POMPANO BEACH FL MORTGAGE LENDERS

POMPANO BEACH FLORIDA COOP MORTGAGE LENDERS

POMPANO BEACH FLORIDA COOP MORTGAGE LENDERS

Welcome and thank you for visiting US Mortgage Lenders webpage. We are local POMPANO BEACH Florida mortgage lenders. We are available to answer any questions you might have 24/7.

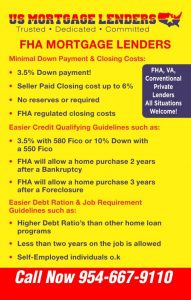

US Mortgage Lenders professionals have earned their excellent 5 star zillow and google reviews by opening more doors to homes in POMPANO BEACH Florida than your average Florida lender. To discuss any of our full service POMPANO BEACH Florida programs including, FHA minimum score 550, FHA Cash Out and Streamlines refinancing, Private lenders, Jumbo Loans, VA Mortgage loans down to 550 and Foreign National Loans. Note All Subject to change without notice.

POMPANO BEACH FL MORTGAGE LENDERS PROGRAMS INCLUDE:

A Pompano Beach Florida cooperative project (co-op) is a multi-unit apartment/condo building where each owner has an interest in the building. In a Pompano Beach Florida co-op, a coop owner does not own the individual unit, but they own a share of the building stock certificates equal to other owners enabling the coop owner to occupy an unit. .

POMPANO BEACH FLORIDA CO-OP MORTGAGE LENDERS

You can buy a Pompano Beach Florida condo, but you will never own your Pompano Beach Florida coop. It’s important for Pompano Beach Florida coop buyers to know the difference between a condo and a Coop before you make a Pompano Beach Florida coop purchase. You can find tons of Pompano Beach Florida condos but coops are less common. Either way, you need to know the difference before you buy a Pompano Beach Florida coop. The biggest difference determines the property taxes you pay, and the type of loan you will get. And, If you get a home loan on a Pompano Beach Florida coop you will not be a property owner and the lender does not place a mortgage lien on your coop. You can not buy a coop, instead become a shareholder in the Pompano Beach Florida corporation that owns the building. This means you cannot get a mortgage lien against your coop. Instead, you must obtain a Pompano Beach Florida coop home loan. In addition, you must be approved by the coop board before you can become an investor in the corporation that owns the Pompano Beach Florida coop building. And since you don’t own anything other than co op shares, you are not building any equity. You’ll still have to pay your share of the property taxes as a percentage of the property tax assessment.

POMPANO BEACH FLORIDA CO-OP MINIMUM & MAX LOAN AMOUNTS

• $100,000 minimum loan amount. Exceptions considered on a case-by-case.

• Co-oP Loan amount exceptions over $4,000,000 available.

POMPANO BEACH FLORIDA CO-OP MORTGAGE LENDERS CREDIT REQUIREMENTS

• 620 middle score required with some exceptions allowed for lack of credit or unestablished credit.

• For Pompano Beach Florida co-op mortgage applicants and co-mortgagers, the lowest mid-score is used for pricing and qualification.

• Meeting the minimum credit score requirement does not automatically constitute a credit approval. A pattern of

adverse credit or overextended credit may disqualify co-op mortgage applicant from financing, even if the minimum credit score is met.

• Credit report is used for Pre-Approval and co-op mortgage lenders will also pull credit before issuing a conditional

approval. Mid-score from co-op mortgage lenders credit pull is used for pricing and qualification.

No Credit or Limited Credit

• No credit or limited credit profiles are allowed on a case-by-case basis for U.S. citizens.

• No U.S. credit or credit score is required for the Work Visa/Expatriate/Immigrant Program or Foreign National Program

POMPANO BEACH FLORIDA CO-OP MORTGAGE LENDERS OPTIONS INCLUDE:

- Primary Pompano Beach Florida Co-op Mortgage Lenders

- Second Home Pompano Beach Florida Co-op Mortgage Lenders

- Investments Pompano Beach Florida Co-op Mortgage Lenders

- Cash Out Pompano Beach Florida Co-op Refinancing

- Second Pompano Beach Florida Co-op Home Financing

- Jumbo Pompano Beach Florida Co-op Loans

- Low Pompano Beach Florida Co-op Closing Costs

- Up to 80 Percent Pompano Beach Florida Co-op Mortgage Loans

POMPANO BEACH FLORIDA CO-OP MORTGAGE MAXIMUM DEBT TO INCOME

Maximum Pompano Beach Florida CO-op Mortgage Lenders Debt To Income Ratio

• 43% maximum back-end ratio.

ELIGIBLE POMPANO BEACH FLORIDA CO-OP PROPERTY TYPES & OCCUPANCY

Pompano Beach Florida Co-op Occupancy Permitted

• Primary Pompano Beach Florida Co-op Residence

• Second Pompano Beach Florida Co-op Home (minimal rental income allowed)

• Investment Pompano Beach Florida Co-op Property (non-owner Pompano Beach Florida Co-op occupied) permitted at maximum Pompano Beach Florida Co-op loan of 60% LTV

ELIGIBLE POMPANO BEACH FLORIDA CO-OP MORTGAGE REQUIREMENTS

• Minimum Down Payment 20% For Pompano Beach Florida Co-op Mortgage Lenders

• Title Insurance for Pompano Beach Florida Co-ops title policy issued through a title company or closing attorney must be issued on Pompano Beach Florida Co-op certificate

• Leaseholds Pompano Beach Florida Co-op allowed on a case-by-case basis

BAD CREDIT POMPANO BEACH FLORIDA CO-OP MORTGAGE LENDERS CREDIT REQUIREMENTS

• Late payments on any mortgage, installment or revolving account of 2×30, 1×60 or more will typically disqualify a

borrower from financing. Exceptions will be reviewed on a case-by-case basis at a lower LTV.

• A pattern of adverse credit or overextended credit may disqualify borrower from financing, even if minimum credit score

is met. Borrowers with 3x monthly income amount in unsecured consumer debt are generally disqualified.

POMPANO BEACH FLORIDA CO-OP MORTGAGE LENDERS REQUIREMENTS AFTER FORECLOSURE, BANKRUPTCY, SHORT SALE

• (4)Four-year seasoning from BK discharge date or sale of property

• Maximum 60% LTV or 40% down payment

• No derogatory credit allowed since the bad credit event

• Strong extenuating circumstance and signed letter of explanation from co-op mortgage applicant detailing event required.

NOT ALLOWABLE FOR POMPANO BEACH FLORIDA CO-OP MORTGAGE LENDERS

– Structural Pompano Beach Florida Co-op deficiencies and certain pending litigation (please contact your AE if litigation is not related to a structural issue)

– Incomplete Pompano Beach Florida Co-op construction of the subject phase

APPROVED OR ALLOWED POMPANO BEACH FLORIDA CO-OP MORTGAGE LENDERS CASE BY CASE:

– Low Pompano Beach Florida Co-op HOA budget reserves

– HOA Pompano Beach Florida Co-op delinquencies exceeding 15%

• Pompano Beach Florida Co-op mortgage lenders Questionnaire must be 100% complete for Approval Commitment. No blanks or questions answered “n/a” or “unknown,” and the Pompano Beach Florida Co-op questionnaire must pass underwriter review.

• Pompano Beach Florida Co-ops mortgage lenders price Pompano Beach Florida Co-ops the same as Non-Warrantable Condos, regardless of loan size or Pompano Beach Florida Co-op questionnaire findings.

• Pompano Beach Florida Co-op must pust have a full kitchen and at least one separate bedroom. Minimum Pompano Beach Florida Co-op size 500 square feet generally required. Efficiency Pompano Beach Florida Co-ops or studio units are not permitted.

• Coinsurance Pompano Beach Florida Co-op is considered case-by-case if no agreed amount endorsement is available.

SELF EMPLOYED POMPANO BEACH FLORIDA CO-OP MORTGAGE LENDERS

Self-Employed co-op mortgage Income calculations

• Borrower should be self-employed in the U.S. for a minimum of 2 years (max 80% LTV).

• 2-years business & personal tax returns required, plus year-to-date Profit & Loss statement.

• Business tax returns required for all businesses in which the borrower has 25% ownership or more. On occasion

business tax returns are needed if the borrower is has less than 25% ownership.

• Fannie Mae cash flow analysis form can be used.

• NOL Carryover Loss: Treated case-by-case when truly a one-time occurrence (i.e. real estate loss, lawsuit settlement or some other form of a truly one-time occurrence). Detailed CPA letter addressing the one-time occurrence is required.

• Less than two years self-employment is considered on a case-by-case basis with a reduced LTV.

REQUIRED BY POMPANO BEACH FLORIDA CO-OP MORTGAGE LENDERS

• 2-months bank statements for monthly asset accounts, and most recent statement for quarterly asset accounts

(VOD not permitted).

• 6 months PITI for all Pompano Beach Florida co-op properties owned including subject.

• At least 3 months of the subject property’s reserves must be liquid non-retirement.

POMPANO BEACH FLORIDA CO-OP MORTGAGE LENDERS CASE BY CASE MORTGAGE APPROVALS

• Pompano Beach Florida Co-op Current reserve balance meets or exceeds 2 months of the subject property’s Pompano Beach Florida Co-op HOA dues in reserves multiplied by all Pompano Beach Florida Co-op units in the Pompano Beach Florida Co-op project or 10% or more reserve allocation designated in the most recent Pompano Beach Florida Co-op budget.

SECOND HOME POMPANO BEACH FLORIDA CO-OP MORTGAGE LENDERS

• Pompano Beach Florida Co-op Mortgage Lenders will typically define a property as a second Pompano Beach Florida Co-op home if it is (1) located in a vacation or resort area 30 or more miles from the primary Pompano Beach Florida Co-op residence or (2) used a Pompano Beach Florida Co-op college housing for enrolled dependent within 5 miles of campus)

• Short-term Pompano Beach Florida Co-op rental income is allowed on second Pompano Beach Florida Co-op homes and generally does not constitute a Pompano Beach Florida Co-op investment property designation. Pompano Beach Florida Co-op Rental income cannot be used to qualify. An evaluation of the 1040 Schedule E is required.

POMPANO BEACH FLORIDA CO-OP MORTGAGE FOR INVESTMENT PROPERTY

• Property titled in LLC allowed

• Maximum Pompano Beach Florida Co-op 60% LTV for investor Pompano Beach Florida Co-op mortgage lenders.

• Gross rental income is calculated by using a 12 month average of the net Schedule E income (Line 21) plus depreciation, mortgage interest paid to banks, taxes and insurance, and Pompano Beach Florida Co-op HOA dues.

• Rental income not appearing on Schedule E may be considered case-by-case with 3 months canceled checks and a

current lease agreement. Use 75% of gross rent as gross rental income.

• Immediate Pompano Beach Florida Co-op rental income on the purchase of an investment property is allowed using 75% of the monthly rent schedule as documented by Form 1007 or 1025.

• Cash-out is allowed up to $3,000,000 with no seasoning required.

WHAT IS A POMPANO BEACH FLORIDA CO-OP MORTGAGE LENDERS AND HOW DO I GET A POMPANO BEACH FLORIDA MORTGAGE?

A Pompano Beach Florida Co-op or cooperative apartment is an individual living unit within a Pompano Beach Florida Co-op building or development where a buyer purchases shares (equal to the value of the unit) in a Pompano Beach Florida Co-op corporation that holds title to a building Coops are predominantly located. Normally a Pompano Beach Florida Co-op sponsor will buy the building (takes out the underlying Pompano Beach Florida Co-op mortgage) and then will sell off the shares. Therefore, when buying a coop, you are actually buying Pompano Beach Florida Co-op shares in a corporation, not buying real property.

HOW TO POMPANO BEACH FLORIDA CO-OP MORTGAGE LENDERS BUILDINGS GET PRE QUALIFIED BY POMPANO BEACH FLORIDA MORTGAGE LENDERS?

To start with Pompano Beach Florida Co-op lender will look at the following factors to see if a particular Pompano Beach Florida Co-op building corresponds with their guidelines: the Pompano Beach Florida Co-op property’s resale value, investor concentration, and Pompano Beach Florida Co-op owner occupancy. Based on the previous example, if there are 20 units, five sponsor rentals and 15 sold units (with 12 owner-occupied units and 3 units being rented by the Pompano Beach Florida Co-op owners), the following ratios and guideline percentages result:

HOW IS A POMPANO BEACH FLORIDA MORTGAGE LENDERS CO OP DIFFERENT FROM A HOUSE OR CONDO?

When you get a mortgage to purchase a house or condo you get the deed. But not with a Pompano Beach Florida Co-op, individual units do not have individual deeds. A Pompano Beach Florida Co-op mortgage is actually a “share-loan” or a loan that purchases a share within in the Pompano Beach Florida Co-op. The difference makes securing a loan for a Pompano Beach Florida Co-op more complicated them getting a traditional mortgage and fewer mortgage lenders offer share loans.

POMPANO BEACH FLORIDA COOP MORTGAGE LENDERS BOARDS AND APPROVAL RULES

To buy into a Pompano Beach Florida Co-op, you must be approved by the Pompano Beach Florida Co-op board. The approval process is often extensive and may require interviews and character references, in addition to your employment, financial, and credit history. Pompano Beach Florida Co-op boards can refuse a prospective buyer for any reason, so long as it doesn’t run afoul of anti-discrimination policies. What you can do WITH your Pompano Beach Florida Co-op unit. As a Pompano Beach Florida Co-op shareholder, you don’t have the right of alienation where basically, you can’t sell your Pompano Beach Florida Co-op share (or rent your Pompano Beach Florida Co-op unit) without the permission of the Pompano Beach Florida Co-op board. Some Pompano Beach Florida Co-op associations have the right of first refusal, meaning they have the option to buy the property before you offer your Pompano Beach Florida Co-op to outside buyers. Pompano Beach Florida Co-op boards, though, can simply deny a sale without matching the sale price.

HOW POMPANO BEACH FLORIDA COOP MORTGAGE LENDERS OWNERSHIP DIFFERS FROM CONDO OWNERSHIP

When you purchase a condominium you are purchasing a specific unit the surface and the interior walls of the unit in the space the condo contains. With a Co-op, you are purchasing a share in a corporation, which then entitles you to a unit. This share is considered personal property rather than real estate.

POMPANO BEACH FLORIDA CO-OP MORTGAGE LENDERS – POMPANO BEACH FLORIDA CO-OP HOME LOANS MORTGAGE LENDERS – 5% DOWN – POMPANO BEACH FLORIDA CO-OP MORTGAGE LENDERS

POMPANO BEACH FLORIDA COOP MORTGAGE LENDERS – APPROVAL PROCESS AND KEY REQUIREMENTS

All Cooperative (Co-op) Projects must be submitted to and approved by Pompano Beach Florida coop mortgage lenders Cooperative Project Approval Group (CPAG). Outlined below are instructions:

1. Validate an existing project review status. AND/OR

2. Initiate a Co-op Project review with Pompano Beach Florida coop mortgage lenders.

Pompano Beach Florida Cooperative Home Loan Project Approval Process

All Pompano Beach Florida Cooperative (Co-op) Projects must be submitted to and approved by Pompano Beach Florida coop mortgage lenders.

Project Approval Group (CPAG). Outlined below are instructions:

- Validate an existing Pompano Beach Florida coop project review status. AND/OR

- Initiate a Pompano Beach Florida Co-op Project review with Pompano Beach Florida coop mortgage lenders.

Validate a Pompano Beach Florida Coop Project’s Status (Step 1)

- • Access the Pompano Beach Florida co-op database on the dashboard Resource Center.

- Search the Pompano Beach Florida Coop project using name, address and or location.

- Verify the status and take appropriate action.

- If project has been approved and the expiration dates are within the time frame for the closing and funding of the Pompano Beach Florida coop loan, complete the Cooperative (Co-Op Project Approval Request Form and loan should be submitted as per Pompano Beach Florida coop mortgage lenders procedure and policy guidelines.

- If the Pompano Beach Florida coop project has not been reviewed and/or cannot be located in the database, a project review must be initiated. Proceed to step 2 detailed below.

- If the Pompano Beach Florida coop project has been declined, a project review may be initiated to determine if the Pompano Beach Florida coop project qualifications have changed and Pompano Beach Florida coop mortgage lenders is able to approve as of today. Proceed to step 2 below.

- Indicate declined status on the Pompano Beach Florida Co-op Project Review Request and supply any additional documentation or details as needed. IF PROJECT STATUS IS DECLINED DO NOT REGISTER OR SUBMIT LOAN UNTIL PROJECT IS REVIEWED.

- If the Pompano Beach Florida coop project has expired a project review may be initiated to update and extend the approved through date.

- Indicate expired status on the Pompano Beach Florida Co-op Project Review Request and supply any additional and updated documentation with the request.

Initiate a Pompano Beach Florida coop mortgage lenders Project Review (Step 2)

- • Complete the Pompano Beach Florida Cooperative (Co-Op) Project Approval Request Form (select current status of Co-op Project Review option on the form).

- Refer to Pompano Beach Florida project eligibility guideline for required co-op documentation. The form is available on Pompano Beach Florida coop mortgage lenders website under the resource center.

- • Submit the completed form to the CPAG. See submission details below.

- Project approval request can be submitted prior to loan registration and or loan approval.

- CPAG team will work directly with the Pompano Beach Florida co-op board contact or managing agent to request all the required documentation and complete the review. If the attempts are unsuccessful, the board may request additional support to obtain the information or the review will be canceled.

Key Document Requirements for Cooperative Project Review

Details on the documents needed for a project review and general guideline requirements are listed below. Please reference the Pompano Beach Florida coop mortgage lenders Project Standards for complete requirement details. Pompano Beach Florida coop must provide the most Recent 2 Years Audited Financial Statements

- Finalized/board

- Financials must be finalized/board approved and include all pages including notes.

Note: Draft financials are not acceptable for project approval. Approved financials

- Compiled

- Compiled Financial Statements are acceptable on Pompano Beach Florida co-op projects containing 50

units or less.

Note: Pompano Beach Florida Co-op Project Approval Team (CPAT) Underwriters reserve the right to require federal corporate tax returns (form 1120 or 1120C are acceptable) to support the compiled financial statements if they deem them necessary to adequately evaluate the project. Projects containing greater than 50 units must have audited financial statements. Financial Statements <50 units

- Condop Requirements – The term condop in real estate refers to a mixed-used Pompano Beach Florida condominium building where at least one of the units is owned by a cooperative corporation and sub-divided into many Pompano Beach Florida “co-op” apartments.

- Co-ops which are part of Condop projects require 2 years financial statements for both the co-op corporation and the condominium corporation. If the financial statements of the co-op corporation contain a detailed analysis of the financial operations of the condominium component of the development, that is acceptable.

- Condops which cannot provide condominium financial statements are not approvable.

Note: Projects must be deemed financially sound and hold adequate reserves. Pompano Beach Florida coop mortgage lenders defines “adequate” reserves as being 10% of the annual maintenance fees. Reserve funds would include all cash accounts and investments which could be liquidated (that is, stocks, bonds, CDs, etc.). Current asset to current liability ratio should be 1:1 and projects should show an annual positive cash flow. Available line(s) of credit held by the corporation will be considered as a compensating factor for reserves falling below the 10% benchmark, but will not be used as a sole source of reserves.

Master Certificate of Insurance

- Liability Insurance

- Minimum $1,000,000 per single occurrence of bodily injury and property damage is required (minimum $2,000,000 if the project has an elevator).

- Property/Hazard Insurance

- Must cover 100% of the insurable value of the project improvements with

losses paid out on a replacement cost basis.

- Must cover all buildings and units.

- Boiler/Mechanical Insurance

- Must be equal to, at minimum the lesser of 100% insurable replacement cost

of the building housing the property or $2,000,000.

- Fidelity Bond Insurance

- Required if the co-op project has more than 20 units.

- The amount of coverage must be equal to the greater of 3 months of assessments/maintenance fees of all units in the project OR the sum of all cash and reserve monies that are in custody of the co-op corporation or its management.

- If the co-op project is professionally managed and is more than 20 units, proof of Managing Agent Bond is also required either thru a Rider to the co-ops policy or a separate policy held by the co-op corporation covering the Managing Agent.

- Business Income

Insurance (Rent Loss/ Business Continuation)

- Required if the co-op corporation is < 70% Owner Occupied.

- Flood Insurance

- Required if any party of the co-op project’s improvements are in a Special

Flood Hazard Area (SFHA).

- Inflation Guard Endorsement (When it can be obtained) • A provision that gradually and continuously increases the limit of insurance by specified percentage over a specified time period. Pompano Beach Florida coop mortgage lenders Home Mortgage Cooperative Certification Questionnaire

- Generic Questionnaires Generic questionnaires are generally not acceptable, but generic questionnaires may be accepted on a case by case basis if approved by the CPAG.

- Questionnaire Completion The questionnaire must be completed in it’s entirely and signed/dated by the cooperatives designated agent or Board of Directors. Incomplete or unsigned/dated questionnaires are not acceptable and will not be submitted to underwriting for review.

- Sponsor Ownership Co-op projects in which the Sponsor or “Holder of Unsold Shares” retains R etention >10% -Offering Plan Requirement ownership of > 10% of the units require a copy of the most recent Amendment to the Offering Plan (Sponsor Disclosure Amendment) filed with the NY Attorney General (as noted in Pompano Beach Florida coop mortgage lenders’s Cooperative (Co-Op) Certification/Questionnaire).

Note: Sponsorship question should be completed for any project which > 10%

ownership by the Sponsor or “Holder of Unsold Shares.”

- Unit Occupancy Unit occupancy breakdown must be complete and itemized breakdown add

Breakdown up to the total number of units in the cooperative. Management will need to

correct figures if there are units which are not captured. Note: Sublet units are considered Investor /non-owner occupied owned units.

- Subject to a Ground

Lease If a project is subject to a Ground Lease a copy of the Ground Lease and all amendments is required to get submitted along with the project review for review and approval by the Pompano Beach Florida coop mortgage lenders (CPAG will submit for review as part of the project review). Projects subject to unacceptable Ground Leases are not eligible. Leasehold co-ops are only acceptable in approved markets as indicated in published guidelines.

- Projects with Non-

Residential Space Projects with non-residential space (including Condops) must include a square footage itemization.

- Garage square footage must be included as in the non-residential calculation if the garage is leased/rented to a third party or if the income received is from non-shareholders.

- Maximum of 25% of the total building square footage can be used for non- residential purposes.

- Projects Subject to Pending Litigation Generally, co-op projects subject to pending litigation are ineligible property types. If a project has pending litigation co-op management should fully explain the nature of the litigation so CPAT Underwriters can determine the severity of the litigation and the risk to the corporation and shareholders and determine if the litigation falls within acceptable parameters for approval.

- Projects Subject to Transfer Fees or “flip tax” If a project is subject to transfer fees or “flip tax,” management should provide full details of the requirements so the CPAT Underwriters can ensure the requirements are acceptable. The maximum allowed fee is 5% of the sales price.

- No Acceptance/Use ofAztech Recognition Agreement Without Modification or Rider If a co-op corporation does not accept/use the standard Aztech Recognition Agreement without modification or rider, the corporation must provide a complete copy of their recognition agreement (with Rider if applicable) for review. Non-standard Recognition Agreements are subject to Pompano Beach Florida coop mortgage lenders legal review and approval.

WE ARE LOCAL POMPANO BEACH FLORIDA FHA MORTGAGE LENDERS – All POMPANO BEACH FL Zip codes: 33060, 33062, 33064, 33069, 33097.

POMPANO BEACH FL MORTGAGE PROGRAMS

- FIRST TIME HOME BUYER POMPANO BEACH FLORIDA FHA MORTGAGE LENDERS – The FHA mortgage is not only for first time home buyers. Anyone purchasing a primary home can use the FHA loan. The FHA mortgage is popular with first time home buyers because of the with a low down payment requirement. In additions, bad credit, no credit mortgage applicants will find the FHA mortgage program is the only option to purchase a home. Read more »

- BAD CREDIT POMPANO BEACH FLORIDA FHA MORTGAGE LENDERS – Bad Credit FHA mortgage loan approvals are approved based on a more common sense approach to mortgage lending meaning bad credit borrowers with past foreclosure or Bankruptcy, tax liens, and collections or judgments can still qualify can qualify to purchase a home. Read more »

- NO CREDIT SCORE POMPANO BEACH FLORIDA FHA MORTGAGE LENDERS – FHA loan applicants with no credit score lack of trade lines can still qualify for an FHA mortgage loan using alternate trade lines to build a credit or payment history.Read more »

- CONDO POMPANO BEACH FLORIDA FHA MORTGAGE LENDERS– Search and purchase an FHA approved condo using the FHA mortgage program. Read more »

- TOWNHOUSE POMPANO BEACH FLORIDA FHA MORTGAGE LENDERS – The FHA mortgage program was created to help increase home ownership. The FHA program makes buying a townhouse home easier and less expensive than any other types of real estate mortgage home loan programs Read more »

- VILLA POMPANO BEACH FLORIDA FHA MORTGAGE LENDERS– This FHA loan program was created to help increase home ownership. The FHA program makes buying a villa easier and less expensive than any other types of real estate mortgage home loan programs Read more »

- MULTIFAMILY POMPANO BEACH FLORIDA FHA MORTGAGE LENDERS– This FHA loan program was created to help increase home ownership. The FHA program makes buying a multifamily duplex, triplex or four unit easier and less expensive than any other types of real estate mortgage home loan programs. Read more »

- JUMBO POMPANO BEACH FLORIDA FHA MORTGAGE LENDERS– The Jumbo FHA mortgage loan can be used in higher cost areas over 417,000 to help borrowers qualify for a Jumbo low down payment FHA mortgage option.Read more »

- GIFTS ALLOWED POMPANO BEACH FLORIDA FHA MORTGAGE LENDERS – When apply with an FHA mortgage lender you must document where your down payment came from. If you are getting a gift from a family member you must document the transfer, the documenation is very precise. Make sure the follow the FHA rules for a gift step by step, otherwise you may not be able to use the gift funds! Read more »

- MODULAR HOME POMPANO BEACH FLORIDA FHA MORTGAGE LENDERS – The FHA Title I modular home loan mortgage may be used for the purchase or refinancing of a manufactured home and land built after 1977, a developed lot on which to place a manufactured home, or a manufactured home and lot in combination. The home must be used as the principal residence and never moved from its original location. In addition you must own or buy the land with home. Read more »

- INVESTMENT PROPERTY POMPANO BEACH FLORIDA FHA MORTGAGE LENDERS– The idea of owning a multi family real estate investment property can be a very good idea for those who prepare the tenants to make the FHA mortgage payments.

- FORECLOSURE OR BANKRUPTCY POMPANO BEACH FLORIDA FHA MORTGAGE LENDERS – People with recent foreclosure or bankruptcy us the FHA mortgage to purchase or refinance a home every day! Read more »

- STREAMLINE REFINANCE POMPANO BEACH FLORIDA FHA MORTGAGE LENDERS– Lowering your monthly mortgage payment is easier than ever with an FHA streamline refinance mortgage you do not even need a new appraisal! Read more »

- DEBT CONSOLIDATION POMPANO BEACH FLORIDA FHA MORTGAGE LENDERS– An FHA Debt Consolidation Mortgage Refinance can lower your total monthly payment obligations. Contact us now to show you how much money you can save! Read more »

- COLLECTION AND JUDGMENTS POMPANO BEACH FLORIDA FHA MORTGAGE LENDERS – The Federal Housing Administration (FHA) offers mortgage applicants to the opportunity to purchase a home even with collections and judgements. Read more »

- MANUAL UNDERWRITING POMPANO BEACH FLORIDA FHA MORTGAGE LENDERS– If our local bank does not approve you for an FHA mortgage its still possible to qualify for an FHA mortgage using compensating factors and manual underwriting to qualify. Read more »

- LOAN LIMITS FOR POMPANO BEACH FLORIDA FHA MORTGAGE LENDERS – FHA mortgage loan limits very by county. You can purchase above the FHA mortgage loan limit but you would have to come up with the difference. Read more »

- DEBT TO INCOME RATIOS FOR POMPANO BEACH FLORIDA FHA MORTGAGE LENDERS– The FHA mortgage program will allow higher debt to income ratios than any other first time home buyer programs. Read more »

- EXCLUSION LIST FOR POMPANO BEACH FLORIDA FHA MORTGAGE LENDERS – If you have a past Foreclosure or Student loan in default you may not quality for an FHA mortgage. Read more »

- SELLER PAID CLOSING POMPANO BEACH FLORIDA FHA MORTGAGE LENDERS– Many FHA mortgage applicants find that the FHA mortgage is one of the most affordable mortgage programs allowing the seller to pay the buyers closing cost. Read more »

- OCCUPANCY RULES FOR POMPANO BEACH FLORIDA FHA MORGAGE LENDERS – FHA mortgage loans are for primary home use only. Read more »

- VA BAD CREDIT POMPANO BEACH FLORIDA FHA MORTGAGE LENDERS– VA loan applicants will find that the VA loan has the most flexible loan requirements available to purchase or refinance a home up to 100% loan to value even if you have your a veteran with a foreclosure or bankruptcy. Contact US mortgage lenders to learn how to put your (COE) certificate of eligibility to good use. Read more »

- USDA POMPANO BEACH FLORIDA BAD CREDIT FHA MORTGAGE LENDERS – US mortgage lenders has access to USDA mortgage lenders approving borrowers all the way down to a 550 middle credit score. If you can prove the ability to pay your bills on time then we may have a USDA mortgage lender for you. Read more »

- JUMBO POMPANO BEACH FLORIDA BAD CREDIT MORTGAGE LENDERS–US Mortgage lenders has access to jumbo mortgage lenders and jumbo portolio lenders approving jumbo loan applicants for loan amounts over 417,000 with credit down all the way down to a 600 middle credit score! Read more »

- HARD MONEY POMPANO BEACH FLORIDA BAD CREDIT MORTGAGE LENDERS– If you have large enough down payment and can prove the ability and willingness to pay your bills on time then we may have a hard money lender for you. US Mortgage lenders has access to private lenders and portfolio hard money lenders approving borrowers for loans that your bank will never consider. Read more »

POMPANO BEACH FLORIDA MORTGAGE AND CITY DATA

- Population in 2013: 104,410 (100% urban, 0% rural). Population change since 2000: +33.5%

- Males: 54,366 (52.1%)

- Females: 50,044 (47.9%)

- Median resident age: 1 years

- Florida median age: 5 years

- Zip codes: 33060, 33069.

- Pompano Beach Zip Code Map

- Estimated median household income in 2013: $40,191 (it was $36,073 in 2000)

- Pompano Beach: $40,191

- FL: $46,036

- Estimated per capita income in 2013: $23,534 (it was $23,938 in 2000)

- Pompano Beach city income, earnings, and wages data

- Estimated median house or condo value in 2013: $153,600 (it was $94,700 in 2000)

- Pompano Beach: $153,600

- FL: $153,300

- Mean prices in 2013: All housing units: $208,309; Detached houses: $242,560; Townhouses or other attached units: $212,113; In 2-unit structures: $291,890; In 3-to-4-unit structures: $107,525; In 5-or-more-unit structures: $182,636; Mobile homes: $28,642

- Median gross rent in 2013: $1,103.

- Recent home sales, real estate maps, and home value estimator for zip codes: 33060, 33062, 33064, 33069, 33097.

- Pompano Beach, FL residents, houses, and apartments details

Florida coop mortgage lenders coverage areas include

| Address | Subdivision/Complex |

| 1201 S Riverside Dr Unit#302-303 | Fairbanks Terrace South Fairbanks Terrace South |

| 1201 #PHB S Riverside Dr Unit#PHB | Fairbanks Terrace South Fairbanks Terrace South |

| 1530 S Ocean Blvd Unit#14 | Ocean East Ocean East |

| 1530 S Ocean Blvd Unit#603 | ocean east ocean east |

| 401 N Riverside Dr Unit#408 | MARINE TERRACE MARINE TERRACE |

| 1201 S Riverside Dr Unit#207 | FAIRBANKS TERRACE SOUTH C Fairbanks Terrace South |

| 3306 SE 11th St Unit#10C | POMPANO SURF CLUB CO-OP POMPANO SURF CLUB CO-OP |

| 401 N Riverside Dr Unit#406 | Marine Terrace Marine Terrace |

| 743 N Riverside Dr Unit#4C | COASTAL WINDS SOUTH COASTAL WINDS SOUTH |

| 1001 N Riverside Dr Unit#105 | FAIRBANKS COURT CONDO COSTAL VISTA SOUTH |

| 1201 S Riverside Dr Unit#108 | FAIRBANKS TERRACE SOUTH FAIRBANKS TERRACE SOUTH |

| 3306 SE 11th St Unit#C2 | Pompano Surf Club Pompano Surf Club |

| 1201 S Riverside Dr Unit#201 | FAIRBANKS TERRACE SOUTH FAIRBANKS TERRACE SOUTH |

| 1201 S Riverside Dr Unit#202 | FAIRBANKS TERRACE SOUTH FAIRBANKS TERRACE SOUTH |

| 401 N RIVERSIDE DR Unit#507 | MARINE TERRACE MARINE TERRACE |

| 1201 N Riverside Drive Unit#10 | TWIN WATER CO-OP TWIN WATER CO-OP |

| 401 N RIVERSIDE DR Unit#402 | MARINE TERRACE MARINE TERRACE |

| 401 N RIVERSIDE DR Unit#306 | MARINE TERRACE MARINE TERRACE |

| 3201 SE 12th St Unit#C 2 | Lakeside Apts Lakeside Apts |

| 999 N Riverside Drive Unit#10 | NEPTUNE VILLAS |

| 3216 SE 12th St Unit#6 | Silver Shores Silver Shores |

| 3306 SE 11th ST Unit#1C | POMPANO SURF CLUB CO-OP POMPANO SURF CLUB CO-OP |

| 3201 SE 12th St Unit#C4 | LAKESIDE CO-OP Lakeside |

| 934 SE 9th Ave Unit#16 | CYPRESS ISLAND 3 CO-OP CYPRESS ISLAND |

| 2541 NE 11th St Unit#102 | Deauville Terrace Deauville Terrace |

| 2541 NE 11 St Unit#117 | Deauville Terrace Co-Op Deauville Terrace Co-Op |

| 1105 S Riverside Dr Unit#205 | FAIRBANKS TERR CO-OP FAIRBANKS TERR INC. |

| 1105 S Riverside Dr Unit#101 | FAIRBANKS TERRACE CO-OP FAIRBANKS TERRACE CO-OP |

| 651 Pine Dr Unit#208 | GARDEN ISLES #2 CO-OP GARDEN ISLES #2 CO-OP |

| 2541 NE 11 Street Unit#116 | DEAUVILLE TERRACE DEAUVILLE TERRACE |

| 3232 Canal Drive Unit#2 | RIO-MAR APTS CO-OP |

| 3200 NE 7th Ct Unit#306C | OCEANSIDE APTS CO-OP OCEANSIDE |

| 935 SE 9th Ave Unit#12 | CYPRESS ISLAND CO-OP CYPRESS ISLAND CO-OP |

| 1371 SE 9th Ave Unit#4 | Cypress Lake Cypress Lake |

| 3215 SE 10th Unit#107 | Deauville CO-OP Deauville CO-OP |

| 931 SE 9th Ave Unit#7 | Cypress Island COOP Cypress Island COOP |

| 3200 NE 7th Ct Unit#308B | OCEANSIDE APARTMENTS OCEANSIDE APARTMENTS |

| 934 SE 9th Ave Unit#14 | Cypress Island Cypress Island |

| 3201 SE 10th Street Unit#A9 | DEAUVILLE WEST CO-OP |

| 708 SE 7th Ave Unit#13 | Cypress Lake Cypress Lake |

| 3232 Canal Dr Unit#3 | Rio Mar Co-op Rio Mar Co-op |

| 3200 NE 7th Ct Unit#307B | OCEANSIDE APARTMENTS OCEANSIDE APARTMENTS |

| 3215 SE 10th Unit#208 | Deauville CO-OP Deauville CO-OP |

| 301 E Mcnab Rd Unit#207 | WATERVIEW LODGE CO-OP WATERVIEW LODGE |

| 3200 NE 7th Ct Unit#306B | OCEANSIDE APTS CO-OP OCEANSIDE APTS CO-OP |

| 3215 SE 10th Unit#211 | Deauville CO-OP Deauville CO-OP |

| 406 S Cypress Rd Unit#325 | The Virginian The Virginian |

| 651 Pine Dr Unit#109 | GARDEN ISLES GARDEN ISLES |

| 301 E McNab Unit#201 | Waterview Waterview |

| 931 SE 9th Ave Unit#15 | CYPRESS ISLAND APTS 2 CO- CYPRESS ISLAND |

| 1110 N Riverside Dr Unit#23 | Sun Set Apts Co-Op Sun Set Apts Co-Op |

| 650 Pine Dr Unit#15 | Lakeview Lodge Lakeview Lodge |

| 400 S Cypress Rd Unit#421 | The Virginian The Virginian |

| 301 E Mcnab Rd Unit#210 | WATERVIEW LODGE WATERVIEW LODGE |

| 2344 NE 12th St Unit#A | TROPICAIR APTS CO-OP Tropicair Apts, Inc. |

| 400 S Cypress Rd Unit#428 | VIRGINIAN APTS OF POMP BC VIRGINIA APARTMENTS |

| 1401 SE 7th Ave Unit#3 | CYPRESS RIDGE apt co-op CYPRESS RIDGE apt co-op |

| 400 S Cypress Rd Unit#429 | The Virginian The Virginian |

| 412 S Cypress Rd Unit#205 | The Virginian The Virginian |

| 400 S Cypress Rd Unit#402 | VIRGINIAN APTS VIRGINIAN APTS |