Cape Coral FL FHA Mortgage Lenders

FHA mortgage lenders continue to be a popular mortgage choice for Cape Coral, FL home buyers and current homeowners in need to refinance. In fact, the FHA mortgage lenders have to help people own homes in cities like Cape Coral since 1934. Easy qualifying guidelines include easier to qualify with less than perfect credit.

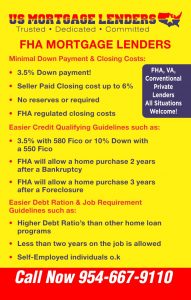

FHA MORTGAGE HAVE MINIMAL DOWNPAYMENT AND CLOSING FEES:

- Down payment is only 3.5%of the purchase price.

- Gifts from family or Grants for down payment assistance and closing costs OK!

- The seller can credit buyers up to 6% of the sales price towards buyers’ costs.

- No reserves or future payments in the account are required.

- FHA regulated closing costs.

FHA MORTGAGE LOANS ARE EASY TO QUALIFY FOR BECAUSE YOU CAN:

- Purchase a Florida home 12 months after a chapter 13 Bankruptcy

- Purchase a Florida 24 months after a chapter 7 Bankruptcy.

- FHA will allow a FHA mortgage 3 years after a Foreclosure.

- Minimum FICO credit score of 580 required for 96.5% financing.

- Bad credit Florida FHA mortgage approvals minimum FICO credit score of 530 required for 90 FHA financing.

- No Credit Score Florida mortgage loans & No Trade Line Florida FHA home loans.

CAPE CORAL FLORIDA FHA MORTGAGE LOANS ALLOW HIGHER DEBT TO INCOME & EASIER JOB QUALIFYING

- FHA allows higher debt ratio’s than any other Florida home loan programs.

- Less than two years on the same job is OK!

- Self-employed buyers can also qualify for FHA.

- Check Florida FHA Mortgage Articles for more information.

CAPE CORAL FLORIDA FHA MORTGAGE LENDERS – Did you know that the FHA mortgage program typically only requires a 3.5% down payment with a min 580 FICO and 10% down payment under a 580!!! In additions FHA allows the seller to credit up to 6% to cover your closing cost and prepaid. Note we do not charge any lender fees. When you purchase a Florida home there are always 3rd party cost involved that include. Prepaid taxes, insurance, docs stamps, mortgage stamps, intangibles, title closing cost including insurance, survey, recording charges ect.

WHAT IS AN FHA MORTGAGE? FHA mortgage loans have been helping people become homeowners since 1934. FHA Loans are backed by the Federal Housing Administration (Also known as FHA). FHA insures private Florida FHA approved mortgage lenders so they can offer loans to riskier borrowers with a lower down payment requirement. For example: FHA loans typically have a lower down-payment and better loan rates for borrowers with lower credit scores.

The Federal government insures Florida FHA mortgage lenders against losses, therefore the FHA mortgage applicants has very minimal down payment and closing cost. FHA mortgages require a minimum 3.5% financial commitment from the applicant. FHA mortgage lenders allow for the home seller to pay all your closing cost up to 6% of the sale price enough to cover 100% of your FHA mortgage closing cost!

• CAPE CORAL FLORIDA FHA MORTGAGE LENDERS OFFER – EASIEST TO QUALIFY

Prequalifying with a Florida FHA mortgage lenders is rather easy. The result of the FHA mortgage insurance guarantee educes Florida FHA mortgage lenders make it feasible for just about anybody with a decent 12 month payment history to qualify. The primary components of an FHA mortgage include down payment, credit, debt to income ratio.

• CAPE CORAL FLORIDA FHA MORTGAGE LENDERS OFFER – FIXED 30 YEAR RATES WITH NO PREPAYMENT PENALTIES

One of the big advantages of using a Florida FHA mortgage lenders is the benefit of having a fixed 30 year interest rate with 0 NO prepayment penalty. In comparison to other conventional Fannie Mae and Freddie mac mortgage loans in which you risk the possibility of a mortgage rate that could change. The FHA mortgage is typically for 30 years. The result of this FHA mortgage provision FHA mortgage applicants can budget their predetermined installment FHA mortgage payment in advance.

• CAPE CORAL FLORIDA FHA MORTGAGE LENDERS OFFER –NO RESERVES ARE REQUIRED

In contrast to most conventional home loan programs, Florida’s FHA home loan is a very tempting option for Florida first time buyers that have a little saved for down payment let alone future mortgage payments.

Florida First Time buyers should click apply now at the top of this website to learn what to expect with the FHA mortgage process. Being prepared will always boost your chances in getting your FHA mortgage approved.

4 C’S CAPE CORAL FLORIDA FHA MORTGAGE LENDER REQUIRMENTS CHECKLIST

1-Collateral/FHA Approved Property Types Include- Single family homes, Townhomes, villas, 1-4 family multi Unit Homes, and FHA Approved Condos!

2-FHA Minimum Cash/Down payment Or Equity -FHA 3.5% Down Payment Cash or 20% Equity/ 80% LTV for cash out or 96.75% Rate term Refinance- Verity the borrower has the down payment from acceptable source on a purchase or enough equity to cover payoffs and closing cost to include taxes insurance on a refinance.

3-FHA Minimum Credit 500+ Credit Score – Does the borrower have the minimum credit score to meet the loan program? Does the borrower have collections that have to be paid off that will reflect the cash needed to close? Do student loans that are deferred need to be added to the monthly obligations? Does the lender require %1 cumulative student loans or 5% of the cumulative collections accounts over +$2000 added back to the debt to income ratios.

4-Capacity-56.9% FHA Maximum- Does the FHA mortgage applicants debt to income ratio meet the loan program requirements or no more debt than 56.9% of the total housing + all monthly payments reflected on the FHA mortgage applicants credit report.

- FIRST TIME HOME BUYER CAPE CORAL FHA MORTGAGE LENDERS – The FHA mortgage is not only for first time home buyers. Anyone purchasing a primary home can use the FHA loan. The FHA mortgage is popular with first time home buyers because of the with a low down payment requirement. In additions, bad credit, no credit mortgage applicants will find the FHA mortgage program is the only option to purchase a home. Read more »

- BAD CREDIT CAPE CORAL FHA MORTGAGE LENDERS – Bad Credit FHA mortgage loan approvals are approved based on a more common sense approach to mortgage lending meaning bad credit borrowers with past foreclosure or Bankruptcy, tax liens, and collections or judgments can still qualify can qualify to purchase a home. Read more »

- NO CREDIT SCORE CAPE CORAL FHA MORTGAGE LENDERS – FHA loan applicants with no credit score lack of trade lines can still qualify for an FHA mortgage loan using alternate trade lines to build a credit or payment history.Read more »

- CONDO CAPE CORAL FHA MORTGAGE LENDERS– Search and purchase an FHA approved condo using the FHA mortgage program. Read more »

- TOWNHOUSE CAPE CORAL FHA MORTGAGE LENDERS – The FHA mortgage program was created to help increase home ownership. The FHA program makes buying a townhouse home easier and less expensive than any other types of real estate mortgage home loan programs Read more »

- VILLA CAPE CORAL FHA MORTGAGE LENDERS– This FHA loan program was created to help increase home ownership. The FHA program makes buying a villa easier and less expensive than any other types of real estate mortgage home loan programs Read more »

- MULTIFAMILY CAPE CORAL FHA MORTGAGE LENDERS– This FHA loan program was created to help increase home ownership. The FHA program makes buying a multifamily duplex, triplex or four unit easier and less expensive than any other types of real estate mortgage home loan programs. Read more »

- JUMBO CAPE CORAL FHA MORTGAGE LENDERS– The Jumbo FHA mortgage loan can be used in higher cost areas over 417,000 to help borrowers qualify for a Jumbo low down payment FHA mortgage option.Read more »

- GIFTS ALLOWED CAPE CORAL FHA MORTGAGE LENDERS – When apply with an FHA mortgage lender you must document where your down payment came from. If you are getting a gift from a family member you must document the transfer, the documenation is very precise. Make sure the follow the FHA rules for a gift step by step, otherwise you may not be able to use the gift funds! Read more »

- MODULAR HOME BRANDON FL FHA MORTGAGE LENDERS – The FHA Title I modular home loan mortgage may be used for the purchase or refinancing of a manufactured home and land built after 1977, a developed lot on which to place a manufactured home, or a manufactured home and lot in combination. The home must be used as the principal residence and never moved from its original location. In addition you must own or buy the land with home. Read more »

- INVESTMENT PROPERTY CAPE CORAL FHA MORTGAGE LENDERS– The idea of owning a multi family real estate investment property can be a very good idea for those who prepare the tenants to make the FHA mortgage payments.

- FORECLOSURE OR BANKRUPTCY CAPE CORAL FHA MORTGAGE LENDERS – People with recent foreclosure or bankruptcy us the FHA mortgage to purchase or refinance a home every day! Read more »

- STREAMLINE REFINANCE CAPE CORAL FHA MORTGAGE LENDERS– Lowering your monthly mortgage payment is easier than ever with an FHA streamline refinance mortgage you do not even need a new appraisal! Read more »

- DEBT CONSOLIDATION CAPE CORAL FHA MORTGAGE LENDERS– An FHA Debt Consolidation Mortgage Refinance can lower your total monthly payment obligations. Contact us now to show you how much money you can save! Read more »

- COLLECTION AND JUDGMENTS CAPE CORAL FHA MORTGAGE LENDERS – The Federal Housing Administration (FHA) offers mortgage applicants to the opportunity to purchase a home even with collections and judgements. Read more »

- MANUAL UNDERWRITING CAPE CORAL FHA MORTGAGE LENDERS– If our local bank does not approve you for an FHA mortgage its still possible to qualify for an FHA mortgage using compensating factors and manual underwriting to qualify. Read more »

- LOAN LIMITS FOR CAPE CORAL FHA MORTGAGE LENDERS – FHA mortgage loan limits very by county. You can purchase above the FHA mortgage loan limit but you would have to come up with the difference. Read more »

- DEBT TO INCOME RATIOS FOR CAPE CORAL FHA MORTGAGE LENDERS– The FHA mortgage program will allow higher debt to income ratios than any other first time home buyer programs. Read more »

- EXCLUSION LIST FOR CAPE CORAL FHA MORTGAGE LENDERS – If you have a past Foreclosure or Student loan in default you may not quality for an FHA mortgage. Read more »

- SELLER PAID CLOSING CAPE CORAL FHA MORTGAGE LENDERS– Many FHA mortgage applicants find that the FHA mortgage is one of the most affordable mortgage programs allowing the seller to pay the buyers closing cost. Read more »

- OCCUPANCY RULES FOR CAPE CORAL FHA MORGAGE LENDERS – FHA mortgage loans are for primary home use only. Read more »

- VA BAD CREDIT CAPE CORAL FHA MORTGAGE LENDERS– VA loan applicants will find that the VA loan has the most flexible loan requirements available to purchase or refinance a home up to 100% loan to value even if you have your a veteran with a foreclosure or bankruptcy. Contact US mortgage lenders to learn how to put your (COE) certificate of eligibility to good use. Read more »

- USDA CAPE CORAL BAD CREDIT FHA MORTGAGE LENDERS – US mortgage lenders has access to USDA mortgage lenders approving borrowers all the way down to a 550 middle credit score. If you can prove the ability to pay your bills on time then we may have a USDA mortgage lender for you. Read more »

- JUMBO CAPE CORAL BAD CREDIT MORTGAGE LENDERS–US Mortgage lenders has access to jumbo mortgage lenders and jumbo portfolio lenders approving jumbo loan applicants for loan amounts over 417,000 with credit down all the way down to a 600 middle credit score! Read more »

- HARD MONEY CAPE CORAL BAD CREDIT MORTGAGE LENDERS– If you have large enough down payment and can prove the ability and willingness to pay your bills on time then we may have a hard money lender for you. US Mortgage lenders has access to private lenders and portfolio hard money lenders approving borrowers for loans that your bank will never consider. Read more »

CAPE CORAL FLORIDA MORTGAGE AND CITY DATA

- Cape Coral, Florida

Cape Coral: Sunst@ Fort Myers beach 4-23-07Cape Coral: Sunst@ Fort Myers beach 4-23-07 - Cape Coral: After the Sunset on 43rd TerraceCape Coral: After the Sunset on 43rd Terrace

- Cape Coral: Living in paradise on the citrus canalCape Coral: Living in paradise on the citrus canal

- Cape Coral: Diamond Bluff Estates, Greer’s Ferry Lake 42 mi. around – ArkansasCape Coral: Diamond Bluff Estates, Greer’s Ferry Lake 42 mi. around – Arkansas

- Cape Coral: sunset on the citrus canalCape Coral: sunset on the citrus canal

- Cape Coral: sunset at cape coral yaht club pierCape Coral: sunset at cape coral yaht club pier

- Cape Coral: Nothing like going for an early morning walk with this for a viewCape Coral: Nothing like going for an early morning walk with this for a view

- Cape Coral: SW Cape Coral Street ViewCape Coral: SW Cape Coral Street View

- Cape Coral: Out on the WaterCape Coral: Out on the Water

- Cape Coral: Cape Coral burrowing owlCape Coral: Cape Coral burrowing owl

- Cape Coral: Traveling Memorial to Fallen Soldiers at King’s Way Christian Center

- OSM Map General Map Google Map MSN Map

- Leaflet | Data, imagery and map information provided by CartoDB, OpenStreetMap and contributors, CC-BY-SA

Current weather forecast for Cape Coral, FL - Population in 2014: 169,854 (99% urban, 1% rural). Population change since 2000: +66.1%

Males: 80,652 (47.5%)

Females: 89,202 (52.5%)

Median resident age: 44.6 years

Florida median age: 41.5 years

Zip codes: 33903, 33904, 33909, 33914, 33990, 33991. - Cape Coral Zip Code Map

Estimated median household income in 2013: $47,767 (it was $43,410 in 2000)

Cape Coral: $47,767

FL: $46,036 - Estimated per capita income in 2013: $22,231 (it was $21,021 in 2000)

- Cape Coral city income, earnings, and wages data

- Estimated median house or condo value in 2013: $158,800 (it was $106,500 in 2000)

Cape Coral: $158,800

FL: $153,300 - Mean prices in 2013: All housing units: $203,499; Detached houses: $209,636; Townhouses or other attached units: $176,231; In 2-unit structures: $132,519; In 3-to-4-unit structures: $110,296; In 5-or-more-unit structures: $145,323; Mobile homes: $47,013

Median gross rent in 2013: $1,098. - Cape Coral, FL residents, houses, and apartments details