JUMBO CASH OUT FLORIDA BAD CREDIT MORTGAGE LENDERS

JUMBO CASH OUT FLORIDA BAD CREDIT MORTGAGE LENDERS

FLORIDA JUMBO CASH OUT 15-30 YEAR FIXED LOAN PROGRAMS

For your traditionally qualified borrower, we offer dynamo FIXED rates on loans $417 – $3mil.

- Primary and 2nd homes

- SFR, Warrantable Condo, 2-unit

- DTI to 45

- First time home buyer to $1.2m

- Cash Out OK!

FLORIDA JUMBO CASH OUT PORTFOLIO ARMS

For your not so traditional borrower… we have an “exceptional” PORTFOLIO capabilities!

- Portfolio Lender: Manual Underwrites & Make-Sense Exceptions

- Loan Amounts $300,000 to $5,000,000

- JUMBO CASH OUT ARMs – 5yr, 7yr and 10yr ARMS

- Interest only – 5/1 and 5/6 ARM

PORTFOLIO JUMBO CASH OUT FLORIDA ALLOWABLE INCOME

- Unique Income Scenarios considered

- Asset Depletion Loan Program: substantial liquid assets may qualify as income

- Listed Properties: Properties listed for sale may be eliminated from DTI calc if certain criteria are met

- Complex Tax Returns

- Self Employed borrowers

- Recent job/income change can be considered

PORTFOLIO FLORIDA JUMBO CASH OUT LOAN PROPERTY APPROVAL TYPES

- Primary, 2nd, Investment properties: No Limits on Acreage

- Condos and Condo-hotels (with full kitchen) (FL/AZ/NV = exceptions)

- High land to home value

- Hobby Farms

- Other unique properties owned by sophisticated borrowers considered

FLORIDA JUMBO CASH OUT PORTFOLIO FEATURES- Vesting Title in Entities Program – LLC’s, Trusts, Partnerships & Sub S Corporations can hold the title

- Pledged Asset Loan Program – allowing 90% financing for sophisticated borrowers (flyer attached)

- Listed properties may not be included in DTI, if file meets additional reserve requirement

- Asset Depletion – helps borrowers qualify based on substantial liquid assets (flyer attached)

- Foreign National loans – up to 50LTV. (flyer attached)

- Call or email me with your JUMBO CASH OUT scenarios today!

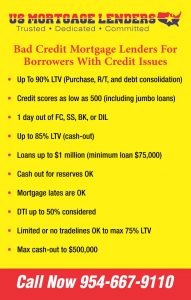

90% JUMBO CASH OUT Bad Credit Florida Mortgage Lenders

Florida Mortgage Lenders.com offers several JUMBO CASH OUT home mortgage solutions for home purchase or refinancing first and second JUMBO CASH OUT Florida mortgages for loans up to (2) two million dollars. Our Florida JUMBO CASH OUT home mortgage solution allows you to and refinance your Florida home and roll your high interest first and second mortgage loans into a new low rate JUMBO CASH OUT Florida mortgage. Finding a Florida JUMBO CASH OUT mortgage lender that offers bad credit JUMBO CASH OUT programs is nearly impossible in today’s challenging secondary market. Florida Mortgage Lenders has one of the last JUMBO CASH OUT lenders offering bad credit JUMBO CASH OUT home loans in today’s challenging market-place.

Up To 90% JUMBO CASH OUT Bad Credit Florida Mortgage Lenders

- Loans to $2+ million (Ask for higher loan amount exceptions)

- No mortgage insurance

- Interest Only available

- Up to 90% LTV/CLTV

- Credit scores down to 500

- No seasoning for foreclosure, short sale, BK

- 24-month personal bank statement program for self-employed borrowers

- Owner-occ, 2nd homes and investment properties

- 24-48 hours in Underwriting

| Portfolio Select Combo | 90% | 75/15 | 5.875%/10.99% (6.728% blended) |

$3,000 | 24 months, 60 months if multiple filings | 24 months from foreclosure deed date | 6 months |

| Prequalification Request | |||||||

| Portfolio Select Single Loan | 90% | 90% | 7.25% | $3,000 | 24 months, 60 months if multiple filings | 24 months from foreclosure deed date | 6 months |

| Prequalification Request | |||||||

| Non Prime Combo | 90% | 75/10 | 7.24%/10.99% (7.681% blended) |

$1,500 | 12 months | 24 months | 3 months minimum, 6-12 months required for certain programs |

| Prequalification Request | |||||||

| Non Prime Single Loan | 90% | 75% | 6.74% | $1,500 | 12 months | 24 months | 3 months minimum, 6-12 months required for certain programs |

(6.728% blended)

(7.681% blended)

* General Requirements

- Rate Quoted is for a 7/1 ARM, based on LTV requested if available – if N/A, rate is based on Max LTV. Add 0.25% to rate for 30 Year fixed.

- Note: This quote is based on the borrower meeting the Standard Tradeline requirements. Need 3 tradelines reporting for a minimum of 12 months -OR- 2 tradelines reporting > 24 months; all with activity in the last 12 months. Cancelled checks for 12 or 24 months housing history may also be used as a tradeline. If the borrower does not meet these tradeline requirements the max LTV is 75% and add 50bps to rate. Additional program restrictions may also apply, contact your Account Executive for details.

- Bank statements are personal and for S/E borrowers. Minimum loan amount for Bank Statement program is $150,000.

- Gift funds not allowed for Portfolio Select Combo and Bank Statement programs.

All rates/programs are subject to review and approval by your AE.

JUMBO CASH OUT Mortgage Rates Starting at 2.75% on 7/1 ARM

• 70- 100% – JUMBO CASH OUT Home Mortgage Refinance

• HARP Refinancing on High Balance Mortgage Loans

• Get Approved for a JUMBO CASH OUT Mortgage with Bad Credit

• Pay-Off ARM or Bad Credit JUMBO CASH OUT Home Loans with Low Fixed Interest

Tips for Million Dollar Mortgages with Bad Credit

Freddie Mac and Fannie Mae set guidelines for mortgage lenders and the borrowing limits for traditional mortgage loans. For single-family homes the loan limit in 2006 is $417,000. Anything above that loan limit is considered a non-conforming mortgage loan, or Florida JUMBO CASH OUT mortgage loan. Any mortgage loan outside of the Freddie Mac and Fannie Mae underwriting guidelines is considered unconventional, including those for people with bad credit.

With Florida housing prices continuing to rise, particularly in areas like Florida, about the only way you can get a mortgage is to get a non-conforming Florida JUMBO CASH OUT mortgage. However, as a result of the sub-prime market, there are many programs available today that help Florida hombuyers with recent bankruptcies, collections and even Florida foreclosures obtain bad credit Florida mortgage financing, including bad credit JUMBO CASH OUT home loans for home purchases and for refinancing JUMBO CASH OUT loans.

Before shopping for a JUMBO CASH OUT Florida mortgage loan, get your credit report from each of the three credit bureaus: Experian, Equifax and TransUnion. Check the reports for errors. You’d be surprised at how much your FICO credit scores can raise by doing nothing more than correcting errors on your reports. Raising your scores as little as five points can make a big difference in the interest you pay on your sub-prime JUMBO CASH OUT loan. Visit myFICO.com for current mortgage rates. Select your location, enter the loan amount and click the “Recalculate” button to compare the rates for different FICO scores. You’ll see how much a difference as little as one point can make.

Ordering your own FICO scores won’t generate any inquiries, either. Then, you can fax your scores and codes from myFICO to lenders you are considering. With that information, they should be able to tell you if you stand a chance of being approved for the bad credit Florida JUMBO CASH OUT mortgage loan or at least refer you to someone else who may be able to work with you. This will save you from having numerous inquiries, which could lower your credit scores even more. Don’t let ANYONE run your credit reports until you’ve narrowed your choices down to 2 – 3 lenders.

Shop for your Florida jubmo mortgage loan online. Online brokers and mortgage sites can either work with you directly or refer you to hundreds of lenders that specialize in bad credit mortgages, JUMBO CASH OUT mortgage loans, sub-prime JUMBO CASH OUT loans and other unconventional loans. Through online lenders, you could get up to four quotes on your JUMBO CASH OUT loan, refinance, cash-out JUMBO CASH OUT or 2nd mortgage (home equity loan).