BAREFOOT BAY FL MORTGAGE LENDERS

Welcome and thank you for visiting US Mortgage Lenders webpage. We are local Barefoot Bay Florida mortgage lenders. We are available to answer any questions you might have 24/7.

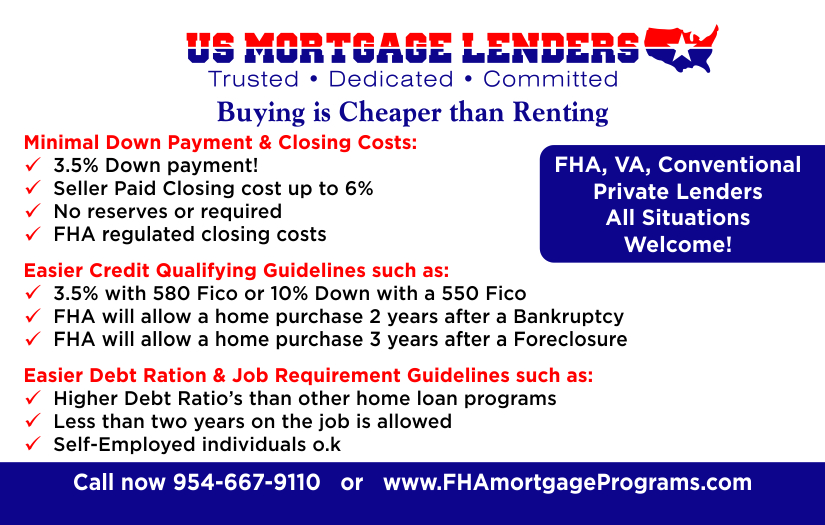

US Mortgage Lenders professionals have earned their excellent 5 star zillow and google reviews by opening more doors to homes in Barefoot Bay Florida than your average Florida lender. To discuss any of our full service Barefoot Bay Florida programs including, FHA minimum score 550, FHA Cash Out and Streamlines refinancing, Private lenders, Jumbo Loans, VA Mortgage loans down to 550 and Foreign National Loans. Note All Subject to change without notice.

BAREFOOT BAY FL MORTGAGE LENDERS PROGRAMS INCLUDE:

FOR SAME DAY PRE APPROVAL!

FOR YOUR FREE NO OBLIGATION CONSOLATION

WE ARE LOCAL BAREFOOT BAY FLORIDA FHA MORTGAGE LENDERS.

BAREFOOT BAY FL MORTGAGE PROGRAMS

- FIRST TIME HOME BUYER BAREFOOT BAY FLORIDA FHA MORTGAGE LENDERS – The FHA mortgage is not only for first time home buyers. Anyone purchasing a primary home can use the FHA loan. The FHA mortgage is popular with first time home buyers because of the with a low down payment requirement. In additions, bad credit, no credit mortgage applicants will find the FHA mortgage program is the only option to purchase a home. Read more »

- BAD CREDIT BAREFOOT BAY FLORIDA FHA MORTGAGE LENDERS – Bad Credit FHA mortgage loan approvals are approved based on a more common sense approach to mortgage lending meaning bad credit borrowers with past foreclosure or Bankruptcy, tax liens, and collections or judgments can still qualify can qualify to purchase a home. Read more »

- NO CREDIT SCORE BAREFOOT BAY FLORIDA FHA MORTGAGE LENDERS – FHA loan applicants with no credit score lack of trade lines can still qualify for an FHA mortgage loan using alternate trade lines to build a credit or payment history.Read more »

- CONDO BAREFOOT BAY FLORIDA FHA MORTGAGE LENDERS– Search and purchase an FHA approved condo using the FHA mortgage program. Read more »

- TOWNHOUSE BAREFOOT BAY FLORIDA FHA MORTGAGE LENDERS – The FHA mortgage program was created to help increase home ownership. The FHA program makes buying a townhouse home easier and less expensive than any other types of real estate mortgage home loan programs Read more »

- VILLA BAREFOOT BAY FLORIDA FHA MORTGAGE LENDERS– This FHA loan program was created to help increase home ownership. The FHA program makes buying a villa easier and less expensive than any other types of real estate mortgage home loan programs Read more »

- MULTIFAMILY BAREFOOT BAY FLORIDA FHA MORTGAGE LENDERS– This FHA loan program was created to help increase home ownership. The FHA program makes buying a multifamily duplex, triplex or four unit easier and less expensive than any other types of real estate mortgage home loan programs. Read more »

- JUMBO BAREFOOT BAY FLORIDA FHA MORTGAGE LENDERS– The Jumbo FHA mortgage loan can be used in higher cost areas over 417,000 to help borrowers qualify for a Jumbo low down payment FHA mortgage option.Read more »

- GIFTS ALLOWED BAREFOOT BAY FLORIDA FHA MORTGAGE LENDERS – When apply with an FHA mortgage lender you must document where your down payment came from. If you are getting a gift from a family member you must document the transfer, the documenation is very precise. Make sure the follow the FHA rules for a gift step by step, otherwise you may not be able to use the gift funds! Read more »

- MODULAR HOME BAREFOOT BAY FLORIDA FHA MORTGAGE LENDERS – The FHA Title I modular home loan mortgage may be used for the purchase or refinancing of a manufactured home and land built after 1977, a developed lot on which to place a manufactured home, or a manufactured home and lot in combination. The home must be used as the principal residence and never moved from its original location. In addition you must own or buy the land with home. Read more »

- INVESTMENT PROPERTY BAREFOOT BAY FLORIDA FHA MORTGAGE LENDERS– The idea of owning a multi family real estate investment property can be a very good idea for those who prepare the tenants to make the FHA mortgage payments.

- FORECLOSURE OR BANKRUPTCY BAREFOOT BAY FLORIDA FHA MORTGAGE LENDERS – People with recent foreclosure or bankruptcy us the FHA mortgage to purchase or refinance a home every day! Read more »

- STREAMLINE REFINANCE BAREFOOT BAY FLORIDA FHA MORTGAGE LENDERS– Lowering your monthly mortgage payment is easier than ever with an FHA streamline refinance mortgage you do not even need a new appraisal! Read more »

- DEBT CONSOLIDATION BAREFOOT BAY FLORIDA FHA MORTGAGE LENDERS– An FHA Debt Consolidation Mortgage Refinance can lower your total monthly payment obligations. Contact us now to show you how much money you can save! Read more »

- COLLECTION AND JUDGMENTS BAREFOOT BAY FLORIDA FHA MORTGAGE LENDERS – The Federal Housing Administration (FHA) offers mortgage applicants to the opportunity to purchase a home even with collections and judgements. Read more »

- MANUAL UNDERWRITING BAREFOOT BAY FLORIDA FHA MORTGAGE LENDERS– If our local bank does not approve you for an FHA mortgage its still possible to qualify for an FHA mortgage using compensating factors and manual underwriting to qualify. Read more »

- LOAN LIMITS FOR BAREFOOT BAY FLORIDA FHA MORTGAGE LENDERS – FHA mortgage loan limits very by county. You can purchase above the FHA mortgage loan limit but you would have to come up with the difference. Read more »

- DEBT TO INCOME RATIOS FOR BAREFOOT BAY FLORIDA FHA MORTGAGE LENDERS– The FHA mortgage program will allow higher debt to income ratios than any other first time home buyer programs. Read more »

- EXCLUSION LIST FOR BAREFOOT BAY FLORIDA FHA MORTGAGE LENDERS – If you have a past Foreclosure or Student loan in default you may not quality for an FHA mortgage. Read more »

- SELLER PAID CLOSING BAREFOOT BAY FLORIDA FHA MORTGAGE LENDERS– Many FHA mortgage applicants find that the FHA mortgage is one of the most affordable mortgage programs allowing the seller to pay the buyers closing cost. Read more »

- OCCUPANCY RULES FOR BAREFOOT BAY FLORIDA FHA MORGAGE LENDERS – FHA mortgage loans are for primary home use only. Read more »

- VA BAD CREDIT BAREFOOT BAY FLORIDA FHA MORTGAGE LENDERS– VA loan applicants will find that the VA loan has the most flexible loan requirements available to purchase or refinance a home up to 100% loan to value even if you have your a veteran with a foreclosure or bankruptcy. Contact US mortgage lenders to learn how to put your (COE) certificate of eligibility to good use. Read more »

- USDA BAREFOOT BAY FLORIDA BAD CREDIT FHA MORTGAGE LENDERS – US mortgage lenders has access to USDA mortgage lenders approving borrowers all the way down to a 550 middle credit score. If you can prove the ability to pay your bills on time then we may have a USDA mortgage lender for you. Read more »

- JUMBO BAREFOOT BAY FLORIDA BAD CREDIT MORTGAGE LENDERS–US Mortgage lenders has access to jumbo mortgage lenders and jumbo portolio lenders approving jumbo loan applicants for loan amounts over 417,000 with credit down all the way down to a 600 middle credit score! Read more »

- HARD MONEY BAREFOOT BAY FLORIDA BAD CREDIT MORTGAGE LENDERS– If you have large enough down payment and can prove the ability and willingness to pay your bills on time then we may have a hard money lender for you. US Mortgage lenders has access to private lenders and portfolio hard money lenders approving borrowers for loans that your bank will never consider. Read more »

BAREFOOT BAY FLORIDA MORTGAGE AND CITY DATA

Barefoot Bay is one of the largest manufactured home developments in the state of Florida. It is located entirely within the unincorporated community of Micco on the Indian River Lagoon.

Barefoot Bay is part of the Palm Bay–Melbourne–Titusville Metropolitan Statistical Area. Most of the residents are retirees & snowbirds. The nearest commercial area is in Sebastian in Indian River County. Barefoot Bay shares the 32976 Sebastian zip code as well as the 772 area code.

As of the census of 2000, there were 5,108 housing units. The racial makeup was 98.9% White, 0.5% African American, and 0.4% from two or more races. The population was primarily retirees and senior citizens, over the age of 65. The median age was 49.2 years. Gender was close to even, with 47.4% being male, and 52.6% female.