2nd mortgage – Florida-Mortgage-Lenders.com

-

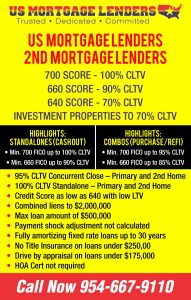

Highlights: 2nd Mortgage Standalones

(Cash out up to 500K!) -

Min. 700 FICO up to 100% CLTV

-

Min. 660 FICO up to 90% CLTV

Here Are Just A Few Lending Scenarios Where Getting A Second Mortgage May Be Preferable To Refinancing Your Existing Home Loan:

- Prepayment penalty: A second mortgage may be better than refinancing if the current 1st mortgage has a prepayment penalty. Some Florida loan programs offer a lower interest rate in exchange for a prepayment penalty that can run 1-3 years or longer and cost as much as 4% of the balance owed.

- Interest Rate Advantage: Getting a second mortgage, home equity loan or home equity line of credit (rather than refinancing your current mortgage) may make sense if your current Florida mortgage has an especially low rate. Working with an expert mortgage representative, you can run the numbers and see which financing alternative makes the most sense. The math is straightforward whether you are considering a 2nd mortgage on a starter home in Hillsborough County or a luxury home in Collier County.

- Desirable 1st Mortgage Feature: Applying for a 2nd mortgage, home equity loan or HELOC instead of refinancing could be the right way to go when your first mortgage has an especially desirable feature. For example, FHA loans are assumable, which is an excellent benefit when it comes time to sell your Florida home. Refinancing with a conventional loan and losing this benefit would not make sense for many borrowers. The better choice: a second mortgage.

- Stability Advantages of 2nd Mortgage over traditional HELOCS: Getting a second mortgage may be better than taking out a home equity line of credit on your Florida home. Lines of credit generally work the same way as adjustable rate mortgages. If the Libor or the CMT (or whatever index the Florida HELOC is tied to) moves upward so does the cost of the money you owe on your home equity line. Second mortgages can give you the peace of mind of fixed monthly payments for the life of the mortgage. No surprises.

- Lump Sum Structure of Second Mortgages: A 2nd mortgage delivers the proceeds in a lump sum at the closing and is fully amortized. This is a far better solution for those borrowers who do not want a loan that makes it too easy to dip continually into home equity without paying down any principal.

- Florida Second Mortgages with Low or No Out of Pocket Closing Costs: Many borrowers elect a Home Equity Line of Credit because of the low or non-existent closing costs. Many of our mortgage clients choose our 15 and 20 year fixed 2nd mortgage programs because they can have options with minimal closing costs and the ideal fixed payments. Why shouldn’t you get the stability of a fixed rate and still not have to pay sky-high costs to close? Call 1-954-667-9110 today!

If you need a loan for any reason, please call 1-954-667-9110 and ask for Florida Mortgage lender FHAMortgagePrograms.com. He has been helping borrowers get the secondary financing they need with low closing costs and interest rates and terms that are second to none. Use our Full Applicationtoday to find out more!

A second mortgage can free up equity in your Florida home to be used for nearly any purpose. Here are just a few of the reasons given by our recentFlorida 2nd mortgage clients who were asking us to find them the best rate and terms from our large assortment of Florida Mortgage Lenders:

- Consolidate high interest credit card debt into one lower monthly payment

- Pay medical bills

- Renovate a kitchen or make other improvements that add value to a home

- Pay for needed repairs or a new roof

- Pay for college tuition and living expenses for a spouse or son or daughter

- Start a new business

- Fund the expansion of a family businesses

- Purchase an income producing investment property at an auction

Regardless of the reason that you are thinking about getting a Florida home equity loan, we can make getting the funds simple and fast. Call a mortgage specialist today at 1-954-667-9110 to apply for your Florida second mortgage.