Self-Employed Florida Mortgage Lenders

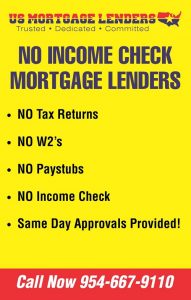

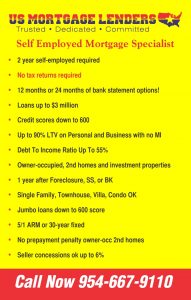

No Doc And Stated Florida Mortgage Lenders – No Income Verification Florida Mortgage Lenders

How do I Qualify For A Florida Mortgage Using 1099’s For Income?

- You must be employed in the same line of work or business for at least 2 years.

- We can then average your 2 years 1099 average with your year-to-date income and 2 months bank statement to document your income has continued year to date. Read More

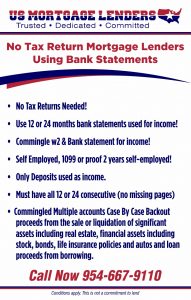

24 Months Bank Statement //12 Months Bank Statement Florida Mortgage Lenders

12 or 24 Months Bank Statement Florida Mortgage Lenders Personal Statements: Qualify using 12 or 24 avg bank statements. We use 100% of the deposits as income. Business Statements: Read More »

- 1099 Florida Mortgage Lenders — Read More » OR

- 12 Months Bank Statement Florida Mortgage Lenders–– Read More » OR

- 24 Months Bank Statement Florida Mortgage Lenders —Read More »

Self Employed Florida No Tax Return Mortgage Lenders

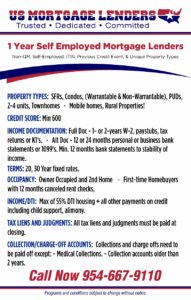

NO TAX RETURN FLORIDA MORTGAGE LENDER’S Cash – Minimum 10% Down.Credit – Minimum 350 Credit score.Capacity – Maximum 55% Collateral – Single-family homes, Townhomes, Villas, Condos, Read More »

24 Months Bank Statement Florida Mortgage Lenders Personal Statements: Qualify using 24 avg bank statements. We use 100% of the deposits as income. Business Statements: Read More »

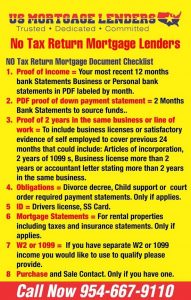

How Do I get a Mortgage In Florida With No Tax Returns?

FLORIDA NO TAX RETURN MORTGAGE LENDERS How Do I get a Mortgage In Florida With No Tax Returns? If you are looking for a Florida Read More »

No Income Verification Florida Mortgage Lenders

No Income Verification Florida Mortgage Lenders No Income Verification Mortgage Lender Requirments Primary Residence & Second Homes Credit Underwritten Based on LTV, FICO, and Liquidity Read More »

Florida Mortgage Lenders Using Bank Statements For Income!

Florida Mortgage Lenders Use Bank Statements For Income! The Bank Statement Only mortgage is often the only option for self-employed borrowers to get the funding Read More »

NO TAX RETURN FLORIDA BANK STATEMENT MORTGAGE LENDERS  – Florida bank statement mortgage lenders make it easier for Florida self-employed mortgage applicants to qualify for a mortgage. We all know that it makes sense to deduct expenses to avoid paying excessive taxes. The problem is that oftentimes Florida self employed borrowers have taken advantage of every write-off available to them and their net income is no longer sufficient to qualify for a Florida mortgage. Bank statement mortgage lenders can approve you using bank statement only to verify your income.

– Florida bank statement mortgage lenders make it easier for Florida self-employed mortgage applicants to qualify for a mortgage. We all know that it makes sense to deduct expenses to avoid paying excessive taxes. The problem is that oftentimes Florida self employed borrowers have taken advantage of every write-off available to them and their net income is no longer sufficient to qualify for a Florida mortgage. Bank statement mortgage lenders can approve you using bank statement only to verify your income. NO Tax Return-Florida Cash-Out Refinance Mortgage Lenders

NO Tax Return-Florida Cash-Out Refinance Mortgage Lenders Category: NO Tax Return Florida Mortgage Lenders

Category: NO Tax Return Florida Mortgage Lenders

- What does the Self Employed mortgage program do? The Self Employed mortgage loan program assists approved Florida Self Employed mortgage lenders in providing low- and moderate-income households the opportunity to own adequate, modest, decent, safe and sanitary dwellings as their primary Florida residence in eligible rural areas. Eligible Self Employed mortgage mortgage applicants may build, rehabilitate, improve or relocate a dwelling in an eligible rural area.

-

www.fhamortgageprograms.com/florida-self-employed-mortgage-lenders/

- Self Employed – Florida Mortgage Lender S

-

https://www.florida-mortgage-lenders.com/self-employed.html

Florida Bank Statement Mortgage Lenders – No Tax Return Florida Mortgage Lenders – Florida Self Employed Mortgage. If you are self-employed, contract worker, business owner, consultant, or entrepreneur with plenty of bank deposits then we can help you get approved for a Florida mortgage…

-

#1 No Tax Return Florida Mortgage Lenders For Self-Employed!

https://www.florida-mortgage-lenders.com/florida…Self employed Florida mortgage applicants must prove that they have been in business for 2+ years to mortgage qualify to purchase or to cash-out refinance a Florida mortgage.. Florida No Tax Return Mortgage Lenders – Use 12 to 24 Months Business or Personal Bank Statements to Qualify.

-

-

No Tax Return Mortgage Lenders -Stated Income!

https://www.fhamortgageprograms.com/no-tax-returns…SELF EMPLOYED MORTGAGE LENDERS OPTIONS INCLUDE: 10% Down with a 660 & 15% Down with a 600 Score! No tax returns Needed! Proof of 2 years self-employed! Owner-occupied, 2nd homes and investment properties. Loan Amounts From $150,000 to $3,000,000. 12 months personal or 24 months business bank statements; Debt to income up to 50% considered.

-

1#YEAR SELF EMPLOYED FLORIDA MORTGAGE LENDERS

https://www.fhamortgageprograms.com/self-employed-florida-mortgage-lenders“Qualify for a FL SELF EMPLOYED Florida mortgage with only your bank statements, business or personal, with reduced documentation which means no 1040 tax returns.“ If you are buying a home and had low income reported on your tax returns use this program in lieu of full-doc programs with just as little as 10% to 20% down on primary residence or as much as 85% loan to value on refinances without …

BANK STATEMENT Q&A

- Can I get a mortgage with no job? Yes, you can qualify to purchase a primary Florida home as long as you can prove the ability to make the mortgage payments. Investment properties do not have the same income qualifying requirements as primary Florida home purchases.

- Can you buy a house without proof of income? The law now requires that you have the ability to pay the mortgage to qualify for a primary Florida home.

- How long do you have to have a job to get a mortgage? Lender need to see 2 years stable income in the same line of work. If you can prove stable income but have had multiple jobs thats is usually ok.

- Can you buy a house if you are unemployed? Yes, there are situations that you can qualify for a house and not be employed as long as you can prove stability and willingness to make the monthly payments.

- Are there still no income verification loans? Yes, but for primary Florida homes lenders must verify your income.

- Can you buy a house with no tax returns? Yes, you can qualify to purchase a primary Florida home using w2 and pay stubs. You could qualify for an investment Florida home purchase with no tax returns as well.

- How can I get a Florida home loan with no proof of income? You can only buy an investment Florida home if you currently own a Florida home if you cannot prove the ability to make the payments.Primary Florida homes require you to prove the ability to repay investment Florida homes do not.

- Do I need proof of income for Florida home equity loan? Any loans on primary Florida homes require proof of the ability to repay.

Are there still no income verification loans? Yes, there are still no doc Florida mortgage lenders available that can provide a no income verification via no tax returns required stated but since the mortgage crash they are now harder to get. Typically, these tax returns bank statement only loans are only available to the self-employed mortgage applicant. These no doc bank statement only mortgage loans and require a larger down payment down payment then the typical first-time Florida homebuyer loans. Additionally, the credit score of the borrower must be impeccable.

No Income Verification Florida Mortgage Lenders Summary

- Min 580 Fico

- 10-15% Down based on credit score!

- 12 or 24 months bank statements from business and or personal.

- NO TAX RETURNS NEEDED

Investor Stated Income Cash Flow Mortgage Requirements

- Rather than being based on income and employment documentation, with this unique program qualification is based on what the cash flow determined by the property appraiser. If the comparable rents cover the new mortgage your loan will fund!

- The (DSCR) or (Debt Service Coverage Ratio = DCR) of the subject property you are purchasing is used to calculate the funds that can be used to qualify as follows:

- DSCR must be greater than or equal to 1. (After your downpayment the gross comparable property rent must be greater than the new mortgage payment including principal, interest, taxes, insurance, and HOA.

- DSCR is defined as gross rents divided by qualifying PITIA and HOA. 100% of the rents can be used.

- For a mortgage purchase, the amount used for rent will be the lesser of market rental price (per an appraisal) or current rental agreement in place.

- For the investor cash flow mortgage refinances the amount will be the lesser of market rental price (per an appraisal) or current rental price. Leases for the previous 12 months must be provided.

-

-

-