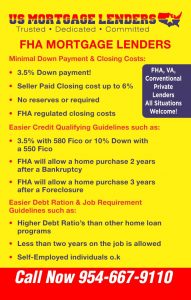

3.5% Arlington Texas FHA Mortgage Lenders

Popular Arlington Texas Pages Include:

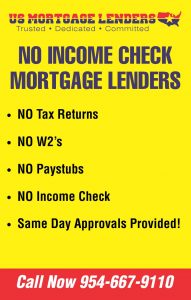

ARLINGTON TEXAS FHA MORTGAGE ADVANTAGES INCLUDE: Arlington Texas no tax return mortgage lenders+purchase or refinance

Arlington Texas no tax return mortgage lenders+purchase or refinance

| FHA MORTGAGE LENDERS SERVING ALL Arlington city TEXAS – |

Arlington city TEXAS MORTGAGE PROGRAMS

|

| Arlington city TEXAS CITY DATA

Population in 2016: 392,787 Zip codes: 75050, 75051, 75052, 76001, 76002, 76006, 76010, 76011, 76012, 76013, 76014, 76015, 76016, 76017, 76018, 76040, 76060, 76063, 76112, 76119, 76120. $54,272 $56,565 Estimated per capita income in 2016: $26,136 (it was $22,445 in 2000) Arlington city income, earnings, and wages data Estimated median house or condo value in 2016: $154,900 (it was $94,800 in 2000) $154,900 $161,500 Mean prices in 2016: All housing units: $172,436; Detached houses: $176,469; Townhouses or other attached units: $141,677; In 2-unit structures: $164,213; In 3-to-4-unit structures: $94,751; In 5-or-more-unit structures: $104,716; Mobile homes: $59,790; Occupied boats, RVs, vans, etc.: $120,446 Median gross rent in 2016: $920. Recent home sales, real estate maps, and home value estimator for zip codes: 76001, 76002, 76005, 76006, 76010, 76011, 76012, 76013, 76014, 76015, 76016, 76017, 76018. |

- BANK STATMENT ONLY TEXAS MORTGAGE LENDERS- No tax returnes needed No 4506T. We use bank statements from business or personal to purchase a Texas home.

- FORECLOSURE OR BANKRUPTCY TEXAS MORTGAGE LENDERS- Learn how you can purchase a home after a recent bankruptcy or Foreclosure.

- Arlington city TEXAS STATED MORTGAGE LENDERS – Stated mortgage lenders can now qualify self employed home buyers for primary homes based on a 12 or 24 months bank statements deposits history.Read More>>

- FIRST TIME HOME BUYER Arlington city TEXAS FHA MORTGAGE LENDERS – The FHA mortgage is not only for first time home buyers. Anyone purchasing a primary home can use the FHA loan. The FHA mortgage is popular with first time home buyers because of the with a low down payment requirement. In additions, bad credit, no credit mortgage applicants will find the FHA mortgage program is the only option to purchase a home. Read more »

- BAD CREDIT Arlington city TEXAS FHA MORTGAGE LENDERS – Bad Credit FHA mortgage loan approvals are approved based on a more common sense approach to mortgage lending meaning bad credit borrowers with past foreclosure or Bankruptcy, tax liens, and collections or judgments can still qualify can qualify to purchase a home. Read more »

- NO CREDIT SCORE Arlington city TEXAS FHA MORTGAGE LENDERS – FHA loan applicants with no credit score lack of trade lines can still qualify for an FHA mortgage loan using alternate trade lines to build a credit or payment history.Read more »

- CONDO Arlington city TEXAS FHA MORTGAGE LENDERS– Search and purchase an FHA approved condo using the FHA mortgage program. Read more »

- TOWNHOUSE Arlington city TEXAS FHA MORTGAGE LENDERS – The FHA mortgage program was created to help increase home ownership. The FHA program makes buying a townhouse home easier and less expensive than any other types of real estate mortgage home loan programs Read more »

- VILLA Arlington city TEXAS FHA MORTGAGE LENDERS– This FHA loan program was created to help increase home ownership. The FHA program makes buying a villa easier and less expensive than any other types of real estate mortgage home loan programs Read more »

- MULTIFAMILY Arlington city TEXAS FHA MORTGAGE LENDERS– This FHA loan program was created to help increase home ownership. The FHA program makes buying a multifamily duplex, triplex or four unit easier and less expensive than any other types of real estate mortgage home loan programs. Read more »

- JUMBO Arlington city TEXAS FHA MORTGAGE LENDERS– The Jumbo FHA mortgage loan can be used in higher cost areas over 417,000 to help borrowers qualify for a Jumbo low down payment FHA mortgage option.Read more »

- GIFTS ALLOWED Arlington city TEXAS FHA MORTGAGE LENDERS – When apply with an FHA mortgage lender you must document where your down payment came from. If you are getting a gift from a family member you must document the transfer, the documenation is very precise. Make sure the follow the FHA rules for a gift step by step, otherwise you may not be able to use the gift funds! Read more »

- MODULAR HOME Arlington city TEXAS FHA MORTGAGE LENDERS – The FHA Title I modular home loan mortgage may be used for the purchase or refinancing of a manufactured home and land built after 1977, a developed lot on which to place a manufactured home, or a manufactured home and lot in combination. The home must be used as the principal residence and never moved from its original location. In addition you must own or buy the land with home. Read more »

- INVESTMENT PROPERTY ABE Arlington cityS FLORIDA FHA MORTGAGE LENDERS– The idea of owning a multi family real estate investment property can be a very good idea for those who prepare the tenants to make the FHA mortgage payments.

- FORECLOSURE OR BANKRUPTCY Arlington city TEXASFHA MORTGAGE LENDERS – People with recent foreclosure or bankruptcy us the FHA mortgage to purchase or refinance a home every day! Read more »

- STREAMLINE REFINANCE Arlington city TEXAS FHA MORTGAGE LENDERS– Lowering your monthly mortgage payment is easier than ever with an FHA streamline refinance mortgage you do not even need a new appraisal! Read more »

- DEBT CONSOLIDATION Arlington city TEXAS FHA MORTGAGE LENDERS– An FHA Debt Consolidation Mortgage Refinance can lower your total monthly payment obligations. Contact us now to show you how much money you can save! Read more »

- COLLECTION AND JUDGMENTS Arlington city TEXAS FLORIDA FHA MORTGAGE LENDERS – The Federal Housing Administration (FHA) offers mortgage applicants to the opportunity to purchase a home even with collections and judgements. Read more »

- MANUAL UNDERWRITING Arlington city TEXAS FHA MORTGAGE LENDERS– If our local bank does not approve you for an FHA mortgage its still possible to qualify for an FHA mortgage using compensating factors and manual underwriting to qualify. Read more »

- LOAN LIMITS FOR Arlington city TEXAS FHA MORTGAGE LENDERS – FHA mortgage loan limits very by county. You can purchase above the FHA mortgage loan limit but you would have to come up with the difference. Read more »

- DEBT TO INCOME RATIOS FOR Arlington city TEXAS FHA MORTGAGE LENDERS– The FHA mortgage program will allow higher debt to income ratios than any other first time home buyer programs. Read more »

- EXCLUSION LIST FOR Arlington city TEXAS FHA MORTGAGE LENDERS – If you have a past Foreclosure or Student loan in default you may not quality for an FHA mortgage. Read more »

- SELLER PAID CLOSING Arlington city TEXAS FHA MORTGAGE LENDERS– Many FHA mortgage applicants find that the FHA mortgage is one of the most affordable mortgage programs allowing the seller to pay the buyers closing cost. Read more »

- OCCUPANCY RULES FOR Arlington city TEXAS FHA MORGAGE LENDERS – FHA mortgage loans are for primary home use only. Read more »

- VA BAD CREDIT Arlington city TEXAS FHA MORTGAGE LENDERS– VA loan applicants will find that the VA loan has the most flexible loan requirements available to purchase or refinance a home up to 100% loan to value even if you have your a veteran with a foreclosure or bankruptcy. Contact US mortgage lenders to learn how to put your (COE) certificate of eligibility to good use. Read more »

- USDA Arlington city TEXAS BAD CREDIT FHA MORTGAGE LENDERS – US mortgage lenders has access to USDA mortgage lenders approving borrowers all the way down to a 550 middle credit score. If you can prove the ability to pay your bills on time then we may have a USDA mortgage lender for you. Read more »

- JUMBO Arlington city TEXAS BAD CREDIT MORTGAGE LENDERS–US Mortgage lenders has access to jumbo mortgage lenders and jumbo portolio lenders approving jumbo loan applicants for loan amounts over 417,000 with credit down all the way down to a 600 middle credit score! Read more »

- HARD MONEY Arlington city TEXAS BAD CREDIT MORTGAGE LENDERS– If you have large enough down payment and can prove the ability and willingness to pay your bills on time then we may have a hard money lender for you. US Mortgage lenders has access to private lenders and portfolio hard money lenders approving borrowers for loans that your bank will never consider. Read more »

Population in 2016: 392,787

Males: 193,410 (49.2%)

Females: 199,377 (50.8%)

Median resident age: 32.4 years

Texas median age: 34.5 years

Zip codes: 75050, 75051, 75052, 76001, 76002, 76006, 76010, 76011, 76012, 76013, 76014, 76015, 76016, 76017, 76018, 76040, 76060, 76063, 76112, 76119, 76120.

Arlington Zip Code Map

Estimated median household income in 2016: $54,272 (it was $47,622 in 2000)

Arlington:

$54,272

TX:

$56,565

Estimated per capita income in 2016: $26,136 (it was $22,445 in 2000)

Arlington city income, earnings, and wages data

Estimated median house or condo value in 2016: $154,900 (it was $94,800 in 2000)

Arlington:

$154,900

TX:

$161,500

Mean prices in 2016: All housing units: $172,436; Detached houses: $176,469; Townhouses or other attached units: $141,677; In 2-unit structures: $164,213; In 3-to-4-unit structures: $94,751; In 5-or-more-unit structures: $104,716; Mobile homes: $59,790; Occupied boats, RVs, vans, etc.: $120,446

Median gross rent in 2016: $920.

Recent home sales, real estate maps, and home value estimator for zip codes: 76001, 76002, 76005, 76006, 76010, 76011, 76012, 76013, 76014, 76015, 76016, 76017, 76018.

Arlington city Texas FHA Mortgage Lenders Search Results

ARLINGTON GEORGIA FHA MORTGAGE LENDERS

https://www.fhamortgageprograms.com/arlington-ga-fha-mortgage-lenders/

US Mortgage Lenders professionals have earned their excellent 5 star zillow and google reviews by opening more doors to homes in Arlington GA than your average Georgia lender. To discuss any of our full service Arlington GA programs including, FHA minimum score 550, FHA Cash Out and Streamlines refinancing,

Arlington Texas FHA Mortgage Lenders

https://www.fhamortgageprograms.com/arlington-texas-fha-mortgage-lenders-2/

Arlington, Texas FHA Mortgage Lenders Florida-CALL NOW! 954-667-9110 +