BROAD BRANCH FL MORTGAGE LENDERS

Welcome and thank you for visiting US Mortgage Lenders webpage. We are local Broad Branch Florida mortgage lenders. We are available to answer any questions you might have 24/7.

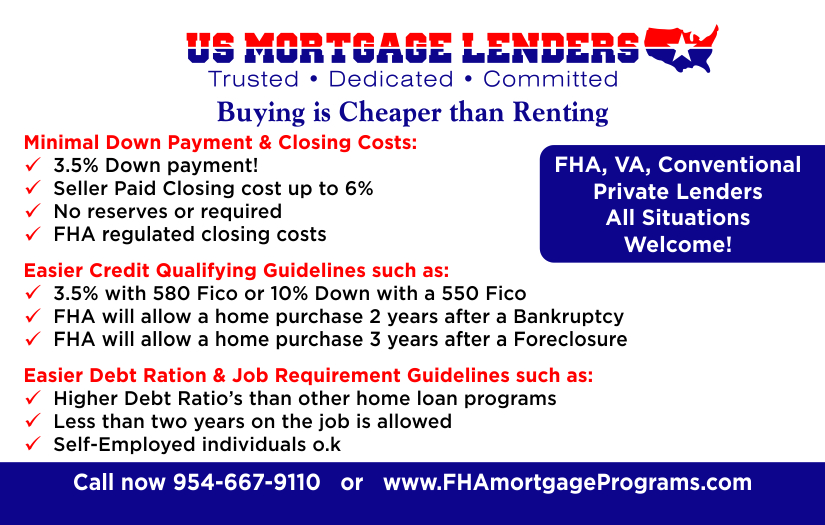

US Mortgage Lenders professionals have earned their excellent 5 star zillow and google reviews by opening more doors to homes in Broad Branch Florida than your average Florida lender. To discuss any of our full service Broad Branch Florida programs including, FHA minimum score 550, FHA Cash Out and Streamlines refinancing, Private lenders, Jumbo Loans, VA Mortgage loans down to 550 and Foreign National Loans. Note All Subject to change without notice.

BROAD BRANCH FL MORTGAGE LENDERS PROGRAMS INCLUDE:

FOR SAME DAY PRE APPROVAL!

FOR YOUR FREE NO OBLIGATION CONSOLATION

WE ARE LOCAL BROAD BRANCH FLORIDA FHA MORTGAGE LENDERS .

BROAD BRANCH FL MORTGAGE PROGRAMS

- FIRST TIME HOME BUYER BROAD BRANCH FLORIDA FHA MORTGAGE LENDERS – The FHA mortgage is not only for first time home buyers. Anyone purchasing a primary home can use the FHA loan. The FHA mortgage is popular with first time home buyers because of the with a low down payment requirement. In additions, bad credit, no credit mortgage applicants will find the FHA mortgage program is the only option to purchase a home. Read more »

- BAD CREDIT BROAD BRANCH FLORIDA FHA MORTGAGE LENDERS – Bad Credit FHA mortgage loan approvals are approved based on a more common sense approach to mortgage lending meaning bad credit borrowers with past foreclosure or Bankruptcy, tax liens, and collections or judgments can still qualify can qualify to purchase a home. Read more »

- NO CREDIT SCORE BROAD BRANCH FLORIDA FHA MORTGAGE LENDERS – FHA loan applicants with no credit score lack of trade lines can still qualify for an FHA mortgage loan using alternate trade lines to build a credit or payment history.Read more »

- CONDO BROAD BRANCH FLORIDA FHA MORTGAGE LENDERS– Search and purchase an FHA approved condo using the FHA mortgage program. Read more »

- TOWNHOUSE BROAD BRANCH FLORIDA FHA MORTGAGE LENDERS – The FHA mortgage program was created to help increase home ownership. The FHA program makes buying a townhouse home easier and less expensive than any other types of real estate mortgage home loan programs Read more »

- VILLA BROAD BRANCH FLORIDA FHA MORTGAGE LENDERS– This FHA loan program was created to help increase home ownership. The FHA program makes buying a villa easier and less expensive than any other types of real estate mortgage home loan programs Read more »

- MULTIFAMILY BROAD BRANCH FLORIDA FHA MORTGAGE LENDERS– This FHA loan program was created to help increase home ownership. The FHA program makes buying a multifamily duplex, triplex or four unit easier and less expensive than any other types of real estate mortgage home loan programs. Read more »

- JUMBO BROAD BRANCH FLORIDA FHA MORTGAGE LENDERS– The Jumbo FHA mortgage loan can be used in higher cost areas over 417,000 to help borrowers qualify for a Jumbo low down payment FHA mortgage option.Read more »

- GIFTS ALLOWED BROAD BRANCH FLORIDA FHA MORTGAGE LENDERS – When apply with an FHA mortgage lender you must document where your down payment came from. If you are getting a gift from a family member you must document the transfer, the documenation is very precise. Make sure the follow the FHA rules for a gift step by step, otherwise you may not be able to use the gift funds! Read more »

- MODULAR HOME BROAD BRANCH FLORIDA FHA MORTGAGE LENDERS – The FHA Title I modular home loan mortgage may be used for the purchase or refinancing of a manufactured home and land built after 1977, a developed lot on which to place a manufactured home, or a manufactured home and lot in combination. The home must be used as the principal residence and never moved from its original location. In addition you must own or buy the land with home. Read more »

- INVESTMENT PROPERTY BROAD BRANCH FLORIDA FHA MORTGAGE LENDERS– The idea of owning a multi family real estate investment property can be a very good idea for those who prepare the tenants to make the FHA mortgage payments.

- FORECLOSURE OR BANKRUPTCY BROAD BRANCH FLORIDA FHA MORTGAGE LENDERS – People with recent foreclosure or bankruptcy us the FHA mortgage to purchase or refinance a home every day! Read more »

- STREAMLINE REFINANCE BROAD BRANCH FLORIDA FHA MORTGAGE LENDERS– Lowering your monthly mortgage payment is easier than ever with an FHA streamline refinance mortgage you do not even need a new appraisal! Read more »

- DEBT CONSOLIDATION BROAD BRANCH FLORIDA FHA MORTGAGE LENDERS– An FHA Debt Consolidation Mortgage Refinance can lower your total monthly payment obligations. Contact us now to show you how much money you can save! Read more »

- COLLECTION AND JUDGMENTS BROAD BRANCH FLORIDA FHA MORTGAGE LENDERS – The Federal Housing Administration (FHA) offers mortgage applicants to the opportunity to purchase a home even with collections and judgements. Read more »

- MANUAL UNDERWRITING BROAD BRANCH FLORIDA FHA MORTGAGE LENDERS– If our local bank does not approve you for an FHA mortgage its still possible to qualify for an FHA mortgage using compensating factors and manual underwriting to qualify. Read more »

- LOAN LIMITS FOR BROAD BRANCH FLORIDA FHA MORTGAGE LENDERS – FHA mortgage loan limits very by county. You can purchase above the FHA mortgage loan limit but you would have to come up with the difference. Read more »

- DEBT TO INCOME RATIOS FOR BROAD BRANCH FLORIDA FHA MORTGAGE LENDERS– The FHA mortgage program will allow higher debt to income ratios than any other first time home buyer programs. Read more »

- EXCLUSION LIST FOR BROAD BRANCH FLORIDA FHA MORTGAGE LENDERS – If you have a past Foreclosure or Student loan in default you may not quality for an FHA mortgage. Read more »

- SELLER PAID CLOSING BROAD BRANCH FLORIDA FHA MORTGAGE LENDERS– Many FHA mortgage applicants find that the FHA mortgage is one of the most affordable mortgage programs allowing the seller to pay the buyers closing cost. Read more »

- OCCUPANCY RULES FOR BROAD BRANCH FLORIDA FHA MORGAGE LENDERS – FHA mortgage loans are for primary home use only. Read more »

- VA BAD CREDIT BROAD BRANCH FLORIDA FHA MORTGAGE LENDERS– VA loan applicants will find that the VA loan has the most flexible loan requirements available to purchase or refinance a home up to 100% loan to value even if you have your a veteran with a foreclosure or bankruptcy. Contact US mortgage lenders to learn how to put your (COE) certificate of eligibility to good use. Read more »

- USDA BROAD BRANCH FLORIDA BAD CREDIT FHA MORTGAGE LENDERS – US mortgage lenders has access to USDA mortgage lenders approving borrowers all the way down to a 550 middle credit score. If you can prove the ability to pay your bills on time then we may have a USDA mortgage lender for you. Read more »

- JUMBO BROAD BRANCH FLORIDA BAD CREDIT MORTGAGE LENDERS–US Mortgage lenders has access to jumbo mortgage lenders and jumbo portolio lenders approving jumbo loan applicants for loan amounts over 417,000 with credit down all the way down to a 600 middle credit score! Read more »

- HARD MONEY BROAD BRANCH FLORIDA BAD CREDIT MORTGAGE LENDERS– If you have large enough down payment and can prove the ability and willingness to pay your bills on time then we may have a hard money lender for you. US Mortgage lenders has access to private lenders and portfolio hard money lenders approving borrowers for loans that your bank will never consider. Read more »

BROAD BRANCH FLORIDA MORTGAGE AND CITY DATA

Broad Branch, Florida is just as much impacted by the current economic climate and people desperately trying to find employment as are many other areas in the United States.

The percentage of jobless in Broad Branch has long reached and gotten past ten percent which sets this place more or less in the same dreadful situation as someplace else. Compared to just 2 months back, the percentage in fact increased, but this may be attributed to the typical rise at the end of every year.

Florida with its main city Broad Branch tend to be among those towns in the United States in which large companies have their headquarters. Having said that, lay-offs as well as downsizing are going on throughout Broad Branchland as holds true in a great number of other US states and areas. Significantly less job opportunities to be found and the rising number of individuals needing work indicates a challenge for the Broad Branch vicinity along with its many locals.