No Income Verification Commercial Mortgage Lenders

Small balance no doc Florida commercial real estate loans.

Call Now: 1-954-667-9110

Call Now: 1-954-667-9110

Florida No Income Verification For Commercial Properties:

- Florida No Income Verification Office Building Lenders

- Florida No Income Verification Retail Store Mortgage Lenders

- Florida No Income Verification Warehouse Mortgage Lenders

- Florida No Income Verification Self-Storage Building Mortgage Lenders

- Florida No Income Verification Automotive Repair Mortgage Lenders

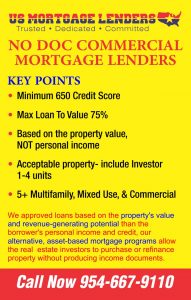

We never look at tax returns or personal income statements, and there is no Debt to income ratio Analysis. You want to think of us a NO INCOME VERIFICATION MORTGAGE LENDER an asset-based Florida no income documentation mortgage lender whose main concern is the subject property, its value, and its cash flow. Our Florida commercial lenders are asset based, credit driven, and perfect for investors that have trouble qualifying with traditional institutions but are not interested in hard money options.

Fast Consultation – Apply Now For A Fast Approval!

Flexible Florida No Doc Commercial Mortgage Lenders Provide Solutions for Florida Self Employed no income verification mortgage applicants

NO Doc Florida mortgage lenders are focused exclusively on financing residential 1-4 investment, multi-family, mixed-use, and small balance commercial properties.

By focusing more on the property’s value and revenue-generating potential than the Florida self employed Commercial mortgage applicants personal income and credit, our alternative, asset–based mortgage programs allow Florida real estate investors, including W-2, self–employed, and small business owners, who are often tough to qualify.

Because all Florida commercial mortgage applicant, even the extraordinary ones, deserve an opportunity.

Florida No Doc Commercial Mortgage Lenders programs may be used for purchase, rate/term refinance, and cash-out refinance transactions.Florida No Doc Commercial Mortgage Lenders also allows an IRS 1031 Exchange for any borrower. All Florida No Doc Commercial Mortgage Lenders require impounds of taxes and insurance.

Commercial Florida mortgage lenders never look at tax returns or personal income statements, and there is no DTI Analysis. You want to think of us as an asset-based lender whose main concern is the subject property, its value, and its cash flow. We‘re asset based, credit driven, and perfect for Florida multifamily investors that have trouble qualifying with traditional institutions but are not interested in hard money options.

FLORIDA COMMERCIAL NO INCOME VERIFICATION PROPERTY TYPES INCLUDE

Acceptable property Florida commercial property types include Investor 1–4 units, 5+ Multifamily, Mixed Use, and Florida Commercial. You want to think of our acceptable property types as properties that are generic and conform to Florida zoned use.

Following this logic, VMC will stay away from highly specialized properties like schools, hospitals, hotels, and any single use properties such as reception halls, theaters, or concert venues.

NO INCOME VERIFICATION FLORIDA MORTGAGE PROGRAMS INCLUDE:

- • FlexPerm No Income Verification Commercial Lenders

- • Fast50 Florida No Income Verification Commercial Lenders

- • Quickfix No Income Verification Commercial Lenders

- • ARV Pro Florida No Income Verification Commercial Lenders

FLEX PER NO INCOME FLORIDA MORTGAGE LENDERS SUMMARY

Likely to be your ‘go-to’ No Income verification mortgage loan program, the FlexPerm Florida mortgage Loan boasts a 3 or 8-year fixed ARM, with a 30-year amortization schedule. This program is available for all Florida Commercial property types.

Designed for Florida Commercial investors seeking a simple financing solution for purchase or refinance, with the flexibility to remain in the loan for up to 30 years. It’s an uncomplicated Florida Commercial mortgage option with flexible underwriting and longer terms. You’ll want to think of this Florida Commercial no income verification loan program as a good fit for no income verification mortgage applicants that are looking to buy and hold their investments.

• Great for qualifying W-2 and self-employed Florida real estate investors

• Based on property value,not personal income.

• Best alternative to hard money loans.

• Available as a 3-year-fixed or 8-year-fixed loan, each amortized over 30 years.

• Minimum mid score requirement is 650

• 75% LTV depending on property type

• 7-9% interest rates

• On SFR ‘s – most important rule across any program – borrower must own their primary residence for at least 12 months.

FAST50-NO INCOME FLORIDA MORTGAGE LENDERS SUMMARY

Think of this No income verification Commercial loan program as a credit forgiving extension of the FlexPerm program. Compliance requirements are still in effect even though Underwriting flexibility is at its highest at 50% LTV or less. All Velocity Florida Commercial Property Types are eligible on this program.

Designed for Florida Commercial investors with derogatory credit issues and high equity seeking quick and easy credit qualification. This is a low LTV loan with easy credit requirements. In addition, the pricing is improved by 0.50% when mid FICO is 650+.

FAST50-NO INCOME FLORIDA MORTGAGE LENDERS KEY FEATURES INCLUDE:

• Great for no income verification mortgage applicants with a recent bankruptcy or notice of default.

•No seasoning of ownership required.

• Improved pricing compared to our FlexPerm program.

•Derogatory mortgage history is okay.

• No active FC or NOD inthe past 12 months on

subject property

• Vacant refinance not eligible

•80% CLTV max

QUICKFIX- NO INCOME FLORIDA MORTGAGE LENDERS EXPLAINED

The QuickFix Program is a 12-month interest-only option that balloons at the end of the term. This program is restricted to Investor 1-4 property types and can be used for purchase as well as refinance transactions. This is a purchase or refi program that allows for deferred maintenance, vacancy, and currently listed properties.

Designed for investors with credit issues seeking an interest-only, short-term loan as an alternative to hard money financing. This is a higher LTV alternative to hard money.

This is a great option for no income verification mortgage applicants looking for a short-term capital solution to acquire or leverage an investor 1-4. It is also a great program for investors with legitimate ownership/experience in “Fix & Flip” real estate activities. Rates on this program will be notably higher, but remind your clients this is an alternative to a hard money option.

QUICKFIX- NO INCOME FLORIDA MORTGAGE LENDERS SUMMARY

• A higher LTV than hard money options.

• Great for no income verification mortgage applicants who need a quick close.

• An interest-only 1-year term provides lower monthly payments.

• Perfect for acquiring or leveraging real estate with deferred maintenance.

• No credit minimum.

• 75% LTV for all purchase transactions.

• Only Investor 1-4 property

types.

• We do an as-is valuation and base the LTV off that value.

• Health and Safety issues are not a concern

• We do not do “tear downs”.

• It is a 12-mo. interest-only term with a 2-point cost.

• There is no prepayment penalty, but there is an interest

guarantee of 4 months. If a borrower pays off the loan after making 2 payments, 2 months of interest would be added to the payoff.

• Pricing Tiers are determined by score. A first-time investor is Tier 3.

• The Location Rate Add of 1.5% is for “Long Foreclosure” states.

• Even though Tier 3 does not have a minimum score requirement, all Tiers have minimum tradeline requirements that mirror the FlexPerm

program.

• Mortgage delinquency restrictions are the same as the FlexPerm program.

• This program allows for the refinance of vacant properties and allows for properties that are

currently listed.

Credit Quickfix Enhancement– We are no longer requiring appraisals on the Credit Quick Fix. A BPO will be required instead. Specifics are found in the Quick Fix BPO attachment.

Credit Quick Fix BPO Procedure

We are tweaking the Credit Quick Fix program to make it easier, and more importantly, quicker to get these deals closed. The game changer is moving from requiring an appraisal to only requiring a BPO. The BPOs will be returned to Velocity within 48–72 hours after the order has been placed.

- l. The BPOs will be paid for through the Alpha Realty site. If the Alpha site is showing a commercial appraisal cost, email Joe Clickener who will fix the glitch.

- The BPO cost is $250. $400-$750 LESS than the appraisal cost.

- The BPOs will be ordered by the Appraisal Desk. BE SURE TO COMPLETE THE CONTACT FORM IN PHASE 2 OF THE PORTAL. The BPO includes an internal inspection so we need to know who we are contacting to get the inspection done.

- The openers will be alerted once the order has been placed. It will be on us to get the submission to them AS QUICKLY as possible.

- The BPO review will take less than an hour and will be a priority in the l-4 Real Estate department.

- The stip sheet will not be issued until the BPO has been returned and reviewed. The stip sheet should look like a clear to close if we are on our sales game and send a complete submission to the openers. REMEMBER the only requirements on a Quick Fix are:

- a. Executed CLA

- b. Complete Application Copy of DL & SSC

- Prelim

- Est. HUD

- f. BPO and Review

- Payoff Demand on refi

- Purchase Contract on purchase

ARV PRO- NO INCOME FLORIDA MORTGAGE LENDERS EXPLAINED

A true fix and flip product, the ARV program is great for cosmetic rehab and bringing the subject property up to speed in terms of renovations and maintenance. This is NOT a construction–based rehab loan – no tearing down walls or additions.

Designed for “fix-and-flip” investors who are seeking a short term, interest-only loan to acquire and improve a property based on its “as repaired value” [ARV). The best short-term solution for acquiring and improving property value.

NO INCOME FLORIDA MORTGAGE LENDERS KEY FEATURES

- • Allows no income verification mortgage applicants to finance improvements.

- • Great for no income verification mortgage applicants who need a quick close.

- • An interest-only 1-year term provides lower monthly payments.

- • A higher LTV than hard money lenders.

Small business owners and investors utilize no income verification small commercial properties nationwide to support and operate their businesses. We believe strongly in this type of asset and have developed financing solutions for commercial real estate loans designed specifically to help entrepreneurs achieve their vision of real estate ownership.

Whether you are a seasoned commercial mortgage broker or thinking about offering small balance commercial real estate loans for the first time, it’s important you understand how the type of property financed can affect the commercial loan terms.

From a no income verification lender’s perspective, commercial buildings with more general use capacity like retail, warehouse or office space are easier to finance than properties built for a specific purpose (i.e., bowling alley, bank or manufacturing plant) because they have an inherently lower risk due to a higher market demand from no income verification investors. No income verification Lenders often avoid financing specific use properties or require a lower LTV (e.g., higher downpayment) on them to offset their higher risk profile.

Florida No Income Verification For Commercial Properties:

- Florida Office Buildings

- Florida Retail Stores

- Florida Warehouses

- Florida Self-Storage Buildings

- Florida Automotive Repair Shops

While we do provide Florida investment property financing for up to $5 million on small balance commercial real estate buildings, most of our commercial real estate loans fall under $4 million in value. These smaller Florida no income verification loans are much easier to approve and close in comparison to “institutional” loans for larger Florida properties, so they’re a great place to start if you’re seeking no income verification real estate loans.

Starting with smaller, easier-to-approve Florida buildings will help you establish your commercial Florida mortgage lending practice. As a Florida investor once you’ve completed a few Stated commercial mortgage purchase or refinance you can quickly move on to larger properties to generate more revenue per commercial purchase.

Florida No Income Verification Commerical Mortgage Lenders

No Income Verification Florida Commercial Mortgage Lenders is a nationwide, direct portfolio Florida commercial lender dedicated exclusively to providing Florida investment property loans for residential 1-4, multi-family, mixed-use, and small balance commercial properties.

By focusing more on the Florida property’s value and revenue-generating potential rather than the Florida investors personal income and credit, our asset-based Florida investment property loans enable investors to meet the unique needs of real estate investors who are tough to qualify, including W-2 employees, self-employed Florida entrepreneurs, and small business owners. Because every borrower, even the extraordinary ones, deserves an opportunity.

To learn more about the benefits of our Florida stated income investment property loans, simply click on any of the images below.

Florida Investment property loans offer a familiar starting point.

Residential rental properties like single family homes, condominiums, town homes and small apartment buildings provide the perfect opportunity for brokers to grow their business by adding investment property loans to their offering.

Most brokers are already familiar with these properties, so the move from consumer home loans to rental property loans provides a fast track for creating a new revenue stream without having to change the way they already do business.

We make financing for Florida apartment buildings easy.

Offering financing for Florida apartment buildings, otherwise known as Florida multi-family properties, is an excellent strategy for brokers to expand their Florida business offering and client base.

To qualify as a Florida multi-family investment property, the building must have five or more dwellings (apartments), whereas buildings with four or less units are still classified as residential 1-4 investment properties in most states.

To real estate investors, a multi-family apartment building is a solid real estate investment strategy for generating revenue since its cash flow is significantly higher than a single-family property and its operating cost is less influenced by any single vacancy.

While a larger multi-family property lowers the risk for investors, it’s important for brokers to communicate that lenders typically assign a higher risk profile to apartment building loans since the properties are harder to liquidate than smaller residential investment properties.

Lenders often use a lower LTV in financing an apartment building to offset the increased risk, so your borrower may need to provide a larger down payment.