Rental Home Stated Investor Mortgage Lenders Texas

T

T

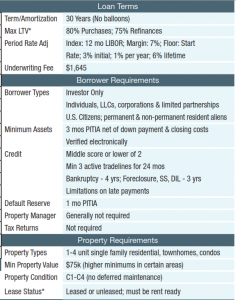

TEXAS INVESTOR MORTGAGE PROGRAM KEY POINTS

- Must Be A Texas Investor

- Close in Weeks, not Months

- Up to 80% Loan-To-Value

- DSCRs down to 0.80

- Fully Amortizing 30-Year

Buy & Hold Products - (Rental360 & Portfolio+)

- 24 Month Interest OnlyBridge Loan

- Min. Loan Amount: $45K

- Max Loan Amount: $2M

- 30-Day Seasoning on Refis

Texas Stated Mortgage lenders focused on the needs of experienced, locally expert Texas residential investors. We have originated across Texas for all real estate investors. Investors value our fast, simple and dependable process, and because we lend based primarily on the property, there are no income verification and no debt-to-income calculations. If your client has a good credit score, we have reduced rates and fees available too.

Investor Loan Purpose: Single-family (1-4 unit) rental property, 30 year finance for professional investors

Key Features: Streamlined qualification process emphasizing property level cash flow; no tax return or personal DTI

Flexible origination fee and prepayment fee options 30 day ownership seasoning; cash out proceeds based on appraised value (not limited to purchase price plus verified improvements)

Stated Income Texas Mortgage Lenders

- Texas Asset Based Loans (NO Employment Verification, NO Income Qualification, NO DTI Calculations, NO Tax Returns or 4506 Required)

- 30-Day Seasoning on Refis

- No Sourcing or Seasoning of Funds

- Long-Term Buy & Hold Products (30-Year Amortizations)

- Texas Portfolio Loans Available

- Close in Weeks, not Months

- Up to 80% LTV on Purchases and 75% on Refi Cash-Outs

- 640 Min. Credit Score

- Min. Loan Amount: $45K, Max Loan Amount: $2 million, depending on loan product

Who: We lend to borrowers with a minimum credit score of 640. Our loan products have no income verifications or debt-to-income calculations.

What: We lend on single-family homes, from one to four units, townhomes and condominiums. We do not lend on commercial properties, mobile homes or land. We don’t source or season funds and only require 30-days of ownership seasoning on cash-out refinances. Our minimum property value is $75K, with LTVs up to 75% (80% on purchases with additional credit requirements).

When: We are committed to a fast and easy process, and a quick close. Typically, we close a loan in a few weeks with our average close time being 21 business days once either an appraisal or application fee is paid for.