NO TAX RETURN MORTGAGE LENDERS CASH-OUT REFINANCE

FLORIDA – GEORGIA – ALABAMA – TEXAS TEXAS BANK STATEMENT MORTGAGE LENDERS

TEXAS BANK STATEMENT MORTGAGE LENDERS

We help self-employed, contractors cash out refinance with no tax turns using our Self Employed Bank Statement Cash Out Mortgage Refinance mortgage lenders.

NO TAX RETURN CASH-OUT INCOME QUALIFYING

● Alt Doc – 12 or 24 months business or personal bank stmts (Self Empl only), Full Doc income with lease agreements, ok (rental income qualified by lease agreements)

● ALT Doc—3-month Bank Statement (24-month CPA compiled and signed P&L statement supported by 3-months bank statements)

● ALT Doc—Profit and Loss (P&L) only. 24-month P&L compiled

and signed by CPA. CPA must also attest to filing tax returns for

borrower for 24-months.

WHAT IS A NO TAX RETURN CASH-OUT REFINANCE

A no tax return cash-out mortgage refinance replaces your existing mortgage with a new mortgage loan for more than you currently owe on your house. The difference goes to you in no tax return cash out refinance you use bank statements do document your income and you can cash out the equity to down debt, make home upgrades or repairs, debt consolidation or to spend how you wish. Lenders usually will not extend must more than 80% of your homes value so you need a lot of equity built up in your house to accomplish a cash-out refinance.

A standard no tax return refinance, in contrast, replaces your existing mortgage with a new one for the same balance. As long as your self employed for at least 2 years you can accomplish a no tax return cash out refinance as follows

- Use 12 months bank statements for income!

- Cash Out up to 80% of your homes value!

- Credit Scores Down To 500!

In other words, no lenders including no tax return mortgage lenders will allow you withdraw 100% of your home’s equity these days. If your home is valued at $300,000 and your current mortgage balance is $100,000, you have $200,000 of equity in your home. The maximum cash out would be 80% of 240,000.

We currently offer many different loan options for self-employed mortgage applicants. Being self-employed does not mean you can’t get mortgage loan. You do not have to submit any tax returns or financial statements other than your Self Employed Bank Statement Cash Out Mortgage Refinances in order to verity your ability to make the mortgage payments!

OPTIONS FOR SELF EMPLOYED NO TAX RETURN CASH-OUT

As a self-employed business owner, you can use a bank statement cash out refinance loan to purchase a new home or to cash out refinance an existing home that you already own.

- Personal Self Employed Bank Statement Cash Out Mortgage Refinances: qualify on 12 or 24 months Self Employed Bank Statement Cash Out Mortgage Refinances. We count 100% of deposits as income.

- Business Self Employed Bank Statement Cash Out Mortgage Refinances: qualify on 12 or 24 months Self Employed Bank Statement Cash Out Mortgage Refinances. We count 95% of the deposits as income based on your self prepared profit and loss statment..

NO TAX RETURN CASH-OUT REFINANCE REQUIREMENTS

- You Must be current on your mortgage Payments.

- Cash Out Up To 80% of the appriasal value.

- You must prove self-employed for at least 2 years. Proof includes CPA letter, 1099’s employer letters and professional licenses.

- As little as 10% down (90% loan-to-value).

- 4 months PITI reserves (mortgage payments in your bank account after nonpayment and closing cost. in the bank for loan amounts under $1 million, 6 months for loan amounts over $1 million

- Minimum credit score of 600 to qualify.

- The minimum loan amount is $100,000, maximum loan is $5,000,000

- We do not take into account withdrawals or tax returns.

- Primary residence and second home purchases

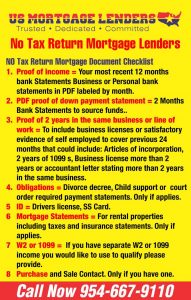

NO TAX RETURN MORTGAGE LENDERS DOCUMENT CHECKLIST

- Proof of income = Your most recent 12 months Self Employed Bank Statement Cash Out Mortgage Refinances Business or Personal Self Employed Bank Statement Cash Out Mortgage Refinances in PDF labeled by month.

- PDF proof of down payment statement= 2 Months Self Employed Bank Statement Cash Out Mortgage Refinances to source funds..

- Proof of 2 years in the same business or line of work = To include business licenses or satisfactory evidence of self employed to cover previous 24 months that could include: Articles of incorporation, 2 years of 1099 s, Business license more than 2 years or accountant letter stating more than 2 years in the same business.

- Obligations = Divorce decree, Child support or court order required payment statements.Only if applies.

- ID = Drivers license, SS Card.

- Mortgage Statements = For rental properties including taxes and insurance statements. Only if applies.

- W2 or 1099= If you have separate W2 or 1099 income you would like to use to qualify please provide.

- Your current mortgage statement, including taxes, insurance, HOA statements and any other liens payoffs.

This Self Employed Bank Statement Cash Out Mortgage Refinance program is perfect for business owners, realtors, consultants, restaurant owners, gig economy, entrepreneurs and all self employed mortgage applicants that make regular Self Employed Bank Statement Cash Out Mortgage Refinance deposits.

Learn more about our Self Employed Bank Statement Cash Out Mortgage Refinance Loan Program here.

NO TAX RETURN MORTGAGE LENDERS

At Self Employed Bank Statement Cash Out Mortgage Refinance Mortgage Lenders you can expect transparency and open communication, a knowledgeable team of industry experts and a customer-centric team working together to make your home buying experience effortless and exciting. We are fast and efficient, closing most of our purchase loans in 30 days or less.