HOLLYWOOD FL MORTGAGE LENDERS

Welcome and thank you for visiting US Mortgage Lenders webpage. We are local HOLLYWOOD Florida mortgage lenders. We are available to answer any questions you might have 24/7.

US Mortgage Lenders professionals have earned their excellent 5 star zillow and google reviews by opening more doors to homes in HOLLYWOOD Florida than your average Florida lender. To discuss any of our full service HOLLYWOOD Florida programs including, FHA minimum score 550, FHA Cash Out and Streamlines refinancing, Private lenders, Jumbo Loans, VA Mortgage loans down to 550 and Foreign National Loans. Note All Subject to change without notice.

HOLLYWOOD FL MORTGAGE LENDERS PROGRAMS INCLUDE:

FOR SAME DAY PRE APPROVAL!

What is an FHA Mortgage Lenders

An FHA mortgage lenders is loan is a mortgage loan that is insured by the Federal Housing Administration (FHA). Essentially, the federal government insures loans for Florida FHA-approved mortgage lenders in order to reduce their risk of loss if a borrower defaults on their mortgage payments.The FHA program was created in response to the rash of foreclosures and defaults that happened in 1930s; to provide Florida FHA mortgage lenders with adequate insurance; and to help stimulate the housing market by making loans accessible and affordable. Nowadays, FHA mortgage loans are very popular, especially with first-time Florida home buyers.

What Are Some Of the FHA mortgage loan Advantages?

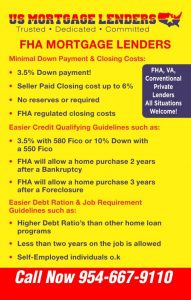

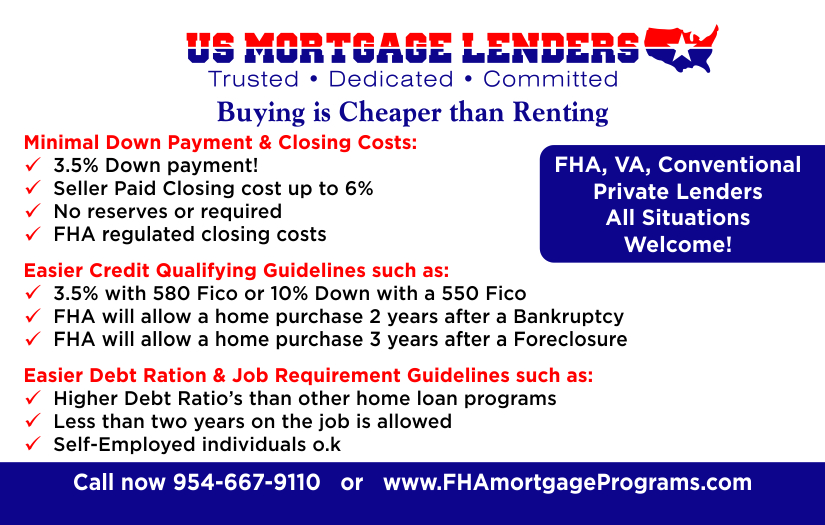

The FHA mortgage loan is one of the easiest types of mortgage loans to qualify for because it requires a low down payment and you can have less-than-perfect credit as low as a 500+ credit score with 10% down. An FHA down payment of 3.5 percent is required if your credit score is over 580+. FHA mortgage applicants who cannot afford a traditional down payment of 20 percent or can’t get approved for private mortgage insurance should look into whether an FHA mortgage loan is the best option. .

example FHA mortgage lenders Loan Requirements

- Must make a minimum down payment of 3.5 percent. The money can be gifted by a family member.

- Must have a stable, steady employment history or in the same line of work for the past two years

- New FHA mortgage loans are only available for primary residence occupancy

- Must have a property appraisal from a FHA-approved appraiser

- Must have a valid Social Security number, lawful residency in the U.S. and be of legal age to sign a mortgage in your state

- Your front-end ratio (mortgage payment plus HOA fees, property taxes, mortgage insurance, home insurance) needs to be less than 31 percent of your gross income, typically. You may be able to get approved with as high a percentage as 46.99 percent. Your lender will be required to provide justification as to why they believe the mortgage presents an acceptable risk. The FHA mortgage lender must include any compensating factors used for loan approval.

- Your back-end ratio (Florida FHA mortgage plus all your monthly debt, i.e., credit card payment, car payment, student loans, etc.) needs to be less than 43 percent of your gross income, typically. It is possible to be approved with as high a percentage as 56.99 percent. Your lender will be required to provide justification as to why they believe the mortgage presents an acceptable risk. The FHA mortgage lender must include any compensating factors used for loan approval.

- Minimum credit score of 580 for maximum financing with a minimum down payment of 3.5 percent.

- Minimum credit score of 500-579 for maximum LTV of 90 percent with a minimum down payment of 10 percent. FHA-qualified lenders will use a case-by-case basis to determine an applicants’ credit worthiness.

- Typically you must be two years out of bankruptcy and have re-established good credit. Exceptions can be made if you are out of bankruptcy for more than one year if there were extenuating circumstances beyond your control that caused the bankruptcy and you’ve managed your money in a responsible manner. See this page for more details.

- Typically you must be three year out of foreclosure and have re-established good credit. Exceptions can be made if there were extenuating circumstances and you’ve improved your credit. If you were unable to sell your home because you had to move to a new area, this does not qualify as an exception to the three-year foreclosure guideline.

Property MUST meet certain standards

Also, an FHA mortgage loan requires that a property meet certain minimum standards at appraisal. If the home you are purchasing does not meet these standards and a seller will not agree to the required repairs, your only option is to pay for the required repairs at closing (to be held in escrow until the repairs are complete).

FHA mortgage loan Limits

There are maximum mortgage limits for FHA mortgage loans that vary by state and county. In certain counties, you may be able to get financing for a loan size up to $729,750 with a 3.5 percent down payment. Conventional financing for loans that can be bought by Fannie Mae or Freddie Mac are currently at $625,000.

Fheck Florida FHA mortgage limits in your area, click here.

HOLLYWOOD FL MORTGAGE PROGRAMS

- FIRST TIME HOME BUYER HOLLYWOOD FLORIDA FHA MORTGAGE LENDERS – The FHA mortgage is not only for first time home buyers. Anyone purchasing a primary home can use the FHA mortgage loan. The FHA mortgage is popular with first time home buyers because of the with a low down payment requirement. In additions, bad credit, no credit mortgage applicants will find the FHA mortgage program is the only option to purchase a home. Read more »

- BAD CREDIT HOLLYWOOD FLORIDA FHA MORTGAGE LENDERS – Bad Credit FHA mortgage loan approvals are approved based on a more common sense approach to mortgage lending meaning bad credit borrowers with past foreclosure or Bankruptcy, tax liens, and collections or judgments can still qualify can qualify to purchase a home. Read more »

- NO CREDIT SCORE HOLLYWOOD FLORIDA FHA MORTGAGE LENDERS – FHA mortgage loan applicants with no credit score lack of trade lines can still qualify for an FHA mortgage loan using alternate trade lines to build a credit or payment history.Read more »

- CONDO HOLLYWOOD FLORIDA FHA MORTGAGE LENDERS– Search and purchase an FHA approved condo using the FHA mortgage program. Read more »

- TOWNHOUSE HOLLYWOOD FLORIDA FHA MORTGAGE LENDERS – The FHA mortgage program was created to help increase home ownership. The FHA program makes buying a townhouse home easier and less expensive than any other types of real estate mortgage home loan programs Read more »

- VILLA HOLLYWOOD FLORIDA FHA MORTGAGE LENDERS– This FHA mortgage loan program was created to help increase home ownership. The FHA program makes buying a villa easier and less expensive than any other types of real estate mortgage home loan programs Read more »

- MULTIFAMILY HOLLYWOOD FLORIDA FHA MORTGAGE LENDERS– This FHA mortgage loan program was created to help increase home ownership. The FHA program makes buying a multifamily duplex, triplex or four unit easier and less expensive than any other types of real estate mortgage home loan programs. Read more »

- JUMBO HOLLYWOOD FLORIDA FHA MORTGAGE LENDERS– The Jumbo FHA mortgage loan can be used in higher cost areas over 417,000 to help borrowers qualify for a Jumbo low down payment FHA mortgage option.Read more »

- GIFTS ALLOWED HOLLYWOOD FLORIDA FHA MORTGAGE LENDERS – When apply with an FHA mortgage lender you must document where your down payment came from. If you are getting a gift from a family member you must document the transfer, the documenation is very precise. Make sure the follow the FHA rules for a gift step by step, otherwise you may not be able to use the gift funds! Read more »

- MODULAR HOME HOLLYWOOD FLORIDA FHA MORTGAGE LENDERS – The FHA Title I modular home loan mortgage may be used for the purchase or refinancing of a manufactured home and land built after 1977, a developed lot on which to place a manufactured home, or a manufactured home and lot in combination. The home must be used as the principal residence and never moved from its original location. In addition you must own or buy the land with home. Read more »

- INVESTMENT PROPERTY HOLLYWOOD FLORIDA FHA MORTGAGE LENDERS– The idea of owning a multi family real estate investment property can be a very good idea for those who prepare the tenants to make the FHA mortgage payments.

- FORECLOSURE OR BANKRUPTCY HOLLYWOOD FLORIDA FHA MORTGAGE LENDERS – People with recent foreclosure or bankruptcy us the FHA mortgage to purchase or refinance a home every day! Read more »

- STREAMLINE REFINANCE HOLLYWOOD FLORIDA FHA MORTGAGE LENDERS– Lowering your monthly mortgage payment is easier than ever with an FHA streamline refinance mortgage you do not even need a new appraisal! Read more »

- DEBT CONSOLIDATION HOLLYWOOD FLORIDA FHA MORTGAGE LENDERS– An FHA Debt Consolidation Mortgage Refinance can lower your total monthly payment obligations. Contact us now to show you how much money you can save! Read more »

- COLLECTION AND JUDGMENTS HOLLYWOOD FLORIDA FHA MORTGAGE LENDERS – The Federal Housing Administration (FHA) offers mortgage applicants to the opportunity to purchase a home even with collections and judgements. Read more »

- MANUAL UNDERWRITING HOLLYWOOD FLORIDA FHA MORTGAGE LENDERS– If our local bank does not approve you for an FHA mortgage its still possible to qualify for an FHA mortgage using compensating factors and manual underwriting to qualify. Read more »

- LOAN LIMITS FOR HOLLYWOOD FLORIDA FHA MORTGAGE LENDERS – FHA mortgage loan limits very by county. You can purchase above the FHA mortgage loan limit but you would have to come up with the difference. Read more »

- DEBT TO INCOME RATIOS FOR HOLLYWOOD FLORIDA FHA MORTGAGE LENDERS– The FHA mortgage program will allow higher debt to income ratios than any other first time home buyer programs. Read more »

- EXCLUSION LIST FOR HOLLYWOOD FLORIDA FHA MORTGAGE LENDERS – If you have a past Foreclosure or Student loan in default you may not quality for an FHA mortgage. Read more »

- SELLER PAID CLOSING HOLLYWOOD FLORIDA FHA MORTGAGE LENDERS– Many FHA mortgage applicants find that the FHA mortgage is one of the most affordable mortgage programs allowing the seller to pay the buyers closing cost. Read more »

- OCCUPANCY RULES FOR HOLLYWOOD FLORIDA FHA MORGAGE LENDERS – FHA mortgage loans are for primary home use only. Read more »

- VA BAD CREDIT HOLLYWOOD FLORIDA FHA MORTGAGE LENDERS– VA loan applicants will find that the VA loan has the most flexible loan requirements available to purchase or refinance a home up to 100% loan to value even if you have your a veteran with a foreclosure or bankruptcy. Contact US mortgage lenders to learn how to put your (COE) certificate of eligibility to good use. Read more »

- USDA HOLLYWOOD FLORIDA BAD CREDIT FHA MORTGAGE LENDERS – US mortgage lenders has access to USDA mortgage lenders approving borrowers all the way down to a 550 middle credit score. If you can prove the ability to pay your bills on time then we may have a USDA mortgage lender for you. Read more »

- JUMBO HOLLYWOOD FLORIDA BAD CREDIT MORTGAGE LENDERS–US Mortgage lenders has access to jumbo mortgage lenders and jumbo portolio lenders approving jumbo loan applicants for loan amounts over 417,000 with credit down all the way down to a 600 middle credit score! Read more »

- HARD MONEY HOLLYWOOD FLORIDA BAD CREDIT MORTGAGE LENDERS– If you have large enough down payment and can prove the ability and willingness to pay your bills on time then we may have a hard money lender for you. US Mortgage lenders has access to private lenders and portfolio hard money lenders approving borrowers for loans that your bank will never consider. Read more »

HOLLYWOOD FLORIDA MORTGAGE AND CITY DATA

- Population in 2013: 146,526 (100% urban, 0% rural). Population change since 2000: +5.1%

- Males: 73,162 (49.9%)

- Females: 73,364 (50.1%)

- Median resident age: 5 years

- Florida median age: 5 years

- Zip codes: 33020, 33021, 33023.

- Hollywood Zip Code Map

- Estimated median household income in 2013: $44,582 (it was $36,714 in 2000)

- Hollywood: $44,582

- FL: $46,036

- Estimated per capita income in 2013: $25,535 (it was $22,097 in 2000)

- Hollywood city income, earnings, and wages data

- Estimated median house or condo value in 2013: $181,300 (it was $98,300 in 2000)

- Hollywood: $181,300

- FL: $153,300

- Mean prices in 2013: All housing units: $243,666; Detached houses: $279,797; Townhouses or other attached units: $178,790; In 2-unit structures: $67,531; In 3-to-4-unit structures: $157,048; In 5-or-more-unit structures: $164,559; Mobile homes: $23,159

- Median gross rent in 2013: $1,040.

- Recent home sales, real estate maps, and home value estimator for zip codes: 33004, 33019, 33020, 33021.

- Hollywood, FL residents, houses, and apartments details

Appraisers List

| Appraiser Roster as of 09/28/2016 (49 records were selected, 49 records displayed.) |

(49 records were selected, 49 records displayed.)

| Name | License/ Expiration Date |

Address |

| FRANCISCO F ARES | FLRD5165 (Certified Residential) 11-30-2018 |

PREMIER ONE APPRAISAL GROUP 5741 HOLLYWOOD BLVD HOLLYWOOD, FL 330210000 |

| JAY S BATCHANOO | FLRD4500 (Certified Residential) 11-30-2016 |

SE FL REAL ESTATE APPRAISAL CO 716 NORTH 20TH AVE HOLLYWOOD, FL 330200000 |

| ANDRES BUENO | FLRD3073 (Certified Residential) 11-30-2016 |

PLANNING & BUILIDING AP. CORP 1706 WILEY STREET HOLLYWOOD, FL 330200000 |

| RICHARD J CALAY | FLRD2636 (Certified Residential) 11-30-2016 |

RICHARD CALAY APPRAISALS 3610 N 56 AVENUE #232 HOLLYWOOD, FL 330210000 |

| CHRISTINE K CATTANACH | FLRD1279 (Certified Residential) 11-30-2016 |

SOUTHERN REALTY & APPRAISAL 2455 HOLLYWOOD BLVD / S 306 HOLLYWOOD, FL 330200000 |

| JAMES S CATTANACH | FLRZ926 (Certified General) 11-30-2016 |

SOUTHERN REALTY & APPRAISAL 2455 HOLLYWOOD BOULEVARD / 306 HOLLYWOOD, FL 330200000 |

| JASON CORDOVES | FLRD7146 (Certified Residential) 11-30-2016 |

1777 POLK STREET UNIT 3B HOLLYWOOD, FL 330200000 |

| PETER DACKO III | FLRD3802 (Certified Residential) 11-30-2016 |

THE SOUTH FLORIDA APPRSL HOUSE 1311 SOUTH 17TH AVENUE HOLLYWOOD, FL 330200000 |

| MATTHEW H DAVIES | FLRZ3230 (Certified General) 11-30-2016 |

6622 ATLANTA STREET HOLLYWOOD, FL 330240000 |

| ANTHONY T DEVITO | FLRD6041 (Certified Residential) 11-30-2016 |

HARTFORD PROPERTY SERVICES INC 1702 MCKINLEY STREET #4 HOLLYWOOD, FL 330200000 |

| DANA M DISANTO | FLRD872 (Certified Residential) 11-30-2016 |

DISANTO APPRAISAL GROUP, INC 2700 N. 29 AVE., #109 HOLLYWOOD, FL 330200000 |

| F W DOWELL | FLRD3414 (Certified Residential) 11-30-2016 |

1ST APPRAISAL SERVICES 7171 TAFT STREET HOLLYWOOD, FL 330240000 |

| MICHAEL FIORINO | FLRD3616 (Certified Residential) 11-30-2018 |

APPRAISAL SERVIECES FRIM INC 2303 HOLLYWOOD BLVD #4 HOLLYWOOD, FL 330200000 |

| JEAN D GALLO | FLRD3696 (Certified Residential) 11-30-2016 |

SOUTH FLORIDA APPRAISALS LLC 3419 S LONGFELLOW CIRCLE HOLLYWOOD, FL 330210000 |

| BONNIE C GOLDBERG | FLRD409 (Certified Residential) 11-30-2018 |

BONNIE C. GOLDBERG, INC 4747 HOLLYWOOD BL 101 PMB 180 HOLLYWOOD, FL 330210000 |

| CHRISTINE M HILLE | FLRD4893 (Certified Residential) 11-30-2016 |

CLASSIC APPRAISAL ASSOCIATES 5511 GARFIELD ST HOLLYWOOD, FL 330200000 |

| PERRY W HODGES III | FLRD7388 (Certified Residential) 11-30-2016 |

5632 GRANT STREET #2 HOLLYWOOD, FL 330210000 |

| SCOTT P KEARNS | FLRD5714 (Certified Residential) 11-30-2016 |

S. KEARNS & ASSOCIATES, INC. 1518 NORTH 59 TERRACE HOLLYWOOD, FL 330210000 |

| DAVID L KIRKPATRICK | FLRD7133 (Certified Residential) 11-30-2016 |

ARDENT APPRAISAL & HOME INSPEC 1947 TAYLOR STREET #2 HOLLYWOOD, FL 330200000 |

| MARJORIE S KORF | FLRD1374 (Certified Residential) 11-30-2016 |

ADVANTAGE APPRAISAL SERVICES 1615 HARRISON ST HOLLYWOOD, FL 330200000 |

| JORGE A MACHARE | FLRZ3034 (Certified General) 11-30-2016 |

MAC APPRAISAL SERVICES INC 450 N. PARK RD. SUITE #405 HOLLYWOOD, FL 330210000 |

| MURDO MACKENZIE | FLRZ2779 (Certified General) 11-30-2016 |

L.B. SLATER & COMPANY INC. 603 N FEDERAL HWY SUITE ONE HOLLYWOOD, FL 330200000 |

| STEPHEN MARASIA | FLRD1715 (Certified Residential) 11-30-2016 |

1ST APPRAISAL SERVICES 7171 TAFT ST HOLLYWOOD, FL 330240000 |

| CHRISTOPHER A MATOS | FLRD7733 (Certified Residential) 11-30-2016 |

CHRISTOPHER ARMANDO MATOS 124 HIDDEN COURT ROAD HOLLYWOOD, FL 330230000 |

| MITCHEL MESTEL | FLRD4930 (Certified Residential) 11-30-2016 |

HOLLYWOOD APPRAISALS 2641 TAFT ST HOLLYWOOD, FL 330200000 |

| DONNA M MONTGOMERY | FLRD3315 (Certified Residential) 11-30-2016 |

SOUTH FLORIDA APPRAISAL HOUSE 1311 S 17TH AVENUE HOLLYWOOD, FL 330200000 |

| LORENZO E NAVARRO | FLRD5320 (Certified Residential) 11-30-2016 |

DIVERSE MARKET RESEARCH, INC. 2010 NORTH 28TH AVENUE HOLLYWOOD, FL 330200000 |

| ROBERT J NEIMAN | FLRD6447 (Certified Residential) 11-30-2016 |

ROBERT NEIMAN APPRAISER, INC 1600 S. OCEAN DRIVE #16E HOLLYWOOD, FL 330190000 |

| ELIZABETH A PASTERNAK | FLRD2523 (Certified Residential) 11-30-2016 |

THE SOUTH FLA APPRAISAL HOUSE 1311 SOUTH 17 AVENUE HOLLYWOOD, FL 330200000 |

| JEFFREY P PICCOLI | FLRD4988 (Certified Residential) 11-30-2016 |

ALPHA ONE REAL ESTATE SERVICES 650 SOUTH FEDERAL HIGHWAY HOLLYWOOD, FL 330200000 |

| TONY PILYAVSKY | FLRD7057 (Certified Residential) 11-30-2016 |

APPRAISALS XPRESS LLC. 2700 N 29TH AVE SUITE 218B HOLLYWOOD, FL 330200000 |

| ROBERT B RAYNOR | FLRD2663 (Certified Residential) 11-30-2016 |

ADVANCED REAL ESTATE APPRAISAL 1310 BUCHNAN ST. HOLLYWOOD, FL 330190000 |

| JOHN T RUPNER | FLRD1898 (Certified Residential) 11-30-2016 |

FIRST APPRAISAL SERVICES 7171 TAFT STREET HOLLYWOOD, FL 330240000 |

| JOHN SAPUTO JR | FLRD1913 (Certified Residential) 11-30-2016 |

JSJ ENTERPRISES PO BOX 221658 HOLLYWOOD, FL 330220000 |

| LINDA L SMITH | FLRD5186 (Certified Residential) 11-30-2016 |

650 SOUTH FEDERAL HIGHWAY HOLLYWOOD, FL 330200000 |

| ELIO A SOTO | FLRD6739 (Certified Residential) 11-30-2016 |

ALLIED CERTIFIED APPRAISERS 5900 DEWEY STREET #203 HOLLYWOOD, FL 330230000 |

| ALAN STEINHOFF | FLRD246 (Certified Residential) 11-30-2018 |

LANDSAFE PO BOX 221561 HOLLYWOOD, FL 330220000 |

| RYAN J SULLIVAN | FLRD7699 (Certified Residential) 11-30-2018 |

CENTERSTONE APPRAISAL, INC 1360 N 73RD WAY HOLLYWOOD, FL 330240000 |

| KENNETH J SWENSON | FLRD875 (Certified Residential) 11-30-2016 |

CLASSIC APPRAISAL ASSOCS. INC. PO BOX 6822 HOLLYWOOD, FL 330810000 |

| PHYLLIS N SWENSON | FLRD950 (Certified Residential) 11-30-2016 |

CLASSIC APPRAISAL ASSOCIATES 5938 FILLMORE STREET HOLLYWOOD, FL 330210000 |

| CRISTIAN M VLAD | FLRD1121 (Certified Residential) 11-30-2016 |

ALPHA ONE REAL ESTATE,INC 650 S. FEDERAL HIGHWAY HOLLYWOOD, FL 330200000 |

| JOCHEN M WAGNER | FLRD5702 (Certified Residential) 11-30-2018 |

CLASSIC APPRAISAL ASSOC 5511 GARFIELD STREET HOLLYWOOD, FL 330210000 |

| KATHERINE A WENDAL | FLRD5031 (Certified Residential) 11-30-2016 |

DBT APPRAISALS, INC. 1315 N 19TH AVENUE HOLLYWOOD, FL 330200000 |

| JAMES E WEST | FLRD3113 (Certified Residential) 11-30-2016 |

1ST APPRAISAL SERVICES 7171 TAFT STREET HOLLYWOOD, FL 330240000 |

| JAMES H WILKINS | FLRD4834 (Certified Residential) 11-30-2016 |

T. FIELDS & ASSOCIATES 4432 PEMBROKE ROAD HOLLYWOOD, FL 330210000 |

| RICHARD A WOLKOWITZ | FLRD268 (Certified Residential) 11-30-2018 |

WOLKOWITZ APPRAISAL CNSLTS. 3530 N 33RD TER HOLLYWOOD, FL 330210502 |

| RAYMOND G WOOD | FLRD1594 (Certified Residential) 11-30-2016 |

5011 LINCOLN STREET HOLLYWOOD, FL 330210000 |

| ALEXANDER YASHIN | FLRD4968 (Certified Residential) 11-30-2016 |

TROPICAL APPRAISALS, INC 2301 S OCEAN DR, # 403 HOLLYWOOD, FL 330190000 |

| LARISA V YASHINA | FLRD7425 (Certified Residential) 11-30-2016 |

TROPICAL APPRAISALS, INC 2301 S. OCEAN DR, # 403 HOLLYWOOD, FL 330190000 |

Expiration Date

(Certified Residential)

11-30-2018

5741 HOLLYWOOD BLVD

HOLLYWOOD, FL 330210000

(Certified Residential)

11-30-2016

716 NORTH 20TH AVE

HOLLYWOOD, FL 330200000

(Certified Residential)

11-30-2016

1706 WILEY STREET

HOLLYWOOD, FL 330200000

(Certified Residential)

11-30-2016

3610 N 56 AVENUE #232

HOLLYWOOD, FL 330210000

(Certified Residential)

11-30-2016

2455 HOLLYWOOD BLVD / S 306

HOLLYWOOD, FL 330200000

(Certified General)

11-30-2016

2455 HOLLYWOOD BOULEVARD / 306

HOLLYWOOD, FL 330200000

(Certified Residential)

11-30-2016

HOLLYWOOD, FL 330200000

(Certified Residential)

11-30-2016

1311 SOUTH 17TH AVENUE

HOLLYWOOD, FL 330200000

(Certified General)

11-30-2016

HOLLYWOOD, FL 330240000

(Certified Residential)

11-30-2016

1702 MCKINLEY STREET #4

HOLLYWOOD, FL 330200000

(Certified Residential)

11-30-2016

2700 N. 29 AVE., #109

HOLLYWOOD, FL 330200000

(Certified Residential)

11-30-2016

7171 TAFT STREET

HOLLYWOOD, FL 330240000

(Certified Residential)

11-30-2018

2303 HOLLYWOOD BLVD #4

HOLLYWOOD, FL 330200000

(Certified Residential)

11-30-2016

3419 S LONGFELLOW CIRCLE

HOLLYWOOD, FL 330210000

(Certified Residential)

11-30-2018

4747 HOLLYWOOD BL 101 PMB 180

HOLLYWOOD, FL 330210000

(Certified Residential)

11-30-2016

5511 GARFIELD ST

HOLLYWOOD, FL 330200000

(Certified Residential)

11-30-2016

HOLLYWOOD, FL 330210000

(Certified Residential)

11-30-2016

1518 NORTH 59 TERRACE

HOLLYWOOD, FL 330210000

(Certified Residential)

11-30-2016

1947 TAYLOR STREET #2

HOLLYWOOD, FL 330200000

(Certified Residential)

11-30-2016

1615 HARRISON ST

HOLLYWOOD, FL 330200000

(Certified General)

11-30-2016

450 N. PARK RD. SUITE #405

HOLLYWOOD, FL 330210000

(Certified General)

11-30-2016

603 N FEDERAL HWY SUITE ONE

HOLLYWOOD, FL 330200000

(Certified Residential)

11-30-2016

7171 TAFT ST

HOLLYWOOD, FL 330240000

(Certified Residential)

11-30-2016

124 HIDDEN COURT ROAD

HOLLYWOOD, FL 330230000

(Certified Residential)

11-30-2016

2641 TAFT ST

HOLLYWOOD, FL 330200000

(Certified Residential)

11-30-2016

1311 S 17TH AVENUE

HOLLYWOOD, FL 330200000

(Certified Residential)

11-30-2016

2010 NORTH 28TH AVENUE

HOLLYWOOD, FL 330200000

(Certified Residential)

11-30-2016

1600 S. OCEAN DRIVE #16E

HOLLYWOOD, FL 330190000

(Certified Residential)

11-30-2016

1311 SOUTH 17 AVENUE

HOLLYWOOD, FL 330200000

(Certified Residential)

11-30-2016

650 SOUTH FEDERAL HIGHWAY

HOLLYWOOD, FL 330200000

(Certified Residential)

11-30-2016

2700 N 29TH AVE SUITE 218B

HOLLYWOOD, FL 330200000

(Certified Residential)

11-30-2016

1310 BUCHNAN ST.

HOLLYWOOD, FL 330190000

(Certified Residential)

11-30-2016

7171 TAFT STREET

HOLLYWOOD, FL 330240000

(Certified Residential)

11-30-2016

PO BOX 221658

HOLLYWOOD, FL 330220000

(Certified Residential)

11-30-2016

HOLLYWOOD, FL 330200000

(Certified Residential)

11-30-2016

5900 DEWEY STREET #203

HOLLYWOOD, FL 330230000

(Certified Residential)

11-30-2018

PO BOX 221561

HOLLYWOOD, FL 330220000

(Certified Residential)

11-30-2018

1360 N 73RD WAY

HOLLYWOOD, FL 330240000

(Certified Residential)

11-30-2016

PO BOX 6822

HOLLYWOOD, FL 330810000

(Certified Residential)

11-30-2016

5938 FILLMORE STREET

HOLLYWOOD, FL 330210000

(Certified Residential)

11-30-2016

650 S. FEDERAL HIGHWAY

HOLLYWOOD, FL 330200000

(Certified Residential)

11-30-2018

5511 GARFIELD STREET

HOLLYWOOD, FL 330210000

(Certified Residential)

11-30-2016

1315 N 19TH AVENUE

HOLLYWOOD, FL 330200000

(Certified Residential)

11-30-2016

7171 TAFT STREET

HOLLYWOOD, FL 330240000

(Certified Residential)

11-30-2016

4432 PEMBROKE ROAD

HOLLYWOOD, FL 330210000

(Certified Residential)

11-30-2018

3530 N 33RD TER

HOLLYWOOD, FL 330210502

(Certified Residential)

11-30-2016

HOLLYWOOD, FL 330210000

(Certified Residential)

11-30-2016

2301 S OCEAN DR, # 403

HOLLYWOOD, FL 330190000

(Certified Residential)

11-30-2016

2301 S. OCEAN DR, # 403

HOLLYWOOD, FL 330190000

Search criteria:

| Sorted by: | Name |

| State: | FL |

| License: | |

| Last Name: | |

| First Name: | |

| City: | HOLLYWOOD |

| Zip Code: |