FLORIDA SELF EMPLOYED MORTGAGE LENDERS

Self-employed Florida Business Owner? And having trouble getting approved for a Florida mortgage?

There are many advantages of being self-employed including not answering to a “boss,” making your own decisions, hours, time off is all Great! Until, it comes time to apply for a Florida mortgage because Florida mortgage lenders are very concerned about projecting your future income. which is hard to verify when you write off all your income.

Stated Income Documentation up to $1.5 million!

- 24 months personal bank statements

- 24 months business bank statements w/P&L

- Asset Xpress program – use assets as income

- Asset Assist program – use assets as additional income

- Lease agreement in lieu of Schedule E

- Up to 50% DTI

- Up to 85% LTV

SELF EMPLOYED FLORIDA MORTGAGE APPROVALS

Self Employed Florida borrowers are no more or less risky then salaried or W-2’d workers. The main challenge for Self-Employed Florida is documenting work history and income. This is the biggest difference between a conventional borrower and a Self-Employed Florida borrower. How can Self Employed Florida borrowers document their income and work history when they do not show any income on their taxes?

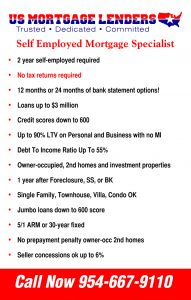

- 12 or 24 Months Business or personal bank statements only!

- Last 2 years personal and business tax returns

- Proof of 2 years Self Employed Florida by showing either a business license or with a CPA letter

- Personal and or Business Bank statements

- Year to date profit and loss report

- 2 years of Credit references if needed for business

SELF EMPLOYED FLORIDA BORROWERS

Many Florida business owners and self-employed borrowers face special challenges when seeking to finance a Florida home. There are a variety of programs available to self-employed borrowers and Florida Mortgage lenders is proud to offer them all to all Florida business owners. Working with Florida business owners and entrepreneurs is very exciting. We take pride in being able to offer aggressive self-employed Florida loan programs to our self-employed Florida mortgage applicants. Please fill out our full mortgage applicants so we dig deeper into the choices and special circumstances of bank statement only Florida mortgage programs.

On a fully documented loan such as this the Florida mortgage lenders lender will consider the “net” income of the individual after deductions. This can be a challenge for some small business owners. If documenting your income via tax returns is a problem don’t work we can offer a 12 or 24 months bank statement only Florida mortgage program!

florida stated income mortgage lenders+same day approval!

https://www.fhamortgageprograms.com/stated-income-florida-investor-loans/

STATED INCOME FL MORTGAGE LENDERS PRIMARY HOMES!

https://www.fhamortgageprograms.com/stated-income-loans/

PRIMARY HOME STATED INCOME LOAN REQUIREMENTS. Stated income loans on Primary Home Approvals are based on Bank statement deposits for the most recent 24 months. The income you can use from your bank statements are determined by your profit and loss statement. The 24 month profit and loss you must …

NO DOC STATED INCOME FLORIDA MORTGAGE LENDERS

https://www.florida-mortgage-lenders.com/…/3619-no-doc-stated-income-florida-mor…

Stated income Florida mortgage lenders provided loans to anyone that met the minimum credit score without verification of income. These stated income mortgage loans are high risk and … Only Florida Mortgage Lenders Min 600+

10% DOWN+STATED INCOME FLORIDA MORTGAGE LENDERS-

https://www.florida-mortgage-lenders.com/florida-mortgage…/186-stated-florida-mort…

Stated Income Florida Mortgage Lenders For Primary Homes! Same Day Approvals Call Now 954-667-9110 Providing Stated Florida home loans in every city and county in Florida!!!

10%down -texas stated income mortgage lenders – Florida FHA …

https://www.fhamortgageprograms.com/6-texas-stated-income-mortgage-lenders-prog…

10%DOWN+BANK STATEMENT FL MORTGAGE LENDERS

Florida -Bank Statement Only Mortgage Lenders

Bank Statement Only Florida Mortgage Lenders Min 600+FICO!

Florida and Georgia Stated Income Mortgage Lenders+Same Day Approval!

Self-Employed Mortgage Approvals – Georgia FHA mortgage lenders

georgia-mortgage-lenders.com/self-employed-mortgage-approvals/ https://www.fhamortgageprograms.com/14147-2/. Bank Statement Only Florida Mortgage Lenders Min 600+FICO! www.fhamortgageprograms.com/bank-

STATED INCOME – www.Florida-Mortgage-Lenders.com

fha-mortgage-lenders.com/stated-income/ The Stated mortgage lenders allow you do document you income by using bank statements in lieu of traditional full doc loans with tax returns via 4506T to support income. In addition, if there is a wage earner borrower, too, primary or co-