- Georgia VA Mortgage LENDERS – Same Day VA Loan Approvals!

- GEORGIA FHA DOWN PAYMENT ASSISTANCE MORTGAGE LENDERS

US Mortgage specializes in good and bad credit VA mortgage loans even no credit score Georgia VA loans in every city and county in Georgia VA Mortgage LENDERS VA mortgages are guaranteed by the Department of Veterans Affairs (VA). These Georgia VA mortgage loans were established to provide transition assistance and other benefits to men and women who served or are serving in the Armed Forces of the Nation. This includes the Army, Navy, Air Force, Marines, Reservists, National Guardsmen, and certain surviving spouses. Also, if you are a disabled veteran, you may qualify for additional Georgia VA mortgage benefits. Including reduced or elimination of Georgia property taxes. We are proud to provide 100% Bad credit Georgia VA mortgage approvals down to 550 fico score va purchase or Georgia VA mortgage refinance!

US Mortgage specializes in good and bad credit VA mortgage loans even no credit score Georgia VA loans in every city and county in Georgia VA Mortgage LENDERS VA mortgages are guaranteed by the Department of Veterans Affairs (VA). These Georgia VA mortgage loans were established to provide transition assistance and other benefits to men and women who served or are serving in the Armed Forces of the Nation. This includes the Army, Navy, Air Force, Marines, Reservists, National Guardsmen, and certain surviving spouses. Also, if you are a disabled veteran, you may qualify for additional Georgia VA mortgage benefits. Including reduced or elimination of Georgia property taxes. We are proud to provide 100% Bad credit Georgia VA mortgage approvals down to 550 fico score va purchase or Georgia VA mortgage refinance!

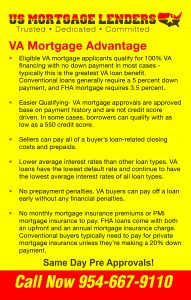

Georgia VA mortgage LENDERS Benefits Include:

- Easier qualification standards

- Less strict credit and income standards

- 100% Financing = No down payment required.

- Bad Credit Score VA loans Down to 580!

- No Credit Score VA Mortgage Loan Approvals.

SAME DAY PRE APPROVALS! CALL NOW

VA MORTGAGE LENDERS LOAN OPTIONS or VA MORTGAGE REFINANCE

VA Mortgage LENDERS Serving VA Purchase and VA Refinance Loans In Every City and County in Georgia!

GEORGIA VA MORTGAGE LENDERS ELIGIBILITY REQUIREMENTS

You must have suitable credit score MINIMUM 550, sufficient income, and a valid Certificate of Eligibility (COE) to Qualify with a Georgia VA mortgage LENDERS . The Georgia home must be for your own personal occupancy. The approval requirements to obtain a COE are listed below for Service members and Georgia Veterans, spouses, and other eligible beneficiaries. VA mortgage loans can be used to:

- Buy a Georgia home, a Georgia condominium unit in a VA-approved project

- Simultaneously purchase and improve a Georgia home.

- Improve a Georgia home by installing energy-related features or making energy efficient improvements

- Get VA approved to buy a Georgia manufactured home w/land lot.

- Georgia Eligibility Requirements for VA Mortgage LENDERS

- Service members and Georgia Veterans- To obtain a COE, you must have been discharged under conditions other than dishonorable and meet the service requirements below

ESTABLISHED VA MORTGAGE LENDERS MINIMUM TRADE LINES

Georgia VA Mortgage LENDERS allow for both traditional and alternative credit trade lines. However, most Georgia mortgage LENDERS require that you must have at least two lines of credit that you have maintained for at least a 12 month payment history.

Alternative lines of credit for NO CREDIT SCORE MORTGAGE APPROVALS for Georgia VA mortgage applicants are used to provide the ability and willingness to pay debt. VA alt trade lines defined as continuing proof of payment for direct service provider obligations, such as electric, cell-phone, home-phone bills, rent history, car insurance, which require a timely monthly payment in order to establish a 12 month payment history. To be used as an alternative credit trade line must have existed for at least 12 months.

VA mortgage LENDERS do not consider absence of a credit history as an adverse factor. However, a minimum 12 month history of the VA mortgage applicant, including residence, income, assets and credit must be proven.

Georgia VA Mortgage LENDERS Funding Fee Tables

| Type of Veteran | Down payment | Percentage for First time Use | Percentage for

Subsequent Use |

| Regular Military | None

5%or more 10%or more |

2.15%

1.50% 1.25% |

3.3% *

1.50% 1.25% |

| Reserves/National

Guard |

None

5%or more 10%or more |

2.4%

1.75% 1.5% |

3.3% *

1.75% 1.5% |

Subsequent Use

5%or more

10%or more

1.50%

1.25%

1.50%

1.25%

Guard

5%or more

10%or more

1.75%

1.5%

1.75%

1.5%

Note:In 2011,funding fees were lower from October 1 through October 5,and November 18 through November 21. The enactment of Public law 112-56,signed November 21,2011,establishes rates at the levels below through September 30,2016.Prior to September 30,2016,we will publish updated information on the fees for loans closed after that date.

Cash-Out Refinancing Loans:

| Type of Veteran | Percentage for FirstTime VA Mortgage Use | Percentage for Subsequent VA Mortgage Applicants |

| Regular Military | 2.15% | 3.3% * |

| Reserves/National Guard | 2.4% | 3.3% * |

Note:There are no reduced funding fees for regular refinances based on equity.Reduced fees only apply to purchase loans where a down payment of atl east

*The higher subsequent use fee does not apply to these types of loans if the Veteran’s only prior use of entitlement was for a manufactured home loan.

| VA Status | Qualifying Wartime & Peacetime Periods | Qualifying Active Duty Dates | Minimum Active Duty Service Requirement |

| Georgia Veteran | WWII | 9/16/1940 – 7/25/1947 | 90 total days |

| Post-WWII | 7/26/1947 – 6/26/1950 | 181 continuous days | |

| Korean War | 6/27/1950 – 1/31/1955 | 90 total days | |

| Post-Korean War | 2/1/1955 – 8/4/1964 | 181 continuous days | |

| Vietnam War | 8/5/1964 – 5/7/1975 *For Veterans who served in the Republic of Vietnam, the beginning date is 2/28/1961 | 90 total days | |

| Post-Vietnam War | 5/8/1975 – 9/7/1980 *The ending date for officers is 10/16/1981 | 181 continuous days | |

| 24-month rule | 9/8/1980 – 8/1/1990 *The beginning date for officers is 10/17/1981 | · 24 continuous months, OR

· The full period (at least 181 days) for which you were called or ordered to active duty |

|

| Gulf War | 8/2/1990 – Present | · 24 continuous months, OR

· The full period (at least 90 days) for which you were called or ordered to active duty |

|

| Currently On Active Duty | Any | Any | 90 continuous days |

| Georgia National Guard & Reserve Member | Gulf War | 8/2/1990 – Present | 90 days of active service |

| · Six years of service in the Selected Reserve or National Guard, AND

· Were discharged honorably, OR · Were placed on the retired list, OR · Were transferred to the Standby Reserve or an element of the Ready Reserve other than the Selected Reserve after service characterized as honorable, OR · Continue to serve in the Selected Reserve |

|||

· The full period (at least 181 days) for which you were called or ordered to active duty

· The full period (at least 90 days) for which you were called or ordered to active duty

· Were discharged honorably, OR

· Were placed on the retired list, OR

· Were transferred to the Standby Reserve or an element of the Ready Reserve other than the Selected Reserve after service characterized as honorable, OR

· Continue to serve in the Selected Reserve

*If you do not meet the minimum VA service service requirements, you may still be eligible if you were discharged due to (1) hardship, (2) the convenience of the government, (3) reduction-in-force, (4) certain medical conditions, or (5) a service-connected disability.

Spouses The spouse of a Georgia Veteran can also apply for home loan eligibility for a VA mortgage under one of the following conditions:

- Un remarried spouse of a Georgia Veteran who died while in service or from a service connected disability, or

- Spouse of a Georgia Service members missing in action or a prisoner of war

- Surviving Georgia spouse who remarries on or after attaining age 57, and on or after December 16, 2003

(Note: a surviving Georgia spouse who remarried before December 16, 2003, and on or after attaining age 57, must have applied no later than December 15, 2004, to establish home loan eligibility. VA must deny applications from surviving spouses who remarried before December 6, 2003 that are received after December 15, 2004.) - Surviving Georgia Spouses of certain totally disabled veterans whose disability may not have been the cause of death

BAD CREDIT GEORGIA VA MORTGAGE LIMITS

Although Georgia VA mortgage do not have a maximum dollar amount, Georgia mortgage LENDERS who sell their VA loans in the secondary market must limit the size of those loans to the maximums prescribed by GNMA (Ginnie Mae) which is currently 417,000..

100% GEORGIA VA MORTGAGE LENDERS HOMESTEAD EXEMPTION

Any Georgia homestead by a veteran who was honorably discharged with a service-connected permanent and total disability and for whom a letter from the United States Government or VA or its predecessor has been issued certifying that the veteran is totally and permanently disabled is exempt from taxation, provided the veteran is a permanent resident of the state on January 1 of the Georgia tax year for which property exemption is being claimed or on January 1 of the year the veteran died.

BENEFITS OF USING A GEORGIA VA MORTGAGE LENDERS

- No money down for Georgia VA loans up to $417,000.

- Seller paid closing cost up to 4%.

- No PMI (Private Mortgage Insurance)

- Government regulated Georgia VA loan closing costs.

- VA streamlined refinance loans can be closed in 7 to 14 days

- VA BAD CREDIT GEORGIA MORTGAGE DOWN TO 580 FICO.

- No limit to the number of times a veteran may use a VA mortgage.

- NO CREDIT SCORE GEORGIA VA HOME LOANS USING ALTERNATE TRADE LINES.

In addition to these benefits, the VA Mortgage Loan program offers default assistance to veteran borrowers in financial difficulty through a higher level of service and a greater range of alternatives to avoid foreclosure. Delinquency and foreclosure rates for VA mortgage loans are substantially less because of the VA mortgage protections in place.

VA GEORGIA MORTGAGE LENDERS FUNDING FEES

The Veterans Administration assesses a Funding Fee to all VA loans between .5% and 3.3% of the loan amount. The VA mortgage funding fee is added into the VA mortgage amount of the loan to be paid over the life of your VA mortgage loan. The VA mortgage Funding Fee replaces the much higher priced Georgia (PMI) Mortgage Insurance required when you get a conventional home loan. Disabled Georgia Veteran homebuyers may even qualify to get the fee waived completely.

QUALIFYING WITH GEORGIA VA MORTGAGE LENDERS

The VA offers excellent qualifying standards. The VA does not use credit scoring as their primary analysis of the loan. Georgia VA mortgage applicants with some past financial difficulties may still qualify for a VA mortgage loan. The VA mortgage can be a tremendous savings compared to the cost of conventional loans for those veterns with past credit issues.

GEORGIA VA MORGAGE REFINANCING WITH VA MORTGAGE LENDERS

VA mortgage loans have built in features allowing a Georgia VA mortgage to be refinanced to a lower interest rate without all of the criteria normally red tape associated with a conventional mortgage. This is called an Interest Rate Red

GEORGIA VA MORTGAGE LENDERS

GEORGIA VA MORTGAGE LENDERS – MIN 580 FICO

https://plus.google.com/118328269799333608826/posts/BcMGAzvBaBa

MIN 580 FICO – BAD CREDIT GEORGIA VA MORTGAGE LENDERS

https://plus.google.com/118328269799333608826/posts/Tn6Jk4hj6Nk

Georgia VA Mortgage LENDERS Min 580 FICO!

www.VAmortgageprograms.com/ga-va-mortgage-LENDERS /

VA Mortgage LENDERS in Georgia – VA GA Home Loans

www.VAmortgageprograms.com/va-mortgage-LENDERS -georgia-va-ga-home-loans/