Alabama FHA Mortgage Lenders – Alabama Mortgage Lenders Providing FHA, VA, Private Lenders!

NO APPLICATION FEES AND NO LENDER FEES! SAME DAY APPROVALS FHA loans have been helping ALABAMA residents since 1934. An Alabama FHA Mortgage Lender can offer you a better Mortgage Deal including:

FHA loans have been helping ALABAMA residents since 1934. An Alabama FHA Mortgage Lender can offer you a better Mortgage Deal including:

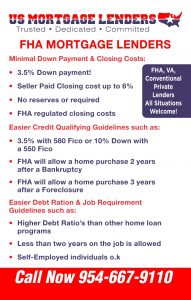

- Low er down payments (if any)

- Lower closing costs

- Easier credit qualifying

- Same Day Pre Approvals!

ALABAMA FHA MORTGAGE LENDERS:

- Down payment only 3.5% of the purchase price.

- Gifts from family or FHA Grants for down payment assistance and closing costs OK!

- Sellers can credit the buyer’s up to 6% of sales price towards buyers costs and pre-paid.

- No reserves or future payments in account required.

- FHA regulated closing costs.

- Read more about buying a home with an FHA mortgage Bad Credit –No Credit – Investment –Second Home –Multi Family –

ALABAMA FHA MORTGAGE LOANS ARE EASIER BECAUSE:

- 12 months after a chapter 13 Bankruptcy FHA mortgage Lender approvals!

- 24 months after a chapter 7 Bankruptcy FHA mortgage Lender approvals!

- 3 years after a Foreclosure FHA mortgage Lender approvals!

- No Credit Score FHA mortgage Lender approvals!

- 580 required for 96.5% financing or 3.5% down payment FHA mortgage Lender approvals.

- 500 required for 90% financing or 10% down payment FHA mortgage Lender approvals.

- BAD CREDIT ALABAMA with minimum 500 FICO credit score with 10% Down Payment FHA. For FHA mortgage applicants with credit scores between 500 and 579 must make down payments of at least 10% down!

- Read more about FHA Qualifying Qualification Summary – Manual Underwrite – Collections-Judgement’s – Bankruptcy or Foreclosure – Compensating Factors –

ALABAMA FHA MORTGAGE DEBT TO INCOME & EASIER JOB QUALIFYING

- FHA allows higher debt ratio’s than any conventional mortgage loan programs.

- Less than two years on the same job is OK!

- Self-employed buyers can also qualify with FHA Mortgage Lenders.

- Read More about Gifts For Down Payment – Documents Checklist – Debt To Income – Student Loans –

Whether you’re a first time ALABAMA home buyer, moving to a new home, or want to FHA refinance your existing conventional or Florida mortgage, we will show you how to purchase or refinance a home with flexible guidelines. Good Credit – Bad Credit – No Credit + No Problem + We work with everyone towards home ownership!

ALABAMA FHA MORTGAGE LENDERS LOAN LIMITS BY COUNTY

One-Family is a single family home or condominium, Townhome, or Villa

Two-Family is two separate living units (duplex)

Three-Family three separate living units (triplex)

Four-Family four separate living units (fourplex)

| Alabama County | One-Family | Two-Family | Three-Family | Four-Family | Median Sale Price |

| AUTAUGA , AL | 294,515 | 377,075 | 455,800 | 566,425 | 145,000 |

| BALDWIN , AL | 294,515 | 377,075 | 455,800 | 566,425 | 183,000 |

| BARBOUR , AL | 294,515 | 377,075 | 455,800 | 566,425 | 97,000 |

| BIBB , AL | 294,515 | 377,075 | 455,800 | 566,425 | 190,000 |

| BLOUNT , AL | 294,515 | 377,075 | 455,800 | 566,425 | 190,000 |

| BULLOCK , AL | 294,515 | 377,075 | 455,800 | 566,425 | 72,000 |

| BUTLER , AL | 294,515 | 377,075 | 455,800 | 566,425 | 99,000 |

| CALHOUN , AL | 294,515 | 377,075 | 455,800 | 566,425 | 117,000 |

| CHAMBERS , AL | 294,515 | 377,075 | 455,800 | 566,425 | 50,000 |

| CHEROKEE , AL | 294,515 | 377,075 | 455,800 | 566,425 | 103,000 |

| CHILTON , AL | 294,515 | 377,075 | 455,800 | 566,425 | 190,000 |

| CHOCTAW , AL | 294,515 | 377,075 | 455,800 | 566,425 | 64,000 |

| CLARKE , AL | 294,515 | 377,075 | 455,800 | 566,425 | 91,000 |

| CLAY , AL | 294,515 | 377,075 | 455,800 | 566,425 | 73,000 |

| CLEBURNE , AL | 294,515 | 377,075 | 455,800 | 566,425 | 113,000 |

| COFFEE , AL | 294,515 | 377,075 | 455,800 | 566,425 | 110,000 |

| COLBERT , AL | 294,515 | 377,075 | 455,800 | 566,425 | 148,000 |

| CONECUH , AL | 294,515 | 377,075 | 455,800 | 566,425 | 74,000 |

| COOSA , AL | 294,515 | 377,075 | 455,800 | 566,425 | 86,000 |

| COVINGTON , AL | 294,515 | 377,075 | 455,800 | 566,425 | 61,000 |

| CRENSHAW , AL | 294,515 | 377,075 | 455,800 | 566,425 | 74,000 |

| CULLMAN , AL | 294,515 | 377,075 | 455,800 | 566,425 | 100,000 |

| DALE , AL | 294,515 | 377,075 | 455,800 | 566,425 | 80,000 |

| DALLAS , AL | 294,515 | 377,075 | 455,800 | 566,425 | 85,000 |

| DEKALB , AL | 294,515 | 377,075 | 455,800 | 566,425 | 105,000 |

| ELMORE , AL | 294,515 | 377,075 | 455,800 | 566,425 | 145,000 |

| ESCAMBIA , AL | 294,515 | 377,075 | 455,800 | 566,425 | 98,000 |

| ETOWAH , AL | 294,515 | 377,075 | 455,800 | 566,425 | 107,000 |

| FAYETTE , AL | 294,515 | 377,075 | 455,800 | 566,425 | 79,000 |

| FRANKLIN , AL | 294,515 | 377,075 | 455,800 | 566,425 | 65,000 |

| GENEVA , AL | 294,515 | 377,075 | 455,800 | 566,425 | 123,000 |

| GREENE , AL | 294,515 | 377,075 | 455,800 | 566,425 | 73,000 |

| HALE , AL | 331,200 | 424,000 | 512,500 | 636,900 | 141,000 |

| HENRY , AL | 294,515 | 377,075 | 455,800 | 566,425 | 123,000 |

| HOUSTON , AL | 294,515 | 377,075 | 455,800 | 566,425 | 123,000 |

| JACKSON , AL | 294,515 | 377,075 | 455,800 | 566,425 | 104,000 |

| JEFFERSON , AL | 294,515 | 377,075 | 455,800 | 566,425 | 190,000 |

| LAMAR , AL | 294,515 | 377,075 | 455,800 | 566,425 | 71,000 |

| LAUDERDALE , AL | 294,515 | 377,075 | 455,800 | 566,425 | 148,000 |

| LAWRENCE , AL | 294,515 | 377,075 | 455,800 | 566,425 | 106,000 |

| LEE , AL | 294,515 | 377,075 | 455,800 | 566,425 | 197,000 |

| LIMESTONE , AL | 294,515 | 377,075 | 455,800 | 566,425 | 160,000 |

| LOWNDES , AL | 294,515 | 377,075 | 455,800 | 566,425 | 145,000 |

| MACON , AL | 294,515 | 377,075 | 455,800 | 566,425 | 78,000 |

| MADISON , AL | 294,515 | 377,075 | 455,800 | 566,425 | 160,000 |

| MARENGO , AL | 294,515 | 377,075 | 455,800 | 566,425 | 95,000 |

| MARION , AL | 294,515 | 377,075 | 455,800 | 566,425 | 85,000 |

| MARSHALL , AL | 294,515 | 377,075 | 455,800 | 566,425 | 91,000 |

| MOBILE , AL | 294,515 | 377,075 | 455,800 | 566,425 | 92,000 |

| MONROE , AL | 294,515 | 377,075 | 455,800 | 566,425 | 50,000 |

| MONTGOMERY , AL | 294,515 | 377,075 | 455,800 | 566,425 | 145,000 |

| MORGAN , AL | 294,515 | 377,075 | 455,800 | 566,425 | 106,000 |

| PERRY , AL | 294,515 | 377,075 | 455,800 | 566,425 | 70,000 |

| PICKENS , AL | 331,200 | 424,000 | 512,500 | 636,900 | 141,000 |

| PIKE , AL | 294,515 | 377,075 | 455,800 | 566,425 | 110,000 |

| RANDOLPH , AL | 294,515 | 377,075 | 455,800 | 566,425 | 90,000 |

| RUSSELL , AL | 294,515 | 377,075 | 455,800 | 566,425 | 189,000 |

| SHELBY , AL | 294,515 | 377,075 | 455,800 | 566,425 | 190,000 |

| ST. CLAIR , AL | 294,515 | 377,075 | 455,800 | 566,425 | 190,000 |

| SUMTER , AL | 294,515 | 377,075 | 455,800 | 566,425 | 77,000 |

| TALLADEGA , AL | 294,515 | 377,075 | 455,800 | 566,425 | 86,000 |

| TALLAPOOSA , AL | 294,515 | 377,075 | 455,800 | 566,425 | 108,000 |

| TUSCALOOSA , AL | 331,200 | 424,000 | 512,500 | 636,900 | 141,000 |

| WALKER , AL | 294,515 | 377,075 | 455,800 | 566,425 | 190,000 |

| WASHINGTON , AL | 294,515 | 377,075 | 455,800 | 566,425 | 90,000 |

| WILCOX , AL | 294,515 | 377,075 | 455,800 | 566,425 | 85,000 |

| WINSTON, AL | 294,515 | 377,075 | 455,800 | 566,425 | 75,000 |

Alabama – FHA MORTGAGE LENDERS

FHAmortgagePrograms.com CURRENTLY SERVING AND LICENSED IN FLORIDA, GEORGIA … Now Approved In Alabama Serving Every location in Alabama!

3.5% Down Alabama FHA Mortgage Lenders Min 580 FICO!!

BAD CREDIT ALABAMA with minimum 500 FICO credit score with 10% Down Payment FHA. For FHAmortgage applicants with credit scores between 500 and

3.5% Alabama FHA Mortgage Lenders Min 580 FICO!!

3.5% Alabama FHA Mortgage Lenders Min 580 FICO!! Same Day FHA, VA, Bad Credit Alabama Mortgage Loans Pre Approvals Call Now 954-667-9110. … FHA mortgage Programs.com questions and answers! First Time Home buyers · FHA …

bad credit Alabama FHA mortgage guidelines – FHA mortgage lenders

Please note Bad Credit Alabama FHA loan guidelines are a moving target and are …. https://www.fhamortgageprograms.com/Alabama-va-mortgage-lenders/.

Tag: Alabama FHA Mortgage Lenders – 3.5% Florida FHA Mortgage …

Alabama FHA Mortgage Lenders- Alabama FHA Home Loans! SAME DAY APPROVALSFHA loans have been helping Alabama residents since 1934.

6 Alabama stated income mortgage lenders programs – fha mortgage …

ALABAMA STATED MORTGAGE LENDERS SUMMARY! No tax returns required.

Alabama Mortgage Lenders Archives – FHA MORTGAGE LENDERS

Apr 16, 2018 – Alabama FHA Mortgage Lenders – Bad Credit – No Credit OK! bad credit … At FHA mortgage programs.com we go the extra mile to help find …