BAD CREDIT TEXAS MORTGAGE LENDERS

- YES! TEXAS Texas bad credit mortgage WITH COLLECTION ACCOUNTS!

- Texas Bad Credit Texas bad credit mortgage lenders requirements regarding 30,60,90,120 days late payments?

Get Pre Approved after a Bankruptcy or Foreclosure!

TEXAS BAD CREDIT CASH OUT LENDERS PROGRAMS INCLUDE:

TEXAS BAD CREDIT CASH OUT LENDERS PROGRAMS INCLUDE:

- TEXAS Texas bad credit mortgage MINIMUM CREDIT SCORE FOR BAD CREDIT

- 3.5% DOWN BAD CREDIT TEXAS Texas bad credit mortgage LENDERS

- TEXAS BAD CREDIT JUMBO Texas bad credit mortgage LENDERS

- Texas Bad Credit Texas bad credit mortgage Lenders – Bad Credit – No Credit OK!

- JUMBO TEXAS BAD CREDIT Texas bad credit mortgage LENDERS – Bad Credit …

- 100% TEXAS VA Bad Credit Texas bad credit mortgage Lenders Min 580 FICO!

- 3.5% DOWN TEXAS BAD CREDIT Texas bad credit mortgage LENDERS Archives …

- Texas Texas bad credit mortgage Lenders Allow Collections and Disputed Accounts

- bad credit texas Bad Credit Texas bad credit mortgage guidelines – Bad Credit Texas bad credit mortgage lenders

KNOWLEDGE IS POWER- Many Bad Credit Texas Texas bad credit mortgage applicants don’t realize that private Bad Credit Texas Bad Credit Texas bad credit mortgage Lenders that provide Government guaranteed Texas bad credit mortgage approvals based on payment history and not based on your Bad Credit Texas scores. Believe it or not there are some Bad Credit Texas Texas bad credit mortgage lenders that still provide low-interest rate government Texas bad credit mortgage loans can help Bad Credit Texas Bad Credit Texas bad credit mortgage applicants purchase or refinance a home with bad credit. Even If you have a Bad Credit Texas past and you’re looking for a low interest rate a Bad Credit Texas Bad Credit Texas bad credit mortgage lender may be able to help you with one of our programs:

WHATS THE MINIMUM REQUIRED CREDIT SCORE FOR BAD CREDIT?

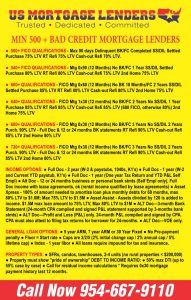

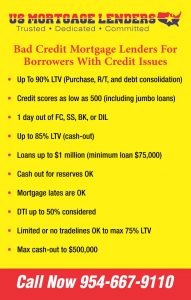

- 10% DOWN WITH +500 CREDIT SCORE.

- 3.5% DOWN WITH +580 CREDIT SCORE.

- Bad Credit DEBT TO INCOME RATIOS APPLY

- Bad Credit Texas bad credit mortgage A HOME WHILE IN A CHAPTER 13 BANKRUPTCY

ADDITIONAL QUALIFYING CRITERIA APPLIES

Bad Credit Texas Bad Credit Texas bad credit mortgage LENDERS APPROVALS WITH MINIMAL DOWN PAYMENT AND CLOSING FEES:

- Down payment only 3.5% of the purchase price.

- Gifts from family or Bad Credit Grants for down payment assistance and closing costs OK!

- Sellers can credit the buyer’s up to 6% of sales price towards buyers costs and pre-paid.

- No reserves or future payments in account required.

- Bad Credit regulated closing costs.

- Read more about buying a home with an Bad Credit Texas bad credit mortgage Bad Credit –No Credit – Investment –Second Home –Multi Family –

Texas bad credit mortgage LENDERS MAKE QUALIFYING EASIER BECAUSE YOU CAN PURCHASE:

- 12 months after a chapter 13 Bankruptcy Bad Credit Texas bad credit mortgage Lender approvals!

- 24 months after a chapter 7 Bankruptcy Bad Credit Texas bad credit mortgage Lender approvals!

- 3 years after a Foreclosure Bad Credit Texas bad credit mortgage Lender approvals!

- No Credit Score Bad Credit Texas bad credit mortgage Lender approvals!

- 580 required for 96.5% financing or 3.5% down payment Bad Credit Texas bad credit mortgage Lender approvals.

- 500 required for 90% financing or 10% down payment Bad Credit Texas bad credit mortgage Lender approvals.

- Bad Credit with minimum 500 FICO credit score with 10% Down Payment Bad Credit . For Bad Credit Texas bad credit mortgage applicants with credit scores between 500 and 579 must make down payments of at least 10% down!

- Read more about Bad Credit Qualifying Qualification Summary – Manual Underwrite – Collections-Judgement’s – Bankruptcy or Foreclosure – Compensating Factors –

Bad Credit Texas Bad Credit Texas bad credit mortgage LENDERS ALLOW HIGHER DEBT TO INCOME & EASIER JOB QUALIFYING

- Bad Credit allows higher debt ratio’s than any conventional Texas bad credit mortgage loan programs.

- Less than two years on the same job is OK!

- Self-employed buyers can also qualify with Bad Credit Texas bad credit mortgage Lenders.

- Read More about Gifts For Down Payment – Documents Checklist – Debt To Income – Student Loans –

BAD CREDIT? – GET PRE APPROVED TODAY!

- Texas Bad Credit CashOut Refinance UP To 500K In Hand!

- 3.5% Plano Texas Bad Credit Texas bad credit mortgage Lenders Min 580 FICO!

- 3.5% Corpus Christi Texas Bad Credit Texas bad credit mortgage Lenders

- 3.5% Arlington Texas Bad Credit Texas bad credit mortgage Lenders

- 3.5% El Paso Texas Bad Credit Texas bad credit mortgage Lenders

- 3.5% Fort Worth Texas Bad Credit /VA Texas bad credit mortgage Lenders

- 3.5% Down Austin Texas Bad Credit Texas bad credit mortgage Lenders

- 3.5% Down Dallas Texas Bad Credit Texas bad credit mortgage Lenders

- BAD CREDIT TEXAS Texas bad credit mortgage LENDERS

- 3.5% San Antonio Texas Bad Credit Texas bad credit mortgage Lenders

ALL SITUATIONS ARE WELCOME!!! MORE Bad Credit Texas Texas bad credit mortgage LENDERS PROGRAMS INCLUDE:

Bad Credit Bad Credit Texas Texas bad credit mortgage LENDERS UNDERWRITING- Bad Credit Texas Bad Credit Texas bad credit mortgage lenders must downgrade and manually underwrite an Bad Credit Texas bad credit mortgage applicant that does not have Automated underwriting system approval or if the the non-occupying co-borrower has a lower credit score. Bad Credit Texas bad credit mortgage applicants with no credit or insufficient credit payment histories may be approved for maximum Bad Credit financing, but must be manually underwritten using the procedures in Handbook 4000. When the Bad Credit Texas bad credit mortgage application involves multiple borrowers, the Bad Credit Texas bad credit mortgage lender must determine the Bad Credit TexasBad Credit Texascredit scores for each borrower, and then select the lowest middle credit score for all borrowers. Where the Bad Credit Texas bad credit mortgage involves multiple borrowers and one or more of the borrowers do not have No credit score the Bad Credit Texas bad credit mortgage lender must select the lowest middle credit score of the borrower’s with the lowest credit score’s. The Bad Credit Texas bad credit mortgage lender must review the credit report to determine the borrower’s credit score and payment histories are acceptable under Bad Credit minimum Bad Credit Texas Texas bad credit mortgage lending requirements.

GOVERNMENT Bad Credit TexasLOANS –An Bad Credit or VA Texas bad credit mortgage lender may be able to help you purchase a new home with 0 or 3.5% down payment even if you have bad credit. Even If you’ve had accounts forwarded to collections, past bankruptcies or Foreclosures, high debt to income ratio, then you still may qualify for our Bad Credit Texasor no credit Texas bad credit mortgage programs. These government-backed Bad Credit Texas Texas bad credit mortgage loans can work for Texas bad credit mortgage applicants that don’t have cash for a down payment or closing costs. And they are a much better choice than a money loan option.

WE HELP Bad Credit Texas bad credit mortgage APPLICANTS WITH Bad Credit TexasGET APPROVED–We work with all types of Bad Credit Texas Texas bad credit mortgage applicants with all types of credit situations who described themselves as having “bad credit” – that are now homeowners! The truth is, there are many more Bad Credit Texas Texas bad credit mortgage applicants that will qualify for an Bad Credit Texas bad credit mortgage over a conventional Texas bad credit mortgage.

WHAT DO Bad Credit Texas Bad Credit Texas bad credit mortgage LENDERS LOOK FOR?Mostly Bad Credit Texas lenders like every other lender want to see stability for at least the last 12 months. Regardless of your past Bad Credit Texas lenders know they are taking a risk. But less of a risk with a borrower that is now back on track with proof of the last 12 months’ timely rental history. And no 30 day +plus late payments within the last 12 months. Bad Credit Texas Texas bad credit mortgage lenders are looking for borrower who can not prove they are back on their feet!

FREE Bad Credit TexasREPAIR CHECKLIST ATTACHED (CLICK HERE)-Bad Credit Texas scores can indicate to Texas bad credit mortgage lenders how well you manage money. You can improve Bad Credit Texas Texas bad credit mortgage approval chances by cleaning up your Bad Credit Texas history.. Furthermore, since Bad Credit Texas scores could translate into high interest rates and a much larger down payment for most it always makes sense to focus on repairing the Bad Credit Texasbefore applying with a Bad Credit TexasTexas bad credit mortgage lender.

HOW TO IMPROVE Bad Credit TexasFAST IF YOU HAVE BAD CREDIT-Here are a few ways Bad Credit TexasTexas bad credit mortgage applicants can raise their credit scores and fix their Bad Credit Texasfast.

- VERIFY TIMELY HOUSING PAYMENT HISTORY- Pay rent by check or bank transfer. Lets face it if you can prove to a Bad Credit Texas Texas bad credit mortgage lender you can pay your rent on time, you can pay a Texas bad credit mortgage. By providing either 12 months timely rental history either provide cancelled checks or verification of rent from a management company you can show the Bad Credit Texas lender you can handle the new obligation. In the hierarchy of Bad Credit Texas Texas bad credit mortgage approvals, if you can prove timely rental history then you can pay a Texas bad credit mortgage

- PAY DOWN BALANCES ON REVOLVING CREDIT CARDS ONLY-Pay down ONLY OPEN ACTIVE REVOLVING ACCOUNTS. The lower the balance the better. For simplicity pay down all charge revolving account you charge up and pay down below 10% of the limit.

- OPEN/ DEPOSIT MONEY ON A SECURED CREDIT CARD IF YOU DON’T HAVE ONE- Google search secured credit cards. Buy a secured credit card. Secured credit cards are a tool that can help you establish or build your credit history. Unlike prepaid cards, secured credit cards provide you with access to a credit line, and your payment activity will be reported to the major credit bureaus. Only you can build a good credit history. Make your payments on time each month, and keep your balance at approximately 10% or less of the credit limit.

- CALL ALL CREDITOR ASK FOR A 1 TIME EXCEPTION TO REMOVE ANY AND ALL LATE PAYMENTS ON YOUR REPORT–Bad Credit Texas loan applicants should call all creditors that reflect 30 60 90 day late payments and ask for a 1 time exception for removal. What do you have to lose? Calle every creditor showing any type of Bad Credit Texas remarks and ask for a “1-time exception for removal”.

- NEGOTIATE AND OR SETTLE ALL Bad Credit TexasCOLLECTIONS TO ZERO BALANCE- Negotiate all past Bad Credit Texas collections on your credit report other than medical bills to show a zero balance.

BAD CREDIT Texas bad credit mortgage LENDERS CREDIT QUALIFYING INFORMATIONAL LINKS

- Is a borrower eligible for Bad Credit insured financing if he or she does not have any credit history?Lack of traditional credit or a Borrower’s decision to not use credit may not be used as the sole basis for rejecting the Texas bad credit mortgage application. For Borrowers without a credit score, the lender must obtain a Non-Traditional Texas bad credit mortgage Credit.

- What are the credit history requirements for borrowers without a credit score in a HECM for Purchase transaction?When a borrower applies for a Home Equity Conversion Texas bad credit mortgage (HECM) for Purchase, but does not have a credit score, the Texas bad credit mortgagee (Lender) must either obtain a Non-Traditional Texas bad credit mortgage Credit Report (NTMCR) from a credit reporting company.

- What are the Bad Credit Texasreport requirements for a manually underwritten Texas bad credit mortgage?The Texas bad credit mortgagee must use a traditional credit report: Either a Tri-Merged Credit report (TMCR) or a Residential Texas bad credit mortgage Credit report (RMCR) must be obtained from an independent credit reporting agency. The Texas bad credit mortgagee must.

- What are the Bad Credit Texasreport requirements when using the TOTAL Texas bad credit mortgage Scorecard?The Texas bad credit mortgagee must use a traditional credit report. A Tri-Merged Credit Report (TRMCR) must be obtained from an independent consumer reporting agency. If a traditional credit report is not available or the traditional credit report.

- Does Bad Credit require a minimum credit score and how is it determined?The borrower is not eligible for Bad Credit -insured financing if the Minimum Decision Credit Score (MDCS) is less than 500. If the MDCS is between 500 and 579 the borrower is limited to a maximum loan-to-value (LTV) of 90%. If the MDCS.

- What are the Bad Credit Texasreport requirements for HECM borrowers?Credit reports must obtain all information from at least two credit repositories pertaining to credit, residence history, and public records information; be in an easy to read and understandable format, and not require code translations. The credit.

- How are disputed credit accounts considered for manually underwritten loans?Disputed Derogatory Credit Account refers to disputed charge off accounts, disputed collection accounts, and disputed accounts with late payments in the last 24 months. If the credit report indicates that the Borrower is disputing.

- What are Bad Credit ’s policies regarding Bad Credit Texashistory when manually underwriting a Texas bad credit mortgage?The underwriter must examine the Borrower’s overall pattern of credit behavior, not just isolated unsatisfactory or slow payments, to determine the Borrower’s creditworthiness. The underwriter must evaluate the Borrower’s payment.

- How are disputed credit accounts considered when using the TOTAL Scorecard?Disputed Derogatory Credit Accounts Disputed Derogatory Credit Account refers to disputed charge off accounts, disputed collection accounts, and disputed accounts with late payments in the last 24 months. If the credit report utilized.

- Can a Bad Credit Texas bad credit mortgage lender use foreign sources to help establish the credit, including the nontraditional credit, of a borrower?Foreign sources of credit that can be adequately documented and verified by the lender may be used to help establish the credit, including nontraditional credit, of a borrower. The lender is fully responsible for determining the authenticity.

- What is acceptable for developing a Bad Credit TexasBad Credit Texas borrower’s non-traditional credit history in a Home Equity Conversion Texas bad credit mortgage (HECM) for purchase?To be sufficient to establish the Borrower’s credit, the credit history must include three credit references, including at least one of the following: rental housing payments (subject to independent verification if the Borrower.

- Is a credit report required for a HECM Borrower, Non-Borrowing Spouse, or Other Non-Borrowing Household Member?The Texas bad credit mortgagee (Lender) must either obtain a tri-merged credit report (TRMCR) or a Residential Texas bad credit mortgage Credit Report (RMCR) from an independent consumer reporting agency for each Borrower who will be obligated on the Texas bad credit mortgage note. The Texas bad credit mortgagee may.

- What is considered satisfactory credit for a Home Equity Conversion Texas bad credit mortgage (HECM) borrower?The Texas bad credit mortgagee (Lender) may consider the Borrower to have satisfactory credit if: the Borrower has made all housing and installment debt payments on-time for the previous 12 months and no more than two 30-day late Texas bad credit mortgage.

- How does a Texas bad credit mortgagee verify a Bad Credit Texasborrower’s nontraditional credit references in a Home Equity Conversion Texas bad credit mortgage (HECM)?The Texas bad credit mortgagee (lender) may independently verify the HECM borrower’s credit references by documenting the existence of the credit provider and that the provider extended credit to the HECM borrower. To verify the existence of each.

- Must Bad Credit Texas bad credit mortgage lenders consider disputed derogatory credit accounts in a HECM borrower’s Financial Assessment?Disputed Derogatory Credit Account refers to disputed charge off accounts, disputed collection accounts, and disputed accounts with late payments in the last 24 months. The lender must analyze the documentation provided for consistency with other.

- How should Bad Credit Texas bad credit mortgage lenders evaluate a Home Equity Conversion Texas bad credit mortgage (HECM) borrower’s credit history?The Texas bad credit mortgagee (Lender) must examine the Borrower’s overall pattern of credit behavior, not just isolated unsatisfactory or slow payments, to determine the Borrower’s ability to manage their financial obligations. The Texas bad credit mortgagee must.

- Do I have to consider the Bad Credit Texasand debts of a non-purchasing spouse in a community property state? specifically excluded by state law. The Lender must not consider the credit history of a non-borrowing spouse. The non-borrowing spouse’s credit history is not considered a reason to deny a Texas bad credit mortgage application. The lender must.

- Are disputed derogatory credit accounts included in the expense analysis for a Home Equity Conversion Texas bad credit mortgage (HECM) Bad Credit TexasBorrower?Disputed derogatory credit accounts refer to disputed charge off accounts, disputed collection accounts, and disputed accounts with late payments in the last 24 months. If the borrower has $1,000 or more collectively in disputed.

- Must an Eligible Non-Borrowing Spouse or Other Non-Borrowing Household Member’s credit history be reviewed in a Home Equity Conversion Texas bad credit mortgage (HECM)?Texas bad credit mortgagees (Lenders) must not review the credit history of Eligible Non-Borrowing Spouses or Other Non-Borrowing Household Members. Whether the Eligible Non-Borrowing Spouse or Other Non-Borrowing Household Member has.

- For whom must the Bad Credit Texas bad credit mortgage Lender obtain a Bad Credit Texasreport? The Lender must obtain a credit report for each borrower who will be obligated on the Texas bad credit mortgage note. Joint reports may be ordered for individuals with joint accounts. The Lender must obtain a credit report for a non-borrowing spouse who.

- What are the additional credit report requirements for an RMCR in a HECM transaction?In addition to meeting the general credit report requirements, the Residential Texas bad credit mortgage Credit Report (RMCR) must: • provide a detailed account of the borrower’s employment history; • verify each borrower’s current.

- Is a Bad Credit Texasborrower eligible for an Bad Credit loan if the borrower has participated in consumer credit counseling?Participating in a consumer credit counseling program does not disqualify a Borrower from obtaining an Bad Credit -insured Texas bad credit mortgage. For manually underwritten loans the lender must document.

- Will a certain score on the Supplemental Performance Metric (SPM) automatically trigger Credit Watch?The Supplemental Performance Metric (SPM) is used to provide additional information in Bad Credit ’s overall evaluation of a Texas bad credit mortgagee’s performance. Bad Credit ’s Credit Watch triggers are not changed. The initial evaluation.

- If I am listed in HUD’s Credit Alert Verification Reporting System (CAIVRS), what does that mean?CAIVRS stands for Credit Alert Verification Reporting System. It is a system maintained by the federal government that lists the Social Security Numbers of persons with federal debt that is delinquent or in default, or who have had a claim.

- What are Bad Credit ’s policies regarding credit history when using the TOTAL scorecard?The Texas bad credit mortgagee must evaluate the Borrower’s credit history in accordance with the Accept Risk Classifications Requiring a Downgrade to Manual Underwriting found in Handbook 4000.1 II.A.4.a.v. If a determination is made.

- August 2016 – HUD Handbook 4000.1 Frequently Asked Questions Update-06ml.pdf Revised Form 92900-A Loan-Level Certification: http://portal.hud.gov/hudportal/documents/huddoc?id=16-06mlatch.pdf ML 2016-06 and attachment 4000.1 Credit Underwriting; Documentation Requirements 2. Does