POPULAR BAD CREDIT ALABAMA MORTGAGE LENDERS PAGES

- 3.5% DOWN ALABAMA BAD CREDIT MORTGAGE LENDERS

- 3.5% BAD CREDIT ALABAMA MORTGAGE LENDERS

- 3.5%DOWN+ BAD CREDIT ALABAMA MORTGAGE LENDERS

- ALABAMA BAD CREDIT JUMBO MORTGAGE LENDERS

- alabama bad credit mortgage lenders – FHA mortgage lender

- GET MORTGAGE APPROVED IN AL AFTER BK- FORECLOSURE

- Alabama Mortgage Lenders Archives – FHA MORTGAGE LENDERS

- ALABAMA BAD CREDIT MORTGAGE LENDERS Archives – FHA …

- ALABAMA MORTGAGE 1 DAY AFTER FORECLOSURE-SS–BK

- We specialize in the following Bad Credit Alabama Mortgage Loans:

- Alabama Mortgage Lenders that allow past collections- Alabama lenders that approve you with collections!

- Alabama Bad Credit FHA / VA Mortgage Lenders- Bad credit lenders exclude disputed, collection chargeoffs

- Bad Credit Alabama Mortgage Lender Programs– Case By Case situational approvals!

- FHA Bad Credit Alabama Mortgage Lenders– Min 580 middle 3.5% Down min 550 With 10% Down.

- VA Bad Credit Alabama Mortgage Lenders – Min 550 middle credit score with 100% financing.

- Alabama Mortgage After Foreclosure – Short Sale – Bankruptcy- Foreclosure– Private Portfolio GA Bad Credit lenders.

- Bad Credit Teas Portfolio Lenders- Private Alabama mortgage lenders that do not sell the loans.

- Hard Money Alabama mortgage lenders- Hard money for case by case bad credit Alabama mortgage applications.

- No Credit Score Alabama Mortgage– No Credit score Alabama with a bad credit past!

- Modular Home Bad Credit Alabama Mortgage Lenders– Factory built bad credit modular home loans.

- Alabama Bad Credit Jumbo Mortgage lenders– Bad Credit GA jumbo mortgage lenders down to a 500 fico!

- Debt Consolidation Bad Refinance in Alabama – Refinance to lower your total monthly obligations to provide financial relief.. JUMBO Alabama BAD CREDIT MORTGAGE LENDERS – FHA …

- Alabama Bad Credit Mortgage Lenders After A Repossessions! We have the right bad credit mortgage lenders that allow repossessions!

-

3.5%Alabama FHA Mortgage Lenders Min 580 FICO!, Alabama BAD CREDIT JUMBO MORTGAGE LENDERS,JUMBO Alabama BAD CREDIT MORTGAGE LENDERS – FHA …

Alabama Bad Credit Mortgage Lenders After A Repossessions! We have the right bad credit mortgage lenders that allow repossessions! 3.5%Alabama FHA Mortgage Lenders Min 580 FICO!

-

Alabama Mortgage Lenders After Bankruptcy – Foreclosure – Short Sale. Purchase 1 day after bankruptcy, foreclosure, short sale and deed in lieu of Alabama foreclosure up to 2.5 million. These are not subprime loans, but they do often have higher interest rates, and higher closing costs.

-

Alabama Mortgage 1 day after Bankruptcy or Foreclosure Approvals!

https://www.fhamortgageprograms.com/Alabama -bankruptcy-foreclosure-short-sale-ok

PORTFOLIO- PRIVATE Alabama MORTGAGE LENDER APPROVALS! Purchase 1 day after bankruptcy, foreclosure, short sale and deed in lieu of Alabama foreclosure up to 2.5 million. These are not subprime loans, but they do often have higher interest rates, and higher closing costs.

Alabama Mortgage Approvals After Foreclosure, Bankruptcy=YES!!

https://www.fhamortgageprograms.com/Alabama -mortgage-lenders-bankruptcy-ok

Jan 25, 2018 – Alabama FHA-VA-Private Mortgage Lenders After Bankruptcy Alabama Chapter 7, 11 or 13 bankruptcies and want to know if you can still get a Alabama mortgage the answer is YES!!! Call Now 954-667-9110.

You visited this page on 2/7/18.Alabama Mortgage 1 Day After Bankruptcy Or Foreclosure

https://www.fhamortgageprograms.com/Alabama -mortgage-1-day-after-bankruptcy-or-fo..

Alabama Mortgage Lenders After Bankruptcy – Foreclosure – Short Sale. Purchase 1 day after bankruptcy, foreclosure, short sale and deed in lieu of Alabama foreclosure up to 2.5 million. These are not subprime loans, but they do often have higher interest rates, and higher closing costs.

- Same Day Alabama Bad Credit Loan Approvals!

- Many Bad Credit Alabama mortgage applicants don’t realize these Government guaranteed low-interest rate FHA, VA mortgage loans can help Alabama home buyers with bad credit. Even If you have a bad credit past and you’re looking for a low Alabama mortgage interest rateAlabama mortgage a government or private lender may be a better option then renting.

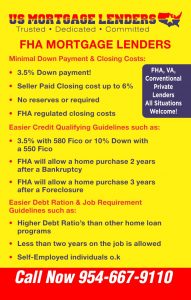

- BAD CREDIT Alabama FHA MORTGAGE LENDERS:

- Down payment only 3.5% of the purchase price.

- Gifts from family or FHA Grants for down payment assistance and closing costs OK!

- Sellers can credit the buyer’s up to 6% of sales price towards buyers costs and pre-paid.

- No reserves or future payments in account required.

- FHA regulated closing costs.

- Read more about buying a home with an FHA mortgage Bad Credit –No Credit – Investment –Second Home –Multi Family –

- BAD CREDIT Alabama LENDERS MAKE QUALIFYING EASIER BECAUSE YOU CAN PURCHASE:

- 12 months after a chapter 13 Bankruptcy FHA mortgage Lender approvals!

- 24 months after a chapter 7 Bankruptcy FHA mortgage Lender approvals!

- 3 years after a Foreclosure FHA mortgage Lender approvals!

- No Credit Score FHA mortgage Lender approvals!

- 580 required for 96.5% financing or 3.5% down payment FHA mortgage Lender approvals.

- 500 required for 90% financing or 10% down payment FHA mortgage Lender approvals.

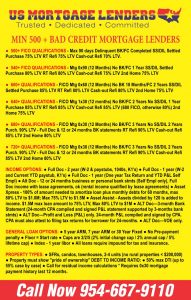

- BAD CREDIT Alabama with minimum 500 FICO credit score with 10% Down Payment FHA. For FHA mortgage applicants with credit scores between 500 and 579 must make down payments of at least 10% down!

- Read more about FHA Qualifying Qualification Summary – Manual Underwrite – Collections-Judgement’s – Bankruptcy or Foreclosure – Compensating Factors –

- BAD CREDIT FHA Alabama LENDERS ALLOW HIGHER DEBT TO INCOME & EASIER JOB QUALIFYING

- FHA allows higher debt ratio’s than any conventional mortgage loan programs.

- Less than two years on the same job is OK!

- Self-employed buyers can also qualify with FHA Mortgage Lenders.

- Read More about Gifts For Down Payment – Documents Checklist – Debt To Income – Student Loans –

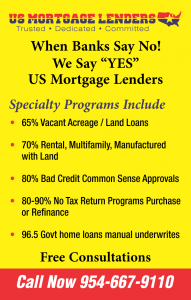

- Alabama Bad Credit Mortgage Solutions!

- 1 day out of foreclosure, short sale, BK, DIL

- Rates starting in the low 5’s

- Bad Credit Alabama Home Loans up to $1 million

- Credit scores down to 500

- Up to 85% LTV

- Combo loans up to 85% CLTV (min 680 score)

- DTI up to 50% considered

- Owner-occupied, 2nd homes, and investment properties

- Non-warrantable condos considered

- Jumbo loans down to 500 score

- 5/1 ARM or 30-year fixed

- No pre-payment penalty for owner-occ and 2nd homes

- No active tradelines OK with housing hisstory

- SFRs, townhomes, condos, 2-4 units

- Seller concessions to 6% (2% for investment)

- ALL Alabama SITUATIONS ARE WELCOME!!!

- The FHA mortgage can help you purchase a new Alabama home with 3.5% down payment even if you have bad credit. Even If you’ve had accounts forwarded to collections, past bankruptcies or Foreclosures, high debt to income ratio, then you still may qualify for our bad credit or no credit Alabama mortgage. These government-backed bad credit Alabama mortgage loans can work for Alabama mortgage applicants that don’t have cash for a down payment or closing costs. And they are a much better choice than a Alabama hard money loan.

- We work with all types of bad credit Alabama mortgage applicants with all types of credit situations who described themselves as having “bad credit” – that are now Alabama homeowners! The truth is, there are many more Bad credit mortgage applicants that will qualify for an FHA mortgage over the conventional mortgage.

- Alabama BAD CREDIT REPAIR CHECKLIST

- Credit scores indicate to Alabama mortgage lenders how well you manage money. You can improve bad credit mortgage application by demonstrating that you can now handle monthly obligations more responsibly. Furthermore, since bad credit scores could translate into high interest rates on your next bad credit Alabama mortgage, your improved credit score will help you get lower interest rates when you are ready to qualify.

- HOW DO I IMPROVE BAD CREDIT TO QUALIFY FOR A Alabama MORTGAGE?

- Here are a few ways bad credit Alabama mortgage applicants can raise their chances of qualifying for a Alabama mortgage:

- Prove 12 months’ timely rental history either provide canceled checks or verification of rent from a management company. In the hierarchy of credit if you can prove to the Alabama bad credit mortgage lender timely rent then you have proven the ability to pay the mortgage.

- Show the Teas mortgage lender last 12 months’ timely payment history with 0 x 30 days late in the last 12 months on any credit reported obligations.

- Keep all revolving charge card balances as low as possible less than 10% of the limit is best.

- Negotiate all past collections on your credit report other than medical bills to show a zero balance.

- BAD CREDIT Alabama MORTGAGE LENDERS PROGRAMS INCLUDE:

- Alabama Bad Credit Bank Statement Only

- FL Mortgage After Foreclosure – Short Sale – Bankruptcy- Foreclosure

- Bad Credit Alabama mortgage

- Bad Credit Alabama Mortgage Refinance

- Bad Credit Alabama Portfolio Lenders

- Buy a Alabama home 1 day after a Foreclosure or Bankruptcy

- Bad Credit Alabama FHA Mortgage Lenders

- No Credit score Alabama mortgage

- Bad Credit Alabama FHA mortgage

- Hard Money Alabama mortgage

- Bad Credit Alabama Modular Home Loans

- Alabama Chapter 13 Bankruptcy Mortgage Lenders

- Bad Credit 2nd Second Alabama Mortgage

- Alabama Stop Foreclosure Loans

- Bad Credit Alabama VA mortgage

- Bad Credit Alabama Cash for Deed

- Bad Credit Alabama Mortgage Rates Sheet

- Bad Credit Alabama Mortgage with Judgements

- Bad Credit Alabama Mortgage with Evictions

- Bad Credit Alabama Mortgage with Tax Liens

- Bad Credit Investor Loans Buyer Or Refi With Alabama LLC!

- ALL Alabama SITUATIONS ARE WELCOME- SERVING EVERY CITY LOCATION IN Alabama INCLUDING:

- ALL Cities In Alabama

- Vestavia Hills

- Hoover

- Trussville

- Auburn

- Homewood

- Mountain Brook

- Highland Lakes

- Redland

- Shoal Creek

- Indian Springs Village

- Helena

- Spanish Fort

- Enterprise

- Cullman

- Fairhope

- Priceville

- Hartselle

- Meadowbrook

- Margaret

- Orange Beach

- Stockton

- Alabaster

- Mount Olive

- Cottondale

- Largest Cities In Alabama

- Birmingham

- Montgomery

- Mobile

- Huntsville

- Tuscaloosa

- Hoover

- Dothan

- Auburn

- Decatur

- Madison

- Florence

- Phenix City

- Gadsden

- Prattville

- Vestavia Hills

- Alabaster

- Opelika

- Enterprise

- Bessemer

- Homewood

- Northport

- Athens

- Daphne

- Pelham

- All AlabamaBad Credit Mortgage Lenders Cities

Abanda

Abbeville

Adamsville

Addison

Akron

Alabaster

Albertville

Alexander City

Alexandria

Aliceville

Allgood

Altoona

Andalusia

Anderson

Anniston

Arab

Ardmore

Argo

Ariton

Arley

Ashford

Ashland

Ashville

Athens

Atmore

Attalla

Auburn

Autaugaville

Avon

Axis

Babbie

Baileyton

Bakerhill

Ballplay

Banks

Bay Minette

Bayou La Batre

Bear Creek

Beatrice

Beaverton

Belgreen

Belk

Bellamy

Belle Fontaine

Benton

Berry

Bessemer

Billingsley

Birmingham

Black

Blountsville

Blue Ridge

Blue Springs

Boaz

Boligee

Bon Air

Bon Secour

Boykin

Brantley

Brantleyville

Brent

Brewton

Bridgeport

Brighton

Brilliant

Bristow Cove

Brook Highland

Brookside

Brookwood

Broomtown

Brundidge

Bucks

Butler

Calera

Calvert

Camden

Camp Hill

Carbon Hill

Cardiff

Carlisle-Rockledge

Carlton

Carolina

Carrollton

Castleberry

Catherine

Cedar Bluff

Center Point

Centre

Centreville

Chatom

Chelsea

Cherokee

Chickasaw

Childersburg

Choccolocco

Chunchula

Citronelle

Clanton

Clay

Clayhatchee

Clayton

Cleveland

Clio

Coaling

Coats Bend

Coffee Springs

Coffeeville

Coker

Collinsville

Colony

Columbia

Columbiana

Concord

Coosada

Cordova

Cottondale

Cottonwood

County Line

Courtland

Cowarts

Creola

Crossville

Cuba

Cullman

Cullomburg

Cusseta

Dadeville

Daleville

Daphne

Dauphin Island

Daviston

Dayton

Deatsville

Decatur

Deer Park

Delta

Demopolis

Detroit

Dodge City

Dora

Dothan

Double Springs

Douglas

Dozier

Dunnavant

Dutton

East Brewton

East Point

Eclectic

Edgewater

Edwardsville

Egypt

Elba

Elberta

Eldridge

Elkmont

Elmore

Emelle

Emerald Mountain

Enterprise

Epes

Ethelsville

Eufaula

Eunola

Eutaw

Eva

Evergreen

Excel

Fairfield

Fairford

Fairhope

Fairview

Falkville

Faunsdale

Fayette

Fayetteville

Fitzpatrick

Five Points

Flomaton

Florala

Florence

Foley

Forestdale

Forkland

Fort Deposit

Fort Payne

Fort Rucker

Franklin

Fredonia

Frisco City

Fruitdale

Fruithurst

Fulton

Fultondale

Fyffe

Gadsden

Gainesville

Gallant

Gantt

Garden City

Gardendale

Gaylesville

Geiger

Geneva

Georgiana

Geraldine

Gilbertown

Glen Allen

Glencoe

Glenwood

Goldville

Good Hope

Goodwater

Gordo

Gordon

Gordonville

Goshen

Graham

Grand Bay

Grant

Grayson Valley

Graysville

Greensboro

Greenville

Grimes

Grove Hill

Gu-Win

Guin

Gulf Shores

Gulfcrest

Guntersville

Gurley

Hackleburg

Hackneyville

Haleburg

Haleyville

Hamilton

Hammondville

Hanceville

Harpersville

Hartford

Hartselle

Harvest

Hatton

Hayden

Hayneville

Hazel Green

Headland

Heath

Heflin

Helena

Henagar

Highland Lake

Highland Lakes

Hillsboro

Hissop

Hobson

Hobson City

Hodges

Hokes Bluff

Hollins

Hollis Crossroads

Holly Pond

Hollywood

Holt

Holtville

Homewood

Hoover

Horn Hill

Hueytown

Huguley

Huntsville

Hurtsboro

Hytop

Ider

Indian Springs Village

Irondale

Ivalee

Jackson

Jacksons’ Gap

Jacksonville

Jasper

Jemison

Joppa

Kansas

Kellyton

Kennedy

Killen

Kimberly

Kinsey

Kinston

La Fayette

Ladonia

Lake View

Lakeview

Lanett

Langston

Leeds

Leesburg

Leighton

Leroy

Lester

Level Plains

Lexington

Libertyville

Lillian

Lincoln

Linden

Lineville

Lipscomb

Lisman

Littleville

Livingston

Loachapoka

Lockhart

Locust Fork

Lookout Mountain

Louisville

Lowndesboro

Loxley

Luverne

Lynn

Macedonia

Madison

Madrid

Magnolia Springs

Malcolm

Malvern

Maplesville

Marbury

Margaret

Marion

Maytown

McDonald Chapel

McIntosh

McKenzie

McMullen

Meadowbrook

Megargel

Memphis

Mentone

Meridianville

Midfield

Midland City

Midway

Mignon

Millbrook

Millerville

Millport

Millry

Minor

Mobile

Monroeville

Montevallo

Montgomery

Moody

Moores Mill

Mooresville

Morris

Morrison Crossroads

Mosses

Moulton

Moundville

Mount Olive

Mount Olive CDP (Coosa County)

Mount Vernon

Mountain Brook

Movico

Mulga

Munford

Muscle Shoals

Myrtlewood

Nanafalia

Nances Creek

Napier Field

Natural Bridge

Nauvoo

Nectar

Needham

New Brockton

New Hope

New Market

New Site

New Union

Newbern

Newton

Newville

North Courtland

North Johns

Northport

Notasulga

Oak Grove

Oak Hill

Oakman

Odenville

Ohatchee

Oneonta

Onycha

Opelika

Opp

Orange Beach

Orrville

Our Town

Owens Cross Roads

Oxford

Ozark

Paint Rock

Panola

Parrish

Pelham

Pell City

Pennington

Penton

Perdido

Perdido Beach

Peterman

Petrey

Phenix City

Phil Campbell

Pickensville

Piedmont

Pike Road

Pinckard

Pine Apple

Pine Hill

Pine Level

Pine Ridge

Pinson

Pisgah

Pleasant Grove

Pleasant Groves

Point Clear

Pollard

Powell

Prattville

Priceville

Prichard

Providence

Putnam

Ragland

Rainbow City

Rainsville

Ranburne

Ray

Red Bay

Red Level

Redland

Redstone Arsenal

Reece City

Reeltown

Reform

Rehobeth

Repton

Ridgeville

River Falls

Riverside

Riverview

Roanoke

Robertsdale

Rock Creek

Rock Mills

Rockford

Rockville

Rogersville

Rosa

Russellville

Rutledge

Saks

Samson

Sand Rock

Sanford

Saraland

Sardis City

Satsuma

Scottsboro

Section

Selma

Selmont-West Selmont

Semmes

Sheffield

Shelby

Shiloh

Shoal Creek

Shorter

Silas

Silverhill

Sims Chapel

Sipsey

Skyline

Slocomb

Smiths Station

Smoke Rise

Snead

Somerville

South Vinemont

Southside

Spanish Fort

Spring Garden

Springville

Spruce Pine

St. Florian

St. Stephens

Standing Rock

Stapleton

Steele

Sterrett

Stevenson

Stewartville

Stockton

Sulligent

Sumiton

Summerdale

Susan Moore

Sweet Water

Sylacauga

Sylvan Springs

Sylvania

Talladega

Talladega Springs

Tallassee

Tarrant

Taylor

Theodore

Thomaston

Thomasville

Thorsby

Tibbie

Tidmore Bend

Tillmans Corner

Town Creek

Toxey

Trafford

Triana

Trinity

Troy

Trussville

Tuscaloosa

Tuscumbia

Tuskegee

Twin

Underwood-Petersville

Union

Union Grove

Union Springs

Uniontown

Uriah

Valley

Valley Grande

Valley Head

Vance

Vandiver

Vernon

Vestavia Hills

Vina

Vincent

Vinegar Bend

Vredenburgh

Wadley

Waldo

Walnut Grove

Warrior

Waterloo

Waverly

Weaver

Webb

Wedowee

Weogufka

West Blocton

West End-Cobb Town

West Jefferson

West Point

Westover

Wetumpka

Whatley

White Hall

White Plains

Whitesboro

Wilsonville

Wilton

Winfield

Woodland

Woodstock

Woodville

Yellow Bluff

York