The Florida Self Employed mortgage Rural administers the Single Family Housing Guaranteed Loan Program.

What does the Self Employed mortgage program do? The Self Employed mortgage loan program assists approved Florida Self Employed mortgage lenders in providing low- and moderate-income households the opportunity to own adequate, modest, decent, safe and sanitary dwellings as their primary Florida residence in eligible rural areas. Eligible Self Employed mortgage mortgage applicants may build, rehabilitate, improve or relocate a dwelling in an eligible rural area. The program provides a 90% loan note guarantee to approved lenders in order to reduce the risk of extending 100% loans to eligible rural home buyers.

FLORIDA Self Employed mortgage MORTGAGE ADVANTAGES:

- Min 100K Loan Amounts

- 65% Financing.

- Self Employed mortgage loans allow Florida home buyers to finance out of pocket settlement charges in cases when the appraised value is higher than the sales price.

- No maximum loan limits. .

- Min 600 Flexible credit qualifying

- Please note we provide free credit counseling to and work with everyone to get PRE APPROVED!

What Florida area is eligible for a Self Employed mortgage loan?

Who may apply for the Self Employed mortgage loan program? Applicants must:

- Meet the Florida income-eligibility

- Agree to personally occupy the Florida home as their primary residence.

- Be a U.S. Citizen, U.S. non-citizen national or Qualified Alien

- Have the legal capacity to incur the loan obligation

- Have not been suspended or debarred from participation in federal programs

- Demonstrate the willingness to meet credit obligations in a timely manner

- Purchase a property that meets all program criteria

How may funds be used? Funds backed by loan guarantees be used for:

- New or existing residential property to be used as a permanent residence. Closing cost and reasonable/customary expenses associated with the purchase may be included in the transaction

- A site with a new or existing dwelling

- Repairs and rehabilitation when associated with the purchase of an existing dwelling

- Refinancing of eligible loans

- Special design features or permanently installed equipment to accommodate a household member who has a physical disability

- Reasonable and customary connection fees, assessments or the pro rata installment cost for utilities such as water, sewer, electricity and gas for which the buyer is liable

- A pro rata share of real estate taxes that is due and payable on the property at the time of loan closing. Funds can be allowed for the establishment of escrow accounts for real estate taxes and/or hazard and flood insurance premiums

- Essential household equipment such as wall-to-wall carpeting, ovens, ranges, refrigerators, washers, dryers, heating and cooling equipment as long as the equipment is conveyed with the dwelling

- Purchasing and installing measures to promote energy efficiency (e.g. insulation, double-paned glass and solar panels)

- Installing fixed broadband service to the household as long as the equipment is conveyed with the dwelling

- Site preparation costs, including grading, foundation plantings, seeding or sod installation, trees, walks, fences and driveways.

- Why does Self Employed mortgage Rural Development do this?

This program helps lenders work with low and moderate income families living in rural areas to make home ownership a reality. Providing affordable home ownership opportunities promotes prosperity, which in turn creates thriving communities and improves the quality of life in rural areas.

SELF EMPLOYED FLORIDA MORTGAGE LENDERS

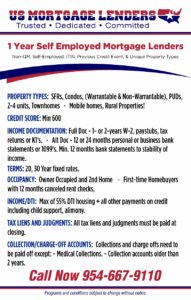

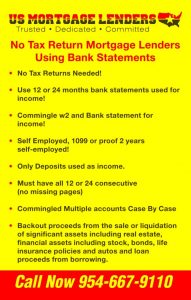

SELF EMPLOYED 1 ONE YEAR FL SELF EMPLOYED MORTGAGE LENDERS – NO TAX RETURN CASH OUT REFINANCE Florida MORTGAGE LENDERS Self-employed and/or freelancer or 1099 SELF EMPLOYED mortgage applicants can NOT get approved for a Florida mortgage because they take advantage of to many tax deductible write-offs.