Florida Bad Credit Refinance with Bankruptcy, Foreclosure, or Short Sale

BAD CREDIT MORTGAGE REFINANCE IN FLORIDA WITH 120-90-60-120 DAY LATE PAYMENTS!

- Florida Bad Credit Refinance with1 day out of FC, SS, BK, or DIL

- Florida Bad Credit Refinance with Loans up to $1 million

- Florida Bad Credit Refinance with Mortgage lates OK

- Florida Bad Credit Refinance with Credit scores as low as 500

- Florida Bad Credit Refinance with 100% gift funds allowed

- Florida Bad Credit Refinance with No active tradelines OK

- Florida Bad Credit Refinance with Up to 80% LTV

- Florida Bad Credit Refinance with O/O, 2nd homes & investment

- Florida Bad Credit Refinance with Non-warrantable condos OK

- Florida Bad Credit Refinance with SFRs, townhomes, 2-4 units

- Florida Bad Credit Refinance with Short Sale

- Florida Bad Credit Refinance with Deed-in-Lieu

- Florida Bad Credit Refinance with Foreclosure

- Florida Bad Credit Refinance with Chapter 7Bankruptc

- Florida Bad Credit Refinance with Chapter 13Bankruptcy

- Florida Bad Credit Refinance with 1 day out of FC, SS, BK, or DIL

- Florida Bad Credit Refinance with Loans up to $1 million

- Florida Bad Credit Refinance with Mortgage lates OK

- Florida Bad Credit Refinance with Credit scores as low as 500

- Florida Bad Credit Refinance with 100% gift funds allowed

Getting a new bad credit mortgage to refinance to replace the original is called bad credit refinancing. Bad Credit mortgage refinancing is done to allow a borrower to obtain a better interest term and rate. The first bad credit mortgage loan is paid off, allowing the second bad credit mortgage loan to be created, instead of simply making a new bad credit mortgage and throwing out the original bad credit mortgage. For bad credit mortgage borrowers with a bad credit history, refinancing can be a good way to convert a variable loan rate to a fixed, and obtain a lower interest rate. Bad credit Florida mortgage applicants with less than perfect, or even bad credit, or too much debt, refinancing can be risky.

In any economic climate, it can be difficult to make the payments on a home mortgage. Between possible high interest rates and an unstable economy, making mortgage payments may become tougher than you ever expected. Should you find yourself in this situation, it might be time to consider refinancing. The danger in refinancing lies in ignorance. Without the right knowledge, it can actually hurt you to refinance, increasing your interest rate rather than lowering it. Below you will find some of this basic knowledge written in order to help you reach your best deal. For comparative purposes, here is a rate table highlighting current rates in your area.

BAD CREDIT FLORIDA MORTGAGE REFINANCE

MORTGAGE REFINANCE IN FLORIDA WITH 120-90-60-120DAY LATE PAYMENTS!

Getting a Florida Mortgage with bad credit isn’t as easy as it was a year or two ago. However, it isn’t as impossible as some news reports make it seem. Even Floridians with bad credit reports which reveal past financial sins still sometimes get to the promised land of mortgage approval. Most Home Buyers and Refinance clients do so with the help of a skilled and experienced Florida mortgage lender who specializes in Florida bad credit home mortgages.

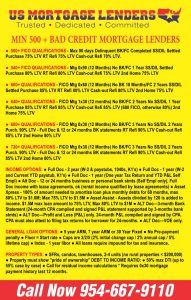

BAD CREDIT MORTGAGE LENDERS PROGRAMS INCLUDE:

-

PURCHASE OR REFINANCE A FLORIDA MORTGAGE LOAN WITH 30 60 90 DAY LATE MORTGAGE PAYMENTS!

- Bank Statement Only Bad Credit Florida Mortgage Lenders

- CASH OUT REFINANCE Bad Credit Mortgage Lenders

- VA Bad Credit Florida Mortgage Lenders

- USDA Bad Credit Florida Mortgage Lenders

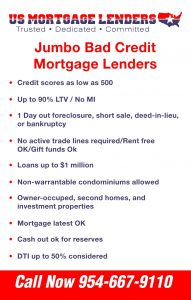

- Jumbo Bad Credit Florida Mortgage Lenders

- Hard Money Bad Credit Hard Money Lenders

- No Credit Score – Previous Bad Credit Florida Mortgage Lenders

- Condominium Florida Bad Credit Mortgage Lenders

- Town House Florida Bad Credit Mortgage Lenders

- Modular Home Florida Bad Credit Mortgage Lenders

- Chapter 13 CASH OUT REFINANCE Mortgage Lenders

- Non-Warrant-able Condo Florida Bad Credit Mortgage Lenders

BAD CREDIT LENDERS- HYPOTHETICAL EXAMPLE

BAD CREDIT HYPOTHETICAL RATES – APR AND CONDITIONS ARE JUST EXAMPLE!

ACTUAL RATES AND CONDITIONS CHANGE DAILY!

WHAT IS A BAD CREDIT FLORIDA NON-QM LENDER? The Dodd-Frank Wall Street Reform and Consumer Protection Act was signed into law in the summer of 2010 by the President of the United States. Along with other regulatory reforms, this Act created minimum qualifying standards for mortgages, including the Ability to Repay (ATR) rules and a Qualified Mortgage definition. The Consumer Financial Protection Bureau (CFPB) put these new rules into effect on January 10, 2014.

A Non-QM loan can help bad credit mortgage applicants who have had credit issues in the past such as foreclosures, bankruptcy, late payments or other isolated credit issues. Non-QM bad credit loans also have underwriting guidelines that are different than the typical conventional or government type loans. These guidelines allow the bad credit mortgage lenders to look at the entire loan picture for a borrower and not just their credit score and government underwriting matrices (DU or LP).

The Non-QM bad credit mortgage lenders guidelines also look at the borrower’s income based on their type of employment and analyze their Ability to Repay (ATR) a loan according to its terms (based on many factors). This includes cash flows through personal and business bank accounts.

Self-employed borrowers typically have more complicated income structures that require different calculations than wage earners. Self-employed income often times does not qualify for the “one size fits all” conventional/government underwriting standards.

US Mortgage Lenders provides loans to bad credit mortgage applicants that have the ability to repay their loans and that meet all regulatory lending criteria. These borrowers can now take part in the American dream of homeownership even though they may have had a life event that affected their credit or they have verifiable income that needs to be considered outside a standard grid.

BAD CREDIT FLORIDA MORTGAGE LENDERS

If your seeking a Florida mortgage lender and have what is known in general as bad credit, and you are trying to obtain a home loan in Florida, then we encourage you to work with an experienced Mortgage Lender with a record of funding even the most difficult Florida mortgage loans.

We have been helping Florida mortgage with bad credit find the right lenders, gather their loan documents, and present complete loan packages to lenders for over a decade. Our technique really comes down to understanding what an underwriter is looking for and putting together a complete and thorough Florida bad credit mortgage package.

For some Florida mortgage applicant, it’s the only way to get a bad credit Florida mortgage lender to say yes to a home loan. This is especially the case for a borrower with bad credit mortgage issues.

We know that a temporary set back like a Foreclosure or Bankruptcy can leave you with damaged credit even though you have worked hard to meet all of your financial obligations for most of a lifetime. Even a Tax lien or Judgement can affect credit ratings quickly and adversely affect the loan process when applying for a bad credit Florida mortgage.

We feel the borrower with less than perfect credit is the one who benefits the most from working with an experienced Florida mortgage lender. A good Florida mortgage lender knows which lenders have the best programs for borrowers with poor credit and knows how to present an application truthfully and ethically in the strongest light possible. No, we won’t exaggerate or misrepresent the facts on your behalf; however, we will work to properly represent you and explain why the situation so you can get approved for a low-interest rate bad credit Florida mortgage.

Your credit report is the key factor for many of the mortgages we offer, but it is not the only factor. With an experienced Florida Mortgage professional working on your behalf, you may be pleasantly surprised at the bad credit home loan quote you get from our network of quality Florida lenders.

We can help you take an objective look at your home loan options regardless of your past credit history. Our experienced loan officers are very skilled at examining your credit report. And our Florida bad credit home loan specialists are happy to offer you free advice on how to clean up your credit report in preparation for your home loan process.

For some bad credit mortgage applicants, the hardest lifting takes place weeks before the mortgage application. It’s never too soon to call 1-954-667-9110 to speak to one of our mortgage officers. If you have a weak credit report but want to get a mortgage or refinance your existing one, now is the time to get started. Use our Full Application to find out more.

We have excellent rapport with many lenders who underwrite and service their own loans in house. Because they don’t resell the loans they originate, these lenders can say yes to a borrower when banks that are more conservative have said no.

It’s actually better for borrowers with bad credit right now than it was before 1990. Before 1990, if a borrower did not qualify for a conventional or government loan, he or she was out of home loan options. The emergence of lenders willing to serve those with poor credit has been a godsend for the borrower who recognizes that a bad credit home loan is a temporary loan.

Used properly with good financial planning, a subprime home loan serves the bad credit borrower for 2-4 years while he or she demonstrates the discipline to pay financial obligations on time. Once the healthier financial pattern yields a higher middle credit score, the borrower can apply for a government insured CASH OUT REFINANCE home mortgage or a fixed rate conventional mortgage.

Even for mortgage borrowers with bad credit, our mortgage company has found ways to secure financing for a decade.

- 30 year fixed rate mortgages for persons with damaged credit to purchase homes;

- Fixed rate mortgages with one, three, or five year Interest Onlyperiods;

- Limited opportunities on loans for purchasing or refinancing single and doublewide Mobile Homes on land for buyers with low FICO scores in Polk County and the other Florida counties we serve;

- A range of Jumbo and Super Jumbo home loans for those borrowers seeking to purchase executive homes

Don’t let credit dings prevent you from applying for a mortgage from one of Florida’s fastest growing mortgage lenders. Call 1-954-667-9110 or apply for a Florida bad credit mortgage online using our Full Application right now!

Bad Credit Hypothetical Examples definition= Supposed but not necessarily real or true.

- FLORIDA BAD CREDIT JUMBO MORTGAGE LENDERS

- Bad Credit Florida Mortgage Lenders- Min 500 FICO

- 3.5% DOWN BAD CREDIT FLORIDA MORTGAGE LENDERS

- www.florida-mortgage-lenders.com/bad-credit.html

- BAD CREDIT CASH OUT REFINANCE MORTGAGE LENDERS – Florida-Mortgage …

- www.Florida-Mortgage-Lenders.com = CASH OUT REFINANCE , VA, Conventional, Bad …

- 15% DOWN+STATED INCOME FLORIDA MORTGAGE LENDERS-

- 3.5% DOWN BAD CREDIT FLORIDA MORTGAGE LENDER

- Florida Home Loans Approvals with Poor or Bad Credit

- JUMBO FLORIDA BAD CREDIT MORTGAGE LENDERS