Houston Texas VA Mortgage Lenders

Houston Texas VA Mortgage Lenders- SAME DAY PRE APPROVALS>>>>

The Houston Texas VA Mortgage Program Offers Eligible Veterans Both home Purchase and Home Refinance Programs.

Houston Texas VA Mortgage lenders along with our Federal Government has taken to benefit home buyers, and specifically, those who are Veterans and Active Duty personnel. The Mission of Houston Texas VA Mortgage Lenders is to help veterans and active duty personnel purchase and retain Houston Texas VA Mortgage in recognition of their service to the Nation.

Houston Texas VA Mortgage Key Points

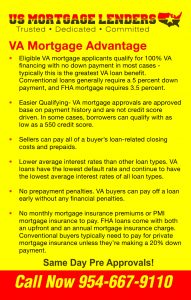

- Houston Texas VA Mortgage loans are for Primary homes only.

- 100% financing up to 453100.

- Seller Paid Closing cost up to 4%.

- Bad Credit Houston Texas VA Mortgage with Fico Score 550!

- Please note we provide free credit counseling to and work with everyone to get PRE APPROVED!

What is a Houston Texas VA Mortgage? In 1944, the U.S. government created a military loan guaranty program to help to return service members purchase homes. The result, the Houston Texas VA Mortgage, is a mortgage loan issued by approved Houston Texas VA Mortgage lenders such as US Mortgage Lenders and guaranteed by the federal government. Since its inception, the VA mortgage program has helped place more than 20 million veterans and their families into an affordable home financing situation through its distinct advantages over traditional mortgages.

With housing prices soaring Houston Texas VA Mortgage program is more important than ever to service members. In recent years, VA mortgage lenders have tightened their lending requirements in the wake of the housing market collapse, making the Houston Texas VA Mortgage Loan a lifeline for military home buyers.

Like all other mortgage programs, Houston Texas VA Mortgages have considerable details and information to review. We at Houston Texas VA Mortgage Lenders encourage you to use our website’s resources to educate yourself on the specifics of this exclusive home loan benefit. If you have further questions, we invite you to call us at 954-667-9110.

Houston Texas VA Mortgage vs. Conventional Mortgages

Military homebuyers have access to one of the most unique and powerful mortgage programs ever created. See below we compare how a Houston Texas VA Mortgage compares to traditional mortgage programs:

| Houston Texas VA Mortgages | Conventional Loans |

| 0% Down (for qualified borrowers)Houston Texas VA Mortgages are among the last 0% down home loans available on the market today. | Up to 20% DownConventional loans generally require down payments that can reach up to 20% to secure a home loan, pushing them out of reach for many homebuyers. |

| No PMISince Houston Texas VA Mortgages are government backed, banks do not require you to buy Private Mortgage Insurance. | PMI Monthly RequiredPrivate Mortgage Insurance is a requirement for borrowers who finance more than 80% of their home’s value, tacking on additional monthly expenses. |

| Competitive Interest RatesThe VA guaranty gives Houston Texas VA Mortgage lenders a greater degree of safety and flexibility, which typically means a more competitive rate than non-Houston Texas VA Mortgages. | Increased Risk for LendersWithout government backing, banks are taking on more risk which, in turn, can result in a less-competitive interest rate on your home loan. |

| Easier to QualifyBecause the loan is backed by the government, banks assume less risk and have less stringent qualification standards for Houston Texas VA Mortgages, making them easier to obtain. | Standard Qualification ProceduresConventional options hold stricter qualification procedures that can put homeownership out of reach for some homebuyers. |

When you’re looking for a Houston Texas VA Mortgage, the last thing you want is an excuse. We provide Houston Texas VA Mortgage approvals down to a 550 fico under certain conditions.

Rest assured in knowing that we offer expert specialty service for specialized programs just like the VA home Loan. Our loan officers have a wide range of expertise; in fact, many choose to select niche programs as their primary focus to better help VA home Buyers become homeowners. We can help to quickly refinance your current Houston Texas VA Mortgage as well!

With both options, you’ll be presented with Great Rates and great confidence that our specialist can get the job done right for you the very first time. No excuses…just results!

And if you have a bad credit history, that’s okay too! Our Houston Texas VA Mortgage specialist will work with you, not against you. We’re partners with a single, identical goal of helping our clients achieve their mortgage goals.

So, what makes our Houston Texas VA Mortgage programs different? The answer is our people, experience and product knowledge.

The Houston Texas VA Mortgage program offers two primary products:

- The VA home Buyer Program – This Product Is Designed To Help Eligible VA Veterans And Active Duty Personnel To Achieve home Ownership.

- The Houston Texas VA Mortgage Refinance Product – This Product Offers Traditional Rate & Term Refinancing, A Cash-Out Refinance Choice & A Streamline Refinance For Existing Houston Texas VA Mortgages.

Houston Texas VA Mortgage Interest Rates

We believe we offer VA home buyers some of the lowest interest rates and closing costs available in the industry today.

Please do know that rates are changing on an a continual basis, so until we are able to lock in your rate, they are always subject to change. The money we lend to home buyers and refinance clients comes from the same pool as conventional lending funds. The difference is, the VA insures the loan rather than a private mortgage insurance policy (PMI). As a result, the interest rates are tied to the same market factors as conventional rates.

To get today’s low rate, just give us a call!

All to often, the cost of obtaining any mortgage can be quite expensive. Thankfully, there is some good news though…

We work hard to keep your closing costs to an absolute minimum. In addition, the VA regulates the closing costs that a veteran may be charged in connection with closing a Houston Texas VA Mortgage.

Fixed Rate Or Adjustable?

With the VA home loan, you can can choose either a fixed rate Houston Texas VA Mortgage option or the adjustable interest rate option. It’s all based upon your financial needs and preferences. Our Houston Texas VA Mortgage originators will go into much more detail with the options you have based upon current VA lending limits and available mortgage products.

Once you’ve selected your Houston Texas VA Mortgage program, the VA will actually order your appraisal. This is great because it means you know you have an independent third party making decisions on the quality of the home you’re about to buy.

What you need and want is not only the best rate at the lowest cost, but a company that delivers low-cost results…not tricky catch phrases, not empty promises, and most certainly not paying for a big company name and the expensive advertising budget that goes along with it.

We believe that we have your interests in mind each step of the way. Our company was created to give home buyers better choices by connecting you with specialists who deliver outstanding results for less. Why not Apply Now?

Fixed Rate Houston Texas VA Mortgages

Why are fixed rate Houston Texas VA Mortgages so highly recommenced?

To begin with, a fixed rate Houston Texas VA Mortgage offers security in knowing your mortgage payment is not subject to change. The mortgage “melt-down” really proves this out. Providing stability is a wonderful thing and something a fixed low interest rate loan can do very reliably. Although the fixed loan type limits options, it does provide a long term strategy to equity and security.

The underwriting is no different, nor is the qualifying; and typically, your cost to close is very comparable too. As an added benefit, you can use the fixed rate Houston Texas VA Mortgage program for both a traditional home purchases and for buying a manufactured home. It is the combination of all of these notable benefits that continues to give qualified Houston Texas VA Mortgage applicants a wide range of choices.

Choosing Your Mortgage Option

Trying to decide whether an adjustable rate mortgage or a fixed rate program is best for your circumstances can be daunting, to say the least. That’s where we come in. Your Houston Texas VA Mortgage specialist will be able to take your information and tailor specific options for you based upon the programs available.

So, why wait and longer? Why not send over a Quick Inquiry and one of our Houston Texas VA Mortgage specialists will be in touch with you before you know it!

What Specific Costs Are Involved in a Houston Texas VA Mortgage?

Although some additional costs are unique to certain localities, the closing costs generally include VA appraisal, credit report, survey, title evidence, recording fees, a 1 percent loan origination fee, along with other miscellaneous costs which are fully disclosed on your Good Faith Estimate. The closing costs and origination charge may not be included in the loan, except in VA refinancing loans.

In addition to negotiating the interest rate with your loan specialist, you may negotiate the payment of discount points and other closing costs with the seller. Often, sellers will consider paying some or all of the discount points charged in your loan in order to complete the sale.

100% TEXAS VA Bad Credit+NO Credit VA Mortgage Lenders MIN580!

US Mortgage specializes in good and bad credit VA mortgage loans even no credit score Texas VAloans in every city Texas VA Bad Credit Mortgage Lenders

BAD CREDIT TEXAS FHA/VA MORTGAGE LENDERS

The middle FHA/VA mortgage applicants credit score refers to … https://www.

Texas FHA/VA Mortgage Lenders+Min 580 Fico

VA TEXAS MORTGAGE LENDERS- 100% VA loan financing with a minimum 550 credit score. Seller paid closing cost up to 4%. Purchase a Texas home using …

Texas Mortgage Lenders Allow Collections and Disputed Accounts

Texas Bad Credit FHA / VA Mortgage Lenders- Bad credit lenders exclude … VA Bad Credit Texas Mortgage Lenders – Min 550 middle credit score with 100% …

TEXAS VA MORTGAGE LENDERS Archives – FHA mortgage lender

TEXAS BAD CREDIT vA Mortgage Lenders NO CREDIT VA TEXAS MORTGAGE LENDERS VA MortgageLenders Advantage Summary 1. No Down Payment …

100% Houston Texas VA Mortgage Lenders – Min 580 FICO!!

Houston VA Mortgage lenders down to 580 fico! Serving ALL TEXAS! Houston Texas VA Mortgage Key Points Houston Texas VA Mortgage loans are for …

TEXAS 5 STAR MORTGAGE LENDERS – FHA MORTGAGE LENDERS

Texas FHA/VA Mortgage Lenders+Min 580 Fico – FHA mortgage lender … About FHA Mortgage Programs.com – FHA mortgage lender …

3.5% Fort Worth Texas FHA/VA Mortgage Lenders Min 580!!

Fort Worth FHA Mortgage Lenders – FHA, VA, Stated Income- Bank Statements Only! CALL NOW!954-667-9110 +Same DAY PRE APPROVALS min 580 …

Texas Mortgage 1 day after Bankruptcy or Foreclosure Approvals!

Texas VA Mortgage Lenders Require A minimum 550 credit score. … https://www.

3.5% TEXAS FHA/VA MORTGAGE LENDERS-Same Day Pre Approvals!

VA FHA Texas mortgage lenders- 100% VA loan financing with a minimum 550 credit score. Seller paid closing cost up to 4%. Purchase a Florida home using …