FHA MORTGAGE LENDERS SAN ANTONIO TEXAS

SAN ANTONIO TX SELF EMPLOYED MORTGAGE LENDERS

Good Credit – Bad Credit – No Credit + No Problem + We work with all San Antonio city Texas FHA mortgage applicants towards home ownership! Whether you’re a San Antonio city Texas first time home buyer, moving to a new San Antonio city home, or want to FHA refinance you’re existing conventional or FHA mortgage, we will show you how to purchase or refinance a San Antonio city Texas home using our full doc mortgage programs or bank statement only mortgage programs.

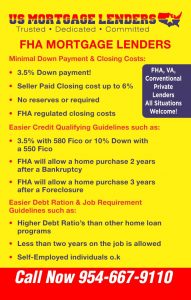

FHA MORTGAGE LENDERS SAN ANTONIO TEXAS ADVANTAGES INCLUDE

SAN ANTONIO TX SELF EMPLOYED MORTGAGE LENDERS

SAN ANTONIO TX SELF EMPLOYED MORTGAGE LENDERS

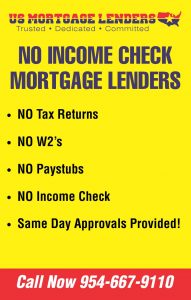

- NO TAX RETURNS! Popular San Antonio Texas Self Employed Pages Include:

- NO DOC TEXAS COMMERCIAL MORTGAGE LENDERS

- 10%DOWN+San Antonio Texas SELF EMPLOYED BANK STATEMENT MORTGAGE LENDERS

- 15% Down(PRIMARY HOME) Self Employed San Antonio Texas Stated Mortgage Lenders

- San Antonio Texas stated income self-employed mortgage lenders

- STATED TX MORTGAGE LENDERS FOR SELF EMPLOYED

| FHA MORTGAGE LENDERS SERVING ALL San Antonio city TEXAS – |

San Antonio city TEXAS MORTGAGE PROGRAMS

|

San Antonio city TEXAS CITY DATAPopulation in 2016: 2,304,388 Zip codes: 77002, 77003, 77004, 77005, 77006, 77007, 77008, 77009, 77010, 77011, 77012, 77013, 77014, 77016, 77017, 77018, 77019, 77020, 77021, 77022, 77023, 77025, 77026, 77027, 77028, 77030, 77031, 77033, 77034, 77035, 77036, 77038, 77040, 77041, 77042, 77043, 77045, 77046, 77047, 77048, 77050, 77051, 77053, 77054, 77056, 77057, 77058, 77059, 77061, 77062, 77063, 77064, 77065, 77066, 77067, 77068, 77069, 77070, 77071, 77072, 77073, 77074, 77075, 77076, 77077, 77078, 77079, 77080, 77081, 77082, 77084, 77085, 77086, 77087, 77088, 77090, 77091, 77092, 77093, 77094, 77095, 77096, 77098, 77099, 77201, 77336, 77339, 77345, 77357, 77365, 77373, 77375, 77377, 77379, 77386, 77388, 77407, 77429, 77433, 77447, 77449, 77478, 77484, 77489, 77493, 77504, 77506, 77587. $47,793 $56,565 Estimated per capita income in 2016: $30,080 (it was $20,101 in 2000) San Antonio city income, earnings, and wages data Estimated median house or condo value in 2016: $163,700 (it was $77,500 in 2000) $163,700 $161,500 Mean prices in 2016: All housing units: $273,612; Detached houses: $279,294; Townhouses or other attached units: $295,678; In 2-unit structures: $207,150; In 3-to-4-unit structures: $140,453; In 5-or-more-unit structures: $227,483; Mobile homes: $42,784; Occupied boats, RVs, vans, etc.: $123,589 Median gross rent in 2016: $952. Recent home sales, real estate maps, and home value estimator for zip codes: 77002, 77003, 77004, 77006, 77007, 77008, 77009, 77010, 77011, 77012, 77013, 77014, 77015, 77016, 77017, 77018, 77019, 77020, 77021, 77022, 77023, 77024, 77025, 77026, 77027, 77028, 77029, 77030, 77031, 77032, 77033, 77034, 77035, 77036, 77037, 77038, 77040, 77041, 77042, 77043, 77044, 77045, 77046, 77047, 77048, 77050, 77051, 77053, 77054, 77055, 77056, 77057, 77058, 77059, 77060, 77061, 77062, 77063, 77064, 77065, 77066, 77067, 77068, 77069, 77070, 77071, 77072, 77073, 77074, 77075, 77076, 77077, 77078, 77079, 77080, 77081, 77082, 77084, 77085, 77086, 77087, 77088, 77089, 77090, 77091, 77092, 77093, 77094, 77095, 77096, 77098, 77099, 77336, 77338, 77339, 77345, 77379, 77386, 77388, 77396, 77407, 77429, 77433, 77447, 77449, 77450, 77532. |

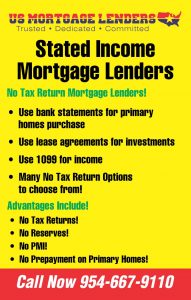

- BANK STATMENT ONLY TEXAS MORTGAGE LENDERS- No tax returnes needed No 4506T. We use bank statements from business or personal to purchase a Texas home.

- FORECLOSURE OR BANKRUPTCY TEXAS MORTGAGE LENDERS- Learn how you can purchase a home after a recent bankruptcy or Foreclosure.

- San Antonio city TEXAS STATED MORTGAGE LENDERS – Stated mortgage lenders can now qualify self employed home buyers for primary homes based on a 12 or 24 months bank statements deposits history.Read More>>

- FIRST TIME HOME BUYER San Antonio city TEXAS FHA MORTGAGE LENDERS – The FHA mortgage is not only for first time home buyers. Anyone purchasing a primary home can use the FHA loan. The FHA mortgage is popular with first time home buyers because of the with a low down payment requirement. In additions, bad credit, no credit mortgage applicants will find the FHA mortgage program is the only option to purchase a home. Read more »

- BAD CREDIT San Antonio city TEXAS FHA MORTGAGE LENDERS – Bad Credit FHA mortgage loan approvals are approved based on a more common sense approach to mortgage lending meaning bad credit borrowers with past foreclosure or Bankruptcy, tax liens, and collections or judgments can still qualify can qualify to purchase a home. Read more »

- NO CREDIT SCORE San Antonio city TEXAS FHA MORTGAGE LENDERS – FHA loan applicants with no credit score lack of trade lines can still qualify for an FHA mortgage loan using alternate trade lines to build a credit or payment history.Read more »

- CONDO San Antonio city TEXAS FHA MORTGAGE LENDERS– Search and purchase an FHA approved condo using the FHA mortgage program. Read more »

- TOWNHOUSE San Antonio city TEXAS FHA MORTGAGE LENDERS – The FHA mortgage program was created to help increase home ownership. The FHA program makes buying a townhouse home easier and less expensive than any other types of real estate mortgage home loan programs Read more »

- VILLA San Antonio city TEXAS FHA MORTGAGE LENDERS– This FHA loan program was created to help increase home ownership. The FHA program makes buying a villa easier and less expensive than any other types of real estate mortgage home loan programs Read more »

- MULTIFAMILY San Antonio city TEXAS FHA MORTGAGE LENDERS– This FHA loan program was created to help increase home ownership. The FHA program makes buying a multifamily duplex, triplex or four unit easier and less expensive than any other types of real estate mortgage home loan programs. Read more »

- JUMBO San Antonio city TEXAS FHA MORTGAGE LENDERS– The Jumbo FHA mortgage loan can be used in higher cost areas over 417,000 to help borrowers qualify for a Jumbo low down payment FHA mortgage option.Read more »

- GIFTS ALLOWED San Antonio city TEXAS FHA MORTGAGE LENDERS – When apply with an FHA mortgage lender you must document where your down payment came from. If you are getting a gift from a family member you must document the transfer, the documenation is very precise. Make sure the follow the FHA rules for a gift step by step, otherwise you may not be able to use the gift funds! Read more »

- MODULAR HOME San Antonio city TEXAS FHA MORTGAGE LENDERS – The FHA Title I modular home loan mortgage may be used for the purchase or refinancing of a manufactured home and land built after 1977, a developed lot on which to place a manufactured home, or a manufactured home and lot in combination. The home must be used as the principal residence and never moved from its original location. In addition you must own or buy the land with home. Read more »

- INVESTMENT PROPERTY San Antonio citys FLORIDA FHA MORTGAGE LENDERS– The idea of owning a multi family real estate investment property can be a very good idea for those who prepare the tenants to make the FHA mortgage payments.

- FORECLOSURE OR BANKRUPTCY San Antonio city TEXASFHA MORTGAGE LENDERS – People with recent foreclosure or bankruptcy us the FHA mortgage to purchase or refinance a home every day! Read more »

- STREAMLINE REFINANCE San Antonio city TEXAS FHA MORTGAGE LENDERS– Lowering your monthly mortgage payment is easier than ever with an FHA streamline refinance mortgage you do not even need a new appraisal! Read more »

- DEBT CONSOLIDATION San Antonio city TEXAS FHA MORTGAGE LENDERS– An FHA Debt Consolidation Mortgage Refinance can lower your total monthly payment obligations. Contact us now to show you how much money you can save! Read more »

- COLLECTION AND JUDGMENTS San Antonio city TEXAS FLORIDA FHA MORTGAGE LENDERS – The Federal Housing Administration (FHA) offers mortgage applicants to the opportunity to purchase a home even with collections and judgements. Read more »

- MANUAL UNDERWRITING San Antonio city TEXAS FHA MORTGAGE LENDERS– If our local bank does not approve you for an FHA mortgage its still possible to qualify for an FHA mortgage using compensating factors and manual underwriting to qualify. Read more »

- LOAN LIMITS FOR San Antonio city TEXAS FHA MORTGAGE LENDERS – FHA mortgage loan limits very by county. You can purchase above the FHA mortgage loan limit but you would have to come up with the difference. Read more »

- DEBT TO INCOME RATIOS FOR San Antonio city TEXAS FHA MORTGAGE LENDERS– The FHA mortgage program will allow higher debt to income ratios than any other first time home buyer programs. Read more »

- EXCLUSION LIST FOR San Antonio city TEXAS FHA MORTGAGE LENDERS – If you have a past Foreclosure or Student loan in default you may not quality for an FHA mortgage. Read more »

- SELLER PAID CLOSING San Antonio city TEXAS FHA MORTGAGE LENDERS– Many FHA mortgage applicants find that the FHA mortgage is one of the most affordable mortgage programs allowing the seller to pay the buyers closing cost. Read more »

- OCCUPANCY RULES FOR San Antonio city TEXAS FHA MORGAGE LENDERS – FHA mortgage loans are for primary home use only. Read more »

- VA BAD CREDIT San Antonio city TEXAS FHA MORTGAGE LENDERS– VA loan applicants will find that the VA loan has the most flexible loan requirements available to purchase or refinance a home up to 100% loan to value even if you have your a veteran with a foreclosure or bankruptcy. Contact US mortgage lenders to learn how to put your (COE) certificate of eligibility to good use. Read more »

- USDA San Antonio city TEXAS BAD CREDIT FHA MORTGAGE LENDERS – US mortgage lenders has access to USDA mortgage lenders approving borrowers all the way down to a 550 middle credit score. If you can prove the ability to pay your bills on time then we may have a USDA mortgage lender for you. Read more »

- JUMBO San Antonio city TEXAS BAD CREDIT MORTGAGE LENDERS–US Mortgage lenders has access to jumbo mortgage lenders and jumbo portolio lenders approving jumbo loan applicants for loan amounts over 417,000 with credit down all the way down to a 600 middle credit score! Read more »

- HARD MONEY San Antonio city TEXAS BAD CREDIT MORTGAGE LENDERS– If you have large enough down payment and can prove the ability and willingness to pay your bills on time then we may have a hard money lender for you. US Mortgage lenders has access to private lenders and portfolio hard money lenders approving borrowers for loans that your bank will never consider. Read more »

San Antonio city TEXAS CITY DATA

Population in 2016: 2,304,388

Males: 1,152,283 (50.0%)

Females: 1,152,105 (50.0%)

Median resident age: 33.0 years

Texas median age: 34.5 years

Zip codes: 77002, 77003, 77004, 77005, 77006, 77007, 77008, 77009, 77010, 77011, 77012, 77013, 77014, 77016, 77017, 77018, 77019, 77020, 77021, 77022, 77023, 77025, 77026, 77027, 77028, 77030, 77031, 77033, 77034, 77035, 77036, 77038, 77040, 77041, 77042, 77043, 77045, 77046, 77047, 77048, 77050, 77051, 77053, 77054, 77056, 77057, 77058, 77059, 77061, 77062, 77063, 77064, 77065, 77066, 77067, 77068, 77069, 77070, 77071, 77072, 77073, 77074, 77075, 77076, 77077, 77078, 77079, 77080, 77081, 77082, 77084, 77085, 77086, 77087, 77088, 77090, 77091, 77092, 77093, 77094, 77095, 77096, 77098, 77099, 77201, 77336, 77339, 77345, 77357, 77365, 77373, 77375, 77377, 77379, 77386, 77388, 77407, 77429, 77433, 77447, 77449, 77478, 77484, 77489, 77493, 77504, 77506, 77587.

San Antonio Zip Code Map

Estimated median household income in 2016: $47,793 (it was $36,616 in 2000)

San Antonio:

$47,793

TX:

$56,565

Estimated per capita income in 2016: $30,080 (it was $20,101 in 2000)

San Antonio city income, earnings, and wages data

Estimated median house or condo value in 2016: $163,700 (it was $77,500 in 2000)

San Antonio:

$163,700

TX:

$161,500

Mean prices in 2016: All housing units: $273,612; Detached houses: $279,294; Townhouses or other attached units: $295,678; In 2-unit structures: $207,150; In 3-to-4-unit structures: $140,453; In 5-or-more-unit structures: $227,483; Mobile homes: $42,784; Occupied boats, RVs, vans, etc.: $123,589

Median gross rent in 2016: $952.

Recent home sales, real estate maps, and home value estimator for zip codes: 77002, 77003, 77004, 77006, 77007, 77008, 77009, 77010, 77011, 77012, 77013, 77014, 77015, 77016, 77017, 77018, 77019, 77020, 77021, 77022, 77023, 77024, 77025, 77026, 77027, 77028, 77029, 77030, 77031, 77032, 77033, 77034, 77035, 77036, 77037, 77038, 77040, 77041, 77042, 77043, 77044, 77045, 77046, 77047, 77048, 77050, 77051, 77053, 77054, 77055, 77056, 77057, 77058, 77059, 77060, 77061, 77062, 77063, 77064, 77065, 77066, 77067, 77068, 77069, 77070, 77071, 77072, 77073, 77074, 77075, 77076, 77077, 77078, 77079, 77080, 77081, 77082, 77084, 77085, 77086, 77087, 77088, 77089, 77090, 77091, 77092, 77093, 77094, 77095, 77096, 77098, 77099, 77336, 77338, 77339, 77345, 77379, 77386, 77388, 77396, 77407, 77429, 77433, 77447, 77449, 77450, 77532.

39 Cities within 30 miles of San Antonio, TX

|

|

|

- Adkins, TX

- Atascosa, TX

- Bergheim, TX

- Bigfoot, TX

- Boerne, TX

- Bulverde, TX

- Canyon Lake, TX

- Castroville, TX

- Center Point, TX

- Cibolo, TX

- Converse, TX

- Devine, TX

- Elmendorf, TX

- Floresville, TX

- Helotes, TX

- Jbsa Ft Sam Houston, TX

- Jbsa Lackland, TX

- Jbsa Randolph, TX

- La Coste, TX

- La Vernia, TX

- Leming, TX

- Lytle, TX

- Macdona, TX

- Marion, TX

- Mc Queeney, TX

- Mico, TX

- Natalia, TX

- New Braunfels, TX

- Pipe Creek, TX

- Poteet, TX

- Poth, TX

- Rio Medina, TX

- Saint Hedwig, TX

- Schertz, TX

- Somerset, TX

- Spring Branch, TX

- Sutherland Springs, TX

- Universal City, TX

- Von Ormy, TX

San Antonio city Texas FHA Mortgage Lenders Search Results

YES! TEXAS MORTGAGE WITH COLLECTION ACCOUNTS!

https://www.fhamortgageprograms.com/yes-can-get-texas-mortgage-collection-accou…

San Antonio city Texas. Dallas city Texas. Austin city Texas. Fort Worth city Texas

10%DOWN -TEXAS STATED INCOME MORTGAGE LENDERS

https://www.fhamortgageprograms.com/6-texas-stated-income-mortgage-lenders-prog…

Anthony Anton Appleby Aquilla Aransas Pass Archer city Texas Arcola Argyle Arlington Arp Arroyo Alto Arroyo Colorado Estates Arroyo Gardens-La Tina Ranch Asherton Aspermont Atascocita Athens Atlanta Aubrey Aurora Austin Austwell Avery Avinger Azle Bacliff Bailey Bailey’s Prairie village Texas Baird Balch Springs

6 TEXAS STATED INCOME MORTGAGE LENDERS PROGRAMS

https://www.fhamortgageprograms.com/6-texas-stated-income-mortgage-lenders-prog…

24 MONTHS PERSONAL Texas Stated Income BANK STATEMENT MORTGAGE LENDERS- APPLY NOW. Use 100% of the deposits; Must … https://www.

12-24 month texas bank statement mortgage lenders program

https://www.fhamortgageprograms.com/12-24-month-texas-bank-statement-mortgage…

… San Angelo, San Antonio, San Benito, San Marcos, Seguin, Sherman, Snyder, Socorro, Stephenville, Sugar Land, Sulphur Springs, Sweetwater, Taylor, Texas City, Tyler, Uvalde, Vernon, Victoria, Vidor, Waco, Waxahachie and Wichita Falls. TEXAS BANK STATEMENT ONLY MORTGAGE LENDERS BENEFITS INCLUDE

3.5% DOWN BAD CREDIT TEXAS MORTGAGE LENDERS

https://www.fhamortgageprograms.com/3-5-down-bad-credit-texas-mortgage-lenders/

Texas Population – FHA Mortgage Lenders, 25,145,561. Houston city, 2,099,451. San Antonio city, 1,327,407. Dallas city, 1,197,816. Austin city, 790,390. Fort Worth city, 741,206. El Paso city, 649,121. Arlington city, 365,438. Corpus Christi city, 305,215. Plano city, 259,841. Laredo city, 236,091. Lubbock city, 229,573.

texas self employed-bank statement mortgage lenders

https://www.fhamortgageprograms.com/texas-self-employed-bank-statement-mortgag…

… Port Lavaca,Self Employed Mortgage Lenders Portland, Richmond, Rio Grande City Self Employed Mortgage Lenders, Rockwall, Roma, Round Rock, San Angelo, San Antonio, San Benito, San Marcos, Seguin, Sherman, Snyder, Socorro, Stephenville, Sugar Land, Sulphur Springs, Sweetwater, Taylor,Texas City, Tyler, …

Self Employed Texas Mortgage Lenders – FHA mortgage lender

https://www.fhamortgageprograms.com/self-employed-texas-mortgage-lenders-2/

Texas Bank Statement only loans for self-employed Texas mortgage applicants who cannot qualify for a traditional Texas bank loan because of Texas business expenses ….. 7, Texas City, 45,363, 2,631, $8,880,059, 21.74%, 5.80, 7.2%, 46.36 …. 134, San Antonio, 1,359,033, 109,186, $1,066,931, 19.09%, 8.03, 5.5%, 31.48.