FORT LAUDERDALE FLORIDA CONDO, CONDOTEL AND NON-WARRANTABLE CONDO LENDERS

Miami Beach — Panama City Beach FL –Fort Lauderdale FL – Palm Beach FL– Clearwater Beach Fl

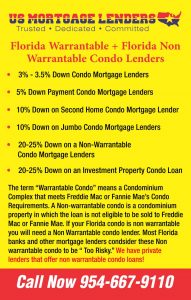

- • 96.5% LTV on Owner Occupied FORT LAUDERDALE FLORIDA Condos= 3.5% Downpayment!

- • 95% LTV on FORT LAUDERDALE FLORIDA Owner Occupied Condos= 5% Downpayment!

- • 90% LTV on Second FORT LAUDERDALE FLORIDA Home Condos= 10% Downpayment!

- • 80% LTV on Second FORT LAUDERDALE FLORIDA Home Condos= 20% Downpayment

- • 80% LTV on Investment FORT LAUDERDALE FLORIDA Condos= 20% Downpayment

- • 80% Non warrantable FORT LAUDERDALE FLORIDA Condo loans

- • 80% FORT LAUDERDALE FLORIDA CONDOTEL MORTGAGE LENDERS

3,5,7,15, 20 and 30 year fixed rate FORT LAUDERDALE FLORIDA condo loan terms available!

all programs subject to change without notice.

www.Florida-Mortgage-Lenders.com

FORT LAUDERDALE FLORIDA CONDO MORTGAGE LENDERS

FLORIDA CONDOTELS + NON-WARRANTABLE CONDO LENDERS

Florida condo mortgage applicants will find that a mortgage on a FORT LAUDERDALE FLORIDA condo is more complex than purchasing a FORT LAUDERDALE FLORIDA single family or town-home or villa. There are additional requirements for FORT LAUDERDALE FLORIDA condo associations that do not exist in other typical Florida mortgage transactions. The Condo must be approved by the Florida mortgage lender via condo association questionnaire before you can get financing on a Florida condo.

MANY FORT LAUDERDALE FLORIDA LENDERS WILL NOT MORTGAGE CONDOMINUMS

Having trouble getting a Florida condo mortgage because the condo you are interested in is being denied by your Florida mortgage lender? Florida mortgage lenders.com offers condominium mortgage loans on many Florida condos projects that are not Fannie Mae approved and which other Florida mortgage lenders consider not financeable. Conditions include the Florida mortgage applicant must:

1. The FORT LAUDERDALE FLORIDA condo purchase must be a primary residence = 25% down payment for a purchase or 25% equity for a refinance.

2. 2nd FORT LAUDERDALE FLORIDA condo home loan transactions require a minimum 30% down payment for purchase and 30% equity in the Florida condo for a refinance.

Our expanded FORT LAUDERDALE FLORIDA condo mortgage approvals for condos require no condo questionnaire, no review of the association budget and no approval of the project reserves. It may seem counter-intuitive, but no matter how strong you may be as a Florida mortgage applicant, or what the down-payment/Loan-to-Value is; most Florida mortgage lenders will not mortgage Florida condos if they fail even basic criteria of a condo questionnaire. Details of most denials include: pending litigation in the project, low % of owner-occupancy, high % of current condo owners late on their HOA fees are just a few reasons that will kill your Florida condo mortgage. It is very risky to attempt to secure financing with Florida mortgage lenders that require Condominium questionnaire approval. A result of the Florida housing market crash is that most Florida condo projects have some of the aforementioned issues. The safe and easy path to a smooth Florida mortgage process is to work through one of the very limited number of Florida mortgage lenders that do not require Florida condo questionnaire approval.

FORT LAUDERDALE FLORIDA condo Mortgage Lenders.com is one of only a very small number of limited Lenders with Access to the Florida mortgage lenders that do not require a Florida condo questionnaire that offer these programs.

FORT LAUDERDALE FLORIDA CONDOMINUM MORTGAGE REQUIRMENTS

Florida Mortgage lenders have requirements for FORT LAUDERDALE FLORIDA condo financing.

Mortgaging a Florida condominium comes with a few more requirements than a standard Florida mortgage. Condominiums are mostly part of a condo association and the reputation of that association can affect a Florida mortgage applicants chances of obtaining condo financing. Due to the number of association delinquencies many Florida mortgage lenders have raised their requirements for financing when purchasing Florida condominiums. Large down payments usually between 20-30%, association questionnaire approvals and inspections approved directly by the Florida mortgage lender are some of the requirements that Florida condo buyers must meet before they obtain a loan for a Florida condominium.

FORT LAUDERDALE FLORIDA CONDO ASSOCIATION FEES

Living in a Florida condominium complex usually requires the unit owners to pay association fees. Most Florida mortgage companies can now refuse financing if 15 percent or more of the residents are 30 days or more behind on their association dues. Delinquency rates in dues worries Florida mortgage lenders because it casts doubt on the association’s cash reserves and financial status.

New Florida condominium units and complexes have a minimum criterion of sold units to meet. Most Florida Mortgage Lenders now want to see at least 49 percent of the units sold or under contract before they will agree to financing.

FORT LAUDERDALE FLORIDA INSPECTIONS

o Condominium inspections usally take place before the Florida mortgage applicant apply for condo financing.. However, all Fannie Mae-backed Florida mortgages for condos will have to undergo an inspection by a Fannie Mae representative. This includes the complex as well as an investigation into the association’s financial situation. Previously, Florida condominium inspections were carried out but by the individual Florida mortgage lender.

FORT LAUDERDALE FLORIDA CONDOS REQUIRE LARGER DOWNPAYMENT

Mortgage insurance (MI) companies are currently not providing private mortgage insurance in Florida due to the large number of defaults. As a result Florida condo mortgage applicants are required to put down a minimum 20 percent down payment.

QUESTIONS TO ASK THE FORT LAUDERDALE FLORIDA ASSOCIATION:

1. Is the Florida condo project Fannie Mae or FHA Approved? If the answer is yes, then you may proceed as long as the FORT LAUDERDALE FLORIDA condo is not on the Florida mortgage lender’s unbendable list (Yes, this is still possible even if a Florida condo project is Fannie Mae approved). It is important to note that some phases within a Florida condo project may be approved while others may not. This is a common mistake that can blow up many deals.

2. Am I eligible for a FORT LAUDERDALE FLORIDA condo Project Review Waiver? (Also called a Limited Review) Primary Florida condo purchases with a 25% down payment/equity. Second FORT LAUDERDALE FLORIDA condo home transactions with a 30% down payment/equity. Investment Properties are not eligible. Beware of lenders offering “Limited Review” of a condo but requiring a Condo Questionnaire. If a condo questionnaire is required, then it is not a limited review and you risk your loan being denied for factors not related to your individual credit worthiness. Check that your Condo is not on the lender’s list of denied projects. The Government Homeowner Assistance Program = HARP will allow you to refinance up to 125% of your home’s value if your Loan is owned by Fannie Mae or Freddie Mac. There is no project approval for these programs.

3. Can I get an FHA Loan in a FORT LAUDERDALE FLORIDA condo that is not FHA Approved? No. Currently FHA and lenders are not allowing spot reviews of condos for FHA Loans. You should check which Condos in the area you are interested in buying are already FHA approved if you are interested in a low down payment FHA loan.

4. What is the minimum down-payment for a FORT LAUDERDALE FLORIDA condo Loan? For purchases, typically the minimum down payment is 20%. We encourage that you put more money down so that we can waive the project approval requirements. 25%- Owner Occupied. 30%- Second Home. If the project is FHA approved, you can purchase a primary residence with a 3.5% down-payment. For Refis, if the loan is eligible for HARP- Government Homeowner Assistance Programs- Then it is possible to get a condo home loan for up to 125% of the home’s value.

MIAMI FL FHA MORTGAGE LENDERS – BAD CREDIT FORT LAUDERDALE FLORIDA MORTGAGE LENDERS

BROWARD FLORIDA CONDO MORTGAGE LENDERS

Broward County Florida Condo Mortgage Lenders Municipalities Broward County Municipalities (pdf) Broward County Municipalities and Zipcodes (pdf) Broward County Municipalities and Commission Districts (pdf) Broward County Municipalities 8.5 x 11 (pdf) Municipal Boundaries Wall Map 60 x 60 inches (pdf)

| BROWARD MUNICIPAL SERVICES DISTRICT Broward County Florida Condo Mortgage Lenders |

Phone: 311 | Website Governing Officials |

| COCONUT CREEK 4800 W. Copans Road, Coconut Creek, FL 33063 |

Phone: 954-973-6770 Fax: 954-973-6794 |

Website Governing Officials |

| COOPER CITY 9090 S.W. 50 Place, P.O. Box 290910, Cooper City, FL 33329 |

Phone: 954-434-4300 Fax: 954-434-5099 |

Website Governing Officials |

| CORAL SPRINGS 9551 W. Sample Road, Coral Springs, FL 33065 |

Phone: 954-344-1001 Fax: 954-344-1016 |

Website Governing Officials |

| DANIA BEACH 100 W. Dania Beach Blvd., Dania Beach, FL 33004 |

Phone: 954-924-3600 Fax: 954-924-2604 |

Website Governing Officials |

| DAVIE 6591 Orange Drive, Davie, FL 33314 |

Phone: 954-797-1000 Fax: 954-797-1087 |

Website Governing Officials |

| DEERFIELD BEACH 150 N.E. Second Ave., Deerfield Beach, FL 33441 |

Phone: 954-480-4200 Fax: 954-480-4268 |

Website Governing Officials |

| FORT LAUDERDALE 100 N. Andrews Ave., Fort Lauderdale, FL 33301 |

Phone: 954-828-5000 Fax: 954-828-5667 |

Website Governing Officials |

| HALLANDALE BEACH 400 S. Federal Highway, Hallandale Beach, FL 33009 |

Phone: 954-458-3251 Fax: 954-457-1342 |

Website Governing Officials |

| HILLSBORO BEACH 1210 Hillsboro Mile, Hillsboro Beach, FL 33062 |

Phone: 954-427-4011 Fax: 954-427-4834 |

Website Governing Officials |

| HOLLYWOOD 2600 Hollywood Blvd., Hollywood, FL 33022 |

Phone: 954-967-4357 Fax: 954-921-3233 |

Website Governing Officials |

| LAUDERDALE-BY-THE-SEA 4501 Ocean Drive, Lauderdale-By-The-Sea, FL 33308 |

Phone: 954-776-0576 Fax: 954-776-1857 |

Website Governing Officials |

| LAUDERDALE LAKES 4300 N.W. 36 St., Lauderdale Lakes, FL 33319 |

Phone: 954-535-2700 No Fax listed |

Website Governing Officials |

| LAUDERHILL 5581 W. Oakland Park Blvd., Lauderhill, FL 33313 |

Phone: 954-730-3000 Fax: 954-730-3062 |

Website Governing Officials |

| LAZY LAKE 2250 Lazy Lane, Lazy Lake, FL 33305 |

Phone: 954-614-9058 Fax: 954-563-5649 |

|

| LIGHTHOUSE POINT 2200 N.E. 38 St., Lighthouse Point, FL 33064 |

Phone: 954-943-6500 Fax: 954-784-3446 |

Website Governing Officials |

| MARGATE 5790 Margate Blvd., Margate, FL 33063 |

Phone: 954-972-6454 Fax: 954-935-5304 |

Website Governing Officials |

| MIRAMAR 2300 Civic Center Place, Miramar, FL 33025 |

Phone: 954-602-3011 Fax: 954-602-3440 |

Website Governing Officials |

| NORTH LAUDERDALE 701 S.W. 71 Ave., North Lauderdale, FL 33068 |

Phone: 954-722-0900 Fax: 954-720-2151 |

Website Governing Officials |

| OAKLAND PARK 3650 N.E. 12 Ave., Oakland Park, FL 33334 |

Phone: 954-630-4200 Fax: 954-630-4215 |

Website Governing Officials |

| PARKLAND 6600 University Drive, Parkland, FL 33067 |

Phone: 954-753-5040 Fax: 954-341-5161 |

Website Governing Officials |

| PEMBROKE PARK 3150 S.W. 52 Ave., Pembroke Park, FL 33023 |

Phone: 954-966-4600 Fax: 954-966-9781 |

Website Governing Officials |

| PEMBROKE PINES 10100 Pines Blvd., Pembroke Pines, FL 33026 |

Phone: 954-431-4500 Fax: 954-437-1149 |

Website Governing Officials |

| PLANTATION 400 N.W. 73 Ave., Plantation, FL 33317 |

Phone: 954-797-2200 Fax: 954-797-2223 |

Website Governing Officials |

| POMPANO BEACH 100 W. Atlantic Blvd., Pompano Beach, FL 33060 |

Phone: 954-786-4600 Fax: 954-786-4504 |

Website Governing Officials |

| SEA RANCH LAKES 1 Gatehouse Road, Sea Ranch Lakes, FL 33308 |

Phone: 954-943-8862 Fax: 954-943-5808 |

General Information Online |

| SOUTHWEST RANCHES 6589 S.W. 160 Ave., Southwest Ranches, FL 33331 |

Phone: 954-434-0008 Fax: 954-434-1490 |

Website Governing Officials |

| SUNRISE 10770 W. Oakland Park Blvd., Sunrise, FL 33351 |

Phone: 954-741-2580 Fax: 954-746-3439 |

Website Governing Officials |

| TAMARAC 7525 N.W. 88 Ave., Tamarac, FL 33321 |

Phone: 954-597-3500 Fax: 954-597-3470 |

Website Governing Officials |

| WEST PARK 1965 S. State Road 7, West Park, FL 33023 |

Phone: 954-989-2688 No Fax |

Website Governing Officials |

| WESTON Weston City Hall 17200 Royal Palm Blvd., Weston, FL 33326 |

Phone: 954-385-2000 Fax: 954-385-2010 |

Website Governing Officials |

| WILTON MANORS Wilton Drive, Wilton Manors, FL 33305 |

Phone: 954-390-2100 Fax: 954-390-2199 |

Website Governing Officials |

Broward County Florida Condo Mortgage Lenders

4800 W. Copans Road, Coconut Creek, FL 33063

Fax: 954-973-6794

9090 S.W. 50 Place, P.O. Box 290910, Cooper City, FL 33329

Fax: 954-434-5099

9551 W. Sample Road, Coral Springs, FL 33065

Fax: 954-344-1016

100 W. Dania Beach Blvd., Dania Beach, FL 33004

Fax: 954-924-2604

6591 Orange Drive, Davie, FL 33314

Fax: 954-797-1087

150 N.E. Second Ave., Deerfield Beach, FL 33441

Fax: 954-480-4268

100 N. Andrews Ave., Fort Lauderdale, FL 33301

Fax: 954-828-5667

400 S. Federal Highway, Hallandale Beach, FL 33009

Fax: 954-457-1342

1210 Hillsboro Mile, Hillsboro Beach, FL 33062

Fax: 954-427-4834

2600 Hollywood Blvd., Hollywood, FL 33022

Fax: 954-921-3233

4501 Ocean Drive, Lauderdale-By-The-Sea, FL 33308

Fax: 954-776-1857

4300 N.W. 36 St., Lauderdale Lakes, FL 33319

No Fax listed

5581 W. Oakland Park Blvd., Lauderhill, FL 33313

Fax: 954-730-3062

2250 Lazy Lane, Lazy Lake, FL 33305

Fax: 954-563-5649

2200 N.E. 38 St., Lighthouse Point, FL 33064

Fax: 954-784-3446

5790 Margate Blvd., Margate, FL 33063

Fax: 954-935-5304

2300 Civic Center Place, Miramar, FL 33025

Fax: 954-602-3440

701 S.W. 71 Ave., North Lauderdale, FL 33068

Fax: 954-720-2151

3650 N.E. 12 Ave., Oakland Park, FL 33334

Fax: 954-630-4215

6600 University Drive, Parkland, FL 33067

Fax: 954-341-5161

3150 S.W. 52 Ave., Pembroke Park, FL 33023

Fax: 954-966-9781

10100 Pines Blvd., Pembroke Pines, FL 33026

Fax: 954-437-1149

400 N.W. 73 Ave., Plantation, FL 33317

Fax: 954-797-2223

100 W. Atlantic Blvd., Pompano Beach, FL 33060

Fax: 954-786-4504

1 Gatehouse Road, Sea Ranch Lakes, FL 33308

Fax: 954-943-5808

6589 S.W. 160 Ave., Southwest Ranches, FL 33331

Fax: 954-434-1490

10770 W. Oakland Park Blvd., Sunrise, FL 33351

Fax: 954-746-3439

7525 N.W. 88 Ave., Tamarac, FL 33321

Fax: 954-597-3470

1965 S. State Road 7, West Park, FL 33023

No Fax

Weston City Hall

17200 Royal Palm Blvd., Weston, FL 33326

Fax: 954-385-2010

Wilton Drive, Wilton Manors, FL 33305

Fax: 954-390-2199