MIAMI BEACH FL MORTGAGE LENDERS

MIAMI FL, AVENTURA FL , Miami Beach, Bad Credit Miami Mortgage ,Self Employed No Tax Return Miami FL Mortgage

- • 96.5% LTV on Owner Occupied Miami Florida Condos= 3.5% Downpayment!

- • 95% LTV on Miami Florida Owner Occupied Condos= 5% Downpayment!

- • 90% LTV on Second Miami Florida Home Condos= 10% Downpayment!

- • 80% LTV on Second Miami Florida Home Condos= 20% Downpayment

- • 80% LTV on Investment Miami Florida Condos= 20% Downpayment

- • 80% Non warrantable Miami Florida Condo loans – Do not have to be FNMA Approved!

- • 80% MIAMI FLORIDA CONDOTEL MORTGAGE LENDERS

MIAMI FL CONDO MORTGAGE LENDERS – MIAMI SELF EMPLOYED MORTGAGE LENDERS – MIAMI FL STATED INCOME MORTGAGE LENDERS

3,5,7,15, 20 and 30 year fixed rate Miami Florida condo loan terms available!

all programs subject to change without notice.

www.Florida-Mortgage-Lenders.com

MIAMI FLORIDA CONDO MORTGAGE LENDERS

FLORIDA CONDOTELS + NON-WARRANTABLE CONDO LENDERS

Florida condo mortgage applicants will find that a mortgage on a Miami Florida condo is more complex than purchasing a Miami Florida single family or town-home or villa. There are additional requirements for Miami Florida condo associations that do not exist in other typical Florida mortgage transactions. The Condo must be approved by the Florida mortgage lender via condo association questionnaire before you can get financing on a Florida condo.

MANY MIAMI FLORIDA LENDERS WILL NOT MORTGAGE CONDOMINUMS

Having trouble getting a Florida condo mortgage because the condo you are interested in is being denied by your Florida mortgage lender? Florida mortgage lenders.com offers condominium mortgage loans on many Florida condos projects that are not Fannie Mae approved and which other Florida mortgage lenders consider not financeable. Conditions include the Florida mortgage applicant must:

1. The Miami Florida condo purchase must be a primary residence = 25% down payment for a purchase or 25% equity for a refinance.

2. 2nd Miami Florida condo home loan transactions require a minimum 30% down payment for purchase and 30% equity in the Florida condo for a refinance.

Our expanded Miami Florida condo mortgage approvals for condos require no condo questionnaire, no review of the association budget and no approval of the project reserves. It may seem counter-intuitive, but no matter how strong you may be as a Florida mortgage applicant, or what the down-payment/Loan-to-Value is; most Florida mortgage lenders will not mortgage Florida condos if they fail even basic criteria of a condo questionnaire. Details of most denials include: pending litigation in the project, low % of owner-occupancy, high % of current condo owners late on their HOA fees are just a few reasons that will kill your Florida condo mortgage. It is very risky to attempt to secure financing with Florida mortgage lenders that require Condominium questionnaire approval. A result of the Florida housing market crash is that most Florida condo projects have some of the aforementioned issues. The safe and easy path to a smooth Florida mortgage process is to work through one of the very limited number of Florida mortgage lenders that do not require Florida condo questionnaire approval.

Miami Florida condo Mortgage Lenders.com is one of only a very small number of limited Lenders with Access to the Florida mortgage lenders that do not require a Florida condo questionnaire that offer these programs.

MIAMI FLORIDA CONDOMINUM MORTGAGE REQUIRMENTS

Florida Mortgage lenders have requirements for Miami Florida condo financing.

Mortgaging a Florida condominium comes with a few more requirements than a standard Florida mortgage. Condominiums are mostly part of a condo association and the reputation of that association can affect a Florida mortgage applicants chances of obtaining condo financing. Due to the number of association delinquencies many Florida mortgage lenders have raised their requirements for financing when purchasing Florida condominiums. Large down payments usually between 20-30%, association questionnaire approvals and inspections approved directly by the Florida mortgage lender are some of the requirements that Florida condo buyers must meet before they obtain a loan for a Florida condominium.

MIAMI FLORIDA CONDO ASSOCIATION FEES

Living in a Florida condominium complex usually requires the unit owners to pay association fees. Most Florida mortgage companies can now refuse financing if 15 percent or more of the residents are 30 days or more behind on their association dues. Delinquency rates in dues worries Florida mortgage lenders because it casts doubt on the association’s cash reserves and financial status.

New Florida condominium units and complexes have a minimum criterion of sold units to meet. Most Florida Mortgage Lenders now want to see at least 49 percent of the units sold or under contract before they will agree to financing.

MIAMI FLORIDA INSPECTIONS

o Condominium inspections usally take place before the Florida mortgage applicant apply for condo financing.. However, all Fannie Mae-backed Florida mortgages for condos will have to undergo an inspection by a Fannie Mae representative. This includes the complex as well as an investigation into the association’s financial situation. Previously, Florida condominium inspections were carried out but by the individual Florida mortgage lender.

MIAMI FLORIDA CONDOS REQUIRE LARGER DOWNPAYMENT

Mortgage insurance (MI) companies are currently not providing private mortgage insurance in Florida due to the large number of defaults. As a result Florida condo mortgage applicants are required to put down a minimum 20 percent down payment.

QUESTIONS TO ASK THE MIAMI FLORIDA ASSOCIATION:

1. Is the Florida condo project Fannie Mae or FHA Approved? If the answer is yes, then you may proceed as long as the Miami Florida condo is not on the Florida mortgage lender’s unbendable list (Yes, this is still possible even if a Florida condo project is Fannie Mae approved). It is important to note that some phases within a Florida condo project may be approved while others may not. This is a common mistake that can blow up many deals.

2. Am I eligible for a Miami Florida condo Project Review Waiver? (Also called a Limited Review) Primary Florida condo purchases with a 25% down payment/equity. Second Miami Florida condo home transactions with a 30% down payment/equity. Investment Properties are not eligible. Beware of lenders offering “Limited Review” of a condo but requiring a Condo Questionnaire. If a condo questionnaire is required, then it is not a limited review and you risk your loan being denied for factors not related to your individual credit worthiness. Check that your Condo is not on the lender’s list of denied projects. The Government Homeowner Assistance Program = HARP will allow you to refinance up to 125% of your home’s value if your Loan is owned by Fannie Mae or Freddie Mac. There is no project approval for these programs.

3. Can I get an FHA Loan in a Miami Florida condo that is not FHA Approved? No. Currently FHA and lenders are not allowing spot reviews of condos for FHA Loans. You should check which Condos in the area you are interested in buying are already FHA approved if you are interested in a low down payment FHA loan.

4. What is the minimum down-payment for a Miami Florida condo Loan? For purchases, typically the minimum down payment is 20%. We encourage that you put more money down so that we can waive the project approval requirements. 25%- Owner Occupied. 30%- Second Home. If the project is FHA approved, you can purchase a primary residence with a 3.5% down-payment. For Refis, if the loan is eligible for HARP- Government Homeowner Assistance Programs- Then it is possible to get a condo home loan for up to 125% of the home’s value.

Welcome and thank you for visiting US Mortgage Lenders webpage. We are local MIAMI BEACH Florida mortgage lenders. We are available to answer any questions you might have 24/7.

US Mortgage Lenders professionals have earned their excellent 5 star zillow.com and google reviews by opening more doors to homes in MIAMI BEACH Florida than your average Florida lender. To discuss any of our full service MIAMI BEACH Florida programs including, FHA minimum score 550, FHA Cash Out and Streamlines refinancing, Private lenders, Jumbo Loans, VA Mortgage loans down to 550 and Foreign National Loans. Note All Subject to change without notice.

MIAMI BEACH FL MORTGAGE LENDERS PROGRAMS INCLUDE:

FOR SAME DAY PRE APPROVAL!

FOR YOUR FREE NO OBLIGATION CONSOLATION

WE ARE LOCAL MIAMI BEACH FLORIDA FHA MORTGAGE LENDERS Recent home sales, real estate maps, and home value estimator for zip codes: 33139, 33140, 33141.

MIAMI BEACH FLORIDA MORTGAGE PROGRAMS

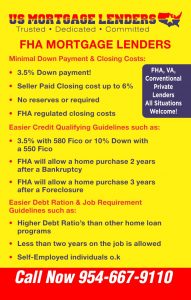

3.5% MIAMI FLORIDA FHA MORTGAGE LENDERS

3.5% MIAMI FLORIDA FHA MORTGAGE LENDERS. MIAMI FLORIDA FHA MORTGAGE LENDERS – Did you know that the FHA mortgage program typically only requires a 3.5% down payment with a min 580 FICO and 10% down payment under a 580!!! In additions FHA allows the seller to credit up to 6% to cover your closing cost and prepaid.

MIAMI-DADE COUNTY FLORIDA FHA MORTGAGE LENDERS

MIAMI–DADE COUNTY FLORIDA FHA MORTGAGE LENDERS – Did you know that the FHA mortgageprogram typically only requires a 3.5% down payment …

MIAMI FLORIDA FHA MORTGAGE LENDERS

3.5% MIAMI FLORIDA FHA MORTGAGE LENDERS. MIAMI FLORIDA FHA MORTGAGE LENDERS -Did you know that the FHA mortgage program typically only requires a 3.5% down payment with a min 580 FICO and 10% down payment under a 580!!! In additions FHA allows the seller to credit up to 6% to cover your closing cost and prepaid.

3.5% MIAMI-DADE COUNTY FL FHA MORTGAGE LENDERS

MIAMI–DADE COUNTY FL FHA Mortgage Lenders Florida-CALLNOW! 954-667-

3.5% Miami Beach Florida FHA Mortgage Lenders Min 580 FICO!!

3.5% Miami Florida FHA Mortgage Lenders Min 580 FICO!! All Credit All Situations Welcome Same Day Pre Approvals!

- FIRST TIME HOME BUYER MIAMI BEACH FLORIDA FHA MORTGAGE LENDERS – The FHA mortgage is not only for first time home buyers. Anyone purchasing a primary home can use the FHA loan. The FHA mortgage is popular with first time home buyers because of the with a low down payment requirement. In additions, bad credit, no credit mortgage applicants will find the FHA mortgage program is the only option to purchase a home. Read more »

- BAD CREDIT MIAMI BEACH FLORIDA FHA MORTGAGE LENDERS – Bad Credit FHA mortgage loan approvals are approved based on a more common sense approach to mortgage lending meaning bad credit borrowers with past foreclosure or Bankruptcy, tax liens, and collections or judgments can still qualify can qualify to purchase a home. Read more »

- NO CREDIT SCORE MIAMI BEACH FLORIDA FHA MORTGAGE LENDERS – FHA loan applicants with no credit score lack of trade lines can still qualify for an FHA mortgage loan using alternate trade lines to build a credit or payment history.Read more »

- CONDO MIAMI BEACH FLORIDA FHA MORTGAGE LENDERS– Search and purchase an FHA approved condo using the FHA mortgage program. Read more »

- TOWNHOUSE MIAMI BEACH FLORIDA FHA MORTGAGE LENDERS – The FHA mortgage program was created to help increase home ownership. The FHA program makes buying a townhouse home easier and less expensive than any other types of real estate mortgage home loan programs Read more »

- VILLA MIAMI BEACH FLORIDA FHA MORTGAGE LENDERS– This FHA loan program was created to help increase home ownership. The FHA program makes buying a villa easier and less expensive than any other types of real estate mortgage home loan programs Read more »

- MULTIFAMILY MIAMI BEACH FLORIDA FHA MORTGAGE LENDERS– This FHA loan program was created to help increase home ownership. The FHA program makes buying a multifamily duplex, triplex or four unit easier and less expensive than any other types of real estate mortgage home loan programs. Read more »

- JUMBO MIAMI BEACH FLORIDA FHA MORTGAGE LENDERS– The Jumbo FHA mortgage loan can be used in higher cost areas over 417,000 to help borrowers qualify for a Jumbo low down payment FHA mortgage option.Read more »

- GIFTS ALLOWED MIAMI BEACH FLORIDA FHA MORTGAGE LENDERS – When apply with an FHA mortgage lender you must document where your down payment came from. If you are getting a gift from a family member you must document the transfer, the documenation is very precise. Make sure the follow the FHA rules for a gift step by step, otherwise you may not be able to use the gift funds! Read more »

- MODULAR HOME MIAMI BEACH FLORIDA FHA MORTGAGE LENDERS – The FHA Title I modular home loan mortgage may be used for the purchase or refinancing of a manufactured home and land built after 1977, a developed lot on which to place a manufactured home, or a manufactured home and lot in combination. The home must be used as the principal residence and never moved from its original location. In addition you must own or buy the land with home. Read more »

- INVESTMENT PROPERTY MIAMI BEACH FLORIDA FHA MORTGAGE LENDERS– The idea of owning a multi family real estate investment property can be a very good idea for those who prepare the tenants to make the FHA mortgage payments.

- FORECLOSURE OR BANKRUPTCY MIAMI BEACH FLORIDA FHA MORTGAGE LENDERS – People with recent foreclosure or bankruptcy us the FHA mortgage to purchase or refinance a home every day! Read more »

- STREAMLINE REFINANCE MIAMI BEACH FLORIDA FHA MORTGAGE LENDERS– Lowering your monthly mortgage payment is easier than ever with an FHA streamline refinance mortgage you do not even need a new appraisal! Read more »

- DEBT CONSOLIDATION MIAMI BEACH FLORIDA FHA MORTGAGE LENDERS– An FHA Debt Consolidation Mortgage Refinance can lower your total monthly payment obligations. Contact us now to show you how much money you can save! Read more »

- COLLECTION AND JUDGMENTS MIAMI BEACH FLORIDA FHA MORTGAGE LENDERS – The Federal Housing Administration (FHA) offers mortgage applicants to the opportunity to purchase a home even with collections and judgements. Read more »

- MANUAL UNDERWRITING BOCA RATON FLORIDA FHA MORTGAGE LENDERS– If our local bank does not approve you for an FHA mortgage its still possible to qualify for an FHA mortgage using compensating factors and manual underwriting to qualify. Read more »

- LOAN LIMITS FOR MIAMI BEACH FLORIDA FHA MORTGAGE LENDERS – FHA mortgage loan limits very by county. You can purchase above the FHA mortgage loan limit but you would have to come up with the difference. Read more »

- DEBT TO INCOME RATIOS FOR MIAMI BEACH FLORIDA FHA MORTGAGE LENDERS– The FHA mortgage program will allow higher debt to income ratios than any other first time home buyer programs. Read more »

- EXCLUSION LIST FOR MIAMI BEACH FLORIDA FHA MORTGAGE LENDERS – If you have a past Foreclosure or Student loan in default you may not quality for an FHA mortgage. Read more »

- SELLER PAID CLOSING MIAMI BEACH FLORIDA FHA MORTGAGE LENDERS– Many FHA mortgage applicants find that the FHA mortgage is one of the most affordable mortgage programs allowing the seller to pay the buyers closing cost. Read more »

- OCCUPANCY RULES FOR MIAMI BEACH FLORIDA FHA MORGAGE LENDERS – FHA mortgage loans are for primary home use only. Read more »

- VA BAD CREDIT MIAMI BEACH FLORIDA FHA MORTGAGE LENDERS– VA loan applicants will find that the VA loan has the most flexible loan requirements available to purchase or refinance a home up to 100% loan to value even if you have your a veteran with a foreclosure or bankruptcy. Contact US mortgage lenders to learn how to put your (COE) certificate of eligibility to good use. Read more »

- USDA MIAMI BEACH FLORIDA BAD CREDIT FHA MORTGAGE LENDERS – US mortgage lenders has access to USDA mortgage lenders approving borrowers all the way down to a 550 middle credit score. If you can prove the ability to pay your bills on time then we may have a USDA mortgage lender for you. Read more »

- JUMBO MIAMI BEACH FLORIDA BAD CREDIT MORTGAGE LENDERS–US Mortgage lenders has access to jumbo mortgage lenders and jumbo portfolio lenders approving jumbo loan applicants for loan amounts over 417,000 with credit down all the way down to a 600 middle credit score! Read more »

- HARD MONEY MIAMI BEACH FLORIDA BAD CREDIT MORTGAGE LENDERS– If you have large enough down payment and can prove the ability and willingness to pay your bills on time then we may have a hard money lender for you. US Mortgage lenders has access to private lenders and portfolio hard money lenders approving borrowers for loans that your bank will never consider. Read more »

-

POPULAR MIAMI FLORIDA MORTGAGE PAGES INCLUDE

Bank Statement Only Florida Mortgage Lenders Min 600+FICO!

15%DOWN+BANK STATEMENT FL MORTGAGE LENDERS

15% DOWN+STATED INCOME FLORIDA MORTGAGE LENDERS-

3.5% MIAMI FLORIDA FHA MORTGAGE LENDERS

MIAMI FLORIDA FHA MORTGAGE LENDERS

Miami – 3.5% Florida FHA Mortgage Lenders Min 580 FICO!!

580+FICO+Miami Florida FHA Mortgage Lenders

MIAMI BEACH FLORIDA MORTGAGE AND CITY DATA

Population in 2013: 91,026 (100% urban, 0% rural). Population change since 2000: +3.5%

Males: 49,062 (53.9%)

Females: 41,964 (46.1%)

Median resident age: 41.0 years

Florida median age: 41.5 years

Zip codes: 33140, 33141.

Miami Beach Zip Code Map

Estimated median household income in 2013: $44,153 (it was $27,322 in 2000)

Miami Beach: $44,153

FL: $46,036

Estimated per capita income in 2013: $38,201 (it was $27,853 in 2000)

Miami Beach city income, earnings, and wages data

Estimated median house or condo value in 2013: $375,500 (it was $138,700 in 2000)

Miami Beach: $375,500

FL: $153,300

Mean prices in 2013: All housing units: $684,417; Detached houses: over $1,000,000; Townhouses or other attached units: $323,698; In 2-unit structures: $317,891; In 3-to-4-unit structures: $155,902; In 5-or-more-unit structures: $492,422

Median gross rent in 2013: $1,077.

Recent home sales, real estate maps, and home value estimator for zip codes: 33139, 33140, 33141.

Miami Beach, FL residents, houses, and apartments details