Lenders: $153,300

Mean prices in 2013: All housing units: $195,055; Detached houses: $214,235; Townhouses or other attached units: $125,910; In 2-unit structures: $148,211; In 3-to-4-unit structures: $141,272; In 5-or-more-unit structures: $218,775; Mobile homes: $41,028

Median gross rent in 2013: $883.

Recent home sales, real estate maps, and home value estimator for zip codes: 33755, 33756, 33759, 33761, 33763, 33764, 33765, 33767.

Serving all cities around Clearwater FL Self Employed Mortgage Lenders

Anna Maria, FL Self Employed Mortgage Lenders

Apollo Beach, FL Self Employed Mortgage Lenders

Aripeka, FL Self Employed Mortgage Lenders

Bay Pines, FL Self Employed Mortgage Lenders

Belleair Beach, FL Self Employed Mortgage Lenders

Clearwater, FL Self Employed Mortgage Lenders

Crystal Beach, FL Self Employed Mortgage Lenders

Dunedin, FL Self Employed Mortgage Lenders

Elfers, FL Self Employed Mortgage Lenders

Ellenton, FL Self Employed Mortgage Lenders

Gibsonton, FL Self Employed Mortgage Lenders

Holiday, FL Self Employed Mortgage Lenders

Hudson, FL Self Employed Mortgage Lenders

Indian Rocks Beach, FL Self Employed Mortgage Lenders

Land O Lakes, FL Self Employed Mortgage Lenders

Largo, FL Self Employed Mortgage Lenders

Lutz, FL Self Employed Mortgage Lenders

Mango, FL Self Employed Mortgage Lenders

New Port Richey, FL Self Employed Mortgage Lenders

Odessa, FL Self Employed Mortgage Lenders

Oldsmar, FL Self Employed Mortgage Lenders

Ozona, FL Self Employed Mortgage Lenders

Palm Harbor, FL Self Employed Mortgage Lenders

Palmetto, FL Self Employed Mortgage Lenders

Parrish, FL Self Employed Mortgage Lenders

Pinellas Park, FL Self Employed Mortgage Lenders

Port Richey, FL Self Employed Mortgage Lenders

Riverview, FL Self Employed Mortgage Lenders

Ruskin, FL Self Employed Mortgage Lenders

Safety Harbor, FL Self Employed Mortgage Lenders

Saint Petersburg, FL Self Employed Mortgage Lenders

San Antonio, FL Self Employed Mortgage Lenders

Seminole, FL Self Employed Mortgage Lenders

Spring Hill, FL Self Employed Mortgage Lenders

Sun City, FL Self Employed Mortgage Lenders

Sun City Center, FL Self Employed Mortgage Lenders

Tampa, FL Self Employed Mortgage Lenders

Tarpon Springs, FL Self Employed Mortgage Lenders

Terra Ceia, FL Self Employed Mortgage Lenders

Wesley Chapel, FL Self Employed Mortgage Lenders

POPULAR CLEARWATER FL Self Employed Mortgage Lenders FHA PAGES